Blog | Personal Finance

Who Pays the Most in Taxes and Why

Five ways you can reduce your tax bill like a millionaire (and it’s all legal)

Rich Dad Personal Finance Team

January 23, 2025

Summary

-

If you want to be rich, you need to play by the rules of the rich

-

The rules of money are skewed in favor of the rich— and against the working and middle class

-

The money you earn and the wealth that you build belongs to you

Most people like to complain about the “rich” not paying their fair share in taxes.

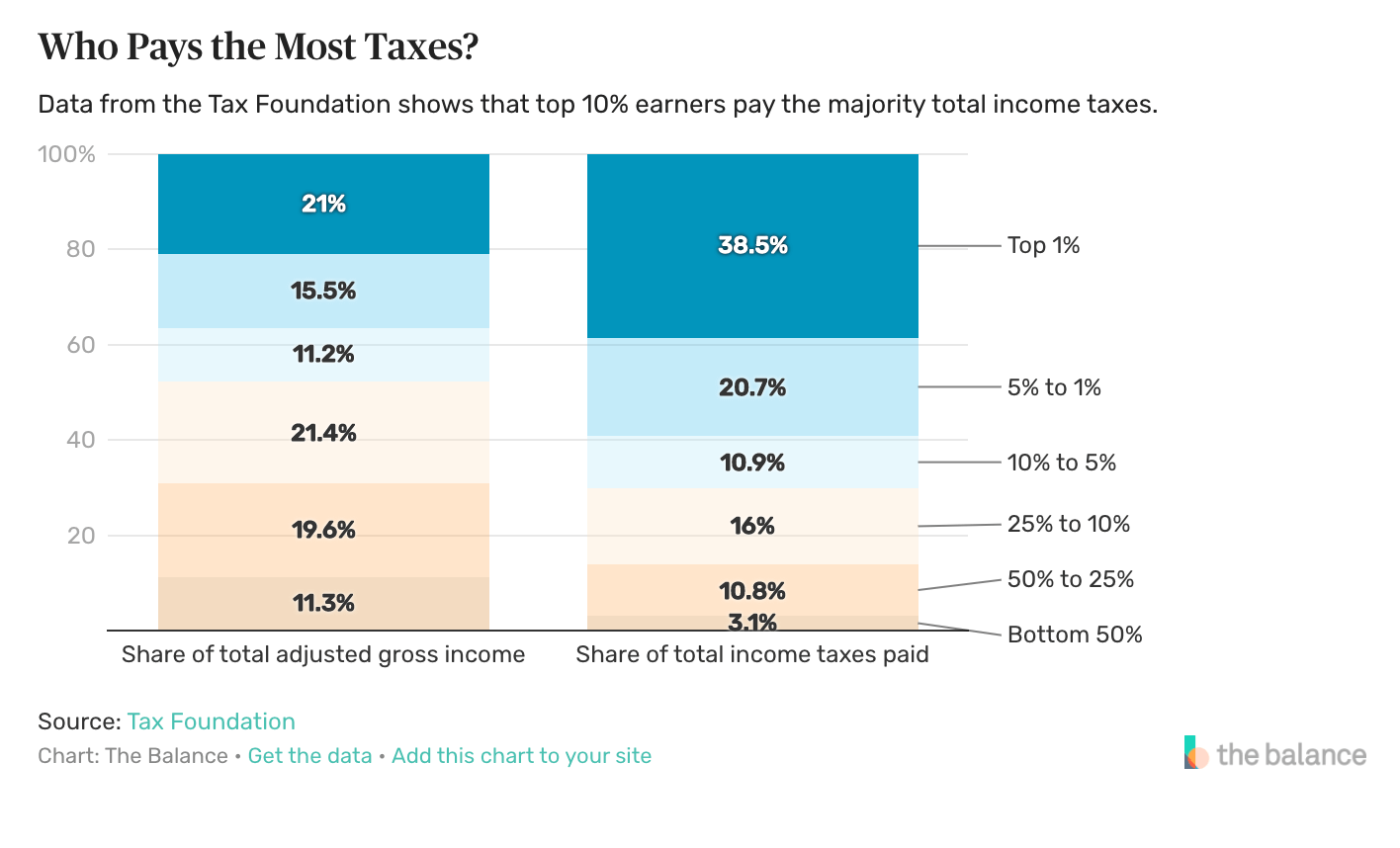

But if you look closely at the numbers, those whom most people would consider “rich” pay almost all of the income taxes collected by the US government.

This chart by The Balance shows that the top 10% of earners in the US pay almost 60% of the federal income tax.

