Blog | Entrepreneurship

Is the Gig Economy Job a Path to Entrepreneurship?

You may be wondering if the gig economy is right for becoming an entrepreneur; it depends on what you mean by “entrepreneur”

Rich Dad Entrepreneur Team

June 01, 2023

Summary

-

Many people confuse being self-employed with being an entrepreneur

-

Being a successful entrepreneur requires a true understanding of how business works

-

Putting a system in place shifts you from the E quadrant, to the S quadrant

If you’ve been mulling over the idea of starting your own business someday, the logistics can be incredibly daunting. There’s nothing more exciting than the moment someone wants to take their financial future into their own hands, pursue a passion, and start a business.

But over the last 15 years or so, the world of work has changed dramatically due to the rise of gig economy jobs. Seems like you can’t go to the grocery store these days without seeing Instacart workers loading up shopping carts for other people who have better things to do than their own shopping.

Or imagine what it would be like to actually have to get a taxi these days? It’s so much easier to open up Uber or Lyft to hitch a ride. You can see those stickers, sometimes both of them, in the windows of cars all the time.

Want food from your favorite restaurant without going out? There’s a gig economy job for that too. Just pull up Grubhub and place your order. You can have that double stack without getting out of the sack.

Gig economy jobs are taking over?

According to Marcin Zgola, owner of a Wage, a platform that connects freelancers and those in need of their services, the gig economy is taking over the jobs market.

“The gig economy experienced 33% growth in 2020 and is expanding much faster than the U.S. economy as a whole. About 1.1 billion on-demand gig workers exist worldwide, and 2 million new gig workers emerged in the U.S. in 2020 alone. Statista estimates that by 2027, about half of the U.S. population will have engaged in gig work. Today, 35% of U.S. workers are involved in the on-demand gig economy.”

Of course, the owner of a freelancer platform would want a study to say that, but nonetheless the growth is strong.

Annie Lowrey, writing for “The Atlantic,” has a slightly different take. “Last week two influential labor economists revised down their much-cited estimate of the size of the alternative workforce, meaning workers in temporary, on-call, contract, or freelance positions. Lawrence Katz of Harvard and Alan Krueger of Princeton had initially found that this workforce grew five percentage points in the decade up to 2015, accounting for nearly all job creation over that time period. Now they think it is more like one or two points. Their correction comes shortly after a major government survey—one that surprised a lot of labor and workforce experts—found that 3.8 percent of workers held ‘contingent’ jobs as of 2017, roughly the same share as in 2005.”

Lowrey’s point is that gig economy jobs, while growing strong even at 1 to 2 points, are not real jobs in the traditional sense of full-time employment but rather contingent (or side) side jobs to help make up income gaps from an existing full-time job. In other words, they’re a new way to do a second job.

Why people take on gig economy jobs

Second income needs aside, there are other reasons why people seem so attracted to the gig economy.

For one, people are worried about inflation. As “The New York Times” reports, “And lately, inflation has provided an extra incentive. As the cost of rent and food soars, gig work can supplement primary jobs that don’t provide enough to live on or are otherwise unsatisfying.”

Others are worried about whether they’re skills will be employable in the near future. According to an Oxford study cited by Wonolo.com, “Although unemployment is low, automation is also a threat to many jobs. Another Oxford University study suggests that nearly half of American jobs will be threatened by automation over the next two decades. This is deeply felt in the workforce too, with 54% of the US workforce saying they were not confident their job would still exist in 20 years.”

Wonolo.com also cites some reasons people take on gig economy jobs from their own research:

-

A portfolio of clients is more reliable than a single employer: 63%

-

Earn more money and supplement income: 57%

-

Create and control their own work and schedules: 46%

-

Enhanced work and life balance: 35%

-

1% of freelancers surveyed said that they also have a permanent job in addition to their freelance work.

Finally, some are just focused on living life how they want to after the pandemic shifted their thinking on work.

The cost of gig economy jobs

Of course, there is a hidden cost to these types of jobs, mainly the traditional benefits that employees enjoy from employers. As “The New York Times” reports, “Labor advocates have long been concerned about businesses that depend on independent contractors, since those workers aren’t entitled to the rights and benefits that come with employee status, like employer contributions to payroll taxes and unemployment insurance.”

The tragedy is that employees, who are already in some of the most insecure positions in the economy—given an employer can fire them at any time—are now chasing after what appears to be entrepreneurship, but rather is owning a job with even more insecurity than when they were an employee.

Is a gig economy job right for you?

But if your question is whether the gig economy is right for you, the answer always is, “It depends.”

It depends on what you’re trying to accomplish. If you want some side money to use for investing while working a full-time job, it might be right for you. If you want to have flexibility like an entrepreneur, possibly. If, however, you want to be a truly financially-free business owner, it probably isn’t.

As mentioned, the reality is that those who work in the gig economy don’t own a business. Rather they own a job. And in many cases, the benefits are worse than those who simply work full-time.

