Blog | Paper Assets

Avoid Systemic Risk in Stock Investing

Is there risk in stock investing? Yes. But those who educate themselves on true diversification and advanced trading techniques will thrive, no matter what the market is doing.

Rich Dad Paper Assets Team

June 15, 2023

Summary

-

Avoiding risk doesn’t make for smart investing

-

Having a strong financial education is the key to successful investing

-

A truly diverse portfolio is the best way to manage risk

The name of the game isn't avoiding risk, but managing it

Google the term “SEC lawsuit” and you’ll find that the world of securities trading is full of crooks. Notably, in 2010, the SEC sued Goldman Sachs for failing “to disclose to investors vital information about the CDO, known as ABACUS 2007-AC1, particularly the role that hedge fund Paulson & Co. Inc. played in the portfolio selection process and the fact that Paulson had taken a short position against the CDO.”

Translation: Goldman tried to pull one over on investors investing for the long term while knowing that a hedge fund was ready to pull the rug under them.

As a result, Goldman Sachs paid a record $550 million in fines. Was that a lot for them? Not really. According to ProPublica, it was about two week’s worth of profit. A small price to pay for a calculated bet. In this case they lost; they only made $15 million in fees from the deal in question. But as ProPublica points out, “...keep in mind: Goldman did 25 of these so-called Abacus deals in all, and created many more CDOs without the Abacus label.” In short, Goldman got caught on one deal but will come ahead across all deals.

You against Big Firms: A big stock market risk

You might remember the old game called RISK. The game is set in the Napoleonic era, and you control an army and a section of the board. The goal of the game is simple: world domination. It’s a game without mercy and requires high intelligence and much planning. It’s not a game for suckers.

For decades, Wall Street has been playing their own version of the game RISK—and though the stakes are higher, the strategies are the same. The source of all this risk? Trading.

In Conspiracy of the Rich: The 8 New Rules of Money, Robert Kiyosaki writes about how those who play by the old rules of money—go to school, get a job, buy a house, save money, and invest in a diversified portfolio of stocks, bonds, and mutual funds—are playing to lose. This is especially true when it comes to investing for retirement in the stock market and Wall Street’s financial vehicles.

Why? Because you’re playing the game of stock market RISK against firms that have way bigger arsenals than you—and also have no problems with cheating—firms like Goldman Sachs.

Understanding systemic risk

Rich Dad Advisor, Andy Tanner, often talks about the difference between systemic and non-systemic risk when it comes to investing.

Simply put, non-systemic risk is when a company or a stock is performing poorly as an anomaly to the rest of the market.

Systemic risk is when the entire market is performing poorly as a patterned whole.

Understanding the difference between systemic risk and non-systemic risk is important, because it allows you to understand when the standard investing advice of “invest in a diversified portfolio of stocks, bonds, and mutual funds” is really going to bite you—hard.

Stock market risk and taking the fall

If you ask most people what their strategy for retirement is, they’ll say investing in the stock market for the long term through vehicles like a 401k and mutual funds.

Those who invest for their retirement in the stock market and financial vehicles made by Wall Street firms are betting on the market rising in value. They’re fed “facts” like the stock market returns 7-10% per year. They are investing for capital gains instead of cash flow.

Of course, playing the game of averages is risky. Why? Just ask the folks who were ready to retire when the Great Recession hit in 2008. Averages didn’t mean anything to them when their portfolios were wiped out. And many retirees are now facing a prolonged bear market…maybe even a big crash. Years of gains could be wiped out right when they need them most.

Again, this is the average Joes taking the fall, not the big Wall Street firms. They know they can take the risks because you’ll take the fall.

Stock market risk through trades

The problem is that the true money is made in trading—in the sell, not the hold. If you’re finally ready to retire and sell but the market has recently crashed, your average return means nothing. In fact, traders need the middle class to invest for the long term so that they can cash in on their financial ignorance through trades and fees—often highly complex trades that take advantage of market swings and that require a high financial intelligence.

All the major Wall Street financial firms understand that the real money is made in short-term trading, not in long-term investment. And the reality is that the higher the risk, the bigger the return. And big firms are willing to risk it all for the big payoff.

In a 2010 article in TIME Magazine called “The Case Against Goldman Sachs”, Stephen Gandel writes: “‘With a trader, the goal of every minute of every day is to make money,’ says Philipp Meyer, who worked for UBS as a trader in the late 1990s and early 2000s before going on to write about his time there. ‘So if running the economy off the cliff makes you money, you will do it, and you will do it every day of every week.’”

These big firms are not just experts in trading, but they’re also experts in hedging those trades. The true victims are rarely the firms themselves—or the executives and traders collecting big bonuses—but rather good, hard-working investors with little intelligence.

