Blog | Paper Assets

The Difference Between Fundamental and Technical Investing

Setting the foundation to move beyond the 401(k) to advanced paper asset strategies

Rich Dad Paper Assets Team

April 05, 2023

Over the years, The Rich Dad team has worked with thousands upon thousands of individuals who want to get into the investing game. Usually these are people who have realized that it’s time for them to take control of their financial future rather than rely on a job or someone else to do it for them.

But not all of these people are ready to quit their jobs or radically alter their lifestyles in order to begin investing full time. The good news is that no matter where you are in life personally, professionally, or financially, there is never a bad time to start investing and never too small of a beginning.

Most people looking to get into investing for the first time are interested in investing in stocks, bonds, and mutual funds—paper assets—as they have the lowest barrier to entry, can be done in their spare time, and are most familiar to the average investor.

But unfortunately, familiarity does not mean expertise or even working knowledge. Most people’s knowledge of paper assets extends to investing in mutual funds through a 401(k). If you want to know more about why this is not only a bad way to invest but also a dangerous one, please read Rich Dad Expert Andy Tanner’s book, 401(k)aos, which you can get for free here.

Andy also teaches an incredible course on paper asset investing called “The Four Pillars of Investing,” which we always encourage folks to take. It’s perfect for building the knowledge base you need to invest successfully and to do so while limiting your risk.

The first two pillars to successful investing are Fundamental Analysis and Technical Analysis, and these are the pillars we encourage all new investors to study, learn, and master prior to jumping into the markets with their money.

Let’s dig a little bit more into what each is and the difference between them.

Fundamental Analysis is like a financial check up

Just like when you go to see your doctor and she measures your vitals to know whether you are healthy or if there is something more concerning she’ll need to investigate more, assets also have vital signs you need to pay attention to in order to know if they are healthy or toxic investments.

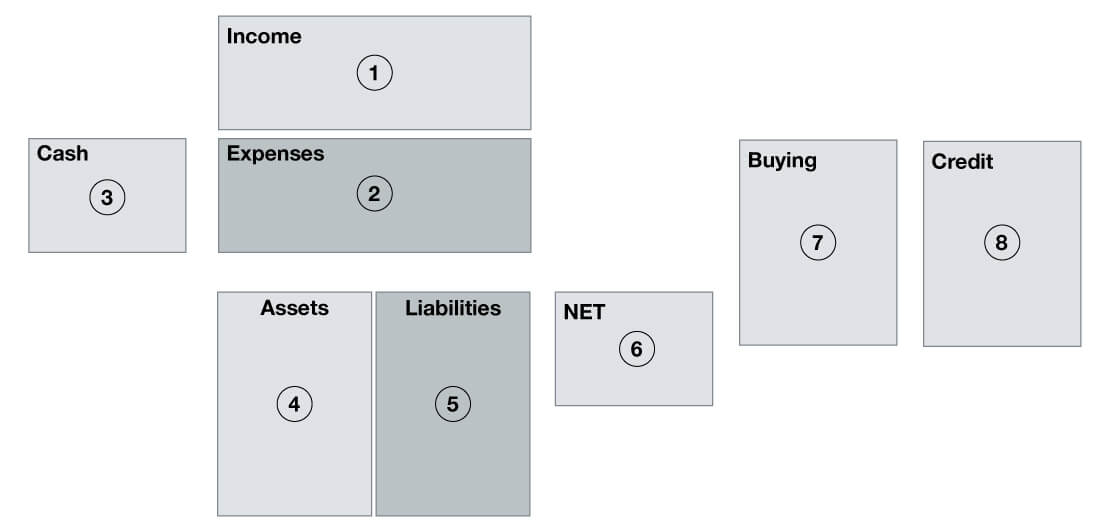

Andy Tanner refers to these vital signs as “The Eight Numbers That Can Change Your Life.” Very briefly they are:

- Income: the money you bring in regularly. It can be active or passive, derived from investments or from a paycheck. But not all income is created equal.

- Expense: The amount you have to pay out each month on bills, leisure, food, taxes, and more.

