Blog | Entrepreneurship, Real Estate

Entrepreneurial Investing: Leveraging Business for Greater Financial Gains

The best investments start with knowing how business works

Rich Dad Entrepreneur Team

January 09, 2024

Summary

-

The key to becoming rich is understanding how investing through businesses works

-

Being an employee means missing out on investment opportunities

-

Pro tip: the best way to invest is to have your business buy your investments

Robert Kiyosaki became aware of the power of investing around the age of twelve. He was walking along the beach with rich dad (his best friend’s father), and his son, Mike, and he was showing them the piece of land that he had just purchased.

Although he was only 12 years old, he knew that it was very expensive to buy beachfront property. Robert realized that rich dad had just purchased one of the most valuable pieces of land in their city.

His first thought was, “How can Mike’s dad afford this?”

As he stood on that beachfront property, the waves washing over his feet, he was in awe that his friend’s dad, a man the same age as his own dad, could buy this land— something his poor dad (Robert’s natural father) could never do.

It was that day that he learned the power of the word “investing.”

The questions remain the same about business investing

Today, decades later, he now has people asking him many of the same questions he began asking as a boy.

In the investment classes he teaches, people ask things like:

-

“How can I invest when I don’t have any money?”

-

“I have $10,000 to invest. What would you recommend I invest in?”

-

“Do you recommend investing in real estate, mutual funds, or stocks?”

-

“Can I buy real estate or stocks without any money?”

-

“Doesn’t it take money to make money?”

-

“Isn’t investing risky?”

-

“How do you get such high returns with low risk?”

-

“Can I invest with you?”

The power of investing through businesses

People understand the power found in the word “investing,” and many want to enjoy that power for themselves.

Yet, many people are also afraid of this power and stay away from it, and many even fall victim to it.

Instead of running from the power, or condemning it by saying such things as, “The rich exploit the poor,” or “Investing is risky,” or “I’m not interested in becoming rich,” Robert became curious.

It was his curiosity and his desire to acquire the power found in investing that set him on a lifelong path of inquiry and learning about investing.

“How can you afford this?”

Standing on that beach with rich dad many decades ago, he finally worked up the courage to ask him, “How can you afford this?” Rich dad gave an answer Robert would never forget. Putting his arm around him, they began walking along the water line, and he said, “I can’t afford to buy this land, but my business can.” Robert’s investor lesson had begun.

The business of investing

Many years ago, Robert taught a three-day class on investing in Sydney, Australia. The first day and a half, he discussed the ins and outs of building a business. Finally, in frustration, a participant raised his hand and asked, “I came to learn about investing! Why are you focusing so much time on business?”

Robert gave the man two reasons in response.

-

We ultimately invest in business. If you invest in stocks, you invest in business. If you buy a piece of real estate, such as an apartment building, that is a business. If you buy a bond, you’re investing in a business. Logically, it follows that if you want to be a good investor, you first need to be good at and understand business.

-

The best way to invest is to have your business buy your investments. The worst way to invest is as an individual. The most successful investors in the world buy their investments through their businesses, and the really successful ones create investments through their businesses that others want to purchase.

The difference between those who invest through businesses and those who don’t

He went on to share another story about a lesson rich dad taught when he was just a young boy.

“If you want job security, follow your dad’s advice,” rich dad said. “If you want to be rich, you need to follow my advice.”

Rich dad then went on to show Robert the difference between his investment plan and poor dad’s investment plan.

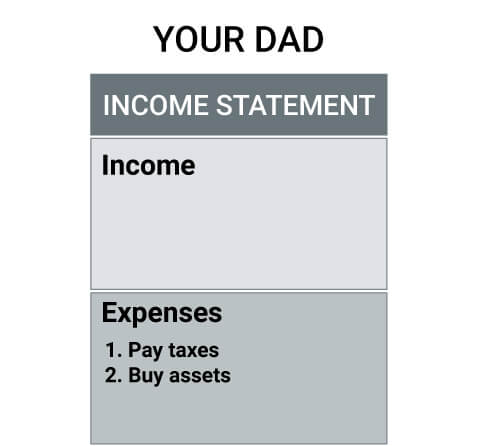

“My business buys assets with pre-tax dollars,” said rich dad as he drew the following diagram.

“Your dad tries to buy assets with after-tax dollars. His financial statement looks like this,” said rich dad.