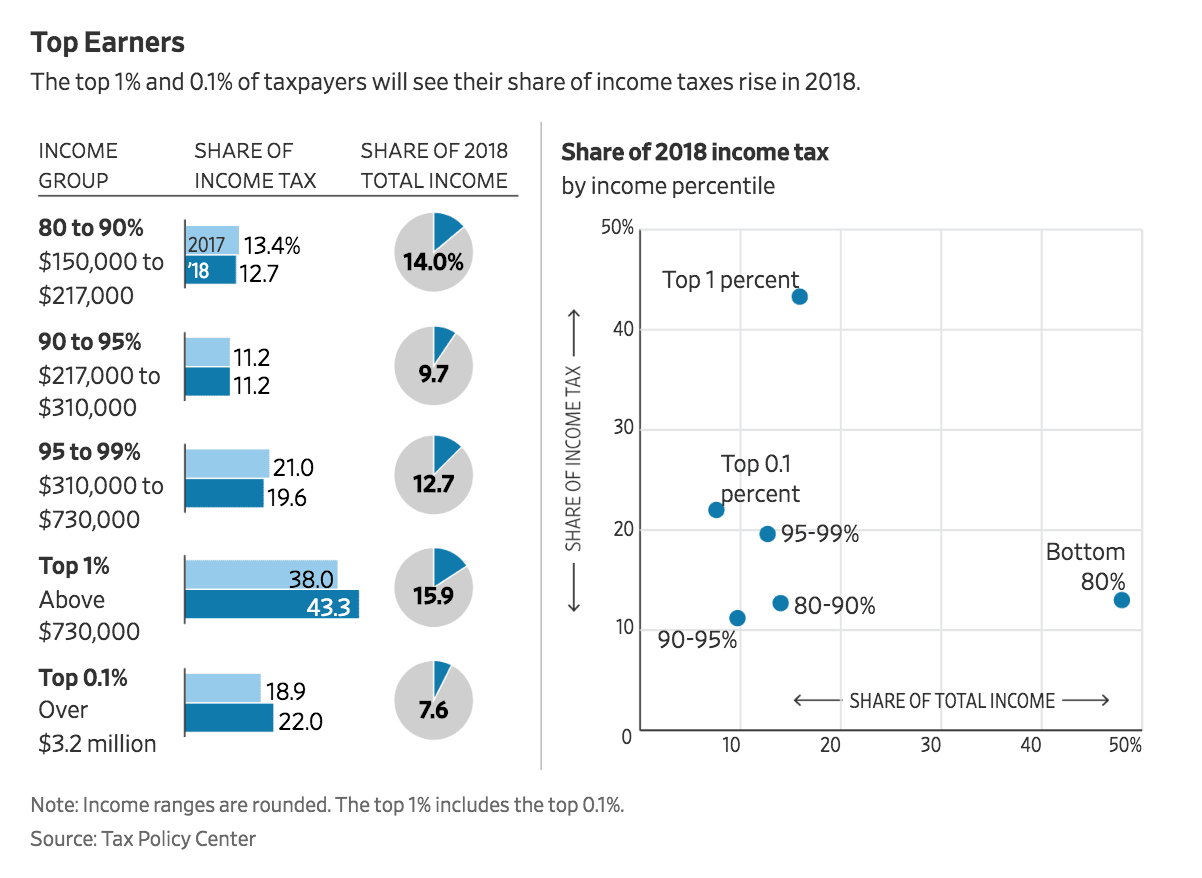

But if you slice the numbers even further in that 10%, things get interesting. A 2018 analysis from the Tax Policy Center, a non-partisan think tank in Washington D.C., was visualized in this chart in “The Wall Street Journal” to help break down the numbers.

When you look at the lower tier of income earners, people making up to $48,000 a year actually pay net negative income tax. They get money back.

What’s interesting, however, is when you break down the share of income tax paid by the rich vs. the ultra-rich. Based on 2018 estimates, while the top 1% of earners (those above $730,000) were predicted to pay 43% of all income tax, the 0.01% (those above $3.2 million) were only estimated to pay 22%.

When you take into account that the average earner in the 0.01% makes $26.1 million, you can start to see that those who many would consider “rich”—the top 1% of earners—are actually paying a lot more in income tax than those who are ultra-rich, the top 0.01%.

Why is this?

Paying nothing in taxes

How many of you know somebody who cheats on their taxes so they do not pay taxes? You do not have to cheat to avoid paying taxes.

