Blog | Commodities, Paper Assets

Asia’s Export Crisis

November 15, 2015

This month Robert Kiyosaki is speaking at a number of events around Asia and I have the pleasure of tagging along with him. So, in my blog this week, I would like to show you a series of charts that illustrate how the global recession is impacting Asia.

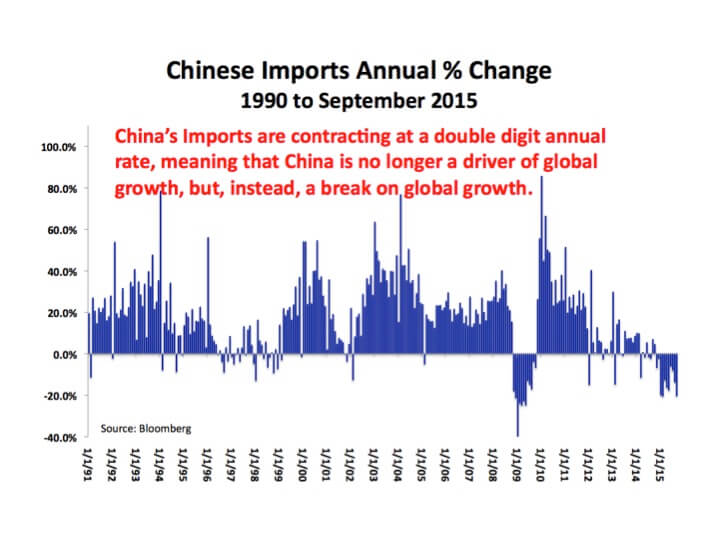

After decades of very rapid economic growth, China’s bubble economy has finally begun to deflate. China has massive excess capacity across practically every industry. Product prices are falling, corporate profitability is suffering and non-performing loans are rising sharply. Consequently, investment is slowing significantly and China is now buying less from the rest of the world. Chinese imports have been contracting at a double-digit rate all year.

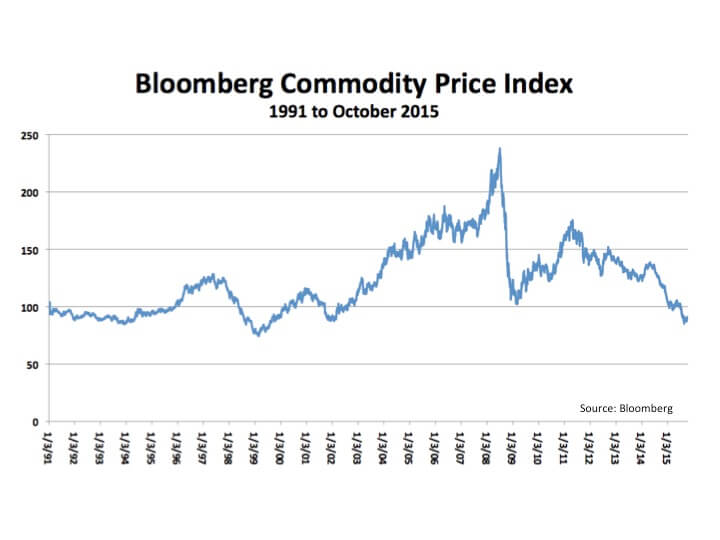

The plunge in Chinese demand has caused commodity prices to crash back to levels last seen during the last century.