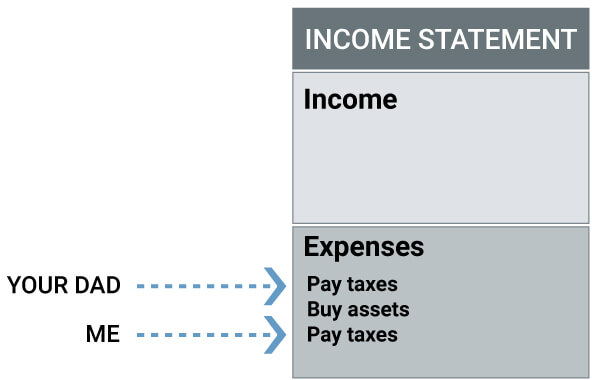

To sum it up nicely, rich dad combined the two diagrams to highlight the difference between him and poor dad.

When you invest through a business, you play by different rules

The point rich dad was making was that even though we live in a free country, not everybody plays by the same rules. The rich have laws of their own that allow them to become richer.

Rich dad went on to teach Robert that because his dad was an employee, he had to pay his taxes first and then invest. That meant that up to 50 percent or more of his income would be spoken for before he could even begin investing.

As a business owner, rich dad was able to buy assets through his business and then pay taxes on what income was left over. He bought his assets first and paid his taxes later.

“I pay my taxes on net income,” he said. “Your dad pays taxes on his gross income, and then tries to buy assets. Because of that, it is very, very hard for him to achieve any kind of wealth.”

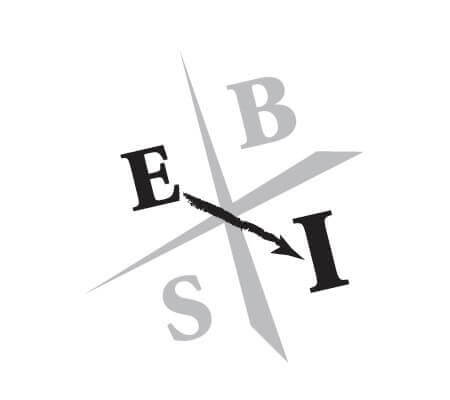

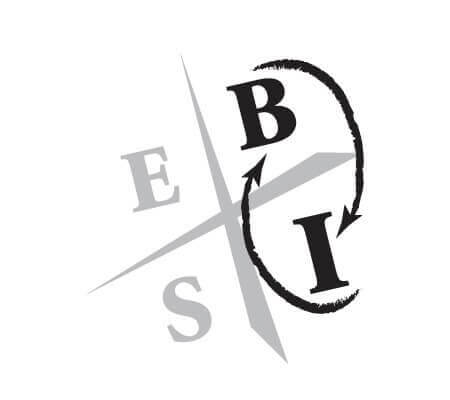

If we were to map this to the CASHFLOW Quadrant, rich dad’s points would look like this:

How poor dad invested

How rich dad invested:

“Always remember,” said rich dad, “that the rules are different for the different quadrants. Make your decisions about your future wisely. Decide which rules you want to play by.”

This, of course, is a much different way of thinking about investing, which is why the man in Australia had such a hard time with it initially. But it is the type of thinking that separates the very successful investors from the simply average investors.

“Can I invest through business?”

Today, Robert continues to spread the wisdom he was taught by rich dad. And as taught by rich dad, he invests through his businesses, while teaching others to do the same.

When he speaks on this, invariably people raise their hands and say things like:

-

“But I’m an employee, and I don’t own a business.”

-

“Not everyone can own a business.”

-

“Starting a business is risky.”

-

“I don’t have the money to start a business, let alone invest.”

To these types of statements, it’s important to remember that less than 100 years ago, approximately 85 percent of people in the US did own their own businesses as either independent farmers or small shopkeepers. Only a small percentage of the population was employee-based.

Today, in just a couple generations, it seems that the Industrial Age—with its promise of high-paying jobs, job security, and pension benefits—has bred independence out of us.

What do you want to do?

Chances are that you have the potential to be a great business owner if you have the desire to develop the skills necessary. Our ancestors developed and depended on their entrepreneurial skills, and so can you.

If you don’t have a business today, the question is: Do you want to go through the process of learning how to build a business?

You are the only one who can answer that question. That being said, it’s always nice to have a guide along the way. That is why we created Rich Dad Coaching, so you could enjoy the benefits of your very own rich dad, just like Robert did.

He may have made his own decisions, but rich dad was there to help him process them—and follow through on them—every step of the way. It’s likely that Robert couldn’t have done it without him, and chances are you can’t do it on your own either.

So, make your decision today, and get the help you need to succeed.

Original publish date:

March 04, 2014