According to a recent report by Prudential Financial Inc:

-

Only 7% of people who work in the gig economy only, “gig-only workers,” had long-term disability insurance. It was 21% among workers who did gig work plus had a traditional full-time or part-time job, “gig-plus workers.”

-

Only 20% of gig-only workers and 37% of gig-plus workers have life insurance.

-

In addition, 16% of gig-only workers and 25% of gig-plus workers have assets in an employer-sponsored retirement plan, compared to 52% of those with traditional full-time jobs.

Additionally, those who work only in the gig economy earn $36,500 per year versus $62,700 for full-time employees.

About the only benefit of the gig economy is the control over your schedule…except you have to work so much you don’t get to enjoy it.

The difference between entrepreneurs and employees

If you want to get out of the rat race, the very rat race that allows employers to determine your financial future, you need to change the way you think about making money in the first place.

That, in the end, is what separates entrepreneurs from employees. Don’t get worked up about how unfair the system is and instead learn to use the system to your advantage.

Moving from employee to self-employed

Many people tend to believe that the way to financial security and happiness is to do your own thing. So, the motivations of those who want to get a gig economy job can be appreciated. It has the appearance of doing your own thing.

But in most cases, it is simply moving from being an employee to being self-employed—moving from the E quadrant to the S quadrant, the left side of the CASHFLOW® Quadrant.

In the S quadrant, you aren’t really doing your own thing. Rather you are selling your time and services to help support someone else who is doing their own thing. What’s worse, as the Prudential report points out, the S quadrant is very risky. You don’t have traditional benefits that at least employees enjoy, and when it comes time to cut costs, the contractors are the first ones to go.

S-type vs. B-type business skills

S-type businesses and B-type businesses have different strengths, weaknesses, risks, and rewards. Many people who want to start a B-type of business wind up with an S-type of business and become stalled in their quest to move to the right side of the CASHFLOW Quadrant—the B for big business and I for investor side.

Many people attempt to move from the S quadrant to the B quadrant, but only a few who attempt it actually make it. Why? Because the technical and people skills required to be successful in each quadrant are different. You must learn the skills and mindset required by a quadrant in order to find true success there.

If you own a B-type business, it’s possible to go on vacation for a year, come back, and find your business more profitable than when you left it. In an S-type of business, if you take a one-year vacation, you’ll have no business to come back to.

What’s the difference?

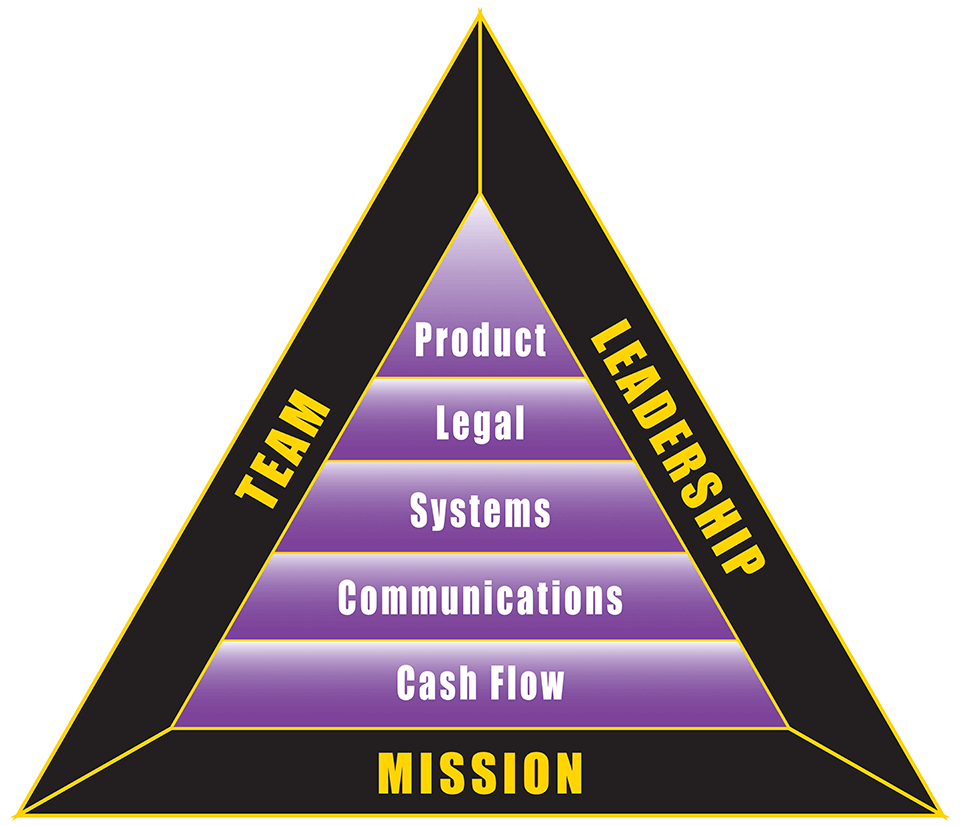

Again, saying it simply, an S-type of business owns a job. A B-type of business owns a system and then hires great employees to operate that system. This is why if a B-type business owner is on vacation, income still comes in. To be successful, a B-type business owner requires:

For S’s to evolve into B’s, they need to convert who they are and what they know into a system, and many people aren’t able to do that—especially in the gig economy. It’s very difficult, for instance, to go from being an Uber driver to having your own driving service that employs other drivers. Uber has spent billions building the systems and structures to scale a business like that.

