Blog | Paper Assets, Personal Finance

The 401(k): Robbing Your Retirement Plan for Over 40 Years

Top wealth-stealing forces that make some people poorer... and others richer.

Rich Dad Personal Finance Team

August 25, 2023

Summary

-

There are four financial forces that cause people to struggle financially; retirement is one of them

-

Having a 401(k) actually works to the advantage of the employer

-

Improving your financial education is the best way to start investing strategically

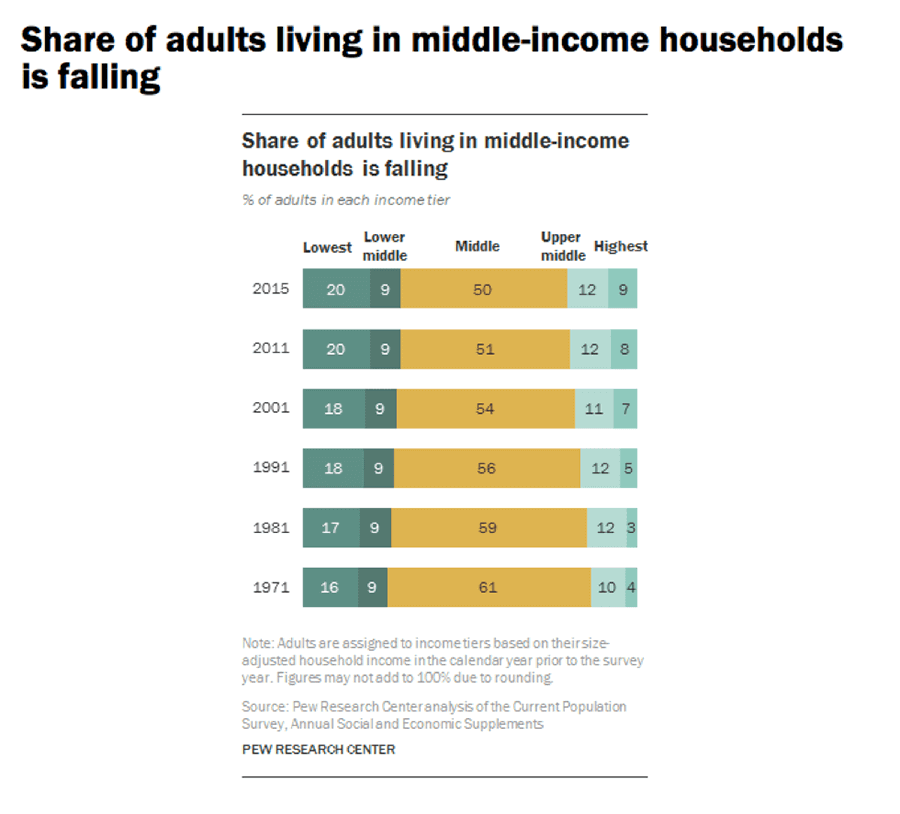

Take a look at this sobering graph from the Pew Research Center.

As you can see, from 1971 to 2015, the share of adults living in middle-income households fell from 61% to 50%.

In a country where the rich are getting richer and the poor are getting poorer, the straw is finally breaking the camel's back. It is why we are seeing such polarizing politics, discussion and violence. The American middle class is the spark that is lighting a powder keg of dissatisfaction.

As you can also tell, this decline of the middle class has happened for a long time and steadily since the 70s. Over the last four decades, there have been forces at work that have stolen wealth from the middle class and given it to the rich. Much of the anger in our country is coming from the fact that people are being financially ripped apart by these forces. Yet, they are not truly aware what those forces are exactly or what to do about them. All they know is that they want change.

If they understood those forces and what to do about them, they would be able to take matters into their own hands rather than hope a politician would fix their problems for them.

Here are the four financial forces that cause most people to work hard but still struggle financially:

-

Taxes

-

Debt

-

Inflation

-

Retirement Plans

That’s right; retirement is on the list of horrible financial forces that are ripping the pockets of the middle class while tricking people into thinking they’re doing what’s best for their future. Though we’ll discuss each briefly, we’re going to spend most of our focus on the disappearing reality of retirement.

Taxes

America was relatively tax-free in its early days. In 1862, the first income tax was levied to pay for the Civil War. In 1895, the US Supreme Court ruled that an income tax was unconstitutional. In 1913, however, the same year the Federal Reserve System was created, the Sixteenth Amendment was passed, making an income tax permanent. The reason for the reinstatement of the income tax was to capitalize on the US Treasury and Federal Reserve. Now the rich could put their hands in our pockets via taxes permanently.

