Blog | Personal Finance

How You Can Profit From Inflation

Defining inflation and learning how the rich make money from it

Rich Dad Personal Finance Team

June 25, 2024

Summary

-

Before knowing how to profit from inflation, first know how inflation comes to be

-

Don’t let the government’s statistics fool you—do your own research

-

Key ways to profit from inflation: leverage and hedging

A while back, Robert Kiyosaki wrote about why the middle class is screwed. He shared how the rising cost of healthcare was causing traditionally financially comfortable folks to spend less and less on basic needs. Before that, he wrote about the reason you feel (and are) poorer.

Robert shared how the wages of the middle class have been largely stagnant. Some people have seen very small gains, but not much. Since 1979, the middle class wages are up only 6% and low-class wages are down 5%.

The only people to do well? Very high earners—or the ultra rich—with a 41% increase.

Inflation is coming!

What is inflation?

Before we get into the effects of inflation on wage growth, let’s take a moment to define inflation.

The simple definition of inflation is when prices rise and the purchasing power of a currency drops. It means that you can buy less with your money than in the past.

All economies experience inflation (and deflation) at some point. But where it gets troublesome is when the income levels of a population don’t track with or exceed inflation. In that case, people become poorer, even if they think they are making more money.

What causes inflation?

There are different ways inflation can happen in an economy.

- Rising demand for goods can cause the supply to go down, thus increasing prices. You can see this in a hot housing market where the number of people wanting to buy a home is larger than the number of homes on the market.

- Rising costs for things like labor and materials can result in the increase of prices. For instance, a while back the global prices of hops went up and the cost of a six pack went up a couple dollars.

- The relationship between the rising costs and workers wage expectations also contribute to inflation. This is called the “ wage-price spiral." Simply, it means that as prices go up, workers expect to be paid more…which in turn makes prices go up.

- A fourth way inflation can happen is when the government manipulates a money supply, like the US has done with quantitative easing after the last financial crisis, aka printing money. As a refresher, QE is when the Fed bolsters its balance sheet by buying treasuries to keep interest rates low. It’s like if you were printing dollars to pay off your credit cards.

What types of inflation are there?

There are many types of inflation but the main three are creeping, walking, and galloping or hyperinflation.

- Creeping inflationis the normal, mild inflation most economies want and expect. For instance, the Federal Reserve sets their policies hoping to target a 2% inflation rate. This is considered healthy for an economy, and theoretically employee wages can keep up with this.

- Walking inflation is an acceleration of inflation in the 3-4% territory. This starts to become harder for wages to keep up with and people begin to feel poorer.

- Hyperinflation is extreme inflation that can go as high as 20%, 100%, 200%, or even more. In the Weimar Republic hyperinflation was so extreme that “A loaf of bread in Berlin that cost around 160 Marks at the end of 1922 cost 200,000,000,000 Marks by late 1923.”

Why most people aren’t concerned about inflation...but should be

Almost everyone expects that with inflation we would see consumer inflation; i.e., when the price of goods goes up, sometimes rapidly. After all, you can’t pump dollars into the economy through artificially low interest rates without those dollars flowing into goods and raising prices. It’s pretty simple economics.

But that isn’t what the government is reporting.

