Blog | Real Estate

Real Estate Investing for Beginners - Tips to Get Started

Real estate investing for beginners can be successful - you just need to take the first step

Rich Dad Real Estate Team

January 09, 2025

Summary

-

Real estate investing for beginners can be jarring, but understanding the learning style that suits you best is a helpful part of the equation

-

There are three main keys to successful real estate investing for beginners

-

Diving in and doing is the best way to perfect the art of real estate investing

Have you ever found yourself saying you’d like to try something — be it piano lessons, growing your own vegetables or learning a new language — only to immediately write it off once you find out how much time and energy you’d need to dedicate to achieving it? It can be so easy to say you want something, but taking action is a completely different story. It’s never as glamorous as we think it will be, it probably doesn’t come naturally or easily, and it’s competing with dozens of other things in your life that also require your time and attention.

The same can be said for achieving financial independence. It’s pretty great to sit around daydreaming about what financial freedom looks like, and all the things you could be doing with your life if you weren’t beholden to your job and mortgage — but for most people, that’s where it ends. It remains a dream.

The thing is, there’s no magic fast-forward button you can hit to speed up the process of achieving a long-term goal. It takes dedication and hard work to get there. Of course, that won’t happen unless you’re willing to take the first step and go for it.

At Rich Dad, we commonly hear from beginner real estate investors: “I really want to achieve my financial dreams, and I’m willing to put in the work, but I have absolutely no idea where to start.” Well, from our perspective, the answer is always the same: Real estate.

How Rich Dad came to be

In 1973, Robert Kiyosaki had just returned from Vietnam where he spent two tours as a helicopter pilot with the Marines. He was faced with opposing advice from his poor dad (his natural father) and his rich dad (his best friend’s father). Either go back to school and get his Master’s degree, or take a real estate investment course.

Well, after six months in the MBA program, Robert realized he had made a mistake. The main reason for leaving the program: the instructors. They weren’t business owners and had no real world experience. They were professional teachers teaching business courses.

While taking a break from his studies, he came across an infomercial for a free seminar on real estate investing. He attended the free weekend class, and decided to invest $385 for a three-day real estate seminar.

The learning experience was completely different; the instructor for this course was different. He was real— a rich, experienced, and successful investor who loved to teach real estate investing for beginners. And Robert learned a lot from him.

The rest is history.

Here are a few tips to get started.

First, Debunk the Myths

We hear lots of excuses from beginners who are contemplating investing in real estate. And we understand: over the years, you’ve been fed misinformation and brainwashed into thinking it’s not for you. Let’s explore and dispel the myths surrounding getting started in real estate investing:

“It’s not for me.”

So, you think real estate investments are just for rich couples or singletons who can take risks because they don’t have hungry mouths to feed? Think again. People of all walks of life are buying properties and profiting from this real estate boom.

Why?

Because contrary to popular belief, it doesn’t matter how much money you have. In fact, many successful real estate investors began very small. And that’s actually for the best, because there’s a lot to learn and lots of mistakes to be made—it’s a lot easier to make mistakes on smaller properties with smaller amounts of money instead of jumping into a huge deal that could end with very costly mistakes.

Remember, you have the money; you simply choose to spend it on other things. Instead, you should look at your budget and reallocate the amount you feel comfortable spending on investments each month. Sure, you might have to cut back in other areas for a bit, but isn’t that going to help you reach your long-term goal?

“I’m afraid of a volatile market.”

Real estate investing beginners may be jarred by fears of a “volatile” market. Perhaps you disagree with economists and think the bubble is about to burst? Well, thankfully, once you learn how to get started in real estate, you’ll realize the market doesn’t really matter. Real estate investor Dean Graziosi says: “Real estate investment works in any area, in up, down or sideways markets, and for anyone who invests their time, energy and enthusiasm in getting started. ” That means, it’s an even playing field.

To ease your confidence, here are a few tips:

-

Location, location, location: You’ll want to find the right first property to begin, and this takes patience and number crunching. Pick an area where vacancy rates are low and choose a property that offers the amenities people are looking for.

-

Timing is key: If you’re investing for cash flow (not for flipping), the market direction really doesn’t matter as much. You aren’t hoping to earn a quick profit by selling before your mortgage paperwork is even dry. This is a long game, not easily affected by the ups and downs of the market.

Live in Learning Mode

Successful investing will not happen overnight. There is no such thing as a get-rich-quick scheme that lasts. The most important tip to carry with you is to live in learning mode.

As a beginner, you should think of investing as learning a new language — you simply can’t become fluent in one day. You start by learning a few words and phrases, and then keep expanding your vocabulary. After continuous practice and effort, you’ll make less and less mistakes. Eventually, if you stick with it, you’ll become fluent. Investing is no different.

Nobody likes making mistakes or being embarrassed, understandably so. But if you’re observant, each time you make a mistake when investing, you’ll learn from it. And hopefully you won’t repeat it.

Because nothing in life stays static, your goal should be to stay ahead of the game. You’ll do this by closely watching market trends and absorbing industry news, so that you know when the rules change and are ready to react immediately. Here are 3 golden learning opportunities to ensure you get a well-rounded ongoing education:

- Real estate investing for beginner classes - Workshops are not only a great place for beginners to start, but they are equally valuable for seasoned professionals. Classes will help open your eyes to opportunities you may not have considered before, maintain your edge, and introduce you to other like-minded individuals who could someday serve as partners or mentors.

