Blog | Commodities, Entrepreneurship

Rich Dad Essentials: Investing in Gold and Silver

Why the dollar is toast and you should move your “money” somewhere else

Rich Dad Commodities Team

August 17, 2023

Summary

-

The rich don’t rely on dollars - they rely on real money

-

Understanding the difference between paper money and truly valuable assets requires an education in financial history

-

Savers are losers - this article outlines why you shouldn’t bank on the dollar

It was back in 1972 during his second tour of duty in Vietnam that Robert Kiyosaki received some very discerning news from his rich dad that read, "President Nixon took the dollar off the gold standard. Watch out, the world is about to change."

Though he was intrigued, he was also confused. Shortly thereafter, Robert read an article in “The Wall Street Journal” that discussed gold. At the time, the price of gold was fluctuating between $35 an ounce to $40 to $60 an ounce.

Thinking they were smart, a fellow pilot named Ted joined Robert to cross 25 miles of sea into enemy territory in search of scoring gold from some naive locals.

They tried to bargain with an old woman in a tiny village, and began their trading salvo at $40 an ounce. Little did they know that spot was significantly higher at $55. The shrewd woman simply smirked and probably thought they were idiots. She wasn't wrong. She quickly educated them that the spot price of gold is the same across the world.

Though they were able to get back to base without any enemy detection, they didn't achieve their mission of scoring some gold. However, they did get a real education on money.

What sparked rich dad to pen that letter?

When Richard Nixon took the dollar of the gold standard earlier in 1971, the dollar instantly became fake money. No longer was the dollar backed by sound money: i.e. gold. the U.S. dollar was now a big IOU.

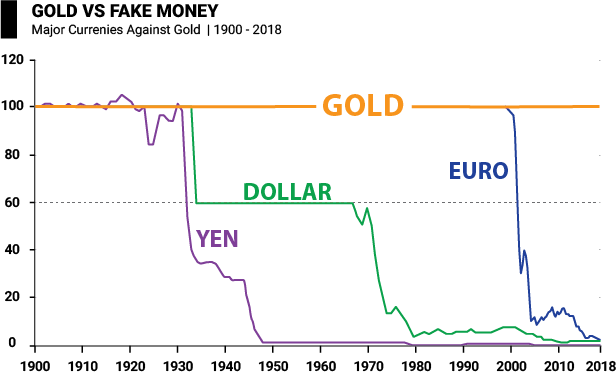

To further explain the inverse relationship between the U.S. dollar and gold, look at the following chart.

For over a century, what you can buy with the dollar compared to gold has dropped significantly. But the inverse relationship doesn‘t only exist between the U.S. dollar and gold.

The value of all currencies have dropped compared to that of gold as seen in the following chart.

Cautionary tale from Robert Kiyosaki’s experience investing in gold and silver mines

In 1996, Robert founded a gold mining company in China and a silver mining company in South America. Both companies eventually became publicly traded on the Canadian Exchanges.

He formed gold and silver mining companies then because he believed that gold and silver were at "lows" and were set to come back up. At the time, gold was around $275 an ounce and silver was around $5 an ounce. If he’d been wrong, he would have lost the mines.

However, he was confident about gold and silver because he wasn't betting on them. Rather, he was betting against the dollar and oil. In 1996, oil was about $10 a barrel, and that seemed low. Robert’s suspicions were that the dollar was strong, and he believed it would drop when oil went higher; as such, he felt the conditions were right for a massive change in the markets.

Today, one could argue those conditions haven't changed. With the current national debt, balance of trade, and the impact of the pandemic, the dollar is growing weaker and oil is going higher. In fact, Robert recently bought more gold as well as more silver—to bet against the dollar and oil yet again. So far, he’s been pretty accurate.

Today the price of oil per barrel is around $82.00—compared to $22 per barrel in 1996.

Today the price of silver per ounce is around $23—compared to $5.00 per ounce in 1996.

Today the price of gold per ounce is around $1,830—compared to $387.00 per ounce in 1996.

In the meantime, the purchasing power of the dollar has dropped nearly 95% since 1996 thanks to inflation.

Inflation or Recession?

