Blog | Real Estate

Real Estate Appreciation vs. Cash Flow

Investing in real estate the Rich Dad way to build true wealth

August 31, 2021

Something is happening in the housing market. Despite a global pandemic, prices have skyrocketed. Year over year, June 2020 compared June 2021, housing prices in the US were up 17.2%, and perhaps more surprisingly, 50% of homes have sold for more than asking price.

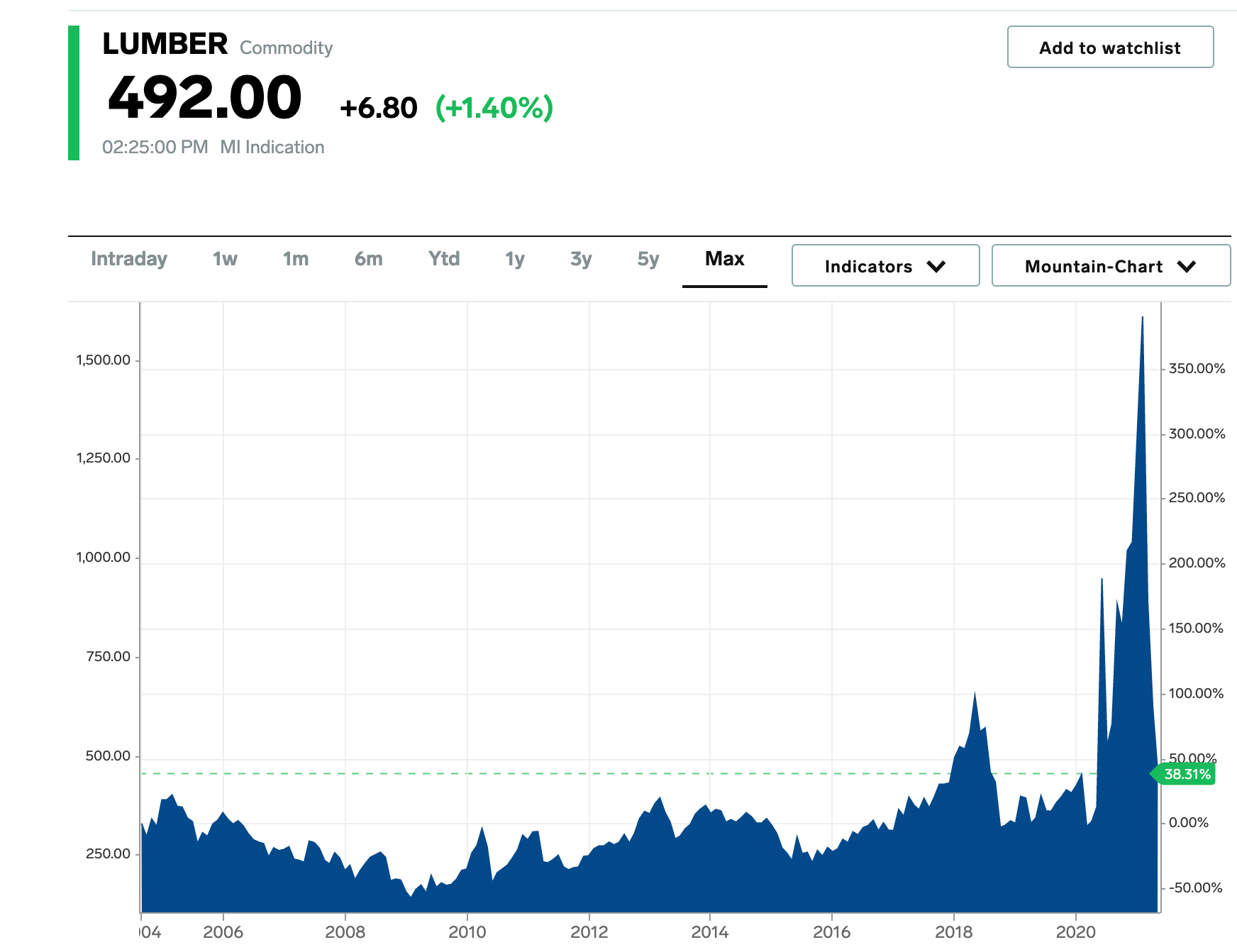

There’s been some contributing factors to this. One, the Fed has kept interest rates at historical lows. Two, raw materials are much more expensive... have you seen the price of wood?