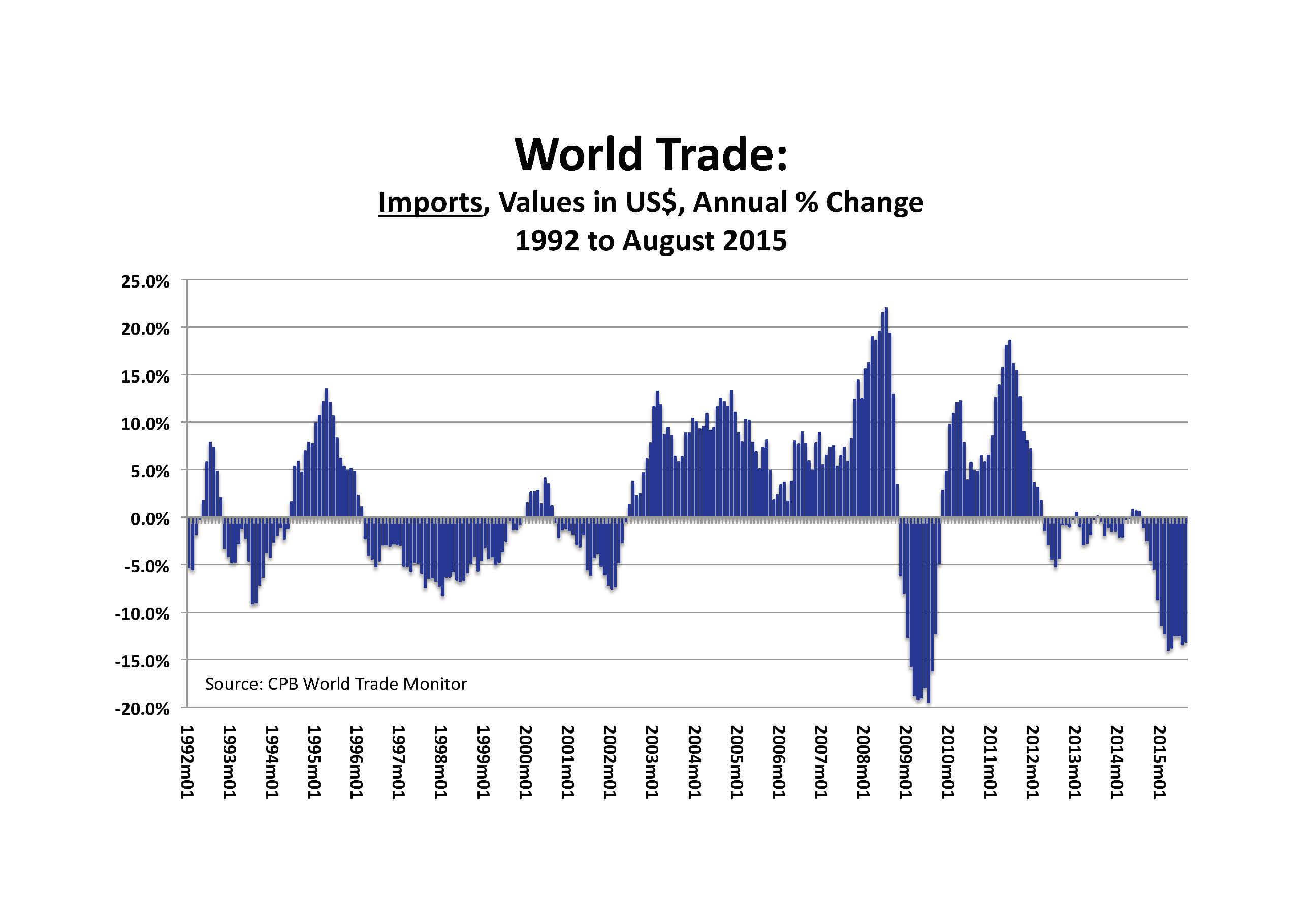

The combination of lower demand and much lower prices for commodities has caused a severe downturn in global trade. The contraction in world trade is now nearly as bad as at the peak of the crisis in 2009.