As Robert Kiyosaki put it: “If you want to be rich, you need to play by the rules of the rich.” Meaning, the rules of money are skewed in favor of the rich, and against the working and middle class.

The problem is that most people are raised to think that you are born to pay taxes. Your only purpose in life is to go to school so you can get a job and then pay into the government. Worldwide, the average person pays 30 to 50 percent (or more!) of their hard-earned income in taxes, through a combination of income, sales, value-added, payroll, estate, or property taxes.

Almost one-third to one-half of the world’s wealth is handed over to governments. That’s bad news.

Who pays nothing in taxes and why it matters

The reality is that the IRS tax code is written to encourage and reward certain types of behaviors. Robert has written about this before, most notably when he published “Why I Hope Donald Trump Paid $0 in Taxes.”

At a high level, the IRS wants people doing activities that spur growth and that provide jobs. Thus, they have many tax breaks for entrepreneurs and investors. On the other hand, the IRS has little value for people who make a lot of money but don’t create anything for the economy in terms of growth or jobs.

So, it then is not surprising that the top 1% of earners pay the largest share of taxes rather than the top 0.01%. Why? Because most of those in the top 1% are not entrepreneurs or investors. They are high-paid employees who earn the highest-taxed type of income: earned income.

The ultra-rich, on the other hand, are those whose wealth is often built on starting a company or investing professionally. These activities are rewarded by the IRS and so they have many more tax breaks than even those making hundreds of thousands of dollars a year. The ultra-rich know how to limit their earned income and instead make most of their money via passive income vehicles like their companies and investments. Thus, they pay a substantially lower tax percentage than high-income earners.

Remember, there are four ways you can earn money:

-

You can go to school, get a job and earn it as an employee.

-

You can go to school even more, become a doctor, a lawyer, an accountant, a specialist or a small entrepreneur

-

You can be a big business owner

-

You can earn it as a professional investor, a true entrepreneur

It does not matter if you are in Santiago, Chile, Sydney, Australia, Johannesburg, South Africa or San Francisco, California. The tax rates are approximately the same depending on how you earn your money.

On average, employees are going to pay about 40 per cent in taxes. If you are a specialist or small entrepreneur, you are going to pay even a higher tax rate, 60 percent on average.

As a big business owner, a big entrepreneur, you can reduce your tax rate to 20 per cent but here is the magic. If you can become a professional investor, a true entrepreneur, you can reduce your tax rates to zero.

For example, here are a few ways to avoid paying unnecessary taxes:

-

Understand that your money is your money- and not the government’s - Unless you live underneath a dictatorship, the money you earn and the wealth that you build belongs to you. Yes, you may be required to give some of it to the government to help build roads, maintain the military, and sustain schools. But fundamentally, it’s your money.

-

Use the complexity of the tax law to your advantage - In the United States, for example, there are over 5,800 pages of tax law. About 30 pages are devoted to raising taxes. The remaining 5,770 pages are devoted entirely to reducing your taxes.Take advantage!

-

Make tax planning a part of your wealth strategy -Remember that your wealth strategy is not just what you make, it’s what you keep. When you invest with taxes in mind, you keep more money and make better investment decisions.

You can pay taxes like the ultra-rich

The biggest difference between the “rich,” that is high-income employees, and the ultra-rich, is mindset. And the good news is that you can start thinking like the ultra-rich when it comes to taxes and money, and your wealth will grow.

First, stop looking for a high-paying job and start thinking how you can create them instead. The IRS will reward you if you take entrepreneurial risks.

Second, invest your earned income into assets that produce passive income via cash flow every month. The IRS will also reward you for that. This doesn’t mean your 401(k), which is taxed at an earned income level. You have to find true assets like rental properties, businesses, and commodities that are taxed at the passive income level.

You do not have to start big. Just do what you can and continue to build into larger and larger opportunities. The most important thing is to think like the ultra-rich, not like an employee.

Here are five practical ways to start acting like the ultra-rich when it comes to taxes. But first a little foundational knowledge is needed.

Taxes and the CASHFLOW Quadrant

When it comes to paying taxes, the Rich Dad CASHFLOW Quadrant is helpful in understanding who pays the most and who pays the least in taxes.

Very briefly, in the CASHFLOW Quadrant:

-

E = Employees: people who work for others

-

S = Self-employed: people who work for themselves. They do not own a business; they own a job. If they don’t work, they don’t make money.

-

B = Business owner: people who own a cash-flowing business that makes money for them even when they’re not working.

