Blog | Personal Finance

Minding Your Business

Here’s why minding your business starts with building a financial foundation, and learning the difference between assets and liabilities.

July 05, 2022

Do you have a job or a business? Are you working long hours to help someone else reach their financial dreams? Here’s why minding your business starts with building a financial foundation, and learning the difference between assets and liabilities.

When I was a young man, I set a goal of being a millionaire by the time I was 30 years old—and I did. The problem was that I immediately lost all that money. I had flaws in my plan, flaws that taught me some valuable lessons.

The lessons I learned from my experiences, successes, and failures allowed me to adjust my plan so that I could become financially free again by the time I was 47 years old. Now, I’m sharing those lessons with you.

Be in the right position

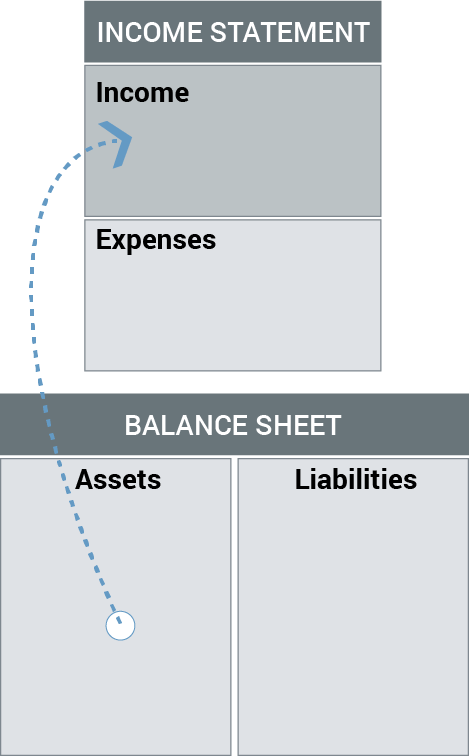

Let’s start with our cashflow quadrant, below:

-

Employee - As an employee, you exchange your time and your effort for income. Here, you simply “have” a job.

-

Self-Employed - While being self-employed, you work for yourself,and though you don’t have a boss, your income depends on your working time. The challenge here, however, is that if you stop working, you may stop receiving income.

-

Business Owner - As a business owner, you’re the boss. Here, you have people using their time, energy and effort making money for you.

-

Investor- finally, by investing in assets, the only thing working is your money. Here, you are truly financially free.

Are you buying assets or liabilities?

When I talk to people about their financial situation, there are a few phrases that I hear frequently:

-

"I need a raise."

-

"If only I had a promotion."

-

"I'm going back to school for more training to get a better job."

-

"I've been working a lot of overtime to make ends meet."

-

"I'm thinking of getting a second job."

In some circles, these are considered reasonable and sensible ideas. But the problem with these statements is that they focus on the income column of the personal financial statement instead of the asset column.

While it makes sense to make more money, it is only helpful if you use the money you make to purchase cash-flowing assets that in turn help you make more money. The problem for most people—the reason why most people struggle financially—is that they rely on their job for income rather than on their investments in assets.

Establishing a financial foundation

When you have to cling to your job in order to survive, you're unable to take any risks. The problem is that relying on others to give you a living is the biggest risk of all. When downsizing happens, you no longer have income come in. And when that happens, you realize all the "assets" you thought you had are really liabilities.

Your car eats you alive. Your $1,000 golf clubs aren't worth $1,000 any more. Your biggest "asset," your home, becomes your biggest liability as you pay the mortgage each month and real estate taxes each year but have no income coming in.

When middle-class people lose their jobs, they generally become poor people very quickly. Middle-class people think a good job is a sure financial foundation, but it’s not. It’s a delusion.

Minding your own business

Rich dad taught me, "Becoming rich and financially secure means minding your own business."

Financial struggle is often the direct result of people working all their lives for someone else. Many people have nothing to show for all their efforts at the end of their working days.

Of course, this is what they're trained to do.

Our current educational system focuses on preparing young people to get good jobs working for others. Their lives will revolve around finding a good wage to fill their income column while filling their liability column with all sorts of gadgets. They will become engineers, scientists, cooks, police officers, bankers, and so on. Their profession will earn them money while they mind someone else's business.

When I ask people what their business is, they generally tell me what they do. They are confusing their profession with their business. The reality is that most people have a job, not a business. They manage or work for other people's businesses.

