Blog | Personal Finance

Why The Global Economy Is Unable To Recover

September 15, 2014

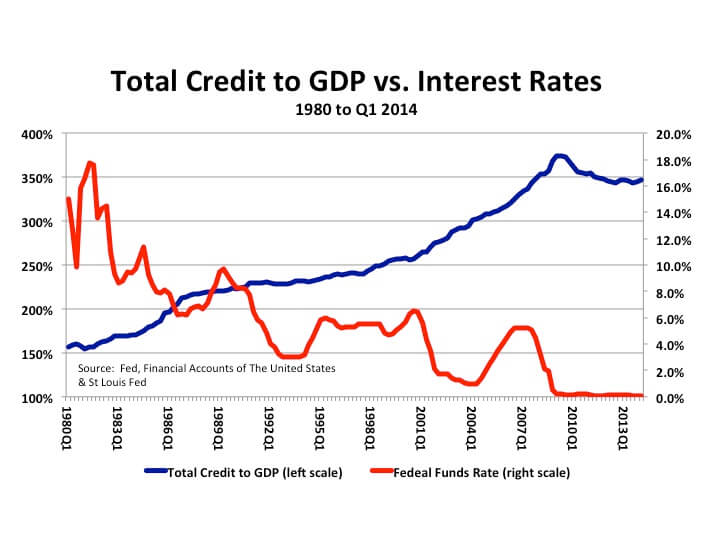

The global economy has been unable to recover from the economic crisis that began in 2008. The following chart explains why.

The blue line shows the ratio of total credit to GDP in the United States. From 1950 to 1980 that ratio averaged around 150% of GDP. After 1980, however, credit began to grow much more rapidly than the economy. Consequently, credit to GDP expanded from 150% of GDP to 370% in 2008. It is easy to understand how rapid credit growth causes the economy to expand. When credit increases consumers have more money to spend; businesses become more profitable and expand their investments; the government receives more tax revenues and can spend more; and asset prices keep inflating, causing a wealth effect that allows even more consumption. For nearly three decades, therefore, credit growth drove economic growth in the United States, and the expanding US trade deficit drove the global economy.

Now notice the red line that runs from the top left to the bottom right. It represents the Federal Funds Rate, the interest rate set by the Fed. It has declined very sharply since the early 1980s, when it peaked at 18%. As the Fed cut interest rates, borrowing became more affordable and the reduction in borrowing costs explains why credit was able to expand so dramatically.

By 2008, the Federal Funds Rate had already been reduced to 2%, near the all-time low. When Lehman Brothers collapsed and AIG, Fannie Mae and Freddie Mac had to be nationalized, the Fed slashed the Federal Funds Rate to zero percent. But even that did not bring about a revival of credit growth and the economy contracted by 8.2% during the fourth quarter of that year.

At the beginning of 2009, the Fed, unable to cut interest rates any further (0% is the floor), introduced a new, unorthodox monetary policy tool to stimulate the economy: Quantitative Easing. Since then, the Fed has injected $3.5 trillion of newly created money into the financial markets by acquiring government bonds and mortgage-backed securities. As a direct result of that policy, household sector net worth increased by $25 trillion (or by 45%) between 2009 and the end of 2013. That increase in wealth enabled the economy to grow, albeit at an unusually weak rate averaging around only 2% a year over the past four and a half years. Credit growth, which had been the driver of economic growth, has yet to recover, however. The ratio of total credit to GDP has remained flat at approximately 350% since 2010.

The third round of QE is scheduled to end next month. Moreover, the Fed has signaled that it is likely to begin increasing the Federal Funds Rate by the middle of next year. The end of QE 3, in itself, represents a tightening of monetary policy. By ending the injection of newly created money into the financial markets, the Fed will be removing the one thing that above all others has generated economic growth in recent years. It is uncertain that the economy will continue to grow without it.

The odds of a new recession will become very much greater if the Fed actually does begin raising the Federal Funds Rate. The cost of borrowing would increase and that would cause credit growth to slow and the ratio of credit to GDP to decline. A reduction in credit growth would deal a severe setback to the economy.

It is difficult to see how the economy will begin to grow again unless credit growth accelerates. However, it is difficult to see how credit growth could pick up given the very high level of credit to GDP that we already have. In order for the US economy to take on more debt, either the number of people employed must expand or wages must increase. Neither of those things is happening on a great enough scale to allow the American public to service the interest expense on more debt. The US labor force participation rate is declining, median income continues to fall and average hourly earnings are increasing by less than 1% a year in real, inflation-adjusted, terms.

As I have written before, I believe that our economic system should be called Creditism instead of Capitalism because credit growth has been THE driver of economic growth for decades. I hope this discussion on the relationship between interest rates, credit and economic growth helps to explain my fear that Creditism is in crisis and, perhaps, incapable of generating any further economic growth.

To learn more about how the global economic crisis will affect you, subscribe to my video-newsletter, Macro Watch:

http://www.richardduncaneconomics.com/product/macro-watch/

Click on the “Sign Up Now” tab, and then, for a 50% discount, use the coupon code: richdad

Original publish date:

September 15, 2014