Blog | Personal Finance

Millennial Finances: Here’s How to Solve the Struggle

The lessons of "Rich Dad Poor Dad" apply more than ever with millennial finances

Rich Dad Personal Finance Team

May 14, 2024

Summary

-

Despite being the most educated in US history, millennials are still struggling to understand how money works

-

Millennial finances are still subject to suffering, because they’re hit with too many financial double whammies

-

Millennials are victims to the love of liabilities, too

The millennial generation has solidly moved into the pole position when it comes to the workplace and our culture. At 72.2 million strong and with the oldest members over the age of 40, they are now the biggest and arguably the most influential generation. So, it’s worth studying their money habits—and, unfortunately, they may be in for a world of hurt.

Millennial finance habits

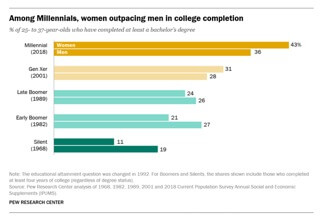

By many reports, the millennial generation is the most educated generation in US history—and by some stretch. Take a look at this graph from Pew Research.

Yet, they have a problem. Despite all this higher education, they had the highest levels of unemployment in 2020, and they make 20 percent less than their parents did at the same stage of life.

And to add insult to injury, a s Refinery 29 reports, “66 percent of surveyed participants believed their savings accounts alone will be sufficient enough to rely on in 20 years.” This means that they have a strong preference for saving money over investing it.

But as other data shows, preference doesn’t always mean action. Bank of America reports that only 1 in 5 millennials have even started saving, and of those who have, 40% have only $5,000 or less in the bank. The same study cited by Refinary 29 reports that 88% of millennials say they intend to save more in 2016, but only 36% say they plan to spend less.

What does this show us?

Many millennials have a very low amount of financial intelligence, and what knowledge they do have about money stems from the old rules of money that no longer work. This confirms that millennials need a new financial game plan.

To say this research is concerning would be an understatement. In the new world of money, savers will always be losers… and we can’t afford to have our largest generation being financial losers.

Millennials value experiences

When Rich Dad Poor Dad came out, Robert Kiyosaki was writing to an audience of baby boomers; a generation that had a love for buying things, like cars, houses, and TVs.

The millennial generation that is maturing into the young adults of today hold a different ethic. They’re more into experiences. As "USA Today" reports, "a recent Harris Group study found 72% Millennials plan to focus on 'experiences rather than physical things' in their future spending."

There is even an air of moral superiority among those that live this way. As Marian Salzman, CEO of Havas PR North America, writes for "Forbes":

"Shop till you drop." "He who dies with the most toys wins." "Greed is good." Those credos seem as dated now as leg warmers and John Hughes films. They seem like relics not just from the '80s but also from an ancient civilization. It's hard to believe that people said them (even ironically) in our lifetime.

Amazing what a difference a generation can make. But this isn't just a generation gap between materialistic baby boomers, nihilistic Gen Xers, and optimistic millennials. It's a shift in cultural values. Capitalism has fundamentally changed, and it isn't going back.

Citing research from her parent company, Havas Worldwide, Salzman writes:

People would rather drop shopping than shop till they drop, and that sharing is good. People have started to think of shopping as a necessary evil. It's something we still have to do, and something we even sometimes (guiltily) enjoy, but most of us no longer brag about it.

We'd rather spend our money on experiences (to quote an industry mantra) and stories we can tell ourselves and others. We're still suffering from the collective debt hangover after the early 2000s (fueled in part by George W. Bush exhorting Americans to shop out of patriotic duty). And, most important, we're mindful of the impact our purchases have on the planet and on other people, and especially on ourselves.

But the truth is, experiences are liabilities,too.

The double Millennial financial whammy

In many ways, millennials are victims of a cruel double whammy: systemic debt and asset bubbles, and an antiquated education on how money works.

In 2017, Charles Hugh Smith published an important blog post called “Will the Crazy Global Debt Bubble Ever End?” In the post, he detailed how most consumer debt is not backed by physical assets but instead by the ability of the borrower to pay the debt.