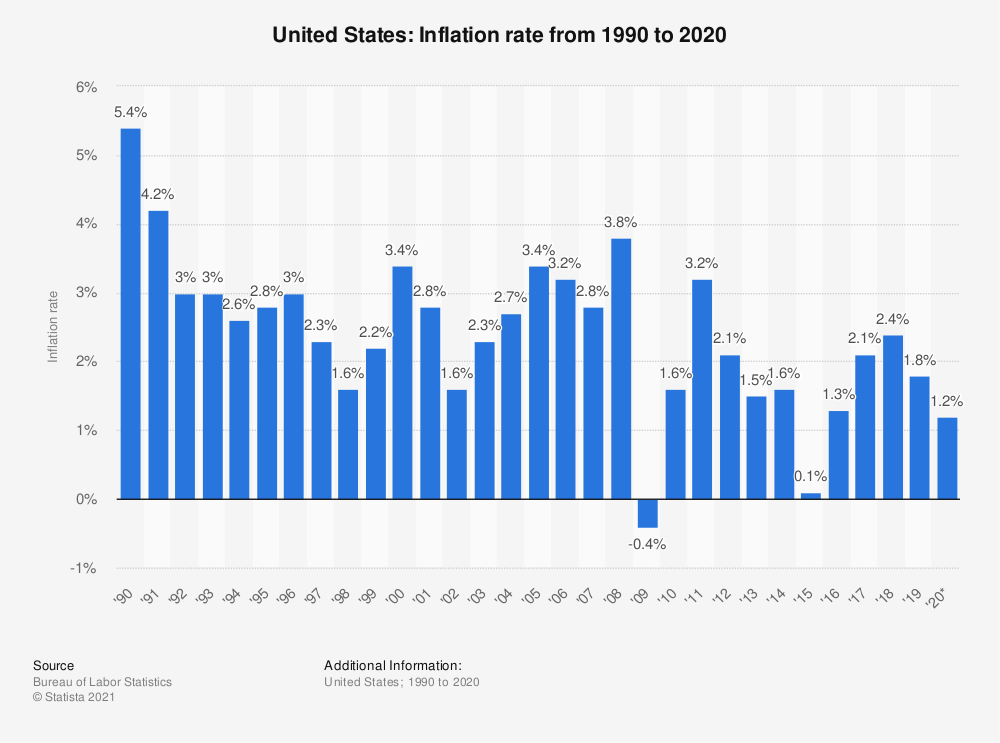

According to the official measurements of inflation, there hasn’t been much consumer inflation. As you can see from this chart by Statistica, it’s actually historically lower.

Source: Statista.

How could this be?

The first thing to explain this is that inflation is happening, but it’s not most readily apparent because of the way the US government measures inflation. As the old saying goes, “There are three kinds of lies: lies, damn lies, and statistics.” In this case, it means that governments can use statistics to tell any story they want by manipulating the numbers. With this data, it’s been clear since 1990 that the government wants to tell the story that inflation is low.

Traditionally, inflation was measured by a fixed basket of goods period after period. This basket of goods was an agreed upon basket of what it would take to have a good standard of living.

But as shadowstats.com writes, that formula was changed in 1990 to match a popular academic concept called “constant level of satisfaction,” as a “true cost of living concept.”

The general argument was that changing relative costs of goods would result in consumer substitution of less-expensive goods for more-expensive goods. Allowing for a substitution of goods within the formerly fixed-basket, the maximization of the “utility” of money held by consumers would allow attainment of “constant level of satisfaction” for the consumer. This type of inflation-measure is more appropriate for the GDP concept—where it is used today—measuring shifting weightings with actual consumption, rather than with the fixed weightings needed to assess the costs of maintaining a constant standard of living.

In simple terms, the statisticians made the assumption that if you were buying steak you would switch to less expensive hamburger if the price went up. This allowed the government to constantly switch the goods in the basket in order to manipulate the inflation rate to a lower rate, rather than to track the same goods each period.

Why would they do this? Shadowstats.com gets into the details, but basically it was a way for the government to save money by, for instance, not having to increase Social Security payouts to match true inflation.

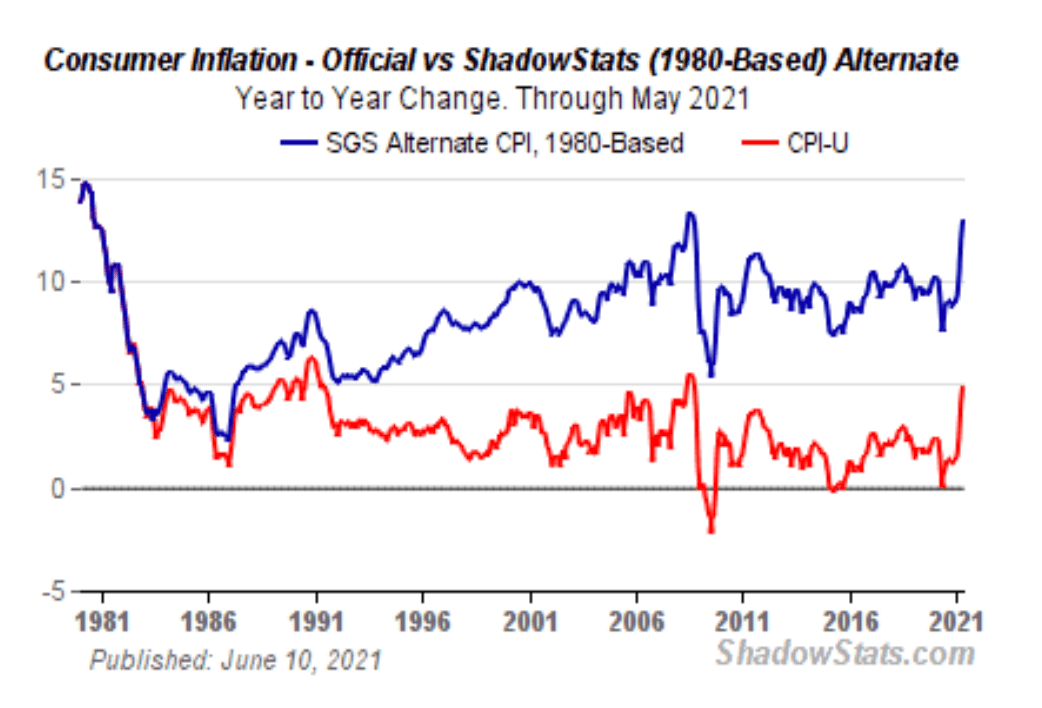

Matching the 1980 measurement method against the 1990 method, it’s easy to see why.