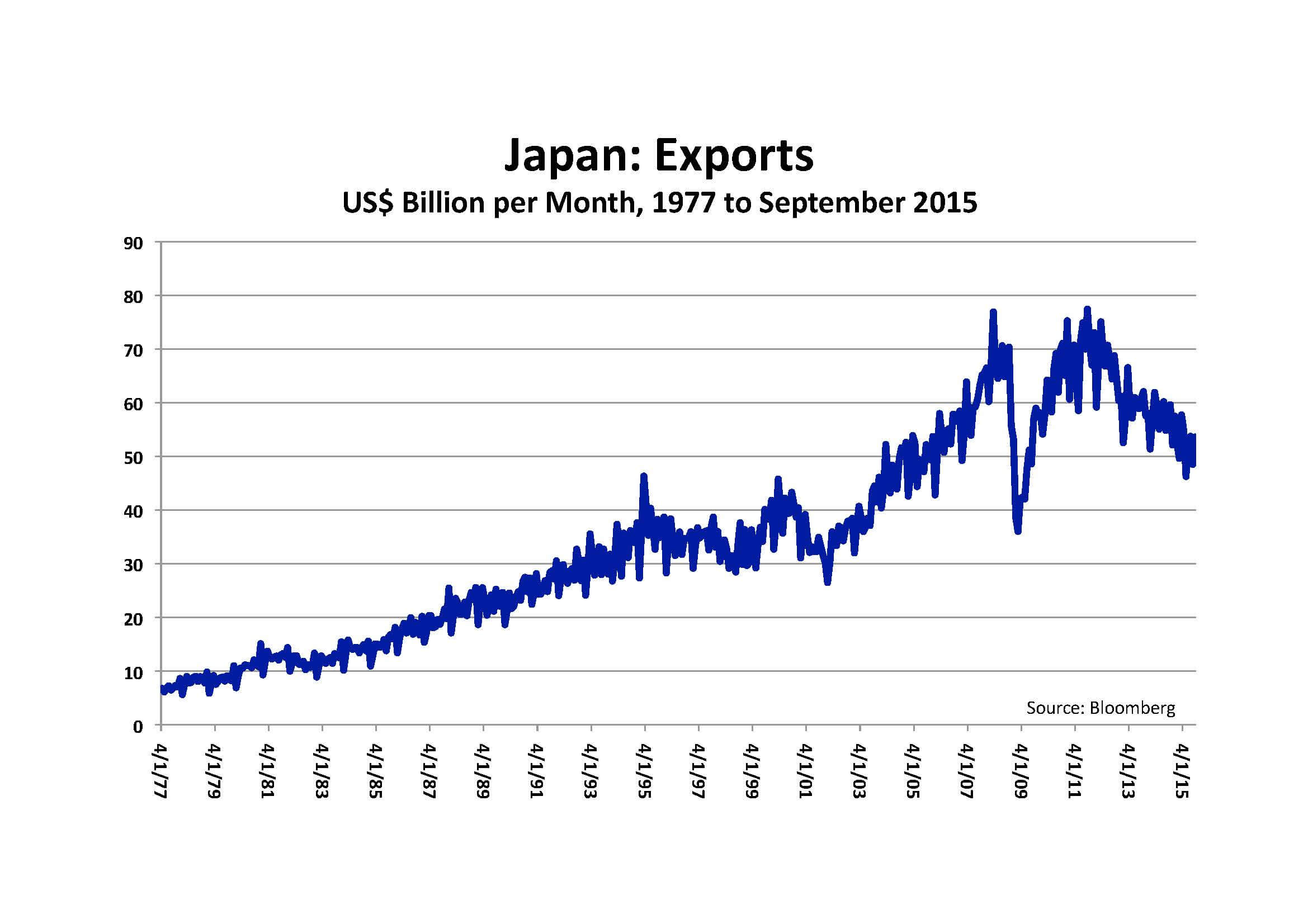

Japan’s exports are down 30% from the peak.

