Blog | Personal Finance

Don’t Be Fooled

September 30, 2014

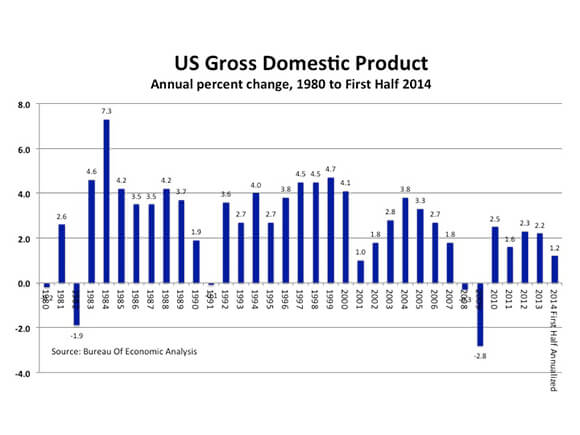

Last week it was reported that the US economy grew by 4.6% during the second quarter. But don’t be fooled. The US economy is far weaker than that headline number suggests. In large part, the second quarter was strong because the first quarter was so weak. In that quarter, GDP contracted by -2.1%. During the first six months of 2014, the economy grew by only 0.6%, which translates into an annualized rate of only 1.2%. To put that into perspective, take a look at the following chart, which shows the US GDP growth numbers going back to 1980. There were only six years out of the past 34 when the economic performance of the Unites States was worse than it was during the first half of this year.

OK. It’s true that the very harsh winter caused the economy to be particularly weak at the beginning of this year. Therefore, it is almost certain that the economy will be considerably stronger during the second half of the year than it was during the first. Nevertheless, it is clear that the economy is suffering from something more than just cold weather.

Notice how much more slowly the economy has been growing during this decade than in the past. The economy grew by an average annual rate of 3.2% during the 1980s and the 1990s. So far during this decade, it has expanded by an average annual rate of only 2.0% - despite the massive government life support infusions it has received since the global economic crisis began. Over the last five and a half years, the budget deficit has exceeded $6 trillion, the Fed has injected $3.5 trillion of newly created money into the financial markets and the Federal Funds rate has been held at zero percent. That kind of stimulus should have created an economic boom of the first degree. The fact that it didn’t should serve as a warning that something is very fundamentally wrong with the US economy.

The financial markets have chosen to ignore the economy’s fundamental weakness and, instead, have seized on the strong second quarter GDP number as proof that the long-awaited US economic recovery is, at last, upon us. This belief, combined with the approaching end of the third round of Quantitative Easing and weak economic numbers out of Europe and Japan, have produced a meaningful bull market in the US dollar. Over the last couple of months, the dollar has gained 7% to 8% against both the Euro and the Yen.

This big move in the dollar is starting to have interesting implications. First, when the dollar strengthens, commodity prices (including the price of gold and silver) tend to weaken. That is what we are seeing now. The Thomson Reuters CRB Commodity Index, which measures a basket of commodities has fallen 10% since July. Many commodities are already under pressure due to either a surge in new supply (oil, corn, wheat) or weakening demand from China (most metals). Consequently, the currencies of the commodity-producing countries (such as Australia and Brazil) are taking a hit.

This strong dollar trend may continue for some time. If it does, some really exciting investment opportunities could arise. The market consensus view is that the Fed is going to stop its program of Quantitative Easing just as the European Central Bank launches one in Europe and the Bank Of Japan accelerates its Yen printing program in Japan. So long as this remains the consensus view, the downward pressure on the price of gold, silver, most other commodities and the currencies of the commodity-producing countries could continue until they are all considerably oversold.

The strong dollar trend is built on the belief that the US economy will become stronger as we move into 2015. I believe this view is mistaken. With QE 3 ending later this month, the US stock market is likely to experience a significant correction between now and next spring. When it does, the US economy will weaken again and that will cause the dollar to fall.

In that scenario, where the US economy moves back toward recession, the global demand for commodities would also weaken. Therefore, while commodity prices would benefit from a weaker dollar, they would suffer from reduced global demand. Global deflationary pressures would probably intensify.

What would happen after that would depend on the central banks. Ultimately, I believe the Fed will have to return as the Printer-Of-Last-Resort and launch the fourth round of Quantitative Easing on an aggressive scale. If I am right, when QE 4 is announced, the dollar will weaken further, while the price of gold, silver, most other commodities, and the currencies of the commodity-producing countries would all rebound sharply.

As they say, timing is everything. Getting the timing right on these moves in currencies and commodities is going to be tricky. But, don’t allow yourself to be fooled. The US economy is much weaker than the second quarter GDP number would suggest. Therefore, the current strong dollar trend, while it could last for some time, is not underpinned by strong foundations.

Original publish date:

September 30, 2014