Source: Shadowstats.com

Looking at this chart, you can see that inflation over the last couple years has been hovering around 10%, among the highest it’s been since the 1980s, when the calculation was changed. And coming out of the pandemic, it’s spiking to some of the highest rates in history...creeping into hyperinflation territory.

Of course you don’t really need to be told this. It’s likely you already recognize the fact that prices have gone up—in some cases massively—for pretty basic things.

The effects of inflation on wage growth

Unfortunately, most of the workers in the U.S. have seen their meager wage gains erased by inflation. As “The Washington Post” reports,

Cost of living was up 2.9 percent from July 2017 to July 2018, the Labor Department reported Friday, an inflation rate that outstripped a 2.7 percent increase in wages over the same period. The average U.S. “real wage,” a federal measure of pay that takes inflation into account, fell to $10.76 an hour last month, 2 cents down from where it was a year ago.

The culprits for this increase in costs? Energy, housing, health care, and care insurance. Basic needs. Again, the only people seeing wage growth are high-paid folks. This is because companies are focusing on rewarding high-skilled workers only with raises, in what The Bank of England Governor, Mark Carney, calls the “massacre of the Dilberts.”

This, unfortunately, is nothing new. The average pay for a U.S. worker has not risen relative to inflation for decades. As PEW reports, “After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.”

The effect of inflation is to make people poorer

Now, to some, inflation is bad news because they don’t know how to use inflation to get richer. So, instead, inflation makes them poorer. For instance, employees are hurt by inflation because they can only sell their time, and time generally does not hedge against inflation well. Raises, if they come at all, generally come on an annual basis after inflation—not with it.

Additionally, people who are deep in credit card debt or who have interest ARM loans are hurt by inflation because the Fed generally raises interest rates to combat inflation. Much bad debt is based on adjustable interest rates that go up during times of inflation, making debt payments more expensive.

Finally, people who play by the old rules of money are hurt by inflation because they believe it is wise and prudent to save money in the bank. But the bank is smart, not dumb. And the bank plays by the new rules of money. They pay interest on money that doesn’t keep up with inflation. Money loses purchasing power as the bank uses your money to make more money.

No matter where you turn, things look grim for the middle class worker.

But rather than focus on the negative, let’s get into what rich dad taught about how to thrive in an economy with inflation.

How to profit from inflation

Rich dad showed Robert how the rich make money during inflation: leverage and hedging. And he’s been doing it ever since.

Robert plays the bank’s game: he borrows money from the bank at a fixed rate, buys a cash flowing asset that covers the debt payment, and using less of his own money, increases his return on investment.

In an inflationary economy, if the debt payment is fixed, it becomes less of a cost as the dollar loses purchasing power; thus, Robert’s investments and income grow.

The reason his investments and income grow is because he purchases assets that hedge against inflation. For instance, in inflationary economies, rents generally rise. When he purchases an investment property, the debt payment stays the same while his rents rise due to inflation. This creates more cash flow. He owes the bank only the agreed payment. The rising costs for rent flow straight into his pocket.

The same thing happens for businesses. As the cost of goods rise for consumers, businesses can adjust their pricing and benefit from inflation.

This works because business owners and investors aren’t selling time. They’re selling products that hedge against inflation in relatively real time. They are in control. Employees aren’t in control of their product—time—nor are they in control of their money (the bank or mutual fund is).

One other thing Robert does to hedge against inflation is invest in commodities. Recently that has been energy products like oil, a great investment when there is inflation. Not great when there’s deflation.

Therefore, they’re not good investments for everyone—especially people who are still learning about the economy and investing who may not be able to react quickly to changing economic conditions.

Inflation is coming!

When it comes to profiting from inflation, Robert believes that investing in assets that hedge against inflation is the best bet.

He could be wrong, but it’s a safer strategy than the prevailing one—saving dollars and investing in stocks, bonds, and mutual funds.

But for your own investment success, it’s important for you to do the hard work of examining the facts and figuring out whether you think this strategy will work for you.

At the end of the day, it comes down to the age old Rich Dad advice—invest for cash flow. It’s the safest and soundest strategy that will serve you well in an inflationary economy. It’s a sure way to grow richer.

Original publish date:

August 14, 2018