Blog | Paper Assets

Becoming A Proficient Investor

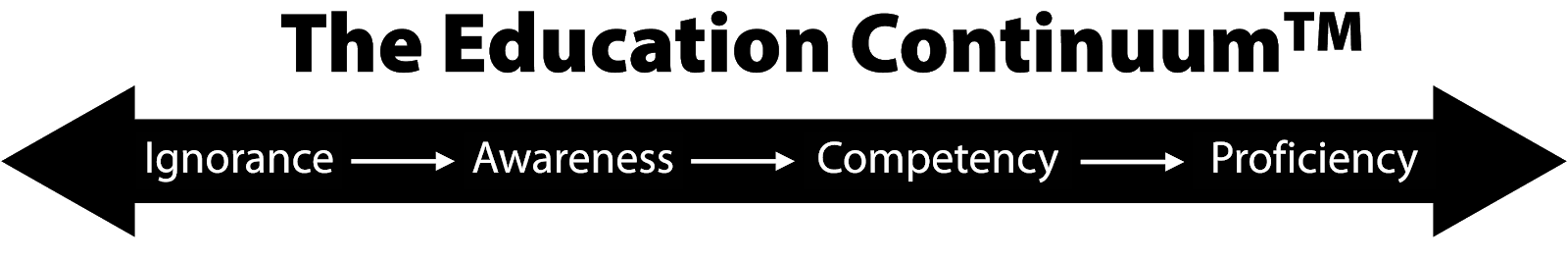

Where are you on the Education Continuum™?

March 09, 2018

Over the years I’ve helped thousands of people successfully navigate their path of financial education. Though everyone is unique, the journey is very similar for virtually everyone as they progress through specific milestones on their way to investing proficiency. To help student investors understand and chart their progression, I have developed what I call The Education Continuum™:

Let’s take a look at The Education Continuum™ and try to honestly assess where you are in regard to your understanding of investing.

IGNORANCE: First of all, don’t mistake “ignorance” for a lack of intelligence. In truth, anyone can be highly intelligent and yet still be ignorant about a certain topic. Whenever we start to learn a new topic, we always start from a point of ignorance. There’s nothing shameful about it, it simply means that our level of knowledge is low. However, if we try to invest our money while we are in this state of ignorance, it’s like trying to drive a car on the highway without any training. It feels like a disaster just waiting to happen. The answer, of course, is to put ourselves on the path of financial education.

AWARENESS: At this level, our eyes begin to open and we become aware of what we don’t yet know. We begin to ask the right questions and learn what to study to move ourselves further along toward competency and proficiency.

COMPETENCY: Think of competency as knowing something without necessarily having the experience of doing it. It’s like a student pilot who can pass a written test of flight regulations and procedures, but has not yet logged any time in the air. As collegiate basketball players, my teammates and I could easily diagram every detail of the offense and readily answer any question posed regarding the play book. But the actual execution of the game-plan in a hostile environment, under pressure, is a very different story. It’s that real-world practice and execution that helps us achieve proficiency.

PROFICIENCY: I really believe that proficiency is not a destination, but a never-ending process. As investors, this is the state of action where we actively generate consistent income from our investments. We know how to control risk and modify investments to achieve our goals.

Setting Your Education Goals

Most people have lifestyle goals. They want a certain sized house or to drive a specific type of car. Some investors have money goals to create income or achieve a certain net worth. But how many investors have education goals?

To achieve our lifestyle goals, we need money. But to achieve new money, we need to gain a financial education. That’s why it’s so important for everyone serious about improving their situation in life to first set and achieve goals of higher financial education.

Don’t Just Have Investments—Be an Investor

One of the most common mistakes new investors make is that they focus on what they want to own rather than what they want to become. A person with no knowledge or understanding can own investments. But being a proficient investor means that we have learned and practiced the ability to take the right steps to achieve specific, desirable results.

As you concentrate on growing your knowledge of investing through education, you will enjoy becoming more aware of the investing techniques people use in the stock market to achieve monthly cash flow and retire early. In time, you will not only realize that it can be done, but that you can become competent in how to invest intelligently for your own success.

The ultimate goal is proficiency – the ability to take the right steps that lead to your desired results. Those who are proficient have become investors, while those who fall short of proficiency must rely on others to hopefully help them achieve their financial goals.

Lack of Knowledge Forces You to Depend on Others

Imagine you are placed in the middle of the woods with another person you have never met before. You are told that it takes one day on foot to get back home. You are given a map, a compass, and just enough food and water for one day. Your companion has the same. The map shows where you are, and where your home is. But you have never used a compass before and you’re not sure how it works. The other person claims to know how to use the compass and offers to guide you to your house.

When we can’t do something for ourselves, we are forced to rely on others. And when we rely on others, we are also surrendering control to them. Do they really know how to use a compass and read maps? Do we trust them to lead us safely out of the woods? Are they most interested in helping us, or themselves?

Because of a lack of education, many people have become totally dependent on outside advisors, such as their 401(k) companies, to take care of their money. They depend on these unknown advisors to make their dreams come true.

Perhaps we are so trusting of these faceless financial advisors because of the illusion that Wall Street has created. There is a perception that they possess almost magical predictive powers far beyond our own abilities. Even more, we are made to feel that these special powers are beyond the reach of regular people like you and me. It has come to the point where our culture just assumes we can’t learn these skills for ourselves, that we can’t do the “magic” that they do. So we quietly kneel before the 401(k) companies and lay our futures on their altars, completely at their mercy.

Make Investing a Life Skill

We can be more than simply a worker bee in life. We have amazing brains that can learn new things and acquire new skills. We can be men and women of many talents. We have the capacity to learn things that can be valuable to us. We can develop hidden talents when we decide it’s important to us.

Take the example of a young man I know who has become quite an accomplished pianist. From age 8 to 18, he spent 30 minutes each day learning to play the piano. When you add it up, that’s almost 2,000 hours spent on that piano bench. He also took lessons once a week that cost about $20. That’s nearly $10,000 invested in just his musical education. He wasn’t born with that skill, but with a committed investment of time and money it became a reality. Today he can make beautiful music that blesses his life and those around him.

We can do the same thing as investors. If generating money through investments is important to us, we can acquire new skills that will bless our lives with freedom, time, and great satisfaction.

Just as people take lessons to play a musical instrument… learn to prepare a gourmet dish… or take a motorcycle safety course… you are allowed to invest a little time in learning new things after the formal ‘education’ of high school and college.

However, people are less likely to search for solutions if they do not know there is a problem. That is exactly why understanding where you are on the Education Continuum is so important. I’m dedicated to teaching every investor who wants to learn the basics of the stock market, risk management, and cash flow. These are concepts and skills that can transform your life.

Original publish date:

March 09, 2018