(Disclaimer: This is not financial advice, the information in this newsletter is for educational purposes only. This article is not sponsored or affiliated with the tokens, teams, and protocols mentioned. It is important to do your own research and never invest what you can’t afford to lose.)

The Cage Bird and the Bat

I find it fascinating that no matter how much time passes and how advanced our technology becomes, there is so much we can learn from the past that is simple and timeless. These lost lessons of life are still valid even now in this current world. The wife of my father’s retired boss gave my parents a set of Harvard Classics. It was their wish that my brother(who was little at the time) would have books to read that they felt were invaluable teaching tools. This allowed me to read various different tales and fables from an early age, and I have continued reading them ever since. One story, in particular, is an Aesop Fable called “The Cage Bird and the Bat”.

The story is short and simple, it focuses on a bird in a cage that only sings at night and stays silent all day. One night, a bat approached the bird’s cage and asked it why it only sung at night. The bird replied that when it sang during the day, its beautiful singing voice attracted a human who caught them and caged them, so to be on the safe side they would only sing at night. This answer perplexes the bat, who is flying freely in the night sky. Finally, the bat said to the bird, “It is no use your doing that now when you are a prisoner: if only you had done so before you were caught, you might still have been free.”

This fable teaches us that there is no point in taking precautions when we are already in a crisis. Those actions become useless when we are already trapped. Precautions have to be implemented before the problems happen. We are currently in a global situation that is very quickly moving towards a crisis. We may be caught in the net, but we are not fully in the cage quite yet. All of the bubbles are bursting; the stock market bubble, the housing bubble, and the illusions of wealth based on credit.

So in a world where cash and financial systems are failing us, what does that mean?

I will share some lessons that I have seen and learned in my personal life.

Crypto and Stocks are Fluid, Hard Assets are Long-Term

Anything we intend to buy low and sell high is a “fluid” investment. We watch it, babysit it, and determine carefully entry and exit positions and in general, we look to profit off the supply and demand value of both crypto and stocks. They are volatile to hold long-term, some are less volatile than others, but the long-term does not always mean bigger, or better profit with these assets.

This is a concept I want to be very careful in discussing because it does branch into the financial advice territory, and that is not really what I intend for my writing to be about. I want to have my articles be informative, and educational and provide possible ways to avoid

the pitfalls that can be experienced in crypto and in the world of low-risk investing in general.

Over the course of several decades, my parents slowly acquired plots of land, bit by bit. They still have these land properties to this day, and over the course of the weekend, my uncle came to visit. He asked them how much land they had and my mother told him, and then he asked a very interesting question. He asked them “would you have been able to buy this land today?” and when my mother thought about this she came to the realization that no, she would not have been able to afford to buy the land she owns now if she were trying to in this current market.

In last week’s article, I wrote about chasing purchasing power is better than chasing money. I want to stay on that topic because time is of the essence. Now, more than ever, I personally feel it is invaluable to have assets versus having cash. Assets can always be sold or used to obtain or acquire cash, but holding cash itself is quickly losing value in this environment.

