Blog | Entrepreneurship, Personal Finance

Your Child’s Future Financial Gorillas

Why understanding the CASHFLOW® Quadrant can save your child's financial future.

October 11, 2022

You've probably heard of the phrase, "the 800-pound gorilla in the room." If not, it simply means there is something—a topic or an idea that carries some weight or needs to be reckoned with—that everyone knows about, but no one wants to talk about.

When it comes to our kids,there are several gorillas they will likely face that will significantly impact their financial future. Few people talk about these gorillas, but they're out there. It's vital that we prepare our children before they encounter them later in life.

800-pound gorilla #1: The new problem of growing old

It used to be that 65 was considered old. Today, "65 is the new 45"—or at least that's what us baby boomers would like to believe.

With advances in medical technology, the new old for your child may be 90 or even over 100. This makes for new opportunities...and new problems.

Getting old is expensive. Most people rely on programs like Social Security and Medicare to assist them financially as they age. But there's a problem, both programs are unfunded liabilities that won't be liquid by the time our kids grow old.

Even worse, our kids will have to support the generation before them who will be on these programs, requiring hundreds of trillions of dollars. Where will the money come from?

800-pound gorilla #2: Accelerating national debt

Most of us have probably heard of the power of compounding interest. Albert Einstein is often credited with referring to it as the "most powerful force in the universe."

A parallel concept is the miracle of compounding debt. Your child will face the tyranny of compounding debt as well as the compounding interest on that debt.

In the year 2000, the US national debt was over $5 trillion. By 2012, it had risen to over $16 trillion. Today, the US national debt is at $31 trillion.

Put simply, that means your children's future will be one of increased financial turmoil as nations face compounding debt and financial pressure.