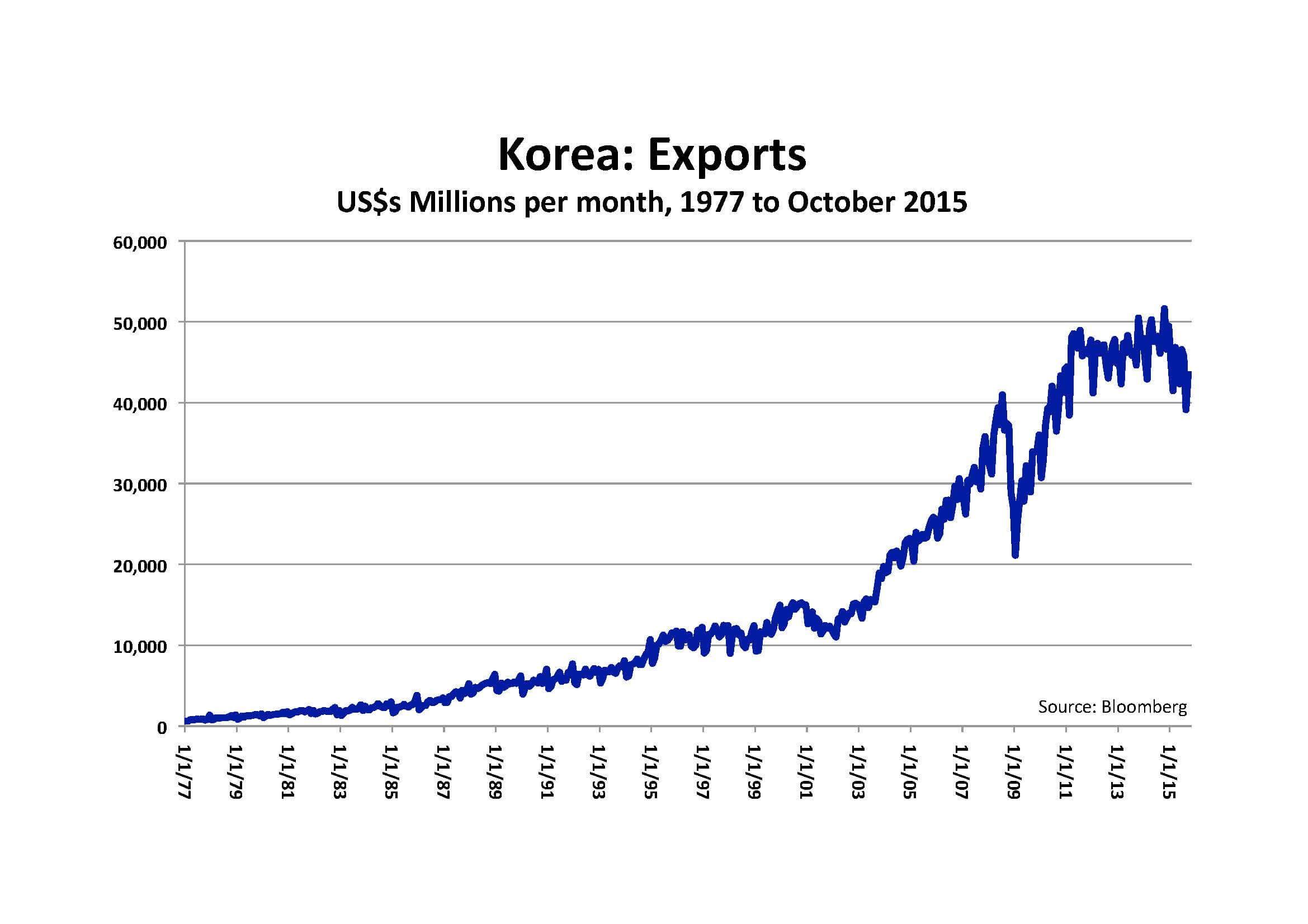

Korea’s exports are down 16% from the peak.

