Blog | Personal Finance

The Four Foundations of Financial Literacy

The four foundations you need to increase your financial literacy and get richer

Rich Dad Personal Finance Team

September 19, 2024

Summary

-

It’s expensive to lack financial literacy

-

The old rules of money don’t work, it’s time to get financially literate

-

Don’t rely on the world to teach you about finances - only you can build your knowledge

When Robert Kiyosaki was growing up, his poor dad, his natural father, never wanted to talk about money. As a result, he never taught Robert or his siblings about it. They were ultimately left to their own devices.

His rich dad, his best friend Mike's father, didn’t share poor dad’s aversion to talking about money. He saw that the way money worked was changing and he made it his mission to prepare his son to thrive financially in this changing world. Thankfully, he also included Robert in his lessons.

Poor dad was not unlike many people in his generation. For them, money was a dirty subject that was not appropriate to talk about, let alone with children. They could get away with this because, for them, things were relatively predictable.

The difference between the rich and poor

For those of poor dad’s generation, if you followed the old rules of money, you could be comfortable. That meant going to college, getting a good job, investing in stocks and saving in the bank, and buying a house.

But rich dad said: “Poor people complain about pay and hard work; rich people do something to solve that problem.”

Rich dad taught that the essence of becoming rich was to take control of your own financial future rather than rely on a boss or a company to do that for you. He also taught that rich people are proactive problem solvers who find solutions rather than complain.

How young is too young?

Poor dad said, “You’re too young to learn about money.”

Rich dad said, “You’re never too young to learn about money.”

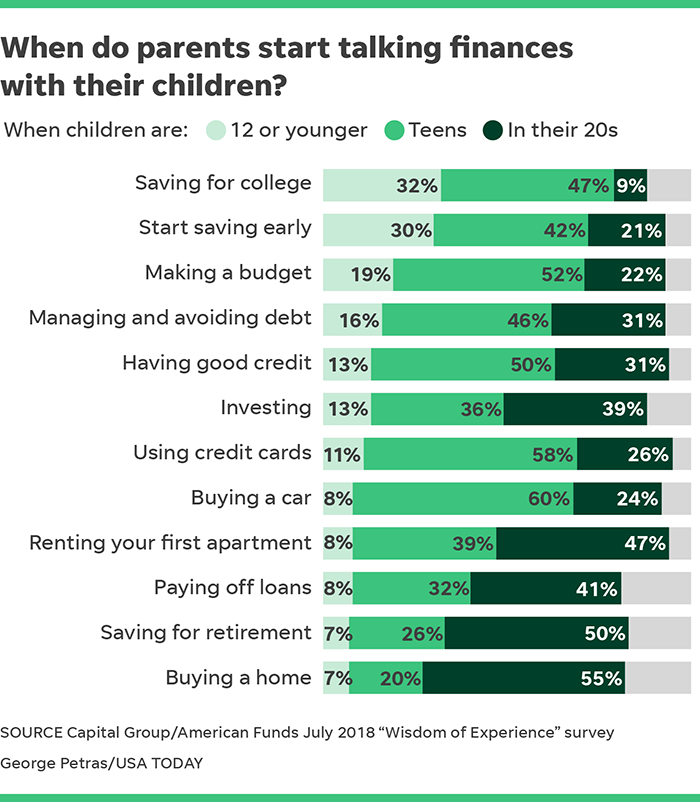

Thankfully, attitudes over time have changed when it comes to teaching kids about money. A 2018 study by USA Today reported that only 2 out of 10 baby boomer parents talked to kids 12 and under about money. But 4 out of 10 millennial parents are teaching their kids about money.

The problem, however, is that millennial parents aren’t teaching their kids the best material when it comes to financial advice. Here’s what the survey by USA Today had to say:

As the old saying goes, “Garbage in; garbage out.” While it’s a good thing that millennial parents are teaching their kids about money at a younger age than previous generations, what they’re teaching will only set their kids up for financial failure later in life. Of course, this is because they can only teach what they have learned. If you aren’t convinced that these financial lessons are garbage, read the post, “Why Savers Are Losers and the Millennial Generation May Be the Biggest Losers of All.”