- Cash: You need to be liquid to live. Some people live well with a cash surplus. Others live stressed out with a cash deficit.

- Assets: Assets are stuff you own. The simple definition of an asset is something that puts money in your pocket.

- Liabilities: Stuff you owe and the promises you’ve made. Liabilities can put you in financial jeopardy if you don’t have the cash or income on hand to cover them.

- Net worth: The sum total of the differences between your assets and your liabilities, and it can be negative or positive.

- Buying power: Your liquid assets, the ability you have to borrow, and your financial reputation with private investors.

- Credit: Payment history and outstanding accounts, debt to income ratios, and more that determine your financial trustworthiness.

Eight Numbers That Will Change Your Life

1. Income, 2. Expenses, 3. Cash, 4. Assets, 5. Liabilities, 6. NET, 7. Buying, 8. Credit

1. Income, 2. Expenses, 3. Cash, 4. Assets, 5. Liabilities, 6. NET, 7. Buying, 8. Credit

If you can manage these numbers and take control of them, you can change your life financially. Similarly, businesses also have the same numbers. Fundamental analysis is the process of determining the health of a person, company, or even a sovereign nation when it comes to financial vitals like the eight numbers that can change your life. If the vital signs are good, chances are it will be a good investment opportunity (though nothing is ever guaranteed!). If they’re not, you’ll want to most likely stay away.

What is Fundamental Analysis used for?

The name is almost self-explanatory. Investors who focus on fundamental analysis are most interested in the fundamentals of a company they are investing in.

This means they carefully review the financial statements of a company and use them to determine the intrinsic value in the company. Fundamental Analysis is less concerned with the price of a stock and more concerned with the value of the company or asset.

Fundamental Analysis is a key tool in your investing toolbox for finding companies that are sound financially but perhaps undervalued by the market. In order to do this, you need to know how to read financial statements and also how to spot trends and opportunities in those financial statements.

Plain and simple, this takes financial education, but it’s well worth it to understand what you’re investing in (or not!).

Technical Analysis and sizing up a market

While Fundamental Analysis is focused on the health of an asset, Technical Analysis is focused on the strength of a market. And it is much more focused on price and trends in pricing than in the fundamentals of the company itself. It’s very useful for advanced techniques like options trading.

Robert Kiyosaki’s rich dad said, “A well-trained technical investor invests on the emotions of the market and invests with insurance from catastrophic loss.” Technical investors are adept at studying the trends of the market and then using certain techniques such as short selling to capitalize on the market. They buy on price and market sentiment, not on fundamentals.

Tools of technical investing

Technical investors use charts and the power of technology to find trends in the market and for individual stocks. There are a large number of chart patterns that have many implications for what a stock might do, and technical investors know how to use technical analysis software to read these charts to see if there are up trends, down trends, or sideways trends for stocks. They use this information to take various positions in the market.

Some of the world’s most successful investors use technical investing. George Soros is a well-known technical investor. He says his philosophy is simple, “We try to catch new trends early and in later stages we try to catch trend reversals.” The fascinating thing about both Fundamental and Technical investing is that you can do what the rich do, and you have the same information available to you.

As with fundamental investing, technical investing takes investment in your financial education to understand the strategies needed to both be successful and to protect yourself from catastrophic loss. But once mastered, technical investing can be quite rewarding and fun.

Want to begin Fundamental and Technical Analysis? Start with financial education

One of the reasons that investing in stocks seems risky to the average investor is because they do not understand the difference between these two types of investing techniques. More than likely, many investors have heard horror stories about others who have tried to invest but lacked the proper knowledge to do so — and the devastating effects it may have had.

But as always, knowledge is power. And what’s riskier, not investing in your financial education and blindly trusting in mutual funds to perform well as you sink your hard earned money into them, or making time to understand a more sophisticated way of investing and investing with the confidence that comes with knowledge and expertise?

It’s not even a competition. Today’s your day to start investing in you and your financial future.

If you want to know more about fundamental and technical investing, we invite you to check out Rich Dad Coaching, where you’ll find a wealth of classes to take you to the next investing level.

Original publish date:

September 10, 2015