Blog |

Contracting World Debt Threatens The Global Economy

July 15, 2016

Credit growth has been the driver of economic growth for decades – not only in the United States, but for the rest of the world as well. Now, however, credit is no longer expanding. That explains why the global economy is so weak.

The ratio of debt to GDP in Japan rose sharply from 1960 to 1990. Then Japan’s economic bubble popped. For the US, the Euro Zone and the UK, the ratio of debt to GDP rose sharply for more than three decades up until 2008. Then their economic bubbles popped. The ratio of debt to GDP in China is still rising sharply. But that is unlikely to continue for much longer since China’s economic bubble is beginning to pop.

The combined total debt of the United States, China, the Euro Area, Japan and the UK (areas of the world accounting for 65% of global GDP) more than doubled between 2002 and 2014 to US$174 trillion.

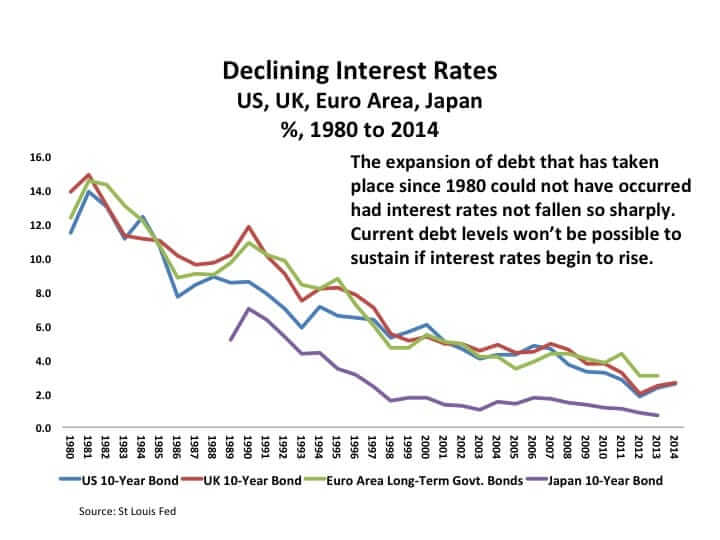

That extraordinary surge in global debt was only possible because the collapse in interest rates after 1980 made borrowing more affordable.

Richard Duncan's chart showing declining interest rates of the global economy.

Richard Duncan's chart showing declining interest rates of the global economy.

Current debt levels won’t be possible to sustain, however, if interest rates ever begin to rise. In fact, last year, Total World Debt actually contracted by 4% to US$166 trillion, despite record low interest rates. Part of the contraction was a result of a currency conversion effect related to the strength of the US Dollar last year. Still, Debt growth has slowed sharply for each of these five parts of the world - even when measured in their domestic currencies.

Debt growth is weak in most parts of the world because the level of private sector debt is too high relative to income to allow more borrowing – even with ultra low interest rates. If interest rates begin to rise, the cost of servicing so much Debt will become unbearable. Debt will contract and the global recession will worsen.

I coined the term “Creditism” to describe an economic system driven by credit creation and consumption, in contrast to Capitalism, which was driven by savings and investment. Creditism replaced Capitalism when money ceased to be backed by gold. Creditism requires Credit growth to survive.

I have just finished work on a new Macro Watch video that analyzes trends in credit and debt growth for the world’s five largest economies. The evidence presented in that video suggests that “Creditism” is in crisis all around the world because Credit is no longer increasing fast enough to drive global growth, even with record low interest rates.

The global economy is like a ship floating on an ocean of Debt. When the ocean rises, it lifts the ship. When the level of the ocean falls, the ship moves down, too. The world has enjoyed decades of a rising tide of Debt. The tide has now begun to turn. If Total World Debt continues to contract, there is a real danger that our global economy will capsize.

If you would like to learn more about how debt and credit fuelled the great global economic boom during the decades since World War II, and what the consequences could be should that trend now reverse, please consider subscribing to my video-newsletter, Macro Watch.

You will find more than 26 hours of video content available to begin watching immediately. A new video will be added approximately every two weeks.

For a 50% subscription discount, hit the orange “Sign Up Now” tab and, when prompted, use the coupon code: richdad

Original publish date:

July 15, 2016