Blog | Personal Finance

Profitable Investment Strategies: Three Reasons Why Smart People Don’t Save

There’s no strong relationship between higher incomes and building wealth

Rich Dad Personal Finance Team

February 27, 2024

Summary

-

Saving money isn’t the key to building wealth

-

Becoming rich doesn’t require a higher income

-

Increase your financial education and start investing the right way

According to a study done by Ohio State University in 2017, findings indicated that people with an IQ of 130 make between $6,000 and $18,500 more per year than those with an IQ of 100. Bloomberg also did a study that stated the highest earners in America live in cities with the highest cost of living—cities where it’s hardest to save.Thus, smart people don’t save.

That’s right, there’s actually no strong relationship between higher incomes and building wealth.

Two types of intelligence

Robert Kiyosaki’s rich dad, his best friend’s father, said there were two types of intelligence: book smarts and street smarts.

By book smarts, he meant people like poor dad, Robert’s natural father, who had advanced degrees and a high-paying job in education. As smart and talented as poor dad was, he always struggled financially. What money he did save up, he lost in a couple get-rich-quick schemes. Towards the end of his life, he was penniless. All his book smarts did not translate to financial intelligence.

Rich dad’s other kind of smarts—street smarts—described people like himself who were not highly educated but who knew how the world and money worked. Rich dad started working in and running his family store at a young age. He learned from experience how to run a business. Later, instead of getting advanced degrees, he got real-world experience in business, eventually owning hotels on Hawaii beaches. He did not have book smarts, but he had a high financial intelligence.

Smart people and saving money

Poor dad always said, “Work hard and save money.” Yet, he didn’t follow his own advice. His lack of financial intelligence led him to make poor money choices, draining his savings. He was one type of smart person who does not save.

Rich dad always said, “If you want to be wealthy and financially secure, working hard and saving money will not get you there.” He followed his own advice, and rather than saving money, he invested it. As a result, he grew his money exponentially and became financially independent at a young age. He was also the type of smart person who does not save.

When it came to being smart, Robert would go on to model his decisions after rich dad. And, as you know, he would also end up being financially independent.

Three reasons why financially smart people don’t save money

Like most people, you were probably told growing up that saving money was a smart financial decision. Our culture is filled with positive little sayings about saving money like, "A penny saved is a penny earned," "rainy day fund," and “another day, another dollar." Our culture is also filled with phrases like, "Broke the bank," "Cleaned out," and "Money burns a hole in his pocket."

So the question becomes, if saving is considered such a good thing, why aren’t we encouraged by the government to do it, and rewarded by the government for doing so? Therein lies the truth.

Rich dad taught that there are three reasons why financially smart people don’t save.

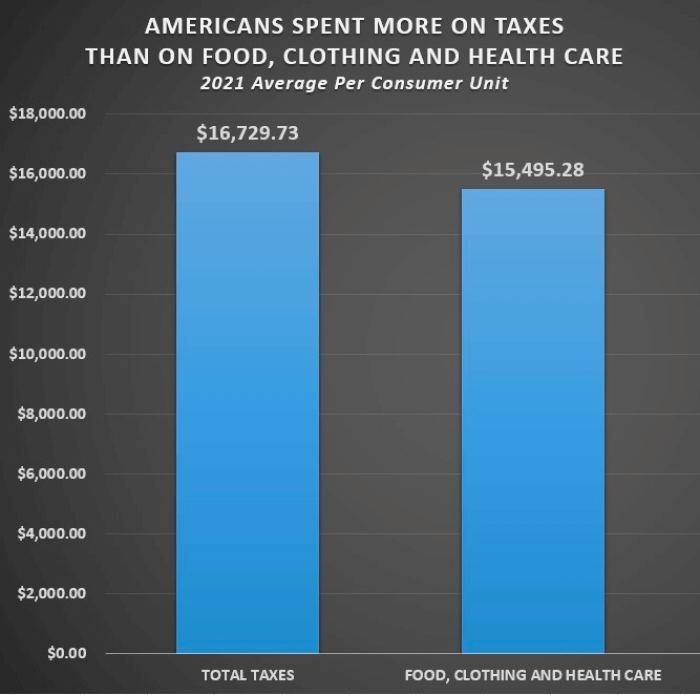

Source: CNSNews.com

“People who work hard and save money have a hard time building wealth because, relatively, they pay more in taxes,” said rich dad.

It’s likely that one big reason why the government doesn’t encourage saving is because banks see your savings as a liability. Why would powerful lobbying forces like our banks allow a law to pass that encourages you to increase their liability sheet? Most policy is not geared to help you and me, but instead to help the banks.

Rich dad went on to explain that the government taxed savers when they earned, saved, spent, and passed on their money in the form of income tax, capital gains tax, sales tax, and estate tax. You can see the impact of these taxations in the chart above.

- Taxes

Tax advisor, Tom Wheelwright, wrote an excellent book on how taxes work as incentives for the behavior our government wants to see from the populace. That book is called Tax-Free Wealth If the government thinks saving is such a good idea, why don't they have tax breaks for those who save in order to encourage such behavior?

In fact, it’s quite the contrary. According to CNSNews, the Bureau of Labor Statistics reported that Americans spent more on average on taxes than they did on clothing, food and healthcare combined in 2021.

- Inflation

Rich dad also explained that another tax decimated savers—a hidden tax called inflation.

Rich dad used a simple figure of $1,000 to explain why savers almost always became losers in the economy.

“Your $1,000 is immediately eaten away by inflation, so each year it is worth less.” Rich dad went on to explain that each year the interest the bank paid you was eaten away by both taxes and inflation. The government took 30 percent of the interest earnings through capital gains taxes and inflation ate away at almost all the rest…or more.

The result is often a net loss. That is why rich dad thought that working hard and saving money was a hard way to get rich.

- Risk-taking

When you work hard to save money, you place your “security” in those savings. It becomes very hard for those who spend all their energy saving money to branch out and invest it for fear all their hard-earned money will be lost.

“People who work hard and save often think that investing is risky,” said rich dad. “And when you think something is risky, you avoid learning.”

Rather than take a perceived risk to grow their money exponentially through investing, most people take the “safe” route of saving their money because it is what they know and understand.

Unfortunately, as we learned above, saving is not safe. In fact, it often is the riskiest way to use your money because of taxes and investing.

Become financially intelligent

At the end of the day, why do people save? For most, it is to prepare for retirement. Yet, most of us know that saving itself is not enough to prepare for a secure retirement. This is especially true for young people who will never see a pension from their employer.

Today, everyone is expected to invest for a secure retirement. Unfortunately, our schools do not prepare us to invest wisely or well. So, it is up to us to become financially educated—and to teach our children financial education as well.

Once you can see and understand the motivations behind conventional advice like “ invest for the long term in a balanced portfolio of stocks, bonds, and mutual funds,” you'll be able to make smarter financial decisions rather than just following the conventional advice.

For instance, Mike, rich dad’s son, had an investment portfolio of $200,000 by the time he was 15-years-old. “Whether he chose to be a policeman, politician, or a poet,” said rich dad, “I wanted Mike to first be an investor. You’ll become far wealthier if you learn to be an investor, regardless of what you do to earn money along the way.”

The rules have changed. In the modern world, you need a greater level of financial sophistication, and so do your kids. Start today by increasing your financial education and prepare for a brighter, more secure financial future.

Original publish date:

November 07, 2017