Blog | Personal Finance

Rich Dad Scam #5: Save Money

Stop trying to learn how to save money and start learning how to spend it

Rich Dad Personal Finance Team

February 01, 2024

Summary

-

“Save money” is an antiquated financial tip - it used to be true, but it’s a scam today

-

In order to understand money, you have to know its history

-

The true path to wealth is to keep your money moving

This is the fifth post in a series called Rich Dad Scams, where we point out the scams the rich use to keep the poor and middle-class poor. The Rich Dad Scams we’ve identified are, very simply, the things you are taught about money that are wrong. They keep you from becoming rich. They are the ideas the rich have built into society to keep you poor and them rich. Unfortunately, they’re so driven into our minds that it can be hard to recognize them as lies.

“If you save money, you will have money.” “Save money for a rainy day.” “A penny saved is a penny earned.” These are common lessons parents teach their kids about money.

Unfortunately, it doesn’t stop with our parents. Nearly every so-called financial expert teaches people that the path to wealth is saving money. This has led to massive demand on money saving strategies. A Google search for the term “save money” will serve up 4.69 billion returns…and the entire first page is almost entirely devoted to telling you how to save money.

Unfortunately, there’s one big problem with the idea that saving money will make you rich: it’s a lie.

“Save money” is antiquated advice

The big problem with Rich Dad Scam #5, “Save Money,” is that it used to be true. A generation or two ago, saving money paid off. You could set aside a certain amount of money and retire on it. Your parents or your grandparents might have done just that, and it worked. But what worked for them cannot work for you in today’s economy. To understand this, you must understand the history of money.

In Robert Kiyosaki’s book, “FAKE: Fake Money, Fake Teachers, Fake Assets: How Lies Are Making the Poor and Middle Class Poorer” you’ll find a story about a letter he got from his rich dad when he was on his tour of duty in Vietnam. Rich dad wrote, “President Nixon took the dollar off the gold standard. Watch out, the world is about to change.”

As Robert would go on to share in a post called “Fake Money is Making You Poorer,” he and his military friend learned a valuable lesson about money after that letter from rich dad.

Though he didn’t quite know what rich dad meant at the time, Robert was intrigued. He would search through “The Wall Street Journal” for answers. One article that caught his attention was on gold. The price was fluctuating from $35 an ounce to $40 to $60 an ounce.

Thinking they were smart, a fellow pilot named Ted flew with Robert from their carrier across 25 miles of sea into enemy territory. They hoped to find a gold dealer and get a good deal.

They tried to negotiate with an old woman in a small village, their opening bid being $40 an ounce. Little did they know, spot was $55. The tiny woman they were bargaining with just smirked and was probably thinking, “The two of you are idiots. Don’t you know that the spot price of gold is the same all over the world?”

Thankfully they got out of there without any detection by the enemy, but certainly didn’t get a deal on gold. Most importantly, they got a lesson on real money.

In 1971, Richard Nixon took the United States off the gold standard, the system where every dollar in the US economy was based on a dollar’s worth of gold that the country owned. When Nixon did this, the U.S. dollar became fake money. This is because rather than have the dollar tied to gold, it was instead tied to “the full faith and credit” of the US. Essentially, the dollar became an IOU.

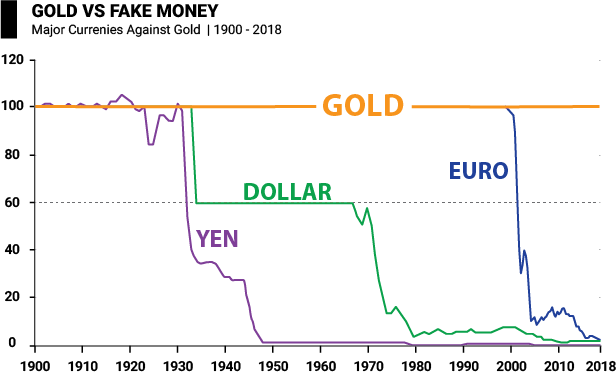

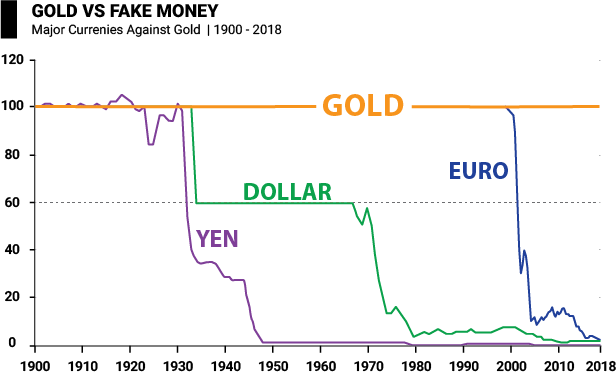

In the process, Nixon’s actions destabilized the economy, kick-starting inflation and a number of other factors that affect the power of your dollar. You can see the impact on the dollar in this chart.

Before 1971, money was money, backed by the value of gold. If you saved 10 percent of your income every year, it could turn into enough to retire on. After 1971, money became a currency that could go up and down in value with nothing of value backing it other than America’s word. That is why there have been so many fluctuations, peaks and valleys, in the economy.

The rich don’t save money

Money is something that holds its value, which is a different concept from currency, which is a representation of that value. When the US went off the gold standard, US dollars really stopped being money and became a currency. Money is something that keeps its value. Currency fluctuates in value, and the US dollar has kept losing value since 1971.

Today, savers are losers. Why? The bank pays you a lower interest rate on your savings than the inflation rate. In essence, this means that your money in the bank loses more value than it gains over time. It’s a losing proposition to save. The dollar you save today will be worth less a year from now. This is why savers are losers. It is not a judgment on the person who saves, it is a reality in regards to their finances. They lose financially while the banks and the rich win.

Entrepreneurs and investors put the dollar to work for them. They understand that in order to be of value, a currency always needs to move. Here’s a simple illustration to help explain: Electricity travels by way of currency. If you plug something into your wall, the electric current flows through the cord and powers your device. In order to exist, a current needs to continually move. Its sole purpose is to move from one place to another, where it provides its value. It has no value in and of itself. In fact, if a current stops moving, it dies.

In the same way, money is now currency. It is only valuable if it moves into something of value. If it sits still, it eventually dies, as the chart above shows. This is why the rich don’t save money. Rather they spend it, moving it into cash flowing assets that grow in value over time and provide even more currency than they put into them.

If you want to learn more about investing in cash flowing assets, read the post, “The Personal Financial Statement: Your Foundation for Being Rich”

Save gold and silver instead of money

Historically, once money isn’t based on something concrete, like gold, its days are numbered. Once your money is simply a piece of paper that really only represents debt, a currency, how can it sustain itself? It can’t.

At Rich Dad, we’re all big believers in diversifying into gold and silver, real concrete representations of money, not currency. Take a look at this chart again:

When measured against the major currencies of the world, gold’s value has held constant while the value of those currencies has dropped, relatively, almost nothing. Precious metals have been the true measures of wealth for thousands of years. If we learn from history, we see that currencies collapse. Gold is consistent. It is truly money.

Making your money work

So, if you can’t put your money in the bank, what can you do? The answer is to get aggressive. Putting money in the bank is passive. Putting your money out in the world is putting it to work. Why put your money in the bank where it will lose value when you can put it to work for you in assets where you can turn your money into more money?

Rather than believing the Rich Dad Scam #5, “Save money,” consider spending your money, and investing it in cash-flowing assets. That is the

Original publish date:

March 22, 2013