As we approach 2025, it’s crucial for you to grasp the vast array of investment opportunities that await.

Our goal is to equip you with the knowledge and tools to make informed financial decisions. This post is dedicated to one of the key components of any investment portfolio: paper assets. We’ll explore what they are, why they matter, and how you can effectively incorporate them into your financial strategy.

What Are Paper Assets?

Paper assets are financial instruments like stocks, bonds, options, and cryptocurrencies that represent an ownership or interest in entities or financial agreements.

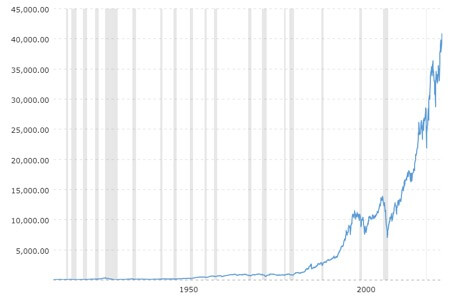

Historically, the stock market has proven to be a robust avenue for wealth creation, typically doubling every nine years. This enduring growth underscores the potential of paper assets as a cornerstone of sound financial planning. Unlike real assets such as gold or real estate, you don’t physically hold these—they exist mainly as digital entries or, historically, as paper certificates. These assets are integral to most investment portfolios, including vehicles like your 401(k) or IRA.

In a time where economic landscapes are continuously shaped by technological advancements and global events, understanding paper assets becomes even more crucial.

The Role and Importance of Paper Assets

To make the benefits of investing in paper assets more tangible and relevant, let’s illustrate the points with specific examples, highlighting how paper assets can be a practical choice for someone new to investing:

✅ Immediate Access to Your Investments (Liquidity):

Imagine you suddenly need to finance a major expense like a medical emergency or a last-minute property purchase. Having investments in paper assets means you can quickly sell part of your portfolio and access the funds usually within a few days. For instance, during the COVID-19 crisis, many investors utilized the liquidity of their stock investments to cover expenses when other sources of income were unstable.

✅ Spread Your Risk to Enhance Returns (Diversification):

Consider the stock market volatility during events like the 2008 financial crisis or the 2020 COVID-19 onset.

Investors with diversified portfolios experienced less financial stress because they could offset losses in stocks with gains in bonds or other less correlated assets. For example, while tech stocks may have dipped, healthcare and consumer staples sectors often saw gains, helping balance the impact.

✅ Grow Your Wealth Over Time (Growth Potential):

Market declines aren’t just challenges though; they’re opportunities!

Because history shows us that the stock market’s downturns are often the best times to invest, as the market’s long-term trajectory has always been upward.

By adopting a disciplined approach to buying during dips, you position yourself to capitalize on potential gains as the market recovers, as evidenced by this chart showing the past 100 years of the Dow Jones performance (gray shaded lines are recessions):

From 1990 to 2020, the S&P 500 grew on average about 7-8% per year, even including periods of downturns. This compound growth is crucial for building retirement savings, showing that many retirement accounts double in value every 10 years due to this average return rate.

✅ Easy Entry into the Market (Accessibility):

With digital platforms like E*TRADE, Schwab, and Interactive Brokers, you can start investing with as little as $100. These platforms also provide educational resources that simplify the process, making stock trading accessible and affordable for beginners.

Why Paper Assets Could Be Right for You

Investing in paper assets offers a flexible, accessible, and potentially lucrative way to build and diversify your investment portfolio.

Whether you’re saving for retirement, a major purchase, or simply aiming to grow your wealth, these assets provide a way to achieve your financial goals with a level of control and transparency not always available in other investment types.

In 2024, the investment landscape is particularly influenced by global economic recoveries, post-pandemic, technological innovations, and a strong shift towards sustainable energies. Here are some sectors and stocks to consider:

- Technology: Companies like Apple and Google continue to expand their ecosystems, consistently providing value to investors through innovation and strong market presence.

- Renewable Energy: Companies such as Tesla in the electric vehicle space and First Solar in solar energy solutions offer promising growth prospects.

- Defense and Aerospace: Companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies are at the core of the defense sector. These firms are heavily involved in the development and manufacturing of advanced military hardware, including aircraft, missile systems, and radar technologies. Given the consistent government spending on defense globally, investing in these companies can offer stable returns and resilience against economic fluctuations.

Their ongoing contracts and projects with governments around the world underscore their critical role in national security and defense infrastructures.

Practical Steps to Investing in Paper Assets

- Start with Education: Begin by understanding basic financial terms and the nature of various paper assets. The Rich Dad Company offers resources like webinars, books, and online courses to get you started.

- Evaluate Your Goals: Consider what you want to achieve with your investments. Your objectives will guide your investment choices.

- Choose the Right Platform: Select an investment platform that fits your needs, whether it’s a robo-advisor for automated investing or a full-service broker that offers personalized advice.

- Monitor and Adjust: Keep track of your investments and the market conditions. Be prepared to make adjustments to your portfolio as your financial goals or the economic environment changes.

Remember, the journey to financial independence starts with a solid foundation of knowledge and a proactive approach to investing.

By understanding and utilizing paper assets effectively, you set yourself on a path towards achieving financial stability and growth. At the Rich Dad Company, we’re committed to providing you with the tools and knowledge to confidently manage and grow your wealth through informed investment choices.