- Reading - You should be reading the newspaper or trusted industry blogs each day to find out the latest news in the world of real estate investing — market conditions can turn, tax laws can change, and industry outlooks can shift. You certainly don’t want to be in the unfortunate position of being the only one who’s not in the loop.

- Doing - You can read and attend classes until the cows come home, but at some point you need to take the plunge and make a small investment. Doing is truly the best way to learn anything! Yes, you’ll make a few mistakes and yes, you’ll probably lose a little sleep in the beginning — but with time (and continuing education), you’ll gain confidence, experience success, and grow your portfolio.

And remember, everyone learns differently.

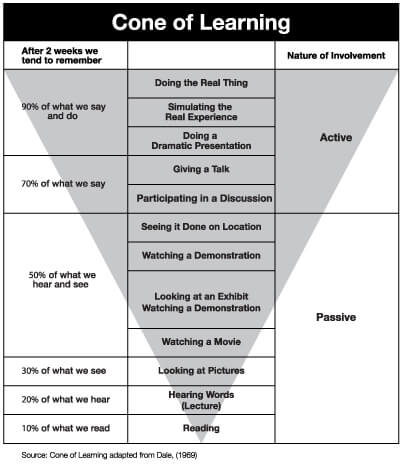

Rich Dad understands this, and uses the Cone of Learning diagram as a way to help explain the different ways people learn.

For example, a student in school may be able to memorize facts and figures with ease by reading textbooks day in and day out. But when test time comes around, they simply access the answers from memory. Most people, however, learn best by doing the real thing. They rely on physical and emotional memory.

It’s because of those differences that we created real estate seminars, business training programs, and stock investing classes in multiple formats available both online and offline. We carefully selected our partners to provide you with world-leading personal finance courses and investing classes that will give you the financial education you want... how you need it.

Real estate investing for beginners - time to get started

Now all that’s left is for you to take the first step. Often, this is the hardest step on any new path, so here are three ways to get started.

-

Invest for cash flow

At Rich Dad, when we speak of real estate, we’re talking about rental real estate that produces a positive cash flow. If you’re investing for cash flow, the market’s direction is no longer important, nor do you need to worry about liquidity. Your goal is to collect monthly rent for profit—and any gain in value of the property itself is a bonus. This long-term play is much less risky than the pundits want investors to believe.

Once you own a property, you become the landlord of your future tenants and are responsible for paying the mortgage, taxes and maintenance costs (and possibly a property manager, if you don’t want calls about broken appliances at midnight). Ideally, you’ll want to be able to charge more than your monthly costs, so that you earn a profit. This is your cash flow—your paycheck for filling the property with a quality tenant.

On the flip side, investing for house-flipping purposes is much more market-driven — you could end up spending quite a bit of cash to renovate a property and then find yourself unable to sell it (or being forced to sell for a loss). That’s quite the gamble, to say the least.

-

Be open to unexpected opportunities

It’s important not to be limited in your terminology. Be open to a wide range of properties, such as single-family houses, duplexes, triplexes, apartment buildings, single office buildings, multiple office buildings, retail stores, retail shopping centers, big box stores, self-storage facilities, industrial warehouses, and so on.

Real estate investment groups are another option. If you want to own a rental property, but don’t want the effort associated with being a landlord, this option may be the right solution for you. Akin to small mutual funds for rental properties, a company will buy or build a set of apartment blocks or condos and then allow investors to buy them through the company, thus joining the group. The company operating the investment group manages all the units, handles maintenance, advertising vacancies and interviews possible tenants in exchange for a percentage of the monthly rent.

As you can see, there is a ton of variety in real estate, so choose the property that best suits your interest and budget.

Harness the power of OPM

One of the best things about real estate investing is using Other People’s Money (OPM) to invest.

On a typical real estate investment, you’ll put down around 20% of the value of the investment while the bank puts down the other 80%. But if you’re really savvy, you can find investors to cover much of the 20% down payment, limiting your cash expenditure, while collecting fees for brokering the deal. This allows you to have the potential for a much greater return on investment (ROI).

You could also look into real estate investment trusts (REITs). An REIT is created when a corporation (or trust) uses investors’ money to purchase and operate income properties (residential and commercial). REITs are bought and sold on the major exchanges, just like any other stock. According to Investopedia, a corporation must pay out 90% of its taxable profits in the form of dividends to keep its status as an REIT. By doing this, REITs avoid paying corporate income tax, whereas a regular company would be taxed its profits and then have to decide whether or not to distribute its after-tax profits as dividends. Since the 1960s, REITs have been a popular choice for income investors due to their reliable payouts and massive capital appreciation potential.

Take Your First Step to Invest in Real Estate

Remember, Robert Kiyosaki started his real estate investing career as a beginner, through small, single-family homes in the late 1980s. Today, he owns over 1,000 apartment units.

And for you, it’s only a matter of time. Once you’ve dipped your toe in the water, you’ll become so much more comfortable with the entire process. You’ll become knowledgeable about the industry lingo, find some trusted advisers, learn how to choose the right investment opportunities (and which ones to turn down), and start seeing that almighty cash flowing into your bank account.

Are you thinking of buying your first investment property? Join us for a special LIVESTREAM event designed specifically for real estate investing beginners. Can you think of anything more empowering than knowing you're building a future of financial freedom?

Original publish date:

August 10, 2017