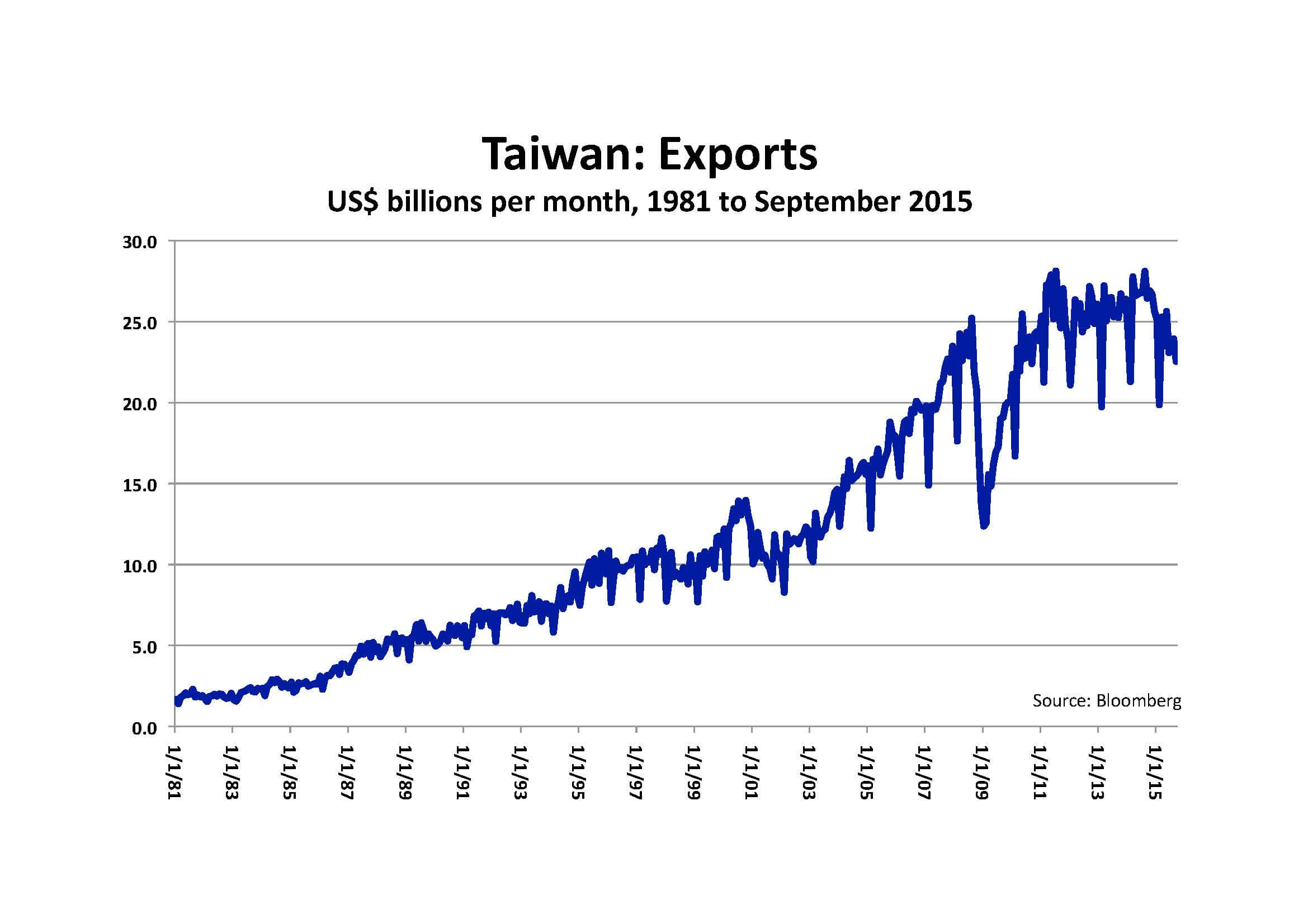

Taiwan’s exports are down 20% from the peak.

Thailand’s exports are down 11% from the peak.