800-pound gorilla #3: College debt

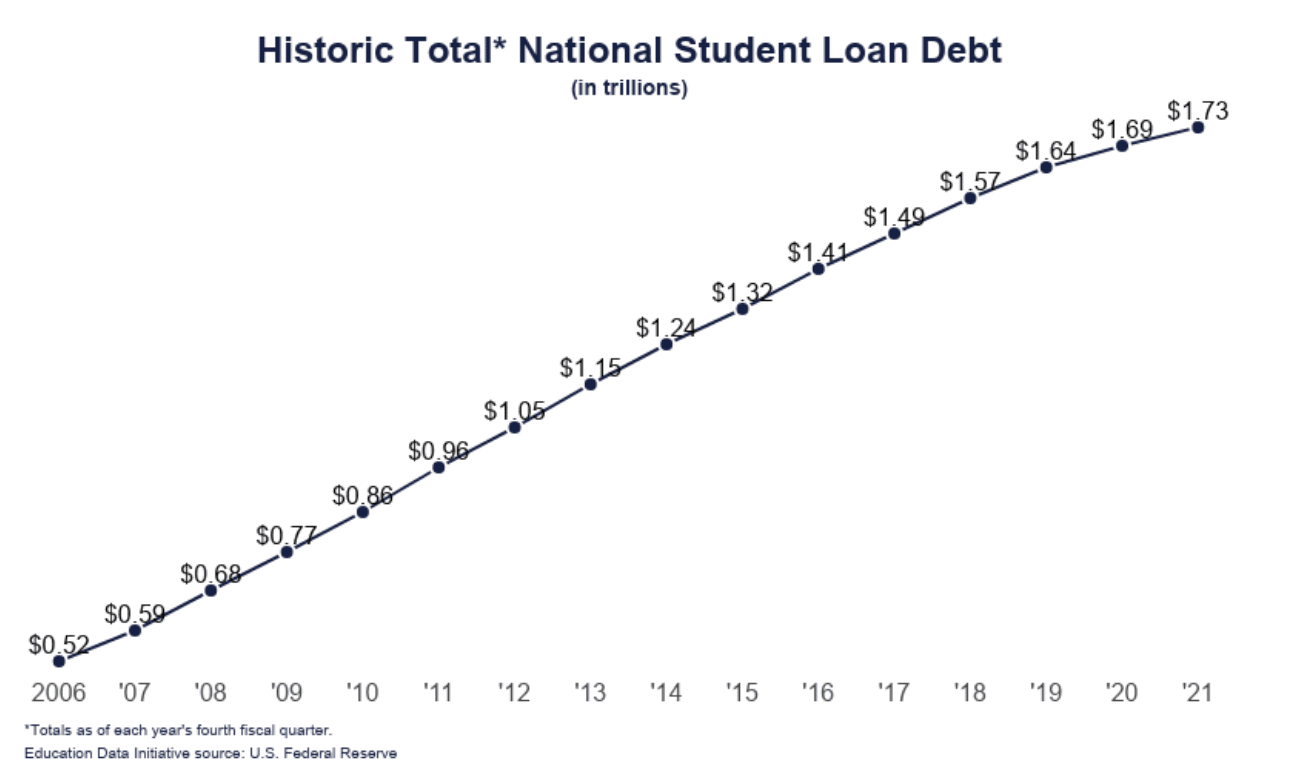

In the United States, the outstanding federal loan balance is at $1.620 trillion. Of that, an astonishing 92.7% is attributed to student loan debt.

According to the Education Data Initiative, the average college student is over $37,000 in debt; as of July 2022, 15% of all American adults report they still have outstanding undergraduate student debt. These numbers are only climbing, as you can see below:

Source: educationdata.org

Source: educationdata.org

My rich dad always made it clear to me that contrary to traditional belief, college isn’t the only way to become successful (not even close, actually). Here are a few things you can encourage your child to do to avoid costly student loan debt:

For some, college may be the best way to go, the above are just a few alternatives. But always remember: student debt is a financial plague. Do anything you can to avoid it.

800-pound gorilla #4: The New Depression

History records two types of financial depressions:

-

The Great Depression of 1929 in the US

-

The German hyperinflation of the 1920's

Summarized in simple terms, the American depression was caused by not printing enough money. The German hyperinflation type of depression was caused by printing too much money.

In 2002, Federal Reserve Chairman Ben Bernanke said, "The U.S. government has a technology called a printing press [or its electronic equivalent today] that allows it to produce as many U.S. dollars as it wishes at no cost." Since 2007, it has been clear that Chairman Bernanke favors printing too much money to fight the financial crisis, having pushed trillions into the global economy. But is there really no cost?

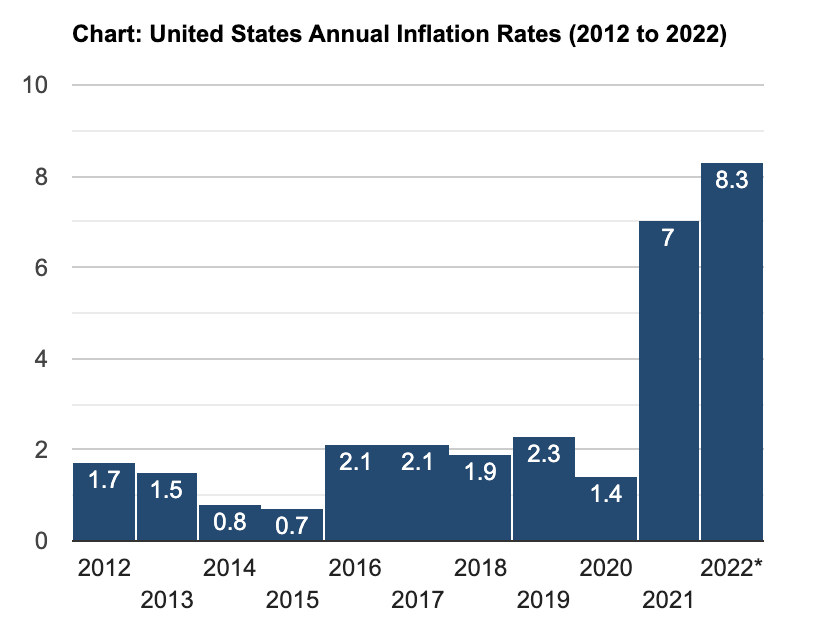

The chart below shows the annual inflation rates and their recent spike over the last few years:

Source: usinflationcalculator.com

Source: usinflationcalculator.com

As you can imagine, the COVID-19 pandemic caused the demand for many goods to drop in 2020, and remain lower through 2021 and into 2022.

