Blog | Paper Assets

Global Deflation Threat

December 15, 2013

Global Deflation is becoming an acute threat. Consequently, while the Fed may soon begin to “taper” the amount of money it creates each month, it is unlikely to stop printing money altogether any time soon. In this blog, I will discuss how the risk of deflation will influence the Fed’s decision-making process over the next few years.

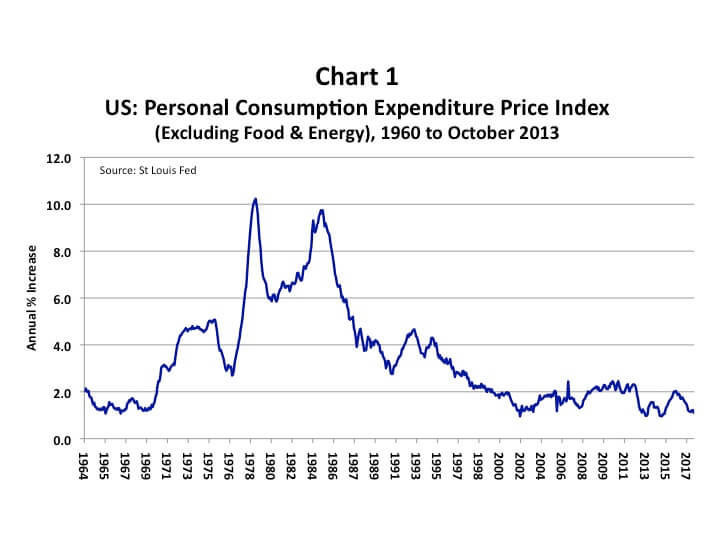

Chart 1 shows the Personal Consumption Expenditure Price Index (excluding Food & Energy), otherwise known as the Core PCE Index. It is the inflation index for the United States that the Fed monitors most closely. In October 2013 (the most recent data available), the index was up only 1.1% compared with one year earlier. The rate of inflation has been lower than this during only eight months since records began in 1960. Moreover, as you can see in the chart, the recent trend is downward, suggesting the possibility of even more disinflation in the US during the months ahead.