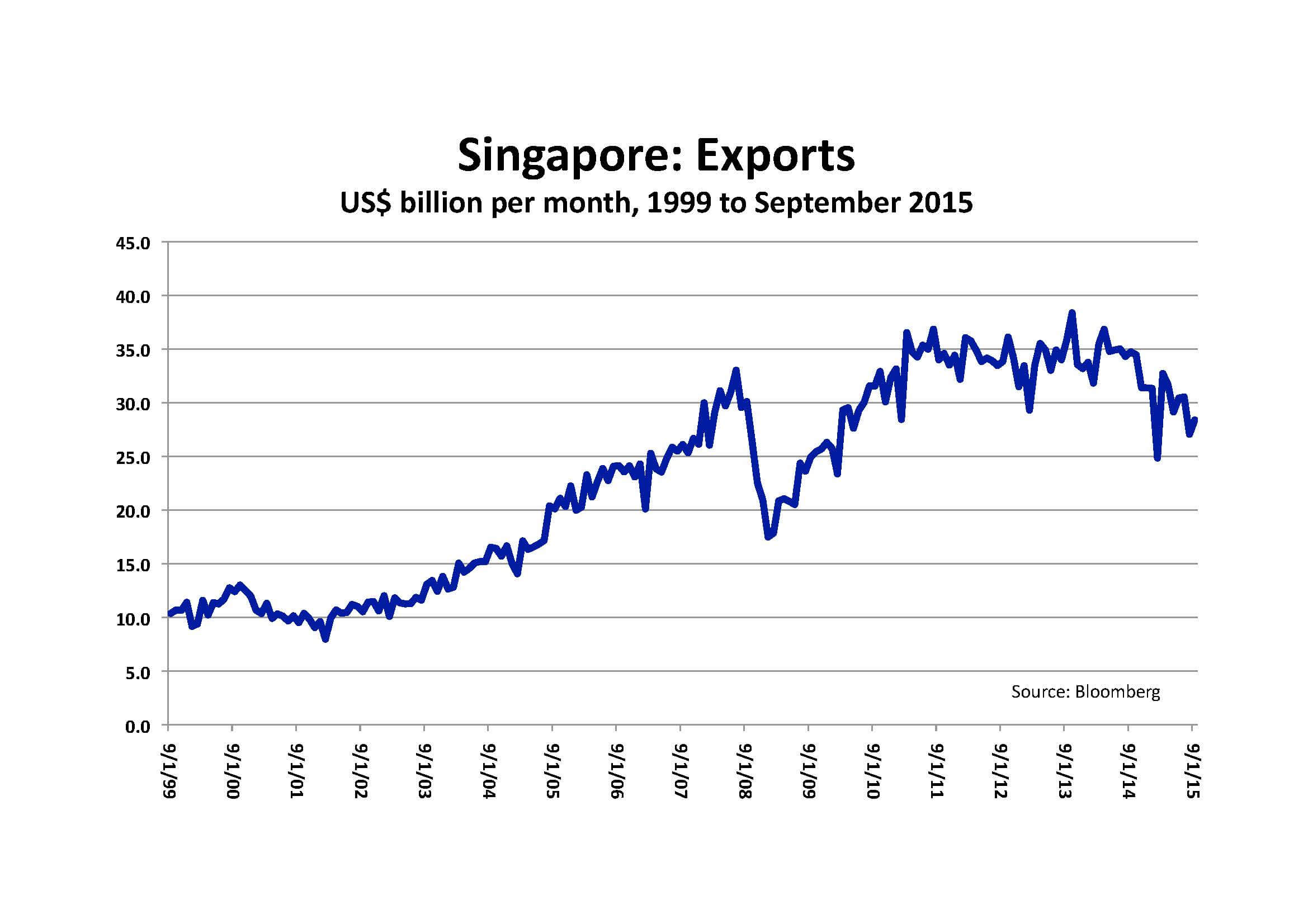

Singapore’s exports are down 26% from the peak.

