We both like games. We like competing. We like winning.

We asked ourselves, “What if we could combine investing, one of the scarier subjects when it comes to money, and accounting, probably the most boring subjects, and create a fun and entertaining board game that teaches people exactly what we did?” That way the board game travels, and we don’t have to, because one of our mantras at Rich Dad is “the more people we serve, the more effective we become.” People teaching people is much more effective and reaches so many more people, than us .

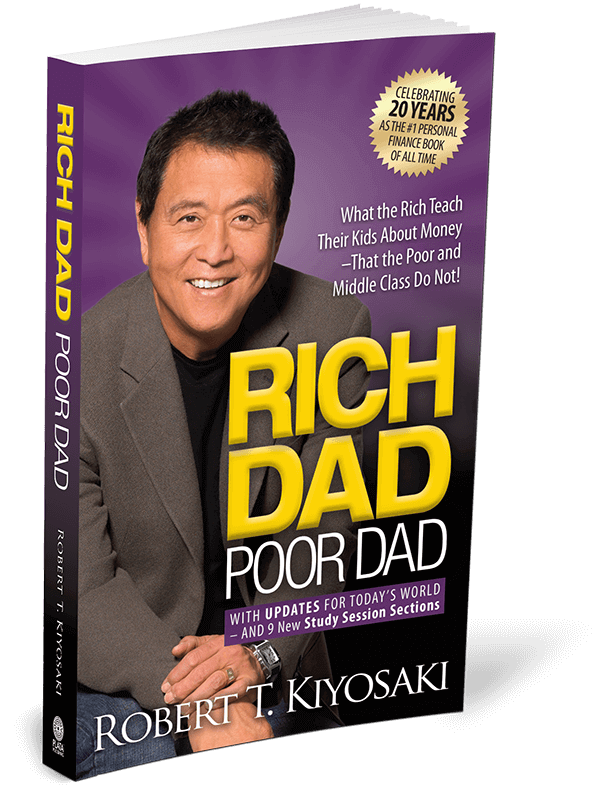

"Rich Dad Poor Dad" - The #1 Personal Finance Book of All-Time

"Rich Dad Poor Dad" - The #1 Personal Finance Book of All-Time

More importantly, a board game allows the players to become the teachers. Everyone learns from everyone else. It’s actually people teaching people.

By playing the game you see different strategies of different players. You make investing mistakes… but with play money, not real money. And it opens up discussion about money and investing that most people never talk about.

And you have fun while you learn!

Having never invented a board game, every day was an experiment in what works and what doesn’t works. And in October 1996, we launched the CASHFLOW board game in Singapore to a group of about 500 players.

By playing the game you see different strategies of different players. You make investing mistakes… but with play money, not real money. And it opens up discussion about money and investing that most people never talk about.

And you have fun while you learn!

Having never invented a board game, every day was an experiment in what works and what doesn’t works. And in October 1996, we launched the CASHFLOW board game in Singapore to a group of about 500 players.