Blog |

The Economic Crisis Enters A New Stage

November 01, 2012

The crisis in the global economy is entering a new stage. Credit growth in the United States is not expanding rapidly enough to drive the global economy. Consequently, global trade is beginning to contract. Corporate profits are taking a beating as a result. It was these developments that forced the Fed to launch its latest round of money creation in September. Today we will take a look at these issues and consider what they imply for the future.

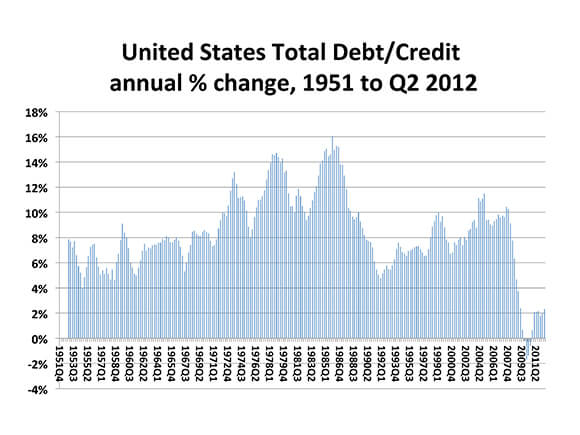

Credit growth has been the driver of economic growth in the Unites States (and globally) since World War II. That was the theme of my recent book, The New Depression. Total credit in the US now amounts to $55 trillion. It is not expanding rapidly enough, however, to generate economic growth. Between mid-2011 and mid-2012, US federal government debt increased by $1.3 trillion and corporate debt increased by $475 billion. Offsetting that, however, financial sector debt contracted by $436 billion and household sector debt contracted by $41 billion. Taken together (with a few smaller sectors), total debt expanded by $1.25 trillion, a 2.3% increase. After deducting 2% for the inflation rate, there was essentially no change. (Keep in mind that debt and credit are two sides of the same coin.)

Between 1952 and 2007, there were only nine years when total credit in the US grew by less than 2% (when adjusted for inflation). Each time that happened there was a recession; and the recession did not end until there was another surge of credit expansion. Since the crisis began in 2008, credit growth adjusted for inflation has been significantly less than 2% a year. GDP shrank by 3.1% in 2009; but thanks in large part to the first two rounds of Quantitative Easing, the economy expanded by 2.4% in 2010 and by 1.8% in 2011.

Over the last 12 months, credit would have had to expand by $2.15 trillion (instead of by $1.25 trillion) in order to have achieved 2% credit growth on an inflation-adjusted basis. A 4% increase in credit (adjusted for inflation) would have been sufficient to generate at least some growth in GDP in the past; but $3.2 trillion in new credit would have been required to achieve that - nearly three times the amount generated over the past year.

It is no easy matter to expand credit significantly when there is already $55 trillion in total credit outstanding. Which sector can take on so much more debt? The household sector remains heavily indebted, underemployed and facing falling median wages. The banking industry is still a mess. Fannie Mae and Freddie Mac are in “conservatorship” (i.e. nationalized). And, to make matters worse, there is immense political pressure to reduce the level of government borrowing. For these reasons total credit is unlikely to expand enough to begin driving economic growth again any time within the foreseeable future.

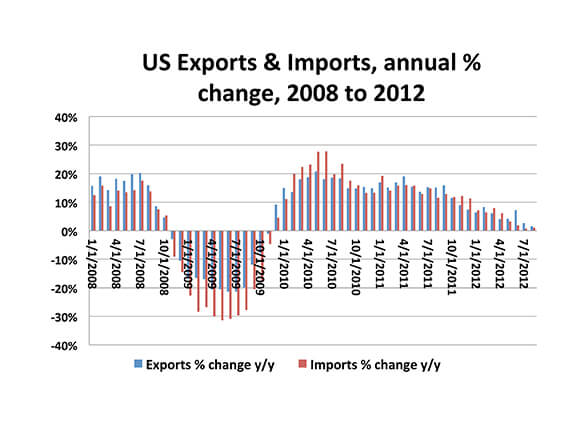

To see the impact that weak credit growth has had on the global economy take a look at the next chart, which shows the annual change in US exports and imports.

Following the sharp contraction of 2009, massive fiscal and monetary stimulus resulted in a remarkable rebound in trade during 2010. That rebound gradually faded. Now there is next to no growth in either exports or imports. US imports fuel the global economy. Therefore, it is not surprising that the trend in Chinese and European exports and imports looks nearly identical to that of the US. The pattern in Japan is considerably worse. According to the CPB Netherlands Bureau of Economic Policy, world trade has actually contracted during each of the last three months. To put that into perspective, world trade expanded at an average rate of 6% a year during the past two decades.

The lack of growth in trade has caused a dangerous slowdown in global production and economic output. Moreover, US corporate profits are expected to decline during the third quarter for the first time since 2009.

This shift from expansion to contraction in global trade marks the beginning of a new – and dangerous – stage of the global economic crisis. Remember, economies are like bicycles. They either move forward or they fall over.

I believe it was this slowdown in world trade that was decisive in the Fed’s recent decision to launch a new round of Quantitative Easing (QE 3). At its September meeting, the Fed announced it would create $40 billion each month until the level of unemployment declined significantly. With credit growth insufficient to drive economic growth, Ben Bernanke and his Fed colleagues believe – or at least hope – that money creation will have the same effect in stimulating the economy as credit creation.

It seems unlikely, however, that $40 billion per month will be sufficient to achieve the desired results. Annualized, that amounts to $480 billion per year, whereas an additional $2 trillion a year in credit ($3.2 trillion in total) is required if total credit is to expand by 4% after inflation. Therefore, I believe it is quite likely that the Fed will “up the dosage” of QE 3 before too long – perhaps as soon as year end when Operation Twist, a different and less effective Fed program, is due to expire.

QE 3 should succeed in reflating our global economic raft - and keep it afloat for some time to come. First, it will push up the price of stocks, bonds and property, creating a wealth effect that will generate more economic growth than would have occurred otherwise. Second, it will also push up commodity prices – including food prices. Finally, QE 3 will cause the dollar to depreciate against other currencies and hard assets like gold and land.

Overall, rising asset prices will benefit the wealthier segments of society who own assets, while rising food prices will harm the poor who spend most of their income on food. Most importantly, QE 3 will ensure this stage of the global economic crisis does not become the terminal stage.

Of course, creating money from thin air will not permanently resolve this crisis. Global supply greatly exceeds effectual global demand, which is ultimately determined by the income of the world’s seven billion people. At best, QE 3 buys us time to look for a way to increase median global income in a sustainable way. Unfortunately, finding that solution may require more time than QE 3 can buy.

One final word on QE 3 and asset prices. The effects of QE 3 on asset prices were partially “discounted” or “priced in” by the financial markets before the policy was officially announced. That happened because the Fed had hinted for several months that a new round of money creation was likely. In fact, during the weeks after the announcement, there was actually some profit taking in stocks and commodities. Over the coming months, however, QE 3 is likely to begin exerting upward pressure on asset prices once again. Why? When the Fed prints money and buys assets (in this case mortgage-backed securities), it puts cash into the hands of the people and institutions from whom it buys the assets; and that cash tends to be quickly reinvested into other assets, pushing up their price. The effect is cumulative. It should therefore make itself increasingly felt as time goes by – particularly if the Fed increases the amount of money it creates each month, as seems probable.

Original publish date:

November 01, 2012