The cost of poor financial literacy

In an interesting, though much less informal survey, The Financial Educator’s Council asked 3,006 people this question: “Across your entire lifetime, about how much money do you think you have lost because you lacked knowledge about personal finances?”

As CardTrack.com reports, the lack of financial knowledge is collectively costing Americans more than $2.3 trillion dollars over their lifetime. “Respondents estimated that their lack of financial knowledge cost them an average of $9,724.83 (calculated by averaging the total number of respondents choosing each category, using the lowest number in each spread).”

Realistically, it’s likely these folks are low-balling. After all, how can you expect people with no financial knowledge to accurately guess how much that lack of knowledge is truly costing them? As they say, “You don’t know what you don’t know.”

At Rich Dad, we’ve seen folks grow their financial knowledge to make more in a month in passive income than the respondents estimated lifetime loss. Indeed, a little bit of financial education put into practice goes a long, long way—and so does a lack of financial education.

What “they” teach kids

The truth is, schools raise good little employees.

Though kids may thrive in school, when it comes to financial education, they will likely learn to think the way poor dad did: don’t take risks. Don’t find unique angles. Don’t think outside the box.

They are taught to stick to a strict schedule. They are taught to do extra work outside those hours. They are taught to not question authority or established systems. They are taught to work alone and that working as a group is cheating. And they are taught that the kids who follow these ways of doing things get the top marks.

What “the rich” teach kids

Every parent wants the absolute best for their kids’ future. But the rich teach their kids differently.

Creating entrepreneurs

If you ever come across parents who are truly successful, rich, and financially free, you may notice a different quality in their kids. Their kids are entrepreneurial in their thinking and aren’t afraid to question accepted ways of doing things. For instance, Robert had a friend who’s child spent their summers finding lost golf balls on the golf course, cleaning them up, and selling them back to the golfers. They made a lot of money doing that in a lot less time than they would have doing a normal, respectable summer job at McDonald's.

The reason for this, of course, is that these parents work hard to teach their kids and provide a counter narrative to what they learn at school. And they teach them how money, business, and investing work.

But perhaps most of all, rather than discourage the hair-brained schemes their kids come up with to make money, they allow them to chase wild ideas and both make mistakes as well as enjoy great successes. We should all be so lucky.

To think outside of the box

Robert and Mike came across a shop that sold comic books, and noticed that the rep who sold them to the store would come and remove the old issues.

“What do you do with those old issues?” Robert asked.

“I rip off the cover and throw them away,” he said.

“Why do you rip off the covers?” Robert asked, shocked that someone would do such a thing to comic books.

“We want to make sure no one finds them and sells them.”

Robert asked if he could take the old issues once the covers were removed, and over time, he and Mike built up a pretty good sized library of old comics. Naturally, they decided to open up a library where they charged kids a quarter fee for entry per hour, and the kids would come in and could read as many old comics as they wanted. Soon Robert and Mike were making more in a day than they made in a week working hard at the store.

Poor dad didn't like that we were doing this. “Those aren’t yours to make money from,” he said. “You should just make your money honestly at the store. It’s a good job.”

But rich dad commended their ingenuity. “You found a way to make money out of nothing. That’s exactly what the richest people in the world do.”

The reality is that they didn’t break any rules by charging an entry to read the comic books. And they were theirs to let other people read. They played by the rules and all it took was seeing things in a different way than most others would.

The foundations of financial literacy

Finally, the rich ensure their kids are well aware of four foundations of financial literacy. This is by far the most important lesson kids will learn when it comes to money. These foundations will set both you and your kids up for financial success if you internalize them and spend your life learning more and more about them.

The four foundations are:

- Understanding the difference between an asset and a liability;

- Cash flow vs capital gains;

- Using good debt and taxes to get rich, and

- Making your own financial decisions

Remember, to create rich kids, you have to teach them the way the rich would - setting an example for your kids is the best way.