-

I = Investor: people who invest in a sophisticated and professional way that produces significant cash flow and tax benefits

The quadrants are not professions. For example, a medical doctor can be an E, such as a doctor who works for a B (a big business such as a hospital or drug company). A doctor can also be an S, working as a self-employed, small-business owner in private practice. Or a doctor can be a B, the owner of a hospital or a drug company. And the doctor can be an I, an investor.

It’s important to note that an investor in the I Quadrant is not someone who simply puts money into his or her 401(k). Perhaps an easy way to distinguish this is to say that most average investors send their money to someone to invest it. Those in the I Quadrant have others send money to them to invest it in larger projects.

The I quadrant is defined by the direction cash is flowing, and that makes a difference in who pays the most in taxes. If you send your money to others to invest for you, you pay more in taxes than the person you send your money to.

Why Es and Ss pay the most in taxes

Looking again at the CASHFLOW Quadrant, we can see who pays the most in taxes. Again, the tax code is made to encourage business and investing. This is why those in the E and S Quadrants pay the most in taxes.

In truth, there is very little that those folks can do to reduced their tax burden, aside from having kids, deducting some debt like mortgage interest and college loan interest, and doing some low level financial vehicles like a 401(k) or Health Savings Account (which are really tax deferments, not savings).

Those in the B and I Quadrants, however, have nearly unlimited means to reduce their tax burden thanks to the IRS codes. In fact, the IRS codes are written to incentivize B and I Quadrant activity. The government knows that the best way to get people to do something is through their pocket book.

As Rich Dad Tax Advisor Tom Wheelwright says, the most patriotic thing you can do is not pay your taxes!

Move quadrants to pay less in taxes

The key to saving the most when it comes to your tax bill is to change quadrants. This is not something that you simply do in a day. Rather, it is built over time, but the steps begin today. If you take the right steps, the benefits last a lifetime.

The first step in changing quadrants is to change your mindset. Learn all you can about how money works, and start spending time with people who think with B and I Quadrant mindsets.

As you do that, the activities mentioned below on how to lower your tax bill will make more and more sense—and you’ll be excited to put them into practice.

A word of warning: these are sophisticated techniques that require strong financial knowledge. They’re not hard to do, but they do require a financial IQ. If you haven’t invested in your financial education, start a learning program that gives you the foundation for these tips.

Pay less in taxes #1: start a side business

Chances are there is some sort of business you can start today.

This isn’t a consulting business that is primarily in the S Quadrant — though those can be helpful for running some of your expenses as tax deductions. The problem, however, is that most consultants pay the most in taxes because they don’t make passive income. Their income is earned income, taxed at the highest rate. What is worse, because they are effectively the employer and employee at the same time, they have to pay the full payroll tax on themselves rather than have their employer pay part of their payroll taxes. Yes, they pay more in taxes than employees.

Rather, this is a business that produces cash flow and is largely self-sustaining. In short, a business that produces passive income—is the lowest taxed income.

The key in whatever you do is to productize. Many consultants have figured this out. For instance, graphic designers might sell posters in an online store. Or an attorney might sell a course online. What these folks have discovered is that if you can make a product that people want to buy, you can scale a business and make money even when you’re sleeping.

One key here is you need to start a business entity. This can be an LLC, an S-Corp or a C-Corp, or some other suitable entity. The best thing to do is to consult an attorney and a tax advisor on the best one for you (more on that later).

The advantage of a tax perspective is that passive income is the lowest taxed income. Also, you can run many expenses through a business that people in the E and S Quadrants simply cannot.

Pay less in taxes #2: get business educated

As Rich Dad Advisor Garrett Sutton teaches, most professions have requirements for continuing education. Even if they’re not required certifications, investment in business education is a must if you want to stay on top of your field.

As Garrett writes:

Internal Revenue Code Section 162 allows you to deduct 100 percent of your expenses for business-related seminars, including your registration, meals, lodging and transportation costs. The corporate entity takes the deduction and the costs are not considered part of your income (so you're not taxed on the benefits.)

Your corporation can also deduct the price of magazine subscriptions, so long as the magazines are for your industry, and you can deduct the cost of membership in professional organizations in your field. If your profession requires periodic testing and licensing, your entity can pay those fees and deduct the costs as well.

If you're looking to learn more about your chosen field, the Internal Revenue Code Section 127 allows you up to $5,250 in educational assistance each year for educational expenses, which is also not included in your gross income.

Pay less in taxes #3: invest in rental property

One of the best ways to reduce a tax burden is to invest in real estate. Many people who work in the E Quadrant but invest in real estate, are moved into the I Quadrant. In the process, they eliminate a lot of tax burden and enjoy substantial cash flow. Many of these folks have gone on to simply invest full time in real estate.