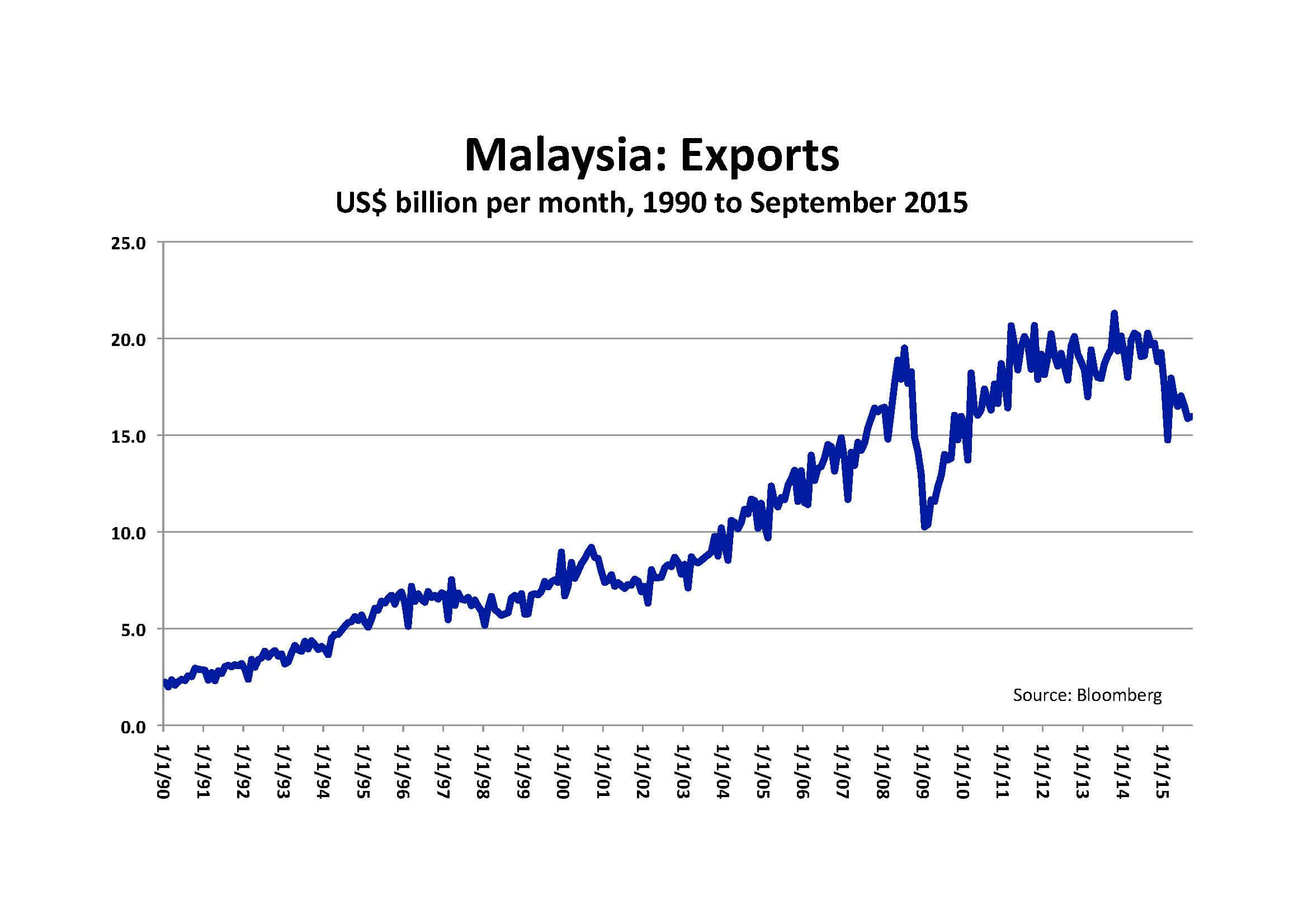

And, Malaysia’s exports are down 25% from the peak.

Since World War II, Asia has developed economically by following a strategy of export-led growth. Now that the Great China Boom is over, the rest of Asia faces a much more difficult outlook, particularly since the United States, Europe and Japan are also all too weak to drive global demand. The danger now is that the plunge in export revenues will soon lead to a new debt crisis in Asia, as well as throughout the rest of the Emerging Market economies. In short, the next phase of the global economic crisis has begun.

To learn how this crisis will impact you, subscribe to my video-newsletter, Macro Watch:

http://www.richardduncaneconomics.com/product/macro-watch/

For a 50% subscription discount, hit the “Sign Up Now” tab and, when prompted, use the coupon code: richdad

You will find more than 18 hours of video content available to begin watching immediately. A new Macro Watch video will be added approximately every two weeks.

Original publish date:

November 15, 2015