Foundation of financial literacy #1: the difference between an asset and a liability

Many people think they know what an asset is. For instance, you probably think your house is an asset- but it’s not.

Accountants use one definition that requires lots of financial calisthenics to make people and companies feel richer than they really are. This keeps them employed and their clients blissfully ignorant.

The rich use another definition grounded in simplicity and reality. An asset is anything that puts money in your pocket and a liability is anything that takes money out of your pocket.

Your house is not an asset because it takes money out of your pocket each month. Even if you own your house outright, you still have to pay for the taxes, maintenance, and more out of your own pocket.

But if you own a rental property, that can be an asset-if it puts money in your pocket each month in the form of cash flow. When your tenant pays rent, they cover your mortgage, maintenance, taxes, and more.

Foundation of financial literacy #2: cash flow versus capital gains

Most people invest for capital gains. The rich invest for cash flow.

Simply put, investing for capital gains is like gambling. You invest your money and hope the price goes up. For instance, many people buy a house hoping they’ll be able to sell it for more money later. In the meantime, they have to pay their mortgage and home expenses. Money goes out of their pocket. It becomes a liability.

The problem is that when you invest for capital gains you have no control over whether the price goes up or down, and the bigger issue is, if you do make a profit, you pay the highest rate in taxes.

Conversely, the rich invest for cash flow. So, for instance, they buy investment real estate with other people’s money, find tenants to pay the expenses, and collect rent each month. It becomes an asset. And if there’s capital gains, that’s a bonus.

By investing for cash flow instead of capital gains, the rich have control over their income and pay the lowest rate in taxes-and sometimes nothing in taxes.

But investing for cash flow, while a simple concept, requires a strong financial education in order to make your own financial decisions.

Foundation of financial literacy #3: using debt and taxes to get richer

Your financial adviser will tell you that debt is bad and taxes are inevitable. But the rich understand that both debt and taxes can be used to create immense wealth.

When it comes to debt, there are two kinds: bad and good. When your financial adviser tells you to stay out of debt, they mean to stay out of bad debt.

Bad debt comes in the form of borrowing money for liabilities such as using credit cards to buy TVs and take vacations, borrowing a line of credit on your personal home, and more.

Staying out of bad debt is good advice, but the problem is that your financial adviser won’t tell you about good debt.

Good debt is debt used to purchase assets like rental property.

When you use the bank’s money to purchase cash-flowing real estate, you use less of your own money to secure an asset by paying only a down payment instead of full price, and your tenant’s rent pays off your debt while you own the asset and pocket the profit.

When it comes to taxes, the rich understand that governments write tax codes to encourage specific types of behavior. If governments want you to build affordable housing, they give you a tax cut. If they want to encourage oil exploration, they give you a tax cut. If they want to see higher employment, they give you a tax cut.

The secret is that most tax benefits are made to help entrepreneurs and investors. With the right financial education, you too can utilize the tax code to not only get richer, but also pay nothing in taxes.

Utilizing good debt and getting richer through taxes takes a high level of financial intelligence. But everyone can learn and put these principles into practice.

Foundation of financial literacy #4: making your own financial decisions

When you’re not confident about your knowledge of money, you let others make your financial decisions for you.

You let your broker decide how your money should be invested. You let your bank tell you what interest rate is worthy of your money. You follow whatever investing trend is popular in the news.

The rich don’t follow the crowds. They set the trends and are gone by the time the trends become mainstream. What’s their secret? They think for themselves about money and make their own financial decisions because they have a high financial intelligence.

Getting started

When aiming to create financially literate kids, remember that a true financial education would teach young people to know the difference between an asset and a liability, how to make passive income rather than to be passive about income, how to use debt and taxes to get rich, and finally, how to think critically for themselves about money and investing.

Start teaching your kids to grow their financial literacy by checking out our free, financial education community here, as soon as they are able to talk and understand what money is. There is no such thing as too young. It’s only a matter of when they are ready.

Original publish date:

July 31, 2018