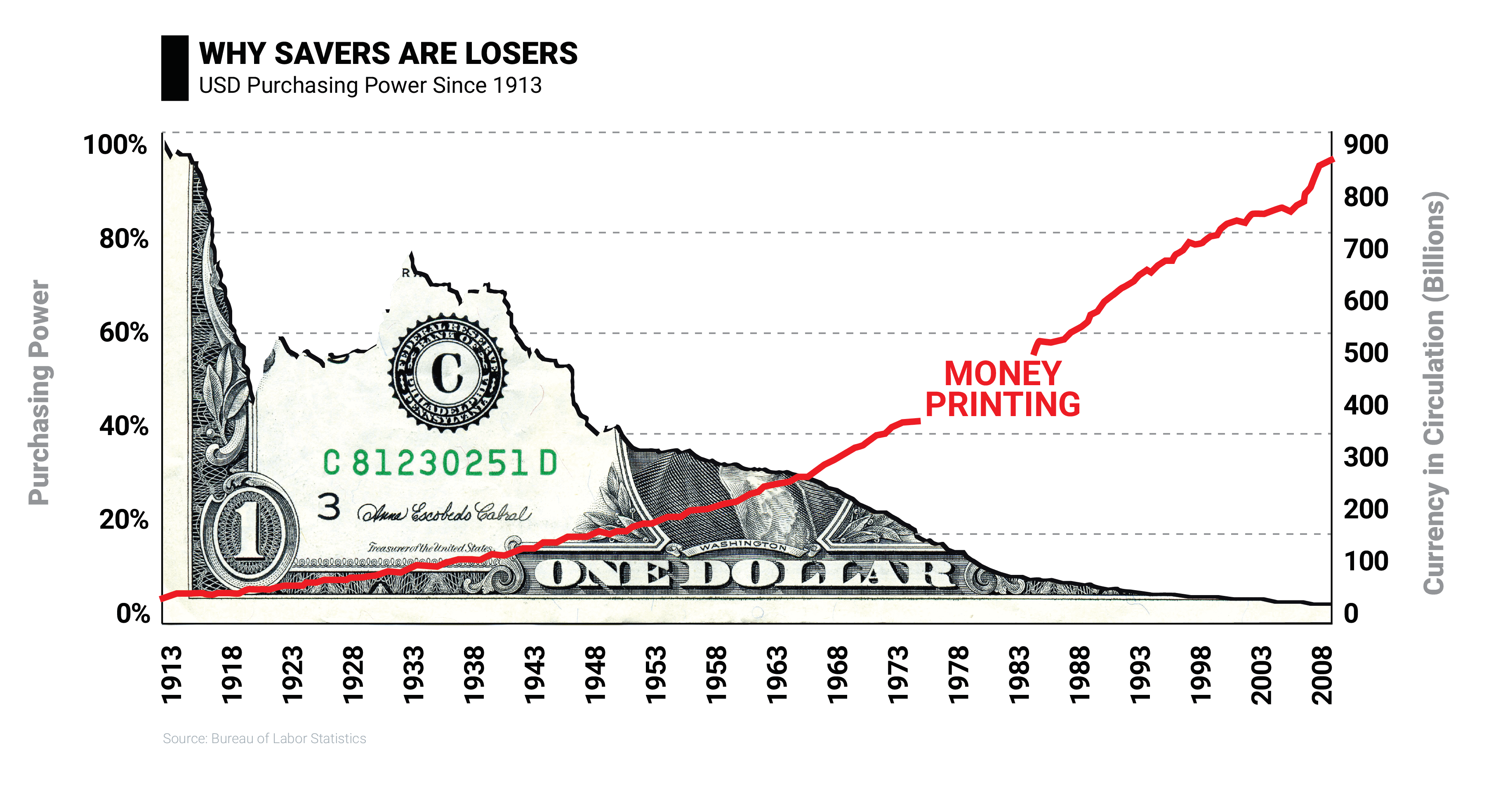

In many ways, the conditions are far worse now than they were in 1996. Today, we have a slowing demand for the dollar. At the same time, it appears that the Federal Reserve is increasing the supply of dollars.