The lawsuit against Goldman only existed because the SEC thought that Goldman hedged unfairly—not because they wiped others out. In reality, most people and organizations are just pawns for the big Wall Street firms in a much larger game of RISK—stock market trading edition.

The TIME article goes on to say: “In 1998, the year before Goldman went public, just 28% of its revenue came from trading and principal investments. By 2009, it was 76%.” And quoting a former Wall Street executive, "The industry became so heavily weighted toward risk, it just made sense to let the traders run things." The traders are in control on Wall Street—and they love the stock trading game of RISK.

The game of RISK—Stock Market Trading Edition

According to the RISK product website, the following are some suggested strategies to be a winner at the board game of RISK. The rules are very similar to the ones for the trading game of RISK played on Wall Street.

-

Focus on the goal and the objective

In the board game of RISK, the goal is total world domination, no mercy. The goal is the same in Wall Street trading. This is not a charity game. It’s a chew ‘em up and spit ‘em out, high stakes game where the winners win big and losers are toast. Big trading firms will not blink twice in wiping you out in order to make a profit. And they’ll cheat if they think they can get away with it.

-

You must grow to win

In the board game of RISK, you must grow a large army and accumulate large capital to conquer the world.

In the trading game of RISK, you must also grow large. By doing so, you earn friends in the government who will overlook your unfair advantage, and you gain insider access to make smart financial moves powered by knowledge while the little guys go down in flames.

-

Make large attacks

Making small attacks in the board game of RISK is worthless. You need to make big,large-scale attacks to win. The risk is higher, but the payoff is worth it.

In the trading game of RISK the rule is the same. Small trades with little risk are worthless. Why? Because traders make money in the form of bonuses based on the size of the trade. As the Time article I referenced earlier states: “As with everything else on Wall Street, the rise of the CDO had to do with bonus checks. Traders' pay was based not just on how much money they made for the firm but on the size of the bet.” In other words, traders have financial incentive to take bigger risks and are discouraged from playing it safe.

-

Don’t hesitate to eliminate a player from the game

When you’re playing the board game of RISK, there’s no room for mercy. Whether it’s your best friend from childhood or a random stranger, you have to treat all opponents the same—you have to take them out whenever you have the chance.

The same holds true on Wall Street. As the old adage goes, “There are no victims on Wall Street, just fools.” Traders are merciless and will sacrifice you, me, the whole economy to make a buck for themselves and for their firm. They don’t have your best interests at heart—they have their own.

-

Know the map

The game of RISK website says this about the game: “New players are fresh meat with huge egos.” Translate this as, “People who don’t know the rules of the game will be eaten alive.”

The same holds true for the stock market trading game of RISK. Those who have a low financial intelligence, who live by the old rules of money, will be eaten alive by the traders on Wall Street

Become confident at the stock investing game

For most people, the concept of making money when the market is going up is easy. However, many are stumped when thinking of ways to make money when the market goes down.

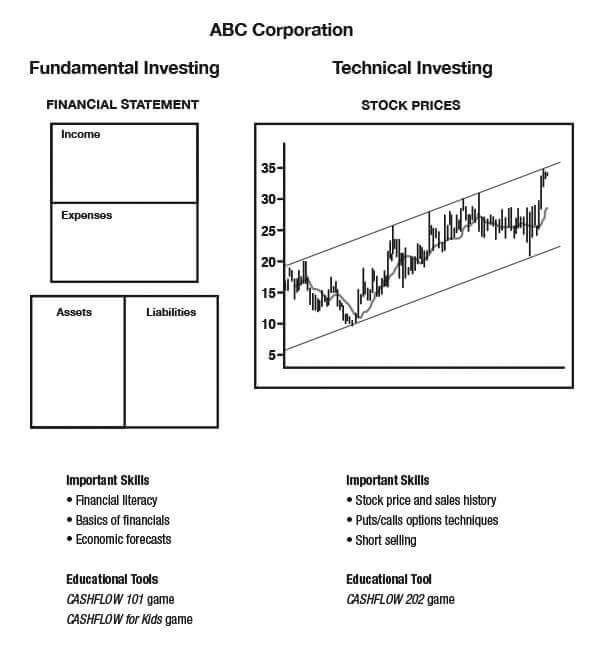

The answer lies in understanding the difference between fundamental and technical investing.

Fundamental investing

Robert Kiyosaki’s Rich dad said, “A fundamental investor reduces risk as he or she seeks value and growth by looking at the financials of the company.” For the fundamental stock investor, the most important consideration for selecting a good stock for investment is the future earnings potential of a company.

A fundamental investor carefully reviews the financial statements of any company before investing in it. He or she also takes into consideration the outlook for the economy as a whole, as well as the specific industry in which the company is involved, and the direction of interest rates.