Can you make a better hamburger than McDonald’s?

To illustrate this point, here’s a technique Robert Kiyosaki uses to determine whether someone is an S or a B when they ask for advice on starting a business.

Usually, these people say they have a great idea for a new product or idea. After about 10 minutes, it’s easy to tell where their focus is, whether it’s a product or a system. In those 10 minutes, they’ll usually say words like these:

-

“This is a far better product than XYZ makes.”

-

“I’ve looked everywhere, and nobody has this product.”

-

“I’ll give you the idea for this product; all I want is 25 percent of the profits.”

-

“I’ve been working on this product for years.”

At this point, Robert usually asks one thing: “Can you personally make a better hamburger than McDonald’s?”

Everyone always says yes; they can all prepare a better hamburger.

The final question then, is: “Can you personally build a better business than McDonald’s?”

The burger vs. the business

Some people see the difference immediately…and some don’t. The difference is whether a person is fixated on the left side of the quadrant, the E and S side, which is focused on the idea of a better burger; or on the right side of the quadrant, the B and I side, which is focused on the business system.

There are lots of entrepreneurs who offer a better product or service, just as there are billions that can make a better burger than McDonald’s—but only McDonald’s has created a system that has served billions.

If people begin to see this truth, Robert suggests to them that they visit a McDonald’s, buy a burger, and sit and observe the system that delivers that burger. Take note of the trucks that deliver the beef, the rancher that raised the beef, the buyer who bought it, and the TV ads that sell it. Notice the training and the employees. See the decor, the regional offices, and the whole corporation. If they can begin to understand the whole picture, then they have a chance of moving to the B-I side of the CASHFLOW Quadrant.

New ideas vs. better systems

Today, many want-to-be entrepreneurs fall into the trap of thinking they need a new or novel idea, something the market has never seen. This is false thinking that holds many people back.

Great ideas do not need to be new or unique. They just have to be better. Many of the most financially successful people are not necessarily people who have creative ideas. Many of them often just copy other people's ideas and turn the idea into millions or even billions of dollars. If you really want to be a rich business owner, you don’t need a better burger. You need a better system for delivering the burger.

Getting rich off others' ideas

Here’s some examples of how those in the B quadrant get rich off other people’s ideas.

On December 31, 1879, Thomas Edison did his first public demonstration of the incandescent light bulb. But the reality is that the light bulb wasn't Edison's idea. As Wikipedia explains, "Many earlier inventors had previously devised incandescent lamps…” Many of these early light bulbs weren't functional for commercial use. Edison's genius was to discover the commercial application of the light bulb for the masses—and to find a way to make the light bulb commercially viable.

Fashion designers watch young kids to see what new fashions they are wearing, and then they mass-produce those fashions.

Bill Gates did not invent the operating system that made him one of the richest men in the world. He simply bought the system from the computer programmers who did invent it and then licensed the product to IBM.

Amazon.com simply took Sam Walton's idea for Walmart and put it on the Internet. Jeff Bezos became rich much more quickly than Sam did.

In other words, who says you need to have creative ideas to be rich? Usually, only those who are still poor.

So, what is the secret then for these entrepreneurs who take other’s good ideas and make millions? What separates them from the people who had the good ideas in the first place? Simply put, they understood how business works. Instead of having creative ideas…they get creative about ideas.

Systems make you rich

As a young man, rich dad gave Robert Kiyosaki insight into how to make any idea an asset by applying the right framework. That framework is called the B-I Triangle.

The B-I Triangle is a system and a model for building a successful business, and products or ideas are the smallest components of the triangle. When the components of the triangle are strong and working in harmony, nearly any idea or product can be successful.

So, if you want to be a successful entrepreneur and have been chasing down the fabled great idea, stop chasing and instead start focusing on learning all you can about the components of the B-I Triangle. Then, you won't need your own light bulb, you'll just need to see the opportunities others' great ideas present.

The reality is that there are unlimited new ideas, billions of people with products and services to offer, and only a few people who know how to build an excellent business system. If your true goal in life is to do your own thing and own a thriving business, opt out of gig economy jobs and start investing in building a system—perhaps even one that can provide gigs for others.

At the end of the day, the question is, as always, which side of the CASHFLOW Quadrant do you want to be on?

Original publish date:

February 28, 2019