Debt

The Federal Reserve System gave politicians the power to borrow money, rather than raise taxes. Debt, however, is a double-edged sword that results in either higher taxes or inflation. The US government creates money rather than raising taxes by selling bonds, IOUs from the taxpayers of the country that eventually have to be paid for with higher taxes-or by printing more money, which creates inflation.

Inflation

This is caused by the Federal Reserve and the US Treasury borrowing money or printing money to pay the government's bills. That's why inflation is often called the "silent tax." Inflation makes the rich richer, but it makes the cost of living more expensive for the poor and the middle class. This is because those who print money receive the most benefit. They can purchase the goods and services they desire with the new money before it dilutes the existing money pool. They reap all the benefits and none of the consequences. All the while, the poor and the middle class watch as their buck gets stretched thinner and thinner.

Retirement Plans

In 1974, the US Congress passed the Employee Retirement Income Security Act (ERISA). This act forced Americans to invest in the stock market for their retirement through vehicles like the 401(k), which generally have high fees, high risk, and low returns. Before this, most Americans had a pension that their work provided. They could focus on their jobs and know they would be taken care of. After ERISA, Wall Street had control over the country's retirement money, and most people had to blindly trust Wall Street because they simply didn't have the education and knowledge to understand how to invest properly.

Here’s the Kicker

The rich know how to use these forces to make more money rather than have them steal their wealth.

The rich know how to make investments and run businesses that allow them to pay little-to-no taxes.

The rich know how to use debt and other people's money to make investments that provide constant cash flow while paying that debt off.

The rich know how to make investments that hedge against inflation and make them money while others are falling behind.

The rich know how to utilize all these forces to have a secure retirement provided by cash-flowing assets.

This is how the rich get richer.

Why the 401(k) is Nothing to Celebrate

For a lot of working Americans, this investment vehicle is all they know about retirement planning. Since they were very young, they’ve been told to sock money away into a 401(k) and when they are ready to retire, they will magically have enough money to live on.

Of course, retirement wasn’t always this way. Historically, many people have enjoyed a pension plan. Work your entire life as a good employee for a company and they’ll take care of you when you retire.

As “Time” points out, the 401(k) wasn’t built to replace this system of pensions:

To be fair to section 401(k)’s framers, the provision was never intended to be a broad-based saving incentive that would serve as a foundation for financial stability in retirement. Instead, it marked a truce between the IRS and firms that wanted to let employees plow their year-end bonuses into pension plans. The IRS sought to tax employees immediately on those amounts, on the theory that the pension plan contributions were equivalent to cash. Congress struck a compromise, which it tucked away in a provision of the 1978 Revenue Act that garnered little notice at the time: employees could delay taxes until they withdrew cash from the plans, as long as the plans satisfied certain statutory criteria (including a requirement that the plans not discriminate in favor of the firm’s highly compensated employees).

Yet, fast-forward over 40 years later, pensions are rare and 401(k)s are everywhere…at least for wealthier workers. Poor workers, well, they have nothing. Turns out that corporations are really good at using “tucked away” provisions to their advantage, and the financial industry is great at selling financial vehicles to people who know little about money.

The 401(k) is a horrible retirement plan

At Rich Dad, we’ve talked for years about how horrible 401(k)s are. Robert Kiyosaki’s advisor, Andy Tanner, is especially good at sharing the reasons why. You should check out his book, “401(k)aos”.

For starters, you have no control over your money in a 401(k). You literally hand it over to a manager and hope that it will grow. Want to access your money? You can’t, at least not without a hefty fine. And if the market crashes? You’re out of luck because there’s no insurance for a 401(k).

You also are capped on the amount you can invest. Your 401(k) contribution limit is $18,500 a year; if you’d like to invest more than that, too bad; you need to find another investment vehicle. The problem is that most people who invest in 401(k)s don’t know a lot about money or investments, so they’re happy to give away their money, even if they could be putting it to much better use in other investments. Extra money around? They save it, which is potentially even worse.

Another horrible thing about 401(k)s is that the fees from the managers cut significantly into your earnings. As Kim Kiyosaki wrote:

"The first thing you should know is that your 401(k) is sprinkled with hidden fees that are buried in pages of legal paperwork. Legal fees, transaction fees, bookkeeping fees, and more. Plus, the mutual funds in the 401(k) often take 2% off the top."

These fees may not seem like a lot when you sign on the dotted line, but over-time, compounding cuts down your returns substantially. Jack Bogle, the Founder of Vanguard, puts it like this: "Do you really want to invest in a system where you put up 100 percent of the capital, you take 100 percent of the risk, and you get 30 percent of the return?"

