Blog | Paper Assets, Personal Finance

The Bitter Taste of Austerity

March 01, 2013

Things are looking increasingly dicey for the global economy. Last week the Organization of Economic Cooperation and Development (OECD) released a report stating that the combined gross domestic product of its 34 member nations declined at an annual rate of 0.6% in the fourth quarter of 2012. This has happened only 13 times since the OECD began publishing these statistics in 1962.

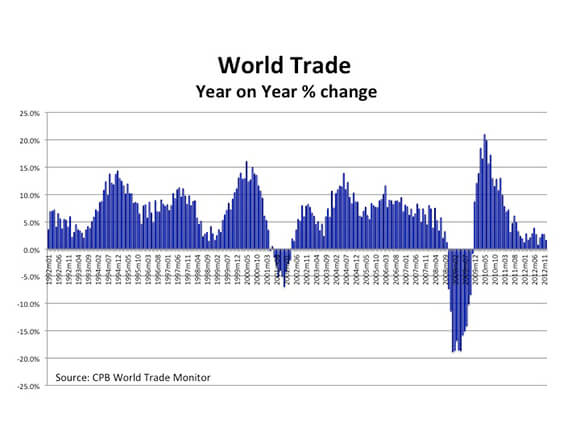

For the G7 nations, the quarter on quarter change in GDP was -0.9% for Italy, -0.6% for Germany, -0.3% for France, -0.3% for the UK, -0.1% for Japan, and no change for the US. Canada’s fourth quarter data had not yet been released. Not surprisingly, under these conditions, the growth in world trade remains depressed. Actual contraction is a growing possibility.

To make matters much worse, the United States has chosen this moment to impose significant fiscal austerity. Thanks to the fiscal cliff deal in January, with its 2-percentage point increase in the payroll tax, most Americans have less disposable income than they did in the fourth quarter. Moreover, thanks to “Sequestration”, the government will begin to spend less after March 1st. Combined, higher taxes and less government spending will knock off roughly 1.5% from the United States’ economic output in 2013 – before any multiplier effect is taken into consideration.

The United States is not alone in going down austerity row. England and the European Union are also doing the wrong thing at the wrong time. Monetary policy alone is now keeping the global economy afloat. Paper money creation on an extraordinary scale is pushing up asset prices and creating the purchasing power that allows consumers to continue to consume. But even monetary policy began to look wobbly when the minutes to the Fed’s January FOMC meeting were released on February 20th. The minutes stated that several members of the committee had begun to question the risk-reward tradeoff involved in continuing the Fed’s current program of creating $85 billion of new money each month. Those words caused a sharp and immediate selloff on the stock market. Calm was only restored when Chairman Bernanke, during congressional testimony, reassured market participants that the Fed would not take away the punchbowl any time soon, but, indeed, would keep topping it up so long as unemployment remained high.

Only China has taken steps to stimulate its economy with fiscal measures; and only China’s economy is showing signs of strengthening. The tide may be beginning to turn, however. In December, the Japanese elected a new Prime Minister on the back of his promise to boost that country’s persistently weak economy by applying much greater fiscal and monetary stimulus. And, in late February, voters in Italy voted against austerity by throwing their support behind the anti-establishment, anti-austerity 5-Star Movement. During the same week, Moody’s downgraded the UK government’s debt rating due, at least in part, to weak economic growth prospects resulting from continuing government austerity.

With higher taxes and sequestration now taking effect, Americans are about to receive their first dose of austerity in many years. They will find the taste very bitter. This medicine is quite likely to tip the economy back into recession. It is certain to cause unemployment to rise.

As the economy sickens further, voters in the United States will have time to reflect on the wisdom of imposing austerity during a depression. Before the next congressional elections in November 2014, let’s hope they have come to the realization that government investment is a much better idea.

Original publish date:

March 01, 2013