But at the same time, houses are well beyond affordability for most people.

This has caused some flattening in housing prices, but no one is ready to predict a steep drop—yet. Partly it’s because things are a bit murky.

As Reuters reports:

"Clearly there are many cross-currents impacting the housing market today from volatile long-term interest rates, low affordability, shortages of labor and land, and sparse existing inventory," said Scott Anderson, chief economist at Bank of the West.

And perhaps the ultimate wild card...new Coronavirus strains might crop up.

Buying a home is a good investment?

All this uncertainty begs the question, why are people buying houses and why has demand been so high?

I believe that partly it’s because people are trained to believe that buying a house is a good investment.

A big reason for that is because they believe that in the long run the value of a house will always go up.

But I’ve maintained for years that your home is not an asset and not (necessarily) a good investment. More on that in a bit.

What is real estate appreciation?

First, I want to quickly cover real estate appreciation.

Put simply, real estate appreciation is when the value of a home, building, or piece of property goes up over time. The opposite of appreciation is depreciation (not the tax write off in this case, but the actual price of real estate going down in the market).

The prevailing wisdom in the US is that it’s always a good investment to buy a home because real estate always appreciates over time.

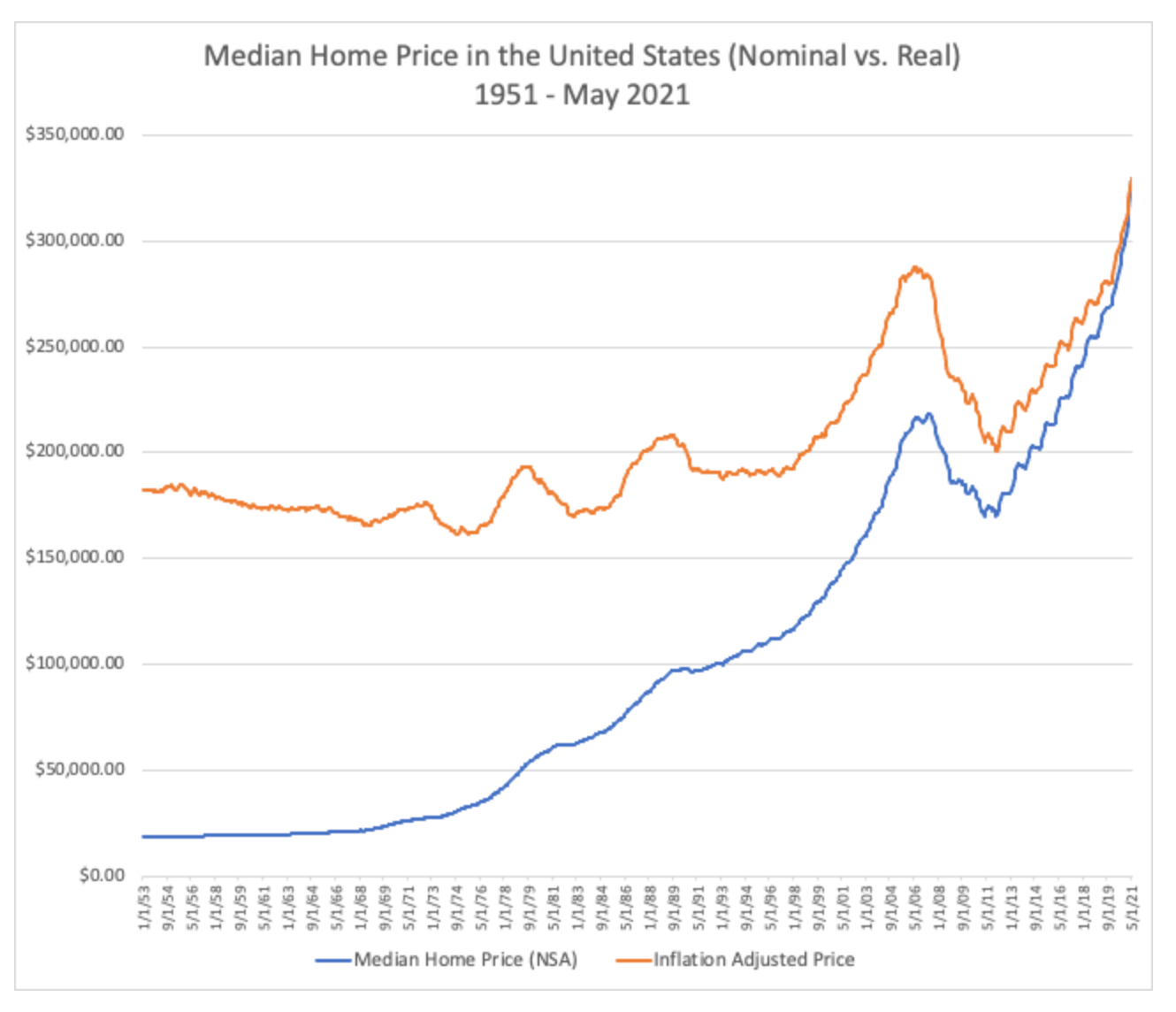

If you look at home appreciation historically, however, you start to see a bit of a different story.

What is interesting about this chart is that if you look at the blue line (not adjusted for inflation), it really does seem like the value of a home goes up consistently year over year...with the exception of the Great Recession of 2008 and the aftermath.

But looking at the data for inflation-adjusted pricing, you see a different story. You see a steady decline until the 70s, and then lots of volatility. What happened in the 70s? Nixon took the dollar off the gold standard.

Adjusted for inflation, the price of housing is actually very volatile. It goes up and down in big peaks and valleys. Perhaps most scary is that right now it’s at a big peak. Could that mean a big valley? It’s possible, but I don’t have a crystal ball. But one sure thing is that what goes up must come down.

Why do people think real estate appreciation is a good investment?

Most people think that buying a home is a good investment because of appreciation. By this they mean that they can either sell their home for more than they bought it for or use their home as an ATM via a home equity loan to pull out money against appreciation.

The problem with this thinking however is that until you actually have a cash event, i.e., sell your home for more than you bought it for, you aren’t actually wealthy. There were a lot of rich people on paper prior to 2008. When the real estate market crashed, they were no longer rich on paper...and because they couldn’t pay their loans, they were soon very poor.

