Blog | Personal Finance

Thankful to Fail

The key to winning is losing

November 22, 2022

This time of year, it’s common to take some time to reflect on the things that you’re thankful for. Most of us are blessed. Quite often we’ve received far more than we need and definitely more than we deserve from others.

As a young man, I was blessed to have my rich dad and poor dad. My poor dad was a great man who gave me many things, including integrity, love, and a hard work ethic. My rich dad also gave me many great things, including street smarts, financial intelligence, and a love for business and investing.

One thing rich dad said to me rings true this time of year. “It’s not enough to just be thankful, you have to do thankful.” By this, rich dad meant that we needed to do something with the blessings we receive.

I learned from rich dad how important it is to embrace failure. In order to show my true thanks, I decided long ago to share what I learned about failure with everyone - that’s part of why Rich Dad Poor Dad came to be.

The biggest winners in life started as losers

Failure is often viewed as negative. Most people fear failure. It’s not their fault. The education system is built to discourage failure. If you take a risk and get a bad grade, they make you think you’re mortgaging your future. Conformity is the rule. Divergent thinking is frowned upon.

But the reality is no one can be successful if they don’t take risks. And if you’re going to take risks, you’re going to fail. In my post “The Best Teacher In the World”, I shared some examples of very successful entrepreneurs who failed spectacularly.

-

Thomas Edison changed the world by making mistakes. He reported failing 3,000 times before inventing the electric light bulb.

-

Henry Ford went bankrupt before Ford Motor Company became a success.

-

Jeff Bezos’ Amazon-offshoot zShops failed.

-

Larry Ellison struggled for years and was on the verge of bankruptcy and mortgaging everything before Oracle took off.

-

Fred Smith received a failing grade in business school for his business plan which today is FedEx.

-

Colonel Sanders had to reinvent himself many times and found himself broke at age 65 before KFC succeeded.

When you look at that list of people, you wouldn’t think “losers”. But that’s what they were, each and everyone of them...before they were winners. They understood that the key to success is taking risks and failing before you succeed.

Want to be successful? Ask, “How can I fail harder?”

Most people try to minimize failure in their life, so they don’t take risks. Successful people don’t fear failure but understand that it’s necessary to learn and grow from. They take big risks knowing that they might fail harder than they ever have in their lives.

Of course, they might succeed more than they ever dreamed.

They’ll only know after they’ve tried.

Embracing failure means overcoming fear

If you've read my posts for a time, you know the importance of financial education. It's only through increasing your financial intelligence that you’ll become rich. That being said, it isn't an easy path. Financial education is hard work, especially in a culture that doesn't understand or value it.

When it comes to increasing your financial intelligence, you'll inevitably come up against fear that will push you to either bear down and fight through or give up. How you respond to fear will set the course for whether you live a rich life or a poor one.

Here's five ways you can overcome fear in your life as you move down the path of wealth.

Acknowledge fear is real

Fear is real. Everyone has it. And everyone has a fear of losing money, even the rich. But it's not having fear that is a problem. It's how you handle your fear. No one likes losing, but often the dividing line between champions and perennial losers is how they handle failure when it does happen. Similarly, the primary difference between a rich person and a poor person is how they manage their fear.

My rich dad told me that if I wanted to be rich, I had to first acknowledge my fear and then overcome it. He said the best way to do that was to think like a Texan.

Think like a Texan

"I like Texans," my rich dad said. "In Texas, everything is bigger. When Texans win, they win big. And when they lose, it's spectacular."

He continued: "Nobody likes losing. Show me a happy loser, and I'll show you a loser in life. Rather, I'm talking about the Texan's attitude toward risk, reward and failure. They live big. They're proud when they win, and they brag when they lose. They have a saying, 'If you're going to go broke, go big.'"

Learn from failure

"The formula for all winners," said rich dad, "is that failure inspires them to become winners because they learn from their failures."

Nobody does anything great without failing. Think of pro golfers; I'm sure they've lost many golf balls over the years. The difference between winners and losers is whether they look at failure as an opportunity to learn and grow, or as an opportunity to quit.

For winners, losing inspires them. For losers, losing defeats them.

Play to win

Former NFL quarterback, Fran Tarkenton, said, "Winning means being unafraid to lose." But there is a difference between hating to lose and being afraid to lose.

People who hate losing take the field and play to win. When they do lose, they use it as inspiration to get better. It's that attitude that makes them champions. If you want to be rich, stop playing not to lose and start playing to win.

Be focused

The conventional financial wisdom is to build a balanced portfolio of stocks, bonds and mutual funds. That is a safe and sensible portfolio. It's a portfolio of someone playing not to lose rather than playing to win. And it's a portfolio that won't get you rich.

The rich don't play it safe with balanced portfolios. If you have any desire to be rich, you must be focused. Do not do what the poor and middle-class do: put their few eggs in many baskets. Put a lot of your eggs in a few baskets and focus. Follow One Course Until Successful. Overcome your fear and don't play it safe.

Hedging against failure makes success more likely

All of this being said, while failure is a very valuable component of success, no one wants to fail all the time. The only reason failure is valuable is because you take the lessons you can from it in order to be successful the next time. The whole point of embracing failure is so you can move from it to success.

So, while I’m encouraging you to embrace failure and to even fail harder...I also want to give you some tips on how to hedge against failure.

