When you start paying attention to your financials, get involved with investments, or even start your own business, you’ll be inundated with an alphabet soup of acronyms to learn. Things like:

- P&L: Profit and Loss statement, which summarizes a company’s performance and financial position,

- LLC: Limited Liability Corporation, which can help shield business owners from losing their entire life savings in the event of a lawsuit, and

- IPO: Initial Public Offering, which is the first time a company sells its shares to the general public.

But the most important one, hands down, is ROI (return on investment). Why is return on investment important? It can be used across a multitude of applications: measuring the profitability of a stock investment, evaluating the results of a real estate transaction, or as a tool to decide whether or not to invest in a business opportunity.

Luckily, ROI is a simple concept — which is why it’s a universal measure of profitability. If you invest “X” number of dollars (pesos, euros, yen or any currency), how much money will “X” make, or return, to you? In other words, it reveals the return of an investment relative to the cost of that investment.

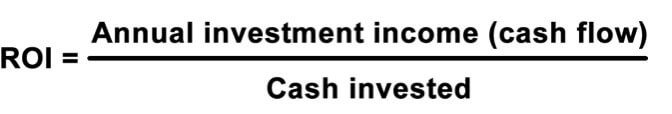

Here’s how to calculate return on investment:

The amount of money earned is called cash flow. It is also referred to as the yield, because it shows what the investment yields or produces.

Return on investment examples

Here are a couple of examples of how to calculate ROI so your results are returned in percentage-format (which is intuitively easier to understand):

If you invested $1,000 in a stock that pays an annual dividend of $40, your return on investment would be 4%. ($40 / $1,000 = 0.04 = 4%)

If you put $10,000 cash as a down payment to purchase a $50,000 rental property with an annual positive cash flow of $1,500, your ROI would be 15%. ($1,500 / $10,000 = 0.15 = 15%)

When it comes to real estate transactions, this is also called a cash-on-cash return because it calculates the cash income earned on the cash invested in a particular property. To successful investors, the cash-on-cash return is the most important number because it tells you exactly what your invested money is earning. In other words, it tells you how hard your money is working for you.

These two examples of stock dividends and rental property are cash-flow investments. But ROI also applies to capital-gains investments, too. For example, if you purchase a share of stock for $20 per share and the stock price goes to $30, after fees and expenses are deducted, your profit or yield would be $5. Your ROI in that case would be $5 / $20 = 0.25 = 25%.

Another way to measure

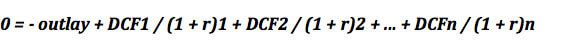

Aside from return on investment, you may also hear the term Internal Rate of Return (IRR), which is a bit more complicated.

IRR takes into account the present value of money (which is something ROI doesn’t factor into the equation). The present value of money is the idea that $1 today is worth more than $1 in one year.

IRR also assumes that the cash flow or yields you are earning are all reinvested immediately and are reinvested at the same rate of return — which is rarely, if ever, the case. One calculation for IRR is:

Are you confused by that nonsense? Yeah, many are. And this complicated equation is precisely why lots of people don’t use IRR as a measure for their money. It’s much too complicated.

If you want to understand the internal rate of return more fully, then by all means start researching. It’s not that it’s impossible to understand; it just muddies the waters unnecessarily. Until you have a full grasp on IRR, it might be wise to stick with cash-on-cash return on investment.

An important word of caution: When someone is pitching you on investing in their deal, be sure to define if the return on investment they are stating is a cash-on-cash return or an internal rate of return. They are very different when it comes to your bottom line and you’ll want to make sure you’re comparing apples to apples.

What is a good return on investment?

That answer depends on a few things. It depends upon the type of investment. It depends upon the economy. And it depends upon your financial intelligence.

Back in the late 1970s, for example, the return on the bank’s certificates of deposit (CDs) was 18%. That seemed normal at the time; just think, who wouldn’t like an 18% return on a CD today? But what’s interesting is when the savings-and-loan crisis hit in the 1980s. The bank retracted the 18% interest rate and basically canceled the outstanding CDs. If an individual had done that, lawsuits would have followed!

With little financial intelligence, you can typically expect a low return on your investments. Why? Because you won’t know what to look for in investments that generate higher returns and will probably end up in investments or savings plans that offer low yields.

This is why financial planners recommend mutual funds, CDs, and savings to people with little money know-how. This is also why so many people get taken in when they are promised too-good-to-be-true returns on investments they know nothing about.

Obtaining and sustaining a high rate of return takes financial education and experience. There is no secret sauce, no magic pill. It takes putting in the time and effort to study, research, and then take action. That’s why Rich Dad offers investing classes on how to begin investing in real estate and the stock market.

How to measure ROI with real estate

Robert’s rich dad taught him that there are two things you need to know before diving into real estate — two sides of a coin that are essential for moving forward on any deal:

How to figure cash-on-cash return for a real estate deal (And now you know how to calculate that number).

How to do your due diligence on a real estate property (Are there hidden expenses that will ruin your financials?).

As an investor, you’ll never have the full story — but you need to get as much information as you can upfront so that you’re making as few financial assumptions as possible.

Once you have determined whether or not a real estate investment provides enough cash-on-cash return, your next step is called “due diligence.” Due diligence is the process of looking under every nook and cranny of a potential investment — this is when you roll up your sleeves and become a detective. It’s not glamorous. And it takes time and effort to do it properly.

Don’t worry, however, there will always enough time for you to do this part properly because as part of any contract to purchase, you must include a due diligence period in the contract — plus, include a clause that requires the seller to provide any and all materials and access requested in a set turnaround time (to ensure they don’t hold you up from meeting your deadline). This includes looking over financials, inspections, rent roll evaluations, and more.

Due diligence is directly linked to financial literacy. Why? The process of due diligence (the careful evaluation of a potential investment to confirm all material facts) allows savvy investors to see what’s not in plain sight — to see the other side of the coin.

So what kinds of things are you looking for when doing your due diligence on a rental property? Here are just a few examples — it’s really only the tip of the iceberg (which is why you need to allow yourself enough time to gather all of this information):

Often during a due diligence period, you’ll discover hidden costs that require you to adjust your financial models for cash-on-cash return. This means you can go back to the seller and renegotiate the purchase price to make your models work. If you had skipped this crucial step and found out these hidden costs after the fact, you would quickly go from a positive gain to a really bad deal.

Bottom line: The quicker you do your due diligence on an investment (without cutting corners), the more likely you are to find the safest investments with the greatest possibility for cash flow.

Take your first step to invest in real estate

Are you ready to take your first step in real estate? Join the Rich Dad Community, and begin by learning the best steps to take on your path to financial freedom.