Here's a real-life situation in which Robert played by the rules of the rich and minimized his taxes through rental property:

-

2004: Robert and his wife, Kim, put $100,000 down to purchase 10 condominiums in Scottsdale, Ariz. The developer paid them $20,000 a year to use these 10 units as sales models. So they received a 20 percent cash-on-cash return, on which they paid very little in taxes because the income was offset by the depreciation of the building and the furniture used in the models. It looked like they were losing money when they were in fact making money.

-

2005: Since the real estate market was so hot, the 380-unit condo project sold out early. Their 10 models were the last to go. They made approximately $100,000 in capital gains per unit. They put the $1 million into a 1031 tax-deferred exchange. They legally paid no taxes on their million dollars of capital gains.

-

2005: With that money, they purchased a 350-unit apartment house in Tucson, Ariz. The building was poorly managed and filled with bad tenants who had driven out the good tenants. It also needed repairs. They took out a construction loan and shut the building down, which moved the bad tenants out. Once the rehab was complete, they moved good tenants in and raised the rents.

-

2007: With the increased rents, the property was reappraised and we borrowed against our equity, which was about $1.2 million tax-free, because it was a loan—a loan that our new tenants pay for. Even with the loan, the property still pays them approximately $100,000 a year in positive cash flow.

-

Of the tax benefits that come with real estate investing, you can also include phantom income. Simply put, phantom income comes from things like depreciation, which means that a set portion of your property value is deducted from your taxable income each year to account for value loss as the property ages. This lowers your tax burden but isn’t a real out of pocket cost. Thus, phantom income.

-

As mentioned in the example above, you can also pull money through a refinance out of your property and make money tax-free. If you do this correctly, the income from the property pays for the excess debt service. You can then use that money to invest in more property. It’s a virtuous cycle.

-

Also, as with any business, you can deduct a lot of expenses through your investment activities.

-

Those are just a few ways investing in rental property can help you reduce your tax burden. There are many more. If you’re interested, do a deep dive and learn.

Pay less in taxes #4: buy a stake in an oil or gas well

In 1966, at the age of 19, Robert was a junior officer on board Standard Oil tankers sailing up and down the California coast. It was then that he became interested in oil. In the 1970s, he worked for an independent investment banker packaging and selling oil and gas tax shelters to wealthy clients. Today, both Robert and Kim continue to invest in oil and gas projects.

They do not invest in stocks or mutual funds of oil companies such as BP or Exxon. They invest in oil exploration and development partnerships, which means they partner with oil entrepreneurs in specific projects, primarily in Texas, Oklahoma, and Louisiana, coincidentally where many of their apartment houses are located. If successful, they receive a percentage of income from the sale of oil and natural gas, aka cash flow with tax advantages.

Oil and natural gas are essential for transportation, food, heating, plastics, and fertilizers. If you look around your kitchen, oil is in use everywhere, even in the foods you eat. The reason the government offers huge tax incentives is because drilling for oil is very risky and oil is essential for life, our economy, and our standard of living.

The beauty of some oil and gas partnerships is the ROI, return on investment. The moment the Kiyosakis invested their $100,000 in the Texas project, they received a 70 percent tax deduction. At their ordinary-income tax rate of 40 percent, that is $28,000 cash back. That is a guaranteed 28 percent ROI in the first year, money the government technically gives back because they want investments in oil.

Why in the world would anyone want a 10 percent capital-gains return with so much risk - like the stock market? Wouldn't you rather have a 28 percent guaranteed return from the government in real cash flow, and not have to gamble on fictitious possible returns on capital gains.

This type of tax-advantaged investment makes more sense than investing in a 401(k) for forty years, buying, holding, and praying that there’s enough money to last the rest a lifetime.

A Word of Caution: Drilling for oil is an extremely risky venture and that is why such investments are, by law, available only to accredited investors, investors who have the money and knowledge.

Pay less in taxes #5: hire a tax advisor and an attorney

Finally, as rich dad always said, investing and business are team sports. The more sophisticated you get in reducing your tax burden, the more help you’ll need from experts. Have a tax advisor and an attorney that you can consult with regularly to make sure that you're positioning yourself correctly and taking full advantage of the tax code (while not breaking any rules).

The poor say that hiring advisors is too expensive. The rich know that not hiring advisors is what makes you poor. Do yourself a favor, and before you do any of the above, find the right advisors.

Original publish date:

March 08, 2016