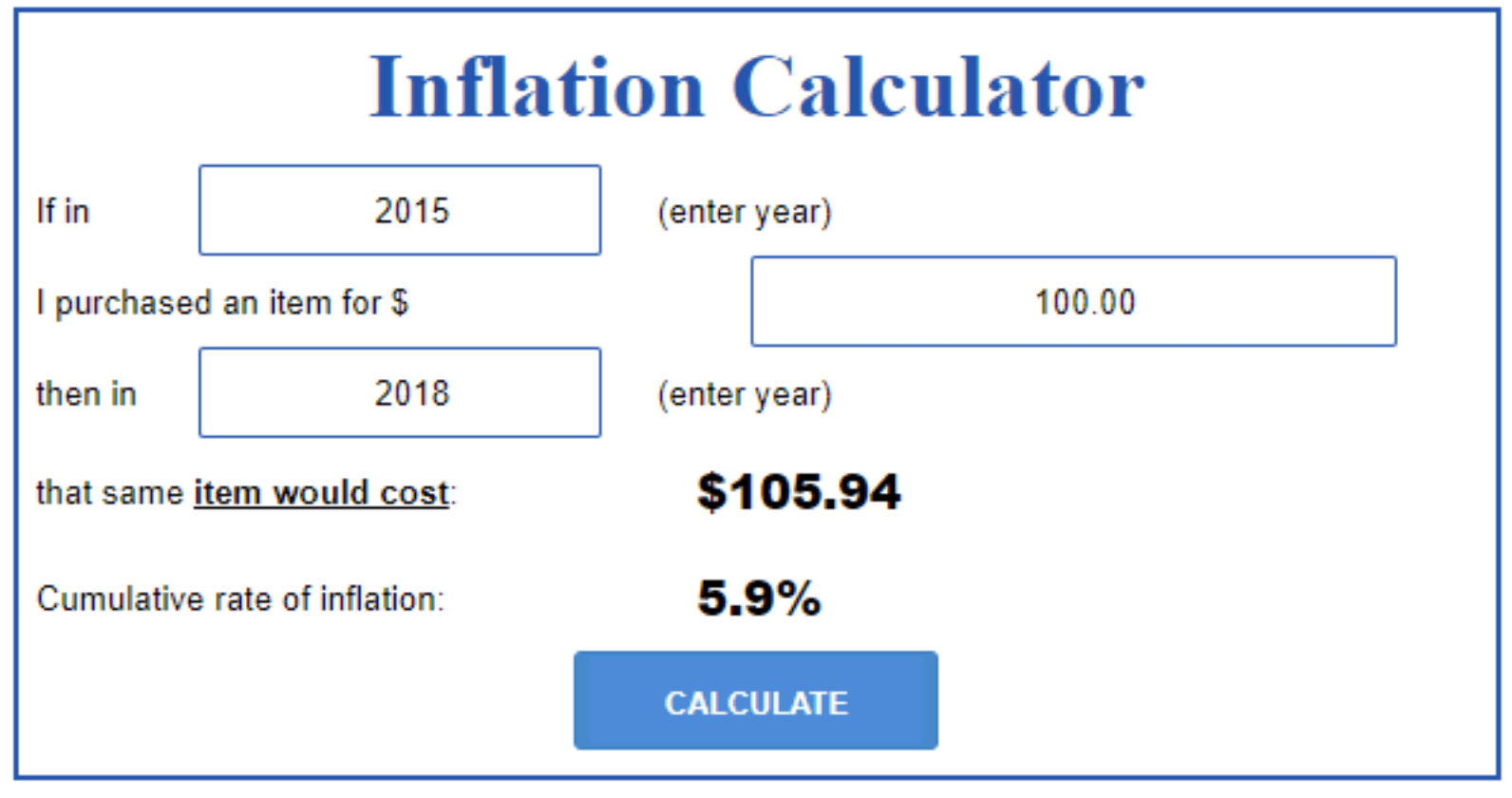

The image above is from the website www.usinflationcalculator.com, and I placed in that if I bought an item in 2021, how much would I pay for that same item now. This is less than 1 year’s time, and we are close to almost a 10% cumulative rate of inflation.

If we go back to 2018, pre-covid an item purchased for $100 would cost $117.99 today in 2022. That is a cumulative rate of inflation by 18%.

For those who blame the pandemic alone for what is economically taking place, if I compare 2015 to 2018 before the pandemic if I purchased an item for $100 in 2015, that same item would cost $105.94 in 2018.

That is still a significant increase in inflation in the span of only three years. I strongly feel that the time to act is now.

The biggest revelation that we are never taught in school is that the only valuable assets are the ones that cannot be created by the Federal Government. Anything a government can create eventually becomes devalued over time. This is apparent throughout history when we analyze how many currencies have come and gone over the course of time.

The Federal Reserve runs the printing presses. They can print up money and put it in circulation. This lowers the value of the dollars in circulation because it raises the supply and decreases the relative value of each unit of money.

Assets Not Created by the Fed

One way to protect yourself from the continued devaluation of fiat currencies is to diversify into assets that are not controlled by the Federal Reserve. Crypto and cash can be used as vehicles in order to acquire more assets, and assets are more valuable than their cash price point.

PreciousMetals(goldandsilver)

Crypto (a form of currency that can be used outside of the financial system. Privacy-based tokens, bitcoin, and tradeable asset-backed tokens)

Land (to use, lease, or with a home property included)

Livestock, Edible Plants, Fruit Trees (provides food and/or a source of income)

Cash Generating(or money-saving) Personal Knowledge and Skills

The first step starts with undoing the educational financial programming we’ve been conditioned to follow.

According to a nationwide survey, conducted by Gold IRA Guide and published on May 4, 2022, Americans had done nothing to combat inflation in their investment strategies. The incorrect methods we have been taught for investing are so deep in our psyche, that even in a crisis, most cannot or will not break from the patterns they have been trained to follow.

Avoiding The Cage

I have spent my adult life always thinking about the “future me”. The me ten years from now who will look back and judge the decisions I am currently making. Just as the bat told the bird that if it had sung at night before it was caught, it would still be free, I too seek those same precautionary actions.

I am grateful for the assets that I have now, and the knowledge that I continue to seek. There are so many timeless lessons that were born from people who sat and thought. They allowed themselves to develop their minds, and their creativity, and breathe it into life through words and actions.

I value each person who reads these articles and I write with a sense of urgency because I feel so strongly that we are heading into more challenging times than we are already facing.

The texts and courses we have been taught in school and university tell us that the best way to invest is to follow the herd. But what happens when the herd is stampeding towards an uncertain fate? We can either get trampled or we can break out of our trained patterns and find a better way.

The net is drawn, but we are not in the cage yet. We can be free and now is the time for us to formulate our plans.