Focus on your asset column

Rather than go to school to become what they study, I encourage people to mind their own business by focusing on their asset columns.

For some, this means owning your own business. If you know cooking, start a restaurant. If you studied engineering, start a firm. If you're an accountant, hire other accountants and build a bigger client base.

At the end of the day, however, I don't encourage anyone to start a business unless they really want to. Knowing what I know now about running a company, I wouldn't wish that task on anyone. The odds are very much against success. Only start one if you really want to.

The good news is that you don't have to start your own business to mind your own business. Keep your daytime job, but start buying real assets, not liabilities or personal effects that have no real value once you get them home.

Minding your own business is simple when you think of it this way: keep expenses low, reduce your liabilities, and diligently build a base of solid assets. Below are 5 types of assets:

An asset can be anything as long as it has value, produces income or appreciates, and has a ready market. This also includes royalties from intellectual property like music, scripts and patents.

The key to minding your own business, however, is establishing a plan for success.

Discovering a plan for success

On my way back to achieving financial freedom, I referred back to the plan I had created, and never changed it. I simply adjusted the strategies I used to execute it; I improved on it more and more. Sticking to my plan helped me to achieve my goals.

So how do you discover your own plan? Here are 5 steps to keep in mind.

Take your time

Good plans rarely happen overnight. To find the right plan for you, you need to think long and hard about your life, what you want from it, and where you want to go. This can take days, weeks, and sometimes months. Take the time to discover and define what is really important for you in life.

During this time, don’t talk with others until you know what you want. All too often, people either innocently or intentionally impose their ideals on others instead of respecting what others want for themselves. This is your time to define what you want for you.

Find a coach

Once you know what you want in life, find a coach that you can trust. This should be someone who has successfully done what you want to achieve. Ask them to provide their qualifications and interview several people. It will be an eye-opening experience for you.

Your coach is there to guide you when you develop your plan and to ensure you stick to it. A coach isn’t there to coddle you; your coach is there to push you when you don’t want to be pushed and correct you when you need it.

Set realistic goals

Often in life, when our plan doesn’t turn out, we abandon it all together. That is the wrong approach. Rather, a failed plan first requires an assessment of what went wrong. More often than not, the plan needed goals to be more realistic, some adjustments, not to be abandoned.

Identify goals in a way that reflects what you want in life. Lots of people say, “I want to be a millionaire!” Don’t do that. That’s a cold, stale and lofty goal and one that is easily dismissed, especially when you’re having a hard time making your first $10,000.

Set goals that are real to you: “I want to have enough passive income to cover my family’s expenses so I don’t have to worry about money and I can spend all my time with my children.” That’s better! Figure out how much passive income you need to achieve it and put a plan in place.

If you make your goals more personal, you’ll have a better chance of sticking to your plan to achieve your ultimate goal.

Don’t just sit on one goal and think that’s it. Start with small, realistic goals then improve or add to those goals as your financial education and experience increase. It’s best to learn how to walk before you run a marathon.

Don’t get discouraged if you make mistakes. Having realistic goals doesn’t mean you’ll win one hundred percent of the time. Mistakes are part of the process of learning from and achieving your goals.

Get a team

Business and investing are team sports. As your plan evolves, you will need team members who can assist you in achieving your dreams. Members of your team might include a banker, accountant, lawyer, broker, bookkeeper, insurance agent, and/or a successful mentor.

Each of these team members will need to be vetted by you. Don’t just take anyone onto your team; instead, find the right player for each position.

When you have assembled your team, meet with them often. I held meetings with my team over lunch for many years. I learned a lot about business, investing, and the process of making money through these meetings.

Mind your business

Finally, whatever your planis, always remember the words of rich dad, “Regardless of whether you work for someone else or for yourself, if you want to be rich, you’ve got to mind your own business.”

Don’t be distracted by side projects. Yes, it may earn you an extra buck but it just ate up your time; time that could’ve gotten you closer to your goal. If it doesn’t move you in the right direction in relation to your plan, don’t do it.

By minding your own business and focusing on your asset column, you'll find your path to financial security and wealth much clearer and surer.

If you're ready to begin investing in your financial future by minding your own business, I encourage you to start by investing in your financial education. By building your financial knowledge base, you will be well-equipped to begin building your asset base.

Today is the day. Start minding your own business.

For additional help, check out our free, financial education community here.

Original publish date:

October 24, 2012