Blog |

China’s Hard Landing Has Begun

May 15, 2016

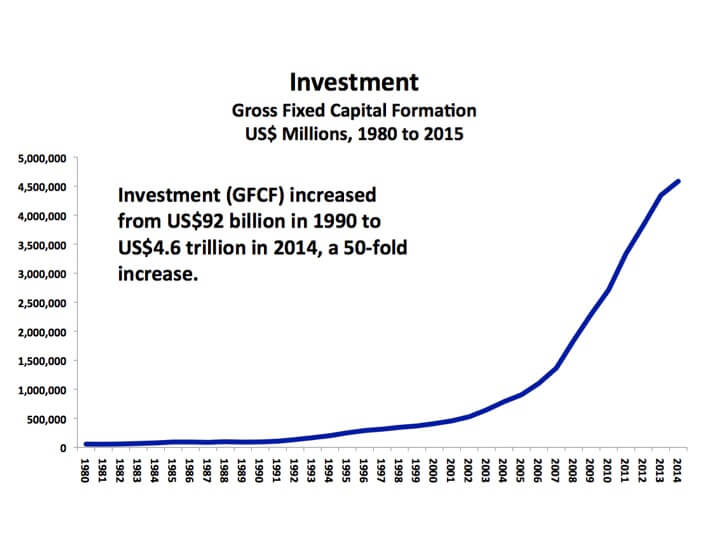

Chinese Investment increased 50-fold between 1990 and 2014. Investment (i.e. Gross Fixed Capital Formation or GFCF) in China grew from US$92 billion in 1990 to US$4.6 trillion in 2014.

Dramatic increase in Chinese Investment between 1990 & 2014.

Dramatic increase in Chinese Investment between 1990 & 2014.

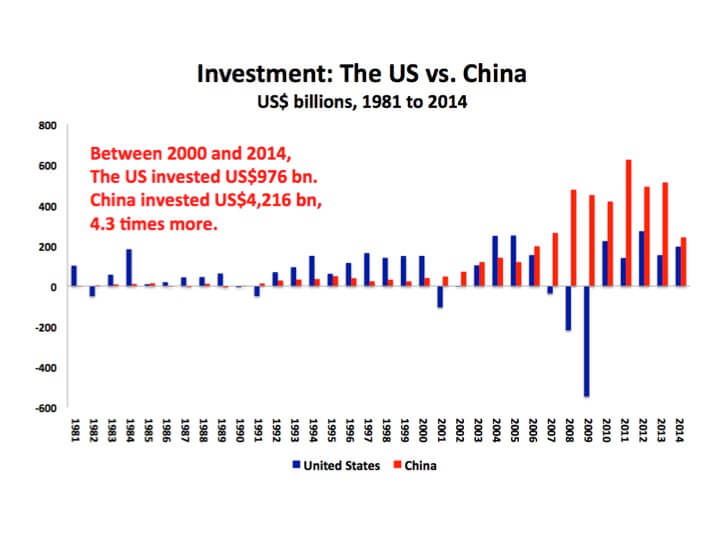

To put China's investment boom in better perspective, let's compare it with the level of investment in the world's largest economy, the United States. Between 2000 and 2014, Investment (GFCF) in the United States amounted to US$976 billion, while Investment in China came to US$4,216 billion - 4.3 times more.

Comparison between US Investment & Chinese Investment.

Comparison between US Investment & Chinese Investment.

In 2014, Investment in the US made up 18% of US GDP. In China, it accounted for an extraordinary 44% of GDP - a level of Investment to GDP probably not witnessed since the Pharaohs built the pyramids with slave labor four thousand years ago.

In 2015, China's colossal investment boom came to an end.

- Between 2000 and 2014, the Building Area Under Construction in China increased by seven times, at an average annual growth rate of 15%. In 2015, however, the Building Area Under Construction contracted by 1%.

- Between 2000 and 2014, Cement Production increased by three times, at an annual average rate of 10%. But, in 2015, Cement production shrank by 5%.

- Steel Production increased by five times between 2000 and 2014, at an average annual rate of 14%. Last year, Steel Production fell by 2%.

- Electricity Production tripled between 2000 and 2014, at an annual average growth rate of 11%. In 2015, Electricity Production increased by only 3%.

- Between 2000 and 2014, Rail Freight grew by 6% a year. Last year, it contracted by 12%.

- Chinese Exports and Imports grew eight-fold between 2000 and 2014, both at an average annual rate of 19%. Last year, however, Chinese Exports fell by 9% and Chinese Imports collapsed by 17%, throwing the global economy into recession.

What these statistics tell us is that China's economic hard landing has already begun.

China's economic model of export-led and investment-driven growth is in crisis. The global economy is simply not large enough to continue absorbing more and more Chinese exports year after year. Meanwhile, China's domestic market is tightly constrained by low income. The median disposable income per person is only US$8.13 per day. That means there is not enough purchasing power overseas or at home to justify further investment. Furthermore, vast excess capacity across most industries in China suggests that much of the investment made in recent years is already loss making.

Last week, we were told by an "authoritative figure" quoted in The People's Daily that China would experience "an L-Shaped Recovery". It is worth keeping in mind that Japan has been in an L-Shaped Recovery for 26 years. I believe China is now facing economic constraints that will keep it trapped in a severe economic slump far into the future.

I am currently producing a series of Macro Watch videos explaining why China's unprecedented economic boom has ended. To learn more about how the economic crisis in China is likely to impact the rest of the world and what that could mean for you, subscribe to my video-newsletter, Macro Watch:

http://www.richardduncaneconomics.com/product/macro-watch/

For a 50% subscription discount, hit the orange "Sign Up Now" tab and, when prompted, use the coupon code: richdad

You will find more than 24 hours of video content available to begin watching immediately. A new video will be added approximately every two weeks.

Original publish date:

May 15, 2016