Blog | Personal Finance

How to Make Your Retirement Plans Last

A.K.A., the Rich Dad way to have a successful retirement plan

Rich Dad Personal Finance Team

April 20, 2023

Summary

-

A significant number of the American population aged 55 to 66 are not able to move forward with their retirement plans

-

Preparing for retirement shouldn’t rely on the size of your savings account

-

Creating on-going cash flow is the key to a successful retirement plan

According to CBSnews.com 50% of women, and 47% of men between the ages of 55 and 66 have no retirement savings.

To put that into perspective, that’s millions of Americans who are near their golden years, that are unable to execute on their retirement plans.

At the worst, that’s millions of people who will either have to go back to work, rely on the charity of friendships, or hope there’s enough money for the government handouts and food stamps.

At the best, they’ll have to drastically alter their standard of living in order to squeeze every last bit out of their retirement money.

For most people, no matter how they get there, the reality is that they will be poorer when they retire than when they were working. Given this reality, there's no shortage of "expert" articles on how to stretch your money once you retire.

We have a few tips of our own that are contrary to the conventional perspective when it comes to true financial freedom.

Understanding finances the Rich Dad way

But before we get started, here’s a quick story to provide some background.

As a young boy in elementary school, Robert Kiyosaki was already being educated by his rich dad, his best friend’s father, about the differences between the rich, the poor, and the middle class.

“If you want job security, follow your dad’s advice,” he said. “If you want to be rich, you need to follow my advice.”

Rich dad then went on to show Robert the difference between his investment plan and his poor dad’s (his natural father’s) investment plan.

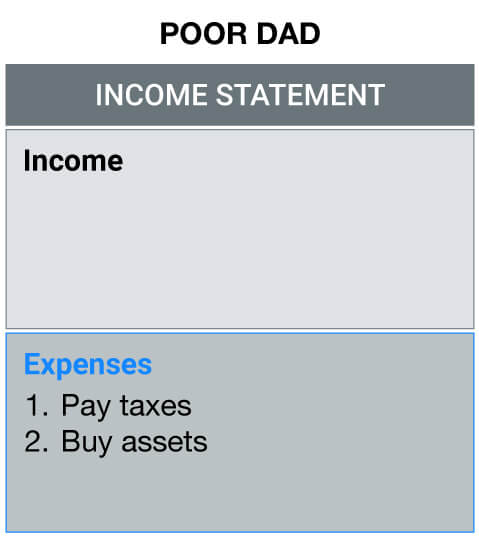

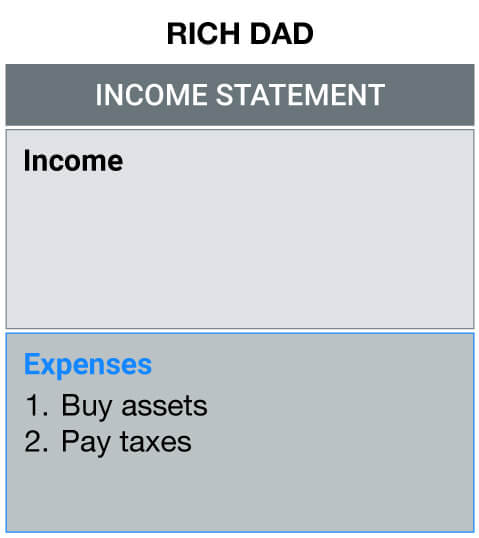

“My business buys assets with pre-tax dollars,” said rich dad as he drew the following diagram.

“Your dad tries to buy assets with after-tax dollars. His financial statement looks like this,” said rich dad.

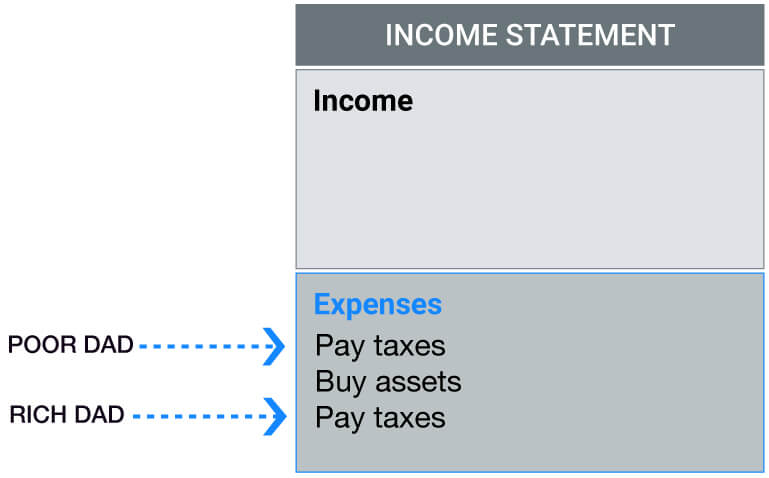

To sum it up nicely, rich dad combined the two diagrams to highlight the difference between Robert’s poor dad and him.