As you know, low demand and high supply means a drop in value of anything, including the dollar. When our troubles started with the Great Recession, the then new Fed Chairman, Ben Bernanke, had a tough choice to make: If he printed more money to bolster the dollar, inflation would increase and the dollar might collapse. If he raised interest rates to slow inflation, the economy might go into recession. The Fed for decades has really been in a bind, a fool’s choice of “do I choose one kind of recession or another?” See the explanation below.

American-Style Depression

The Great Depression was caused by governments trying to cheat on the gold standard. Heavy debts were incurred during World War I. Governments had a hard time paying off those debts because their currencies were pegged to gold. Gold made it so only so much money could be printed. If you had a million ounces of gold and you could only print three dollars for every ounce, you could only print three million dollars. Yet, governments tried their best to find a way around the gold standard.

As debt mounted and defaults rose, banks failed and millions of people lost their life’s savings. There was no FDIC, so if a bank failed you lost everything. As people began losing money, they spent less, which caused prices to crash. Unemployment rose quickly, which caused even less spending and even more deflation. It was a devastating spiral that led to the worst economic crash in US history. Because the US was on the gold standard, they couldn’t print their way out of the crash.

German-style Depression

In Germany it was different. The German government decided to abandon the gold standard and began printing currency as quickly as the presses could handle. The result was massive hyperinflation. From 1919 to 1923, Germany’s currency supply increased from 29.2 billion marks to 497 quadrillion marks—a multiplication of 17 billion.

There’s an old joke about a woman who left her wheelbarrow full of German marks outside while going into a store to buy a loaf of bread. When she came back out, her wheelbarrow was stolen but the money was left behind. That is the devastating effect of hyperinflation. The currency becomes essentially worth nothing because so much is being printed so quickly.

As we know, the Fed went the way of printing more dollars...trillions upon trillions of them. It would seem we’ve made our choice and we’re setting the groundwork for a German-style depression in the future. When? No one knows, but now is the time to prepare.

Why you should “save” dollars

Every day, the dollar is worth less and less. And that's why you should save them. This may sound like a contradiction, so let's review:

The reason you should save dollars, even though they're worth less and less, is because you don’t need to hang onto them. Cash is trash.

One of the reasons why we have this enormous gap between the world's haves and have-nots is because the have-nots value money—they work for it, save it, cling to it, and lose it.

Warren Buffett often says, "The best way to get rich is to not lose money." When people purchase consumer items such as a new car, use debt to finance things that shrink in value, or save U.S. dollars, they're losing money. Some people call it inflation, at Rich Dad, we call it devaluation.

Psychologically, the more Americans' cash -- and the things they buy with it -- decline in value, the more they worry about money. Many begin to work harder or, even worse, go deeper in debt purchasing more consumer items with sliding value. Unfortunately, many wind up with fewer and fewer dollars that continue to sink in value.

The reason people like Robert Kiyosaki, on the other hand, have more and more dollars is simply because they don't hold on to them. Instead, they get as many dollars as possible and to keep those dollars moving into assets that are going up in value, not down.

In the late 1990s, when people were pouring money into the tech and dot-com stocks, Robert’s dollars moved into oil, gold, silver, and real estate, when prices were low. Today, because the dollar continues to drop in value, he keeps moving his money into those same asset classes, although much more cautiously.

Impending financial disaster

The primary reason why Robert keeps dollars moving is because he’s bearish on the greenback. We have all heard the saying, "The U.S. dollar is backed by the full faith and confidence of the U.S. government." It is unfortunate that faith and confidence in the U.S. government is eroding. Americans don’t have the stomach to make the changes that are required to run a fiscally responsible government and save the dollar.

When President George W. Bush attempted to reform Social Security, that proposal was more unpopular with Americans than the Iraq war. People love their entitlements. When Bush pushed the Prescription Drug Benefit plan through, that was an example of the U.S. dollar being toast. All hope of avoiding financial disaster was gone.

Rather than bank on “the full faith and confidence of the U.S. government,” it’s time you put your faith in the ancient form of money: gold and silver.

The funny thing is some people don’t think gold and silver are money...or at least not money worth saving.

Gold vs. the dollar

A writer, R.A., in The Economist wrote a number of years ago on why he thought gold wasn’t money, “But while gold is not money, it shares a very important characteristic with money: its value (apart from limited industrial uses) is derived from the market's perception that it has value.”

