Blog | Personal Finance

Spring Clean Your Budget

Do you have a scarcity mindset? Learn to think like the rich and take control of your finances

April 15, 2021

Spring is one of my favorite seasons, especially here in Arizona. The temperature hasn’t reached those scorching summer highs yet, so I spend a lot of time outdoors, enjoying the sun and fresh air.

I love spring for another reason, too. It’s all about growth and renewal, opening the windows, letting the light in, and cleaning out your life.

Many people have a ritual of spring cleaning, attacking their closets, kitchens, bathrooms, garages, or any other part of the house to freshen it up for summer.

It’s easy to spot the areas in your house that need a good scrub. But it’s much harder to spot areas in your budget that need an update.

That’s why spring cleaning should also include a good review of your budget and financial situation. Take this time to evaluate where your money is going, and identify opportunities to increase your wealth.

Change your mindset

The best part of spring is embracing a new mindset. One that says, “Out with the old, and in with the new.”

You need to bring a new mindset to your budgeting as well.

There are three different mindsets when it comes to budgeting: Poor, Middle Class, and Rich.

If you budget like the Poor, you’ll look at your financial statements and think, “I don’t have enough money. What can I get rid of to live below my means?”

There’s nothing wrong with getting rid of liabilities or expenses that are draining your funds, but the goal of budgeting is not to live below your means. The goal of budgeting is to expand your means, and find new creative ways to pay for the lifestyle you want.

If you budget like the Middle Class, you’ll look at your financial statements and think, “I have some extra money left over from my high-paying job. I should reward myself and treat myself to something nice.”

I like to reward myself as much as the next person, but I don’t do it with any leftover income. Instead, I budget like the rich…

The Rich look at their financial statements and think, “How can I make more money?”

The rich don’t try to eliminate things that bring them happiness and live below their means. They also don’t try to spend their extra money on more liabilities.

Instead, they take that extra money and invest in asset-producing income that will produce more wealth to pay for their lifestyle.

This is the key mindset you need to bring to your budget as you spring clean it. Instead of thinking about all the things you need to get rid of, you have to think creatively and look for new opportunities to increase your income.

3 bad budgeting tips

Now, let’s take a step back and dive a bit deeper into the Middle Class mindset mentioned above. If you fall into this category, it’s probably because you were given bad advice somewhere in your life — probably by a parent, teacher, spouse, boss, or even an article you read from a finance “expert.” And you’re not alone.

Much of the money advice out there is designed to keep you from becoming poor rather than to inspire a mindset to grow rich. And most of the advice out there for managing finances includes living below your means. Here are 3 examples:

Bad budgeting advice #1: See a world of scarcity

The classic mantra to “live below your means” is one of the most destructive things you can teach someone about money. It teaches people to think in terms of scarcity. You only have so much, so you must be careful not to run out.

Robert will often share the story of how growing up his poor dad would always say, “I can’t afford that.” Robert in turn heard his rich dad counteract this sentiment with the question, “How can I afford that?” One way of thinking, the poor dad way, sees a world of scarcity. The other way of thinking sees a world of abundance.

Rather than live below your means, how can you find a way to increase your means?

Bad budgeting advice #2: Set limits

When you live in a world of scarcity, you must find ways to conserve what you have. So, naturally you set limits. Not going out to eat, creating systems to limit spending, and doing everything yourself instead of hiring an expert are all ways those with a scarcity mindset set limits to “save” money. Unfortunately, they sometimes don’t save money, and even when they do, they feel unfulfilled, stressed, and don’t get to enjoy the things they want to.

Again, there are many good reasons to limit things in life. For instance, maybe you don’t eat out because you want to control what is in your food or spend more time with your family. Or maybe you do a DIY project because you really enjoy learning new things. But not being able to afford them should not be the motivating factor.

Rather than set limits, the rich understand that limits are only a state of mind. If you see the world as one of abundance, the trick (and the fun!) comes in figuring out how you can tap into the abundance, not miserly protect the little bit you’ve managed to earn.