Playing by different rules

The point that rich dad was making was that even though we live in a free country, not everybody plays by the same rules. The rich have laws of their own that allow them to become richer.

Rich dad went on to teach Robert that because his natural father was an employee, he had to pay his taxes first and then invest. That meant that up to 50 percent or more of his income would be spoken for before he could even begin investing.

As a business owner, rich dad was able to buy assets through his business and then pay taxes on what income was left over. He bought his assets first and paid his taxes later.

“I pay my taxes on net income,” he said. “Your dad pays taxes on his gross income, and then tries to buy assets. Because of that, it is very, very hard for him to achieve any kind of wealth.”

He finished by saying “Make your decisions about your future wisely. Decide which rules you want to play by.”

Can you do this too?

So, naturally, Robert Kiyosaki went on to create a business that could build his wealth while he taught others to do the same.

When he speaks with beginning investors, he often hears:

-

“But I’m an employee, and I don’t own a business.”

-

“Not everyone can own a business.”

-

“Starting a business is risky.”

-

“I don’t have the money to start a business, let alone invest.”

Remember, less than 100 years ago, approximately 85 percent of people in the US did own their own businesses as either independent farmers or small shopkeepers. Only a small percentage of the population was employee-based.

Today, in just a couple generations, it seems that the Industrial Age—with its promise of high-paying jobs, job security, and pension benefits—has bred the independence out of us.

So, in short, yes, you can do this. To get you started with a clear head, look at our tips below.

Savers are losers

When you discuss your retirement plans with the typical planners, you’ll find they’ll suggest putting funds away and saving several years worth of expenses to protect you when the market drops.

What this piece of advice fails to take into account is that the dollar is dying. What happens if inflation spikes and you're stuck holding 3 to 5 years worth of cash? Your savings become worthless and you lose.

Rather than save cash, keep your liquidity in assets that can be quickly liquefied and that hedge against inflation, not lose value with it. That can be gold, silver, oil, etc.

Invest for cash flow

Financial advisors may also suggest considering long-term-care insurance as a hedge against future nursing-home costs.

In this scenario, you must either be in such poor health that you can’t take care of yourself or be so old that your meager savings have run out in order to reap the benefits of your investments.

Rather than hand your money over to an insurance company or stock it way at a zero return for an old-age annuity, begin now to invest in assets that will provide the cash flow you need to cover your expenses as you grow older. This is smart because it makes your money work for you during your retirement. You get cash, and you keep your assets.

Invest in a truly diversified portfolio

Many people think diversifying means to spread your money around to different types of paper assets.

The only problem is that when you do that, you're not really diversified because you're moving your money around in only one asset-class. True diversification involves investing in as many of the four asset classes as possible: paper, real estate, commodities, business, and cryptocurrency.

Look at your retirement plans from the eyes of an investor; you should be in all five asset classes, and you should be specializing in one or two. Most people are only invested in paper assets, and they have no knowledge about what they’re investing in, so they listen to financial planners and hold a basket of paper assets for the long term, hoping the market goes up.

A truly diversified portfolio also prevents any dramatic hits you may face as a result of inflation. Of course, one can feel safe when treading water, but when you have to do that for more than a decade, you risk drowning. You’d rather be making headway.

Use taxes to your advantage

The rich know how to invest in ways to pay little-to-nothing in taxes. It takes financial intelligence to invest this way. So, rather than spend your time figuring out how to move your money in a way that keeps you poor to avoid taxes, put in the time and effort to learn how to invest your money in a way that makes you rich and decreases your tax burden.

If you want to be rich, you need to put the Rich Dad perspectives into practice.

And to put into practice the Rich Dad way, you need financial education. And financial education is the best investment you'll ever make for your retirement plans.

Want to increase your financial literacy? Check out our free, financial education community here.

Original publish date:

September 11, 2012