Blog | Personal Finance

Why Minimalist Living Will Never Make You Rich

January 22, 2019

Paying yourself first and developing true financial self-discipline is the key to building wealth... not minimalism

Seems like everyone is talking about KonMari these days. For those of you who don’t know about this, KonMari is a minimalist method invented by Marie Kondo for getting rid of clutter in your house.

As described on her website, “The KonMari Method™ encourages tidying by category – not by location – beginning with clothes, then moving on to books, papers, komono (miscellaneous items), and, finally, sentimental items. Keep only those things that speak to the heart, and discard items that no longer spark joy. Thank them for their service – then let them go.”

Rondo gained fame through her book, “The Life-Changing Magic of Tidying Up,” but her latest show on Netflix, “Tidying Up With Marie Kondo,” has really pushed her into the cultural conversation.

Minimalist living on the rise

Marie Kondo is part of a broader cultural movement called Minimalism. As “U.S. News and World Report” writes, “For the uninitiated, minimalism is a lifestyle in which participants think carefully about the items that bring value to their lives and eschew those that don't. It can take many forms. Some people use it as a way to travel the world, owning solely the belongings in their backpacks, while others use it to scale back on unnecessary purchases or lead a more environmentally friendly lifestyle.”

When I was a kid we just called this frugal. The main difference is minimalism invests frugality with a moral meaning, which in some ways can make it more guilt-inducing. In the past, when you spent too much on something or did an impulse buy, you felt the guilt of spending money when you thought you shouldn’t. Now, with minimalism, you feel that guilt and also the guilt of transgressing a moral code you’ve created for yourself.

Personally, I don’t have a problem with minimalism. If someone is happy living simpler, then more power to them. In many ways, Kim and I have practiced what undergirds minimalist thinking, buying and keeping things that bring us joy. Though I don’t think anyone would mistake us for minimalists.

Minimalist living as a way to save?

Perhaps more concerning is the idea that people think minimalism will help them financially.

A recent article in “U.S. News and World Report” hits on this: “For example, ditching an unneeded extra car as part of a minimalist lifestyle can have powerful financial benefits. Not only do you nix auto loan payments and insurance bills, but you slash maintenance, repair and storage costs.”

Additionally, the author suggests pairing minimalism with the following principles:

- “Use it in concert with good budgeting strategies” (aka, cut unnecessary expenses)

- “Along minimalism with your long-term goals” (aka, save and put money in a 401(k)

- “Be mindful — not terrified — of debt” (aka, don’t be afraid of student loans and mortgages)

- “Practice that same level of mindfulness in your financial life” (aka, make sure you like your financial advisor and investment accounts)

Personally, I can think of nothing more depressing than cutting out spending on nice things as simply a way to save money. It makes sense for folks that really want to live simply, but if someone things they can adopt a philosophy that isn’t really core to who they are in hopes of saving money in the long run, they’re in for a world of misery.

A different approach to minimalist living

Rather than look at cutting expenses in your life as a means to saving money, I think you can take the same minimalist approach and apply it as a way to make more money—not just save it.

This method I’m going to share with you takes as much self-discipline as minimalism, but rather than reducing things in your life it multiplies your wealth. What you do with that wealth is up to you. You can still live your minimalist lifestyle with it, but you won’t be poor and frugal either.

The concept I’m sharing with you is the power of paying yourself first.

A tale of two spenders

I have two tales to share with you.

Here is the first tale:

Here is the second tale:

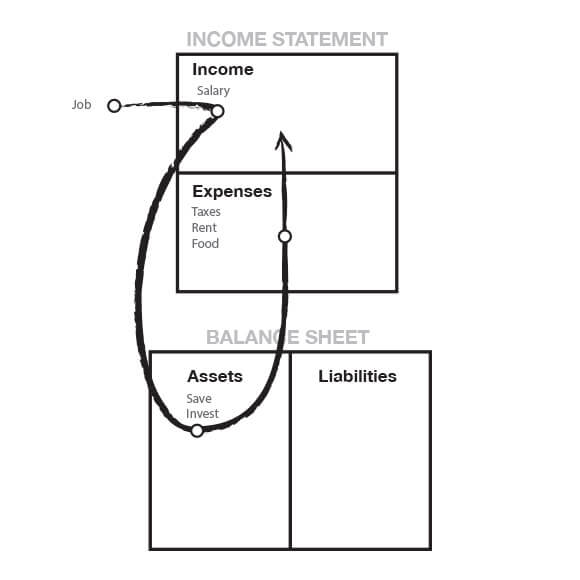

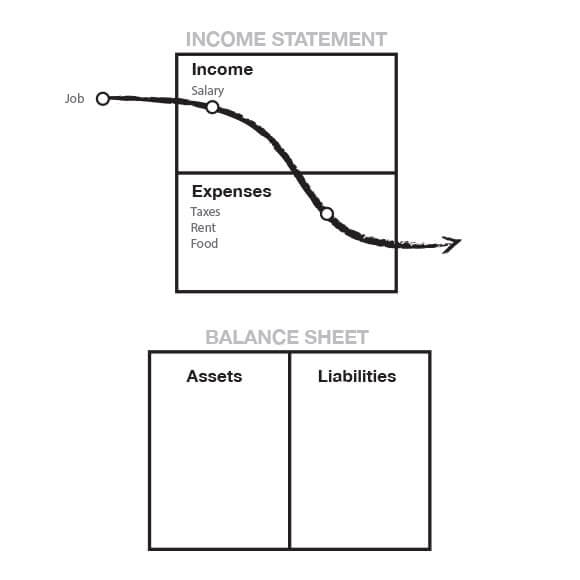

They say that a picture is worth a thousand words. Study the diagrams above and see if you can pick up some of the distinctions between the two tales. If you're financially intelligent, you can see important distinctions in the diagrams above.

The power of cash flow

The first diagram depicts the actions of those who pay themselves first. Each month they allocate money to their asset column before they pay their monthly expenses.

The second diagram depicts the actions of those who pay everyone else before they pay themselves. Each month they allocate money to their expenses column and then invest with whatever is left over—which is usually nothing.

If you understand the power of cash flow, you will understand what is wrong with the second diagram. It's the reason why 90 percent of people work hard all their lives and need government support like Social Security when they are no longer able to work. The reason is they pay themselves last.

It’s also the reason why many people are so attracted to minimalism. They know they have a problem with spending and acquiring liabilities, but they are not sure how to get control over it. So, they take drastic action to cut spending, get rid of things, and pretend it has something to do with philosophy.

Again, this isn’t everyone. There are people who are genuinely living a minimalist lifestyle, but a lot more people are drawn to the benefits—not the idea itself. Getting rid of stuff is just a band-aid for a much deeper problem. They don’t know how to make money work for them and they are not financially self-disciplined.

The self-discipline of the rich

In order to be rich, you must have the self-discipline to pay yourself first. By this, I simply mean using your income to invest in cash-flowing assets before you pay your bills or buy anything fun. This in turn will create more income that you can use to invest in more, cash-flowing assets. Do that and you'll have more money than you know what to do with.

Paying yourself first is not easy. In fact, it can be scary, especially when the bills are piling up. But you must develop the self-discipline to do it.

Simply put, those who have low self-esteem and low tolerance for financial pressure can never be rich. The world will push you around, not because people are bullies (though some of them are) but because it's natural for those with no or low internal control and discipline to be pushed around. People who lack self-discipline are often the victims of those who do have self-discipline.

The three most important self-discipline skills

In the entrepreneur classes I teach, I constantly remind people not to focus on a product, service, or widget. Rather, I tell them to focus on developing management skills, and the three most important skills I tell them to focus on are:

- Cash flow

- People

- Personal time

Whether you own a business or not, these are the three most important self-discipline skills you can master in life. It takes self-discipline to increase your cash flow by paying yourself first, to deal with people who want to take your money before you pay yourself and to negotiate deals, and to spend your personal time wisely by increasing your financial education and finding great deals and opportunities.

If you can master these three self-discipline skills, you can be rich.

Use pressure to grow your self-discipline

Now, I can hear some of you objecting because you believe in paying your bills first. I am not saying don't pay your bills. All I'm saying is pay yourself first. Kim and I have been doing this for years and reaping the benefits. Were there times when we came up short and didn't have the money we needed to pay our bills? Yes.

When we occasionally came up short, we still paid ourselves first, however. The government and creditors would call and howl. I let them. I like it when they get rough. Why? Because they do me a favor. They inspire me to go out and create more money. They grow my self-discipline through pressure.

So, I pay myself first, invest the money, and let the creditors yell. I generally pay them right away and have excellent credit. We just don't cave into the pressure of liquidat-ing or spending our savings to pay consumer debt. That isn't the financially intelligent thing to do. Instead, we grow our cash flow.

To successfully pay yourself first, keep the following in mind:

- Don't get into large debt positions that you personally have to pay for.

- Keep your expenses low. Build up assets first. Then buy the big house or nice car. Being stuck in the Rat Race is not intelligent.

- When you come up short, let the pressure build and don't dip into your savings or investments.

Use the pressure to inspire your financial genius to come up with new ways of making more money and then pay your bills. You will have increased your financial intelligence and ability to make more money.

Original publish date:

February 05, 2013