In recent years, near-zero interest rates have led to continued expansion of consumer debt. In fact, in 2020 it sat at $14.15 trillion. That’s higher than it was during the third quarter of 2008, which was right when the financial world collapsed.

Of course, during this time income has not gone up. As Smith shows, inflation adjusted median household income has been flat since 1998, and those in the bottom 90% of earners have actually seen their incomes go down.

But this isn’t all. As "USA Today" writes,

On the income front, consider a Yale economist's study of earnings from college grads, which showed "large, negative wage effects to graduating in a worse economy." In some cases, they saw as much as $100,000 less in cumulative earnings over the next two decades vs. those who graduated into more favorable times. Many Millennials, of course, hit the job market smack dab during the Great Recession.

And on the investing front, consider a recent McKinsey & Co. report titled "Diminishing Returns: Why Investors May Need to Lower Their Expectations." The name says it all, but the gist is that the consulting firm forecast 4.0% to 6.5% returns annually from the stock market across the coming years - down dramatically from the 7% to 10% annual gains common over the past 50 years or so.

So, we continue to see increasing amounts of debt but no growth in income to service it. How does this continue? By settling artificially low interest rates from the central banks.

This is what the banks wanted. It gives the appearance of growth without actually creating true growth.

This is why millennials are in desperate need of gaining financial literacy through better financial education. So here’s a little bit of monetary history to hopefully educate our millennial friends.

A recent history of money

Robert’s poor dad, his natural father, believed in saving money. “A dollar saved is a dollar earned,” he often said.

The problem was that he didn’t pay attention to changes in monetary policy. All his life he saved, not realizing that after 1971 his dollar was no longer money.

In 1971 President Richard Nixon changed the rules of money. That year, the U.S. dollar ceased being money and became a currency. This was one of the most important changes in modern history, but few people understand why.

Prior to 1971, the U.S. dollar was real money linked to gold and silver, which is why the U.S. dollar was known as a silver certificate. After 1971, the U.S. dollar became a Federal Reserve Note—an IOU from the U.S. government. Instead of our dollar being an asset, it was turned into a liability. Today, the U.S. is the largest debtor nation in history due in part to this change.

Taking a brief look back at the history of modern money, it’s easy to understand why the 1971 change was so important.

After World War I, Germany’s monetary system collapsed. While there were many reasons for this, one was because the German government was allowed to print money at will. The flood of money that resulted caused uncontrolled inflation. There were more marks, but they bought less and less. In 1913, a pair of shoes cost 13 marks. By 1923, that same pair of shoes was 32 trillion marks!

As inflation increased, the savings of the middle class was wiped out. With their savings gone, the middle class demanded new leadership. Adolf Hitler was elected Chancellor of Germany in 1933 and, as we know, World War II and the Holocaust shortly followed.

A new system of money

In the closing days of World War II, the Bretton Woods System was put in place to stabilize the world’s currencies. This was a quasi-gold standard, which meant currencies were backed by gold. The system worked fine until the 1960s when the U.S. began importing Volkswagens from Germany and Toyotas from Japan. Suddenly the U.S. was importing more than it was exporting and gold was leaving our country.

In order to stop the loss of gold, President Nixon ended the Bretton Woods System in 1971 and the U.S. dollar replaced gold as the world’s currency. Never in the history of the world had one nation’s fiat currency been the world’s money.

To better understand this, Robert’s rich dad, his best friend’s father, had him look up the following definitions in the dictionary.

“Fiat money: money (as paper money) not convertible into coin or species of equivalent value.”

“Fiat: a command or act of will that creates something without or as if without further effort.”

Looking up at rich dad, Robert asked, “Does this mean money can be created out of thin air?”

Nodding his head, rich dad said, “Germany did it and now we are doing it.”

“That’s why savers are losers,” he added. “I fought in France during World War II. That’s why I never forget that it was after the middle class lost their savings that Hitler came to power. People do irrational things when they lose their money.”

