Blog |

China’s Credit Troubles

June 01, 2016

China’s economic growth engine is fuelled by extraordinarily large amounts of credit. Between 2002 and 2015, total Aggregate Financing outstanding increased by nine times. (Aggregate Financing is a measure of credit that captures most, but not all, of the credit extended in China.)

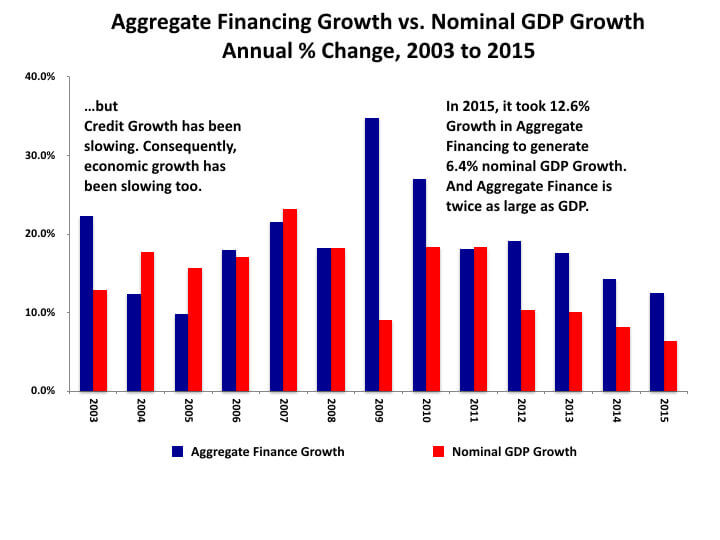

As readers of this blog know well, I believe that credit growth drives economic growth in the United States. The same is just as true for China. Credit growth in China has been slowing. Consequently, economic growth has been slowing as well.

At the same time that credit growth has been slowing, the amount of credit growth required to generate economic growth has been increasing. Last year, Aggregate Financing increased by 12.6%, but the economy grew by only 6.4% (in nominal terms). Put differently, it took Yuan 15.4 trillion of credit growth to make the economy grow by just Yuan 4.1 trillion.

Yuan 15.4 trillion is the equivalent of US$2.4 trillion. In the United States last year, total credit grew by less than that, by just US$1.9 trillion. In fact, in absolute amounts, credit growth in China has exceeded credit growth in the US every year since 2009. That is particularly worrying because the US economy is still nearly 70% larger than China’s economy.

Over the years immediately ahead, it will not be easy for China to fund so much credit expansion. Back in the 1990s, when China’s economy and funding requirements were small, the money entering China through its trade surplus and through direct foreign investment was more than sufficient to financed the required growth in credit. Now, however, the amounts of financing needed have become enormous. For instance, if Aggregate Financing were to continue to grow at 12.6% a year (as in 2015), China would have to finance US$17 trillion of new credit over the next five years.

The global economy is now much weaker than before 2008. China’s trade surplus will not grow enough to bring in the required financing. Worst still, last year there was massive capital flight out of China for the first time in modern history (an outflow of US$500 billion on China’s Financial Account). That occurred because of fears that the Yuan would be devalued. Liquidity conditions tighten significantly as a result.

Chinese policy will have to become increasingly aggressive if the economy’s enormous funding requirements are to be met.

- The Yuan is likely to be devalued further in order to boost China’s (already very large) trade surplus.

- The banking system’s Required Reserve Ratio is likely to be reduced further to permit more domestic credit creation and additional leverage.

- Quantitative Easing is likely to be introduced by the central bank – despite the risk of setting off a politically destabilizing inflation shock.

Even with these measures, a sharp slowdown in China’s credit growth and economic growth is inevitable. Therefore, the questions we must ask include: 1) How much will they slow? 2) How fast? And, 3) How many trillions of dollars worth of deposits will be destroyed by non-performing loans and credit defaults in the meantime?

These are among the questions I am exploring in a series of Macro Watch videos on the economic crisis now unfolding in China. Three videos on this subject have been uploaded so far and one more is in the works. If you would like to learn more about how the economic crisis in China is likely to impact the rest of the world and what that could mean for you, subscribe to my video-newsletter, Macro Watch.

For a 50% subscription discount, hit the orange “Sign Up Now” tab and, when prompted, use the coupon code: richdad

You will find more than 25 hours of video content available to begin watching immediately. A new video will be added approximately every two weeks.

Original publish date:

June 01, 2016