Finally, there are significant tax disadvantages to investing in 401(k)s. Rather than taxed at the lower capital gains rate of around 15%, they are taxed at earned income rates, which can be twice as much.

The one “good” thing

With all these things stacked against a 401(k), why in the world would anyone want one and why are they still around?

To answer the latter part, no one has come up with a better idea and implemented it yet. And big corporations and a whole financial services industry would revolt if they were taken away.

To answer the question of why anyone would want one, people don’t know a lot about money and investing, are often ready to believe whatever they are taught about money and investing, and also buy into the lie that they get free money when their employer matches their investment.

The problem is, there’s no such thing as free money. Here’s an example of an actual conversation between Robert Kiyosaki and a curious investor:

“I have a question for you,” he said. “I’ve read that you say 401(k)s are the worst investments, but I don’t understand why you say that.”

“What is it that you don’t understand?” Robert asked.

“Well,” said the young man. “Most employers match your contribution. For instance, my employer matches up to four percent of my salary. Isn’t that a hundred percent return? Why is that a bad investment?”

“It’s a bad investment,” Robert said, “because it’s your money to begin with.”

He looked puzzled and perplexed.

“Listen, if it weren’t for 401(k)s, your employer would have to pay you that money as part of your salary. As it is, they still pay it, but only if you give up four percent of your existing salary into a retirement account where you have no control. And if you don’t, well the employer comes out ahead. It’s your money, but they’re in control.”

The young man still didn’t look convinced, but Robert could tell he was thinking hard about it. The reason this young man and many others don’t understand this reasoning is that they only think like employees. As an employer, Robert knew that if it weren’t for 401(k)s, he’d have to pay that money to employees in their salary in order to be competitive.

Again, as an employer, a 401(k) is an advantage because he doesn’t have to pay the money unless an employee opts in, and if they leave his company too early, he doesn't have to pay because they aren’t vested.

Plain and simple: a 401(k) steals your money

A study confirms the above logic and should help those of you who still find this logic confusing or not convincing. According to Steven Gandel, a study issued by the Center for Retirement Research indicates that, “All else being equal…workers at companies that contributed to their employees’ 401(k) accounts tended to have lower salaries than those at companies that gave no retirement contribution…In fact, for many employees, the salary dip was roughly equal to the size of their employer’s potential contribution.”

Translation, companies that don’t offer 401(k)s must pay a higher salary to compete with companies that do. Those company’s employees simply get their money as part of their salary rather than having to match it and save it in a tax-deferred retirement plan where they have no control and have high fees.

So, what’s the better alternative?

Back to Rich Dad retirement basics

In a world where you could potentially be living much longer, it’s vital that instead of spending your entire life working for money, you must instead have your money work for you your entire life.

This means moving from the left side of the CASHFLOW Quadrant, the employee and self-employed side, to the right side, the business and investor side.

This is one of the most fundamental concepts of the Rich Dad philosophy on money. By building businesses or investing in assets that provide passive cash flow month in and month out, your money works for you.

The good news is that having your money work for you allows you to still pursue many different passions and hobbies (and maybe even get paid for them), but in a way, that allows you to be financially secure and not dependent on those activities to keep you financially afloat.

No financial intelligence? Stick with the 401(k)

Control is an important aspect of investing. As mentioned above, with a 401(k), you have no control over your investments as you generally invest in funds and indexes controlled by brokers, who are controlled by bankers, who invest in companies that are controlled by boards—all of which you have no control over.

If you want to be rich, you must have a financial education and control over your money and your investments. This is why the rich like to invest in their own business, purchase real estate, and create products. They have a lot of control over those investments. Generally, a good matrix is the more control you have, the higher your potential return. The less control you have, the lower your potential return.

Of course, it takes high financial intelligence to invest in things where you have control because you have to make a lot of important decisions. This is why being forced into a 401(k) probably isn’t a bad thing for most people. This is because most people have little-to-no financial education and wouldn’t know what to do with the extra money other than save it or spend it.

But the average Rich Dad reader should be head and shoulders above the average person in terms of financial intelligence. The reality is that if you’re investing in a 401(k), you’re not making a return on your employer’s match. You’re simply getting what is owed you by your employer.

A so-called financial expert, Ric Edelman, gave the advice: “So you’ll go to school, you’ll get a job, and then you’ll take a couple of years off, go back to school, and emerge with a totally new career.”

That doesn’t sound great.

Instead, invest in your financial education so you can make the right investments to have a happy and healthy retirement. It may not be novel advice, but it’s the right advice.

Original publish date:

November 06, 2018