Fiat money works the same way. Dollars have value because people have deemed them to have value. But as the writer in The Economist points out, dollars can be printed easily and at will, devaluing them quickly. Gold on the other hand has an intrinsic scarcity to it.

“But that's precisely the way that fiat money works. People believe the flimsy pieces of paper we call dollar bills are worth some basket of real goods only because everyone else believes the same thing. The crucial difference in the perception of value is that new gold can only be obtained at great difficulty while new bills can be produced by the truckload at virtually no marginal cost.”

Presently, the reason that gold isn’t money in the way most people think of money is because people still think that paper dollars are money.

The writer concludes that dollars will always be money going forward because people have decided to be content with them with money. And regarding gold? The writer says, “What I don't understand is the argument for gold that falls back on the mystical, 6,000-year old Law of Economics that shiny yellow metal is somehow special.”

Living on borrowed time

Though the writer seems to think it’s an impossibility, riddle this: What happens when people no longer want to accept paper dollars as money? What happens if the Fed prints so many dollars, because it’s so simple and an infinite amount can be printed, that no one cares to use them as money any longer? Then what will be money?

Throughout monetary history, all fiat currencies—currencies that are given value solely based on an authority’s claim of value—have fallen to zero. The writer in The Economist conveniently forgets to share this fact.

And throughout history, societies have always resorted back to gold as money. As the writer in The Economist points out, this has gone on for 6,000 years. The writer can call this mystical if desired, but that’s one hell of a track record.

The reality is the dollar is living on borrowed time...and it’s borrowed that time from gold.

The dollar is toast

It’s no secret, the U.S. is in a lot of debt. For many years, it was a reasonable percentage of our Gross Domestic Product, bumping around 50 to 60% of our GDP. But since 2007 it’s gone up dramatically, and as of April 2020 our debt is 97% of our GDP, but expected to climb to 119% of our GDP in 2023. That’s right, we’re expected to owe more than we make. It doesn’t take a genius to know that if you continually take on more debt than you have income to pay for, you’re going to implode at some point. If the US defaults on its debt, the dollar will be toast, and savers will be losers.

If the US defaults on its debt, many people will wish they’d saved some of the money known as gold. Because just like it’s happened many times over the last 6,000 years, people will turn to it as the repository of value again.

But perhaps the US will fix its debt problems. If so, then the dollar will live on—for a time. But like all fiat currencies before it, the dollar will eventually fall to zero. No matter what, the dollar is toast. It just could be later rather than sooner.