Technical investing

Rich dad also said, “A well-trained technical investor invests on the emotions of the market and invests with insurance from catastrophic loss.” For the technical investor, the most important consideration for selecting a good stock is based on the supply and demand for the company’s stock.

The technical investor studies the patterns of the sales price of the company’s stock, asking, “Will the supply of the shares of stock being offered for sale be sufficient, based on the expected demand for those shares?”

Playing the game of stock RISK like the pros

One of the reasons so many people think the subject of investing is risky is that most people are operating as technical investors, but don’t know the difference between a technical investor and a fundamental one.

Because stock prices fluctuate with emotions, technical investing seems risky to those who do not have a good financial education. They don’t understand fundamentals and have poor technical investing skills. And because they have no control over the direction of the companies they invest in, they’re susceptible to the whim of the markets.

-

They are on the outside looking in. If they don’t know how to read financial statements, they are totally dependent on the opinions of others.

-

If they can’t read business financial statements, chances are their personal ones are a mess too. As rich dad said, “If a person’s financial foundation is weak, his or her self confidence is also weak.”

-

Most people only know how to make money when the market is going up, and they live in terror of the market going down.

But with the right financial education, the reality is that both types of investing are not risky.

Play the game of investing with confidence

Rich dad used to say, “Investors need to be well versed in both fundamental analysis as well as technical analysis.” He would draw the following diagrams for me.

The above diagrams are the reasons why The Rich Dad Company came to be. It exists to develop products that help people become financially literate, and to teach their children to do the same.

With the right financial knowledge, understanding both technical and fundamental investing, you can invest confidently, knowing you can make money whether the market is going up or going down.

The difference between amateur and professional investors

As Andy says, “Risk is related to control.” In a market with systemic risk, you can’t control whether a stock or a group of stocks will go up or go down. But what you can control is whether you are long or short. Again, to quote Andy, “You can’t control the market, but you can control where you are positioned.”

What Andy is talking about is the difference between amateur and professional investors. Amateur investors think that “diversification” will protect them. Professionals know that hedging and true diversification will protect them.

In the stock market, long and short positions are like insurance that hedge against losses, and if you are financially educated, you can read the patterns in the market and know when you should go long or short in order to generate gains and minimize your losses.

Professional investors are also truly diversified

Take a look at this chart. It is the price of Gold Futures over the last decade. As you can see, for a number of years, the price was relatively low. The smart investors were buying during this time, knowing that it will always go up.

Why?

For starters, every currency in the history of the world has gone to zero.

This happened in Rome when the Emperors began clipping the sides of coins and saying those coins were still worth the same amount. It happened in the 1600’s when the Dutch thought tulip bulbs of all things were of estimable value. It happened in France under the Revolutionary regime. It happened in Germany in the early 1900’s. It happened recently in Zimbabwe, where a trillion dollar note can’t buy you a cup of coffee.

In 1971, Nixon took the dollar off the gold standard and ushered in the age of currency. Now, every currency in the world is pegged to the dollar—and the dollar is pegged to nothing.

It’s value is based on confidence in the U.S., which for now, still enjoys its role as the leading economic powerhouse. So, when the markets lose confidence in a crisis, they rush into dollars.

It’s not that people have more confidence in the dollar—they don’t. It’s that they want to cash in on gains and see where to put their money next.

The problem is that those without a financial education follow the investors and are always late.

They sell after the damage is done, go into dollars, and buy when the pros have already moved on and pushed up prices. They get sucker punched.

The question is… what will happen when investors lose total confidence in the dollar?

They run to gold and silver. And when that happens, you don’t want to be stuck holding dollars or paper assets. That is because the professional investors understand that true diversification means moving to a different asset class, especially in times where there is potential for systemic risk.

This is what is happening today to amateur investors. Over the last three years, savers have become big losers, and that has hit overdrive this year with record inflation that doesn’t seem to be “transitory” after all. Those who saw inflation coming and invested in gold and silver are doing very well.

What about Crypto?

Why is there confidence with Bitcoin? Because no government can control it and it has limited supply. Like any commodity, it goes up and down, but the professional investors know that there is always a bottom, and when the true bottom is reached, you will see it skyrocket again…just like gold did around 2020.

With inflation at 40-year highs and it looking like it won’t go away soon, you can bet that commodities will see gains as the dollar weakens. And that is true diversification, moving from overvalued paper assets into other assets such as commodities or real estate or business.

Get financially educated to thrive

Investing in other asset classes for true diversification, as well as long and short positions, are a part of technical investing that requires education, but if you want to move beyond being an amateur to being a professional, it’s worth your time to learn this.

Rich Dad offers classes on technical trading and expert coaching on trading through our Rich Dad Education and Rich Dad Coaching programs. You may want to take advantage of those resources in the coaching and classes sections of this website.

Original publish date:

September 01, 2015