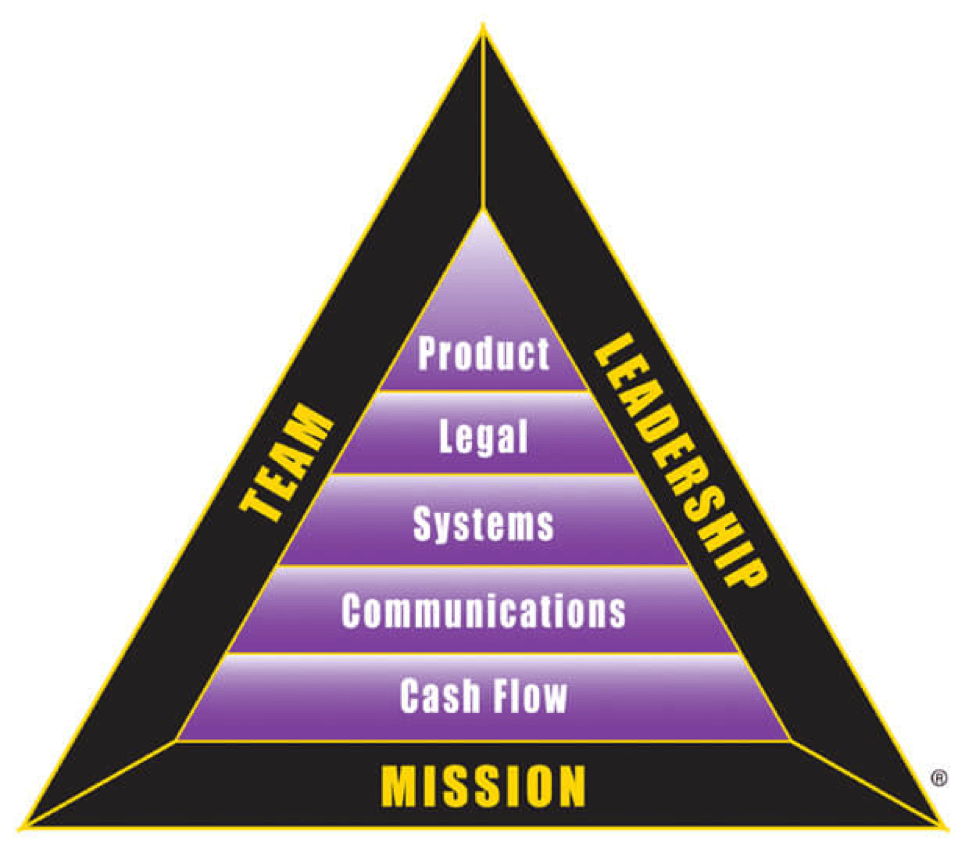

Entrepreneurial success and the B-I Triangle

People who want to be entrepreneurs often approach me and ask “What does it take to be successful?”

I tell them in order to be successful, they must have eight integrities, which I show them in my B-I Triangle.

The eight integrities are:

-

Mission

-

Leadership

-

Team

-

Product

-

Legal

-

Systems

-

Communications

-

Cash flow

Increase your chance of success by being a generalist

In life there are generalists and there are specialists.

Most of the world is made up of specialists. Specialists only focus on one aspect of the B-I Triangle, and because of that, they make poor entrepreneurs.

Students who graduate with a degree in product design seek jobs at the product level of the B-I Triangle. Students who graduate from law school fill roles at the legal level of the triangle. Those with degrees in engineering or computer science tend to focus on jobs at the systems level of the triangle. Students who receive degrees in marketing focus on jobs in the communication section of the B-I Triangle. And students who receive a degree in accounting typically find a job at the cash flow level of the triangle.

Successful entrepreneurs are generalists. One reason why entrepreneurs like Steve Jobs and Bill Gates leave school is because they did not want to be specialists; they hired specialists.

Generalists must be mission driven, have strong leadership skills, and surround themselves with a smart team, often “A” students with experience in the real world.

Why most entrepreneurs fail

There are three primary reasons why most entrepreneurs fail. They are:

-

The entrepreneur does not have all eight integrities in place. For example, most new entrepreneurs focus on their product. They may have a great product, but are likely deficient in some or all of the other seven integrities.

-

The entrepreneur is a mono-professional. The saying “birds of a feather flock together” applies here. For example, attorneys get together with other attorneys to form a business such as a law practice. Or techies get together with other techies to form a web company. Again, they may be smart professionals, but they will lack professional strength at the other seven integrities.

-

The entrepreneur lacks a sense of mission. You will recall that, among the Seven Intelligences, emotional intelligence and a sense of mission is essential in carrying an entrepreneur through the ups and downs of starting a business.

Building the eight integrities takes financial education

Without financial education, many people are financially desperate, needy, and greedy. Financial education, the kind of financial education that transforms both the mind and spirit, opens our eyes to other points of view.

If you want to be an entrepreneur, you must become a generalist who hires specialists. Begin today learning about all eight integrities in the B-I Triangle and building relationships with those that specialize in each.

Most of all, focus on building your mission and finding specialists who are inspired by that mission.

Remember that being an entrepreneur is also about being generous. If you build a great company, you create great jobs for talented people, and you will solve problems for your customers and clients. ‘Tis the season, wouldn’t you say?

To fail harder means to try harder

Finally I’ll leave you with this: trying harder takes strength of character that most people simply don’t possess.

If you’re to do anything of worth in this world, it means that you will fail. And if you’re to do anything big in this world, it will mean that you will fail big. This Thanksgiving, be grateful for the ability to try and fail, again and again.

Original publish date:

November 24, 2015