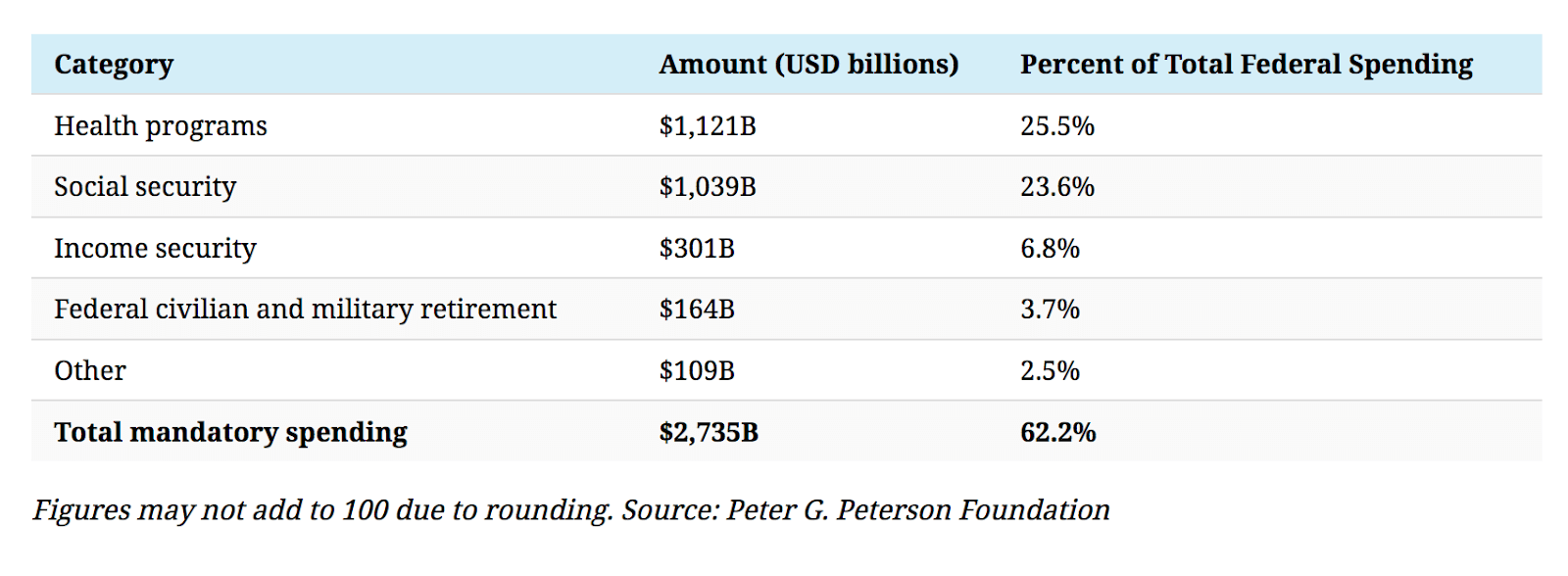

The problem with the U.S. debt is that it is wrapped up in entitlements. Over 60% of our debt spending is due to mandatory spending like medicare and social security. These are programs that will only demand more spending as the baby boomer generation comes of age. Here’s a chart that breaks is down from Visual Capitalist:

The concern is that very soon, citizens of the world will tire of America's gross fiscal mismanagement and hesitate to take U.S. dollars. In order to keep the world interested in the greenback, interest rates must rise. When that happens, U.S. assets, especially paper assets such as U.S. stocks, bonds, mutual funds, and savings will drop in value. Some real estate prices will increase because replacement costs are high, but overvalued real estate will drop.

At the risk of sounding like a politician who flip-flops, there will still be paper assets and real estate that will rise in value. The secret to surviving in paper assets and real estate is to be very careful and very selective. People who diversify will lose. People who focus will win.

Invest in commodities to hedge against borrowed time

The secret to surviving the next few years is keeping your wealth in real money, not in the U.S. dollar. Buy things that hold their value and are exchangeable all over the world. Commodities such as gold and silver have a world market that transcends national borders, politics, religions, and race. A person may not like someone else's religion, but he'll accept his gold.

The important thing to remember about depressions is that wealth doesn’t disappear—it’s simply transferred.

Many people will be paralyzed by fear during the coming years. But for the financially intelligent, this will be the opportunity of a lifetime. For those who aren’t financially intelligent, consider, at the very least, purchasing some gold or silver—as much as you can afford—to protect yourself from inflation. If you have a high financial intelligence, be on the lookout for deals. As asset prices crash, be ready to swoop in and buy them up.

Soon, the biggest transfer of wealth in modern history will come. You have the choice to be on the receiving end—or to lose it all. The dividing line will be those who are financially intelligent and those who aren’t.

One of the reasons why Robert Kiyosaki is bullish on gold and silver is because the American public is still sound asleep to this asset class. Most Americans have no idea how or where to buy physical gold and silver. Outlets that sell gold and silver are already low on inventory.

If and when the American public wakes up to the reality that their dollars are not money, but a currency, the panic and stampede will begin. Should that happen, today's prices for gold and silver will look like bargains.

Today, very few people realize that Warren Buffett reportedly holds one of the largest caches of physical silver in America. He purchased silver in the late 1990s, when it was cheap—and while others were criticizing him for not investing in tech stocks.

What does it all mean?

So, what's going to happen? The answer is, no one knows.

However, one known fact is that the dollar is in trouble. The rich understand that savers are losers, and they're continually looking for assets into which to move their money.

If you want to be rich, you also have to think like the rich.You don’t have to invest in gold and silver. Only do so if you do your homework, measure the risk, and feel it's the right thing to do. Make sure you start looking for places to move your dollars. Whether it be real estate, business, technical stock investing, or commodities, it's important for you to invest in assets that can hedge against inflation—if you want to be rich.

So, what's your take? What do you think is going on with gold? What assets are you targeting with your dollars?

Original publish date:

May 11, 2010