Bad budgeting advice #3: Set the wrong example

Ultimately, if you follow the advice of conventional money experts and model this behavior for your family, you’ll continue to raise generations who struggle to make ends meet financially. Worse yet, you’ll teach them to see the world as one of scarcity, limiting their mindset and potential in the process. Instead, take a leap and start to learn how you can achieve all that you set your mind to. Pass those lessons, both from success and failure, on to your children. They’ll be better off for it.

Where to start

Spring is a great time to reevaluate your budget because you’ve just come through tax season. You should have a good idea of where you are financially, and have all your receipts, paperwork, and bank statements on hand.

Once you have all this information in front of you, it’s time to simplify it. That means understanding two personal finance statements.

Your Income Statement and your Balance Sheet.

Categorize all your expenses and income streams into their respective columns. Don’t forget to include any income-producing assets, and income-draining liabilities.

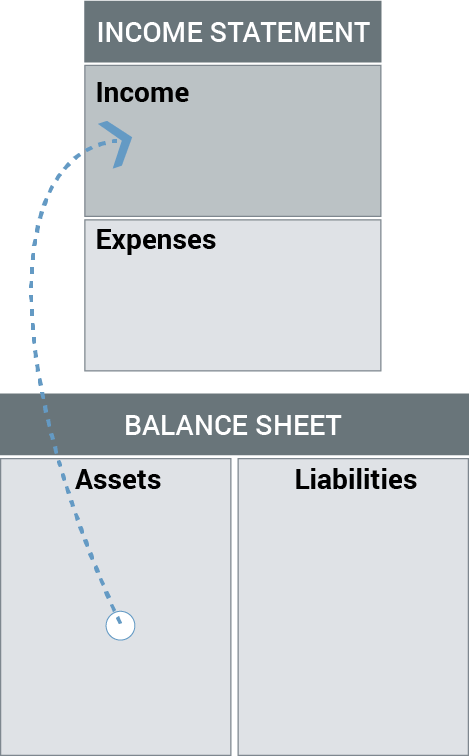

Remember, an asset is something that puts money in your pocket. It’s that simple. This is the cash-flow pattern of an asset:

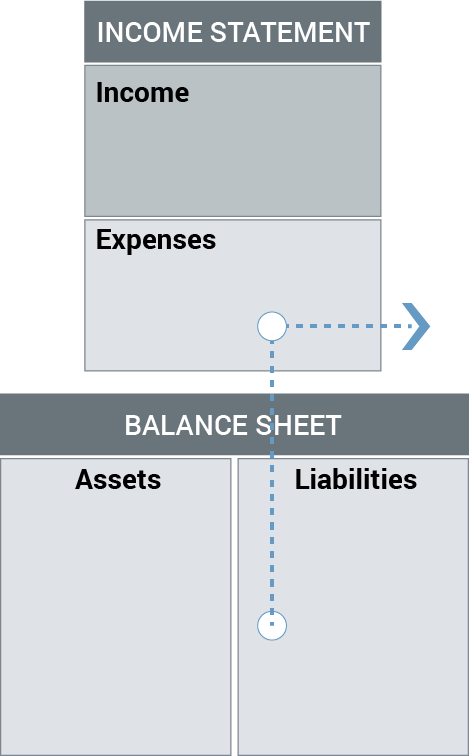

A liability is something that takes money out of your pocket. This is the cash-flow pattern of a liability:

Understanding how these two sheets work together already opens up possibilities for your budget. You can better see what liabilities are draining your budget, and clean out the ones that aren’t bringing you joy. You will also get a better understanding of where your income is going, and open up to new ideas for expanding your income.

Ask how

Still not sure how to do that? Start by asking one simple question:

How?

How can I afford this? How can I pay off my debt or mortgage? How can I live my lifestyle without giving up the things that bring me joy?

Spring cleaning your budget is about opening up to new, fresh possibilities. It should be a fun activity, but for many it becomes sad as they throw out things that make them happy, or start working overtime, searching for a part-time job to increase their salary.

This simple change in language will allow you to expand your thinking when it comes to your budget.

Original publish date:

April 20, 2017