The same is true for a home equity loan. If you pull money out against appreciation, you still owe that money even if the market crashes. If you can’t sell your home to pay off your loans, you’re screwed. It’s not real wealth.

To put it bluntly, people with no financial intelligence invest for appreciation. The rich invest for cash flow

Invest in real estate for cash flow

I never invest in real estate for appreciation. If I want to call a real estate purchase an investment, it must cash flow. By this I mean that it provides income from operations each month. That means rents and other fees are more than the expenses.

“

Very simply, an asset is something that puts money in your pocket. A liability is something that takes money out of your pocket.

~ Robert Kiyosaki

The secret to getting rich with real estate is to invest for cash flow because even if the market goes up and down, you’re not worried about the price of real estate. You’re only concerned that it keeps producing cash flow. You can ride out market peaks and valleys.

This is not to say that I don’t buy property to live in. I love my house. But it’s not an investment. It’s simply my house. If it appreciates, that’s icing on the cake (same with my investments), but I don’t buy a house for appreciation. I buy it because I love it and want to live in it.

Repeat after me, your house is a liability

I'll repeat here: Your house is not an asset, it's a liability. Very simply, an asset is something that puts money in your pocket. A liability is something that takes money out of your pocket.

The common misconception is that a strong housing market generates wealth for the middle class. In reality it doesn’t. It generates debt. People don’t sell their homes to pay for things like college educations and vacations; they borrow against them, growing a liability by taking on more and more bad debt.

How a house can be an asset

As I mentioned earlier, an asset is something that puts money in your pocket.

To me it only matters if a little property appreciates in price. I care only whether it provides cash flow every month. It's the only sure way to build wealth and assure a secure retirement in terms of real estate investing—and it’s the only true way to appreciate real estate as an investment.

Interested in Real Estate?

Download your copy of Rich Dad‘s eBook, How To Buy Your First Investment Property... for free!

Download Your eBook Here

The key is to make your money on the buy, not the sell. What I mean by that is that by doing proper due diligence you can find deals that will provide substantial cash flow for years to come. By doing so you don't have to worry about the price of your asset. If it goes up, that's a bonus. If it doesn't, you still have a great property that puts money in your pocket every month.

Your house is not an asset. But a house can be an asset—if it cash flows.

Original publish date:

March 01, 2016