The liability disease

At the end of the day, fundamentals are fundamentals, even when they are wrapped in a prettier package. And for all their disdain for their parent's generation when it comes to materialism, the reality is that millennials suffer from the same financial disease: the need to spend, and spend richly, on liabilities.

Simply put, as great as experiences are, they are still liabilities that take money out of your pocket. And if you don't get smart about your money and your financial future, you'll find yourself unable to enjoy those experiences later in life.

So what's a millennial to do?

Securing your financial future isn't about greed

The lessons of "Rich Dad Poor Dad" still apply to this day: increase your financial intelligence, invest in assets that provide cash flow, and enjoy the things you love with that cash flow.

The beautiful opportunity the millennial generation has is to turn their love for experiences into opportunities to grow their financial intelligence and assets. This is not about owning more stuff. It's about securing your financial future to do things you love and be the generous people that you are for the entirety of your life.

Get with the currency

This brings up another important lesson, because money is no longer money but instead currency, it must always flow somewhere. Like an electrical current, financial currency must move or it will die.

Saving money is essentially letting your currency die. The reason we see wild swings in places like the stock market, housing, and even cryptocurrency, is because money is moving. The rich understand this and they use their financial education to know where the money is moving to, early and often. Following the old adage, they buy low and sell high. In addition to that, they use their earnings to purchase assets that produce cash flow and exponentially grow their wealth.

The good news is that anyone can do this, if they have a high financial IQ.

Follow the four foundations of financial literacy

If you’re a millennial and this post has you thinking about your financial future, a good place to start increasing your financial intelligence is by understanding the four foundations of financial literacy.

You can read more about them in the link above, but briefly they are:

- The difference between an asset and a liability

Many people think they know what is an asset. For instance, you probably think your house is an asset — but it’s not. The truth is most accounting systems have made the definition overly complicated. Simply put, an asset puts money in your pocket and a liability takes money out. Follow that definition and you’ll do well.

- Cash flow versus capital gains

Most people invest for capital gains. The rich invest for cash flow. Another way of looking at it is investing for capital gains is like gambling. You invest your money and hope the price goes up. Conversely, the rich invest for cash flow. And if there’s capital gains, that’s a bonus.

- Using debt and taxes to get richer

Your financial adviser will tell you that debt is bad and taxes are inevitable. But the rich understand that both debt and taxes can be used to create immense wealth. When it comes to debt, there are two kinds—bad and good. Good debt is debt used to purchase assets like rental property. Bad debt is used to purchase liabilities like using a credit card to fund a vacation.

- Making your own financial decisions

When you’re not confident about your knowledge of money, you let others make your financial decisions for you. You let your broker decide how your money should be invested. You let your bank tell you what interest rate is worthy of your money. You follow whatever investing trend is popular in the news.The key to building great wealth is having great knowledge to act on and great wisdom to know which course of action is the best. This kind of knowledge and wisdom only comes through a high financial intelligence gained from applying yourself to financial education.

How to change the problems with millennials' finances

Still these are at least green shoots in the financial literacy landscape of America. If the monopoly that is higher education in this country is broken by a generation that refuses to play the game, that can force a lot of positive change.

For both the millennials and Generation Z, it’s not too late, but it starts with financial education and understanding how money works in today’s economy. Here are some quick ideas:

-

Turn your trips into opportunities to get to know the local real estate market and identify potential cash-flowing properties

-

Take advantage of sharing economy services like Airbnb and Uber to create income opportunities

-

Form an investing club with your friends and make the idea more appealing by giving it a social-good component such as using part of the funds to support a charity together

-

Find ways to sell the goods you create from your hobbies to fund them and build a business

Each of these ideas could be a post in themselves, but the purpose is simply to get the gears of your mind turning. More than ever, the lessons of "Rich Dad Poor Dad" apply today. You must change the way you view money and investing in order to survive your financial future. Simply buying into the old rules of money like saving, buying a house, investing in a 401(k), and getting a good job won't do the trick. It didn't work for your parents and it won't work for you.

Original publish date:

January 09, 2018