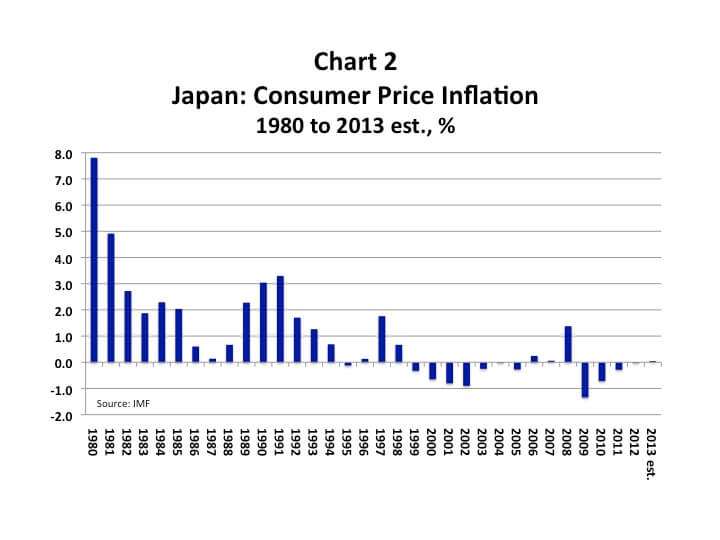

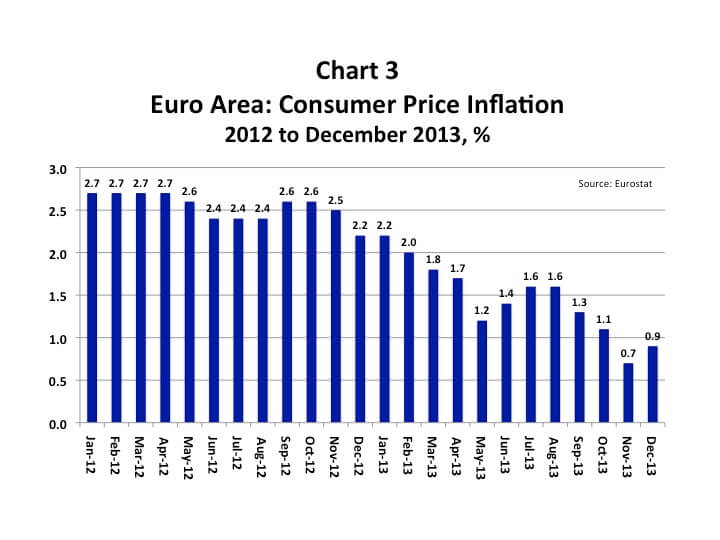

Keep in mind that this weakness in US consumer prices is occurring even though the Fed is creating $85 billion a month and pumping it into the economy. I’ll come back to the US in a moment, but first consider Japan (Chart 2) and the Euro Area (Chart 3).

As you can see in Chart 2, consumer prices in Japan began falling in 1995. Since then, the country has experienced deflation during 12 out of the last 19 years. This year the Consumer Price Index (CPI) is expected to rise by 0.5%. However, the Japanese Central Bank is printing money much more aggressively than even the Fed. The US central bank is currently printing new money roughly equivalent to 6% of US GDP per year, while the Bank of Japan (BOJ) is printing something closer to 18% of Japan’s GDP. Given that scale of fiat money creation, it is very surprising that inflation in Japan is still barely positive.

Finally, consider the Euro Area, shown in Chart 3. The European Central Bank (ECB) is not creating fiat money through a program of Quantitative Easing, as are the Fed and the BOJ. But, in light of the pronounced downward trend in consumer price inflation during 2013, they have begun to consider it. The ECB’s key policy interest rate was cut from 0.5% to 0.25% in November; and ECB Governor Draghi has made it clear that the ECB has numerous policy tools it could employ, if necessary, to insure price stability.

Against this background of global disinflation, it is unlikely that the Fed will be able to stop printing money any time soon. Here’s why.

There are three kinds of inflation:

- Consumer Price Inflation

- Commodity Price Inflation; and

- Asset Price Inflation

As we saw in Chart 1, consumer price inflation excluding food and energy in the US has rarely been lower than it is now.

Commodity prices are falling sharply. The high commodity prices of a few years ago have resulted in a surge of new supply for many types of commodities; and that new supply is driving prices down. The Jefferies CRB Commodity Price Index has dropped 25% since mid-2011.

Asset prices, on the other hand, are inflating sharply. The reason they are inflating is because the Fed is printing money and using it to acquire assets. The S&P 500 stock index is up 25% this year and US home prices have risen by 13% over the past 12 months. This increase in asset prices has driven up the “Net Worth” of the household sector by 11% over the past year to $77 trillion, creating a wealth effect that has allowed those Americans who own assets to spend more. Their spending has added to aggregate demand. Without the increase in aggregate demand brought about by QE and its impact on asset prices, the United States would most probably be experiencing deflation now.

If the Fed ends QE altogether, asset prices will fall and aggregate demand will fall. Then, the chances are high that consumer prices will fall as well. Falling prices make it very difficult for people and businesses to repay their debts. That increases the danger that the economy will spiral into a debt-deflation depression. Deflation is the Fed’s worst nightmare.

So, here’s the bottom line. You are going to hear a lot of talk about Fed tapering over the next few weeks. And, sometime between now and March, the Fed probably will begin to reduce the amount of money it creates each month. This could cause the stock markets around the world to have a significant correction. My suggestion is to be prepared for a selloff, but don’t panic. There is a very big difference between tapering QE and ending QE. I believe the Fed will have to continue printing more than $500 billion during both 2014 and 2015 in order to continue pushing up asset prices. At this point, only higher asset prices will make the US economy grow and only higher asset prices will stave off deflation.

Original publish date:

December 15, 2013