For people who work for money and savers who believe in saving money, hyperinflation could wipe them out.

The theory of printing money in abundance, especially during unprecedented world-changing events (insert: pandemic), may force our children to face hyperinflation. In that scenario, the old rules of getting a job and saving cash won't help them. They'll need to be equipped to survive and thrive in this new reality.

800-pound gorilla #5: Higher taxes

Every time central banks print money, two things happen:

-

Higher taxes

-

Higher inflation (which is another type of tax)

As the previous three 800-pound gorillas unfold in our children's lives, one thing is for certain: taxes will go up—significantly.

Because of this, parents should talk with their children as early as possible about who pays the most in taxes—and why.

The importance of understanding the CASHFLOW Quadrant

Below is the CASHFLOW Quadrant:

The letters in the four quadrants represent:

Everyone resides in at least one of the four quadrants, and each quadrant determines where our cash comes from.

Our school system prepares our kids for the left side of the CASHFLOW Quadrant, the E and S quadrants. That is why the common advice is "Go to school to get a job" (E quadrant) or "Become a doctor or a lawyer" (S quadrant).

It is generally the "A" students, those who do well in school, which go on to do these types of jobs.

The problem is that those on the left side of the CASHFLOW Quadrant pay the most in taxes. This is because where your income comes from determines how that income is taxed.

Generally, this is how it breaks down:

-

E = 40% taxes

-

S = 60% taxes

-

B = 20% taxes

-

I = 0% taxes

Looking at that, it should be clear why it's vital that our kids have a solid financial education in order to learn how to operate on the right side of the CASHFLOW Quadrant as business owners and investors. By doing so, they'll thrive financially in a future where most will struggle just to survive.

It's generally the "C" students, those who are smart but don't do well in traditional school, that go on to work in the right side. In truth, everyone can work on the right side of the quadrant, but they need the right financial education—and education that our schools do not provide.

800-pound gorilla #6: Higher inflation

The higher inflation rate, first observed in 2021 as a result of the COVID-19 pandemic, took financial markets by surprise.

Add in the recent war between Russia and Ukraine, which pushed the CPI inflation rate to 8.6% in May of 2022. According to the Federal Reserve Bank of St. Louis, this is the highest level in 40 years.

Experts believe that the length of our current inflation episode depends on two things:

-

The interplay between the persistence of labor market tightness and supply chain bottlenecks, and the central bank response, and

-

The duration of the War in Ukraine, and its impact on prices globally.

In short, our children are subjected to coming face to face with persistent inflation, because of external factors of which they can’t control.

800-pound gorilla #7: Fuel

As of 2022, the US crude oil production in our forecast averages 11.8 million barrels per day. This has gone up by over 8% from last year.

So why exactly are gas prices rising?

The reality is that factors beyond our control are causing the pain you’re feeling at the pump. Among those factors are increased demand in China and the ongoing war between Russia and Ukraine.

As the New York Times once stated: “A country that consumes more than 20 percent of the world’s oil supply but owns 2 percent of its reserves cannot drill its way out of high prices or dependence on exports from unstable countries.”

Like we have witnessed ourselves, the continual increased cost of fuel will be handed down to our children.

Your child's financial future hasn't been decided yet

In preparing our children for the gorilla-wrestling that lies ahead, it's important that they know there are different options open to them than just "go to school, get a job, work hard, and pay higher and higher taxes." This starts with you providing a great financial education at home.

So the question is, what are you doing to prepare your kids for the future?

If you're looking for more resources, join our free financial education community here.

Original publish date:

March 27, 2013