Blog | Entrepreneurship

How to Move from an S to a B - Part 2

Starting a business? Guarantee its success by implementing the eight integrities of the B/I Triangle

December 03, 2018

Last month, we answered the question, “What is a ‘B’ business?”

We’re no longer in the Industrial Age. With the creation of the Information Age, we’ve had to redefine a “B” business.

Where a big business used to require 500 employees or more, it currently only requires 50. That makes a big difference with how you incorporate your business, who you hire and how many hours those new employees can work.

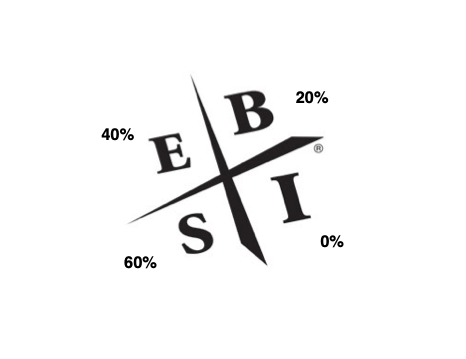

In addition, we discussed how taxes greatly affect what people in the different sections of the CASHFLOW® Quadrant actually take home from their income.

Revisiting the CASHFLOW® Quadrant, you would really want to take your business from the S to the B quadrants. From a tax perspective that’s true, but from a management point of view, maybe not.

When my wife and business partner, Lisa, and I listen to Robert discussing those differences, we take the lesson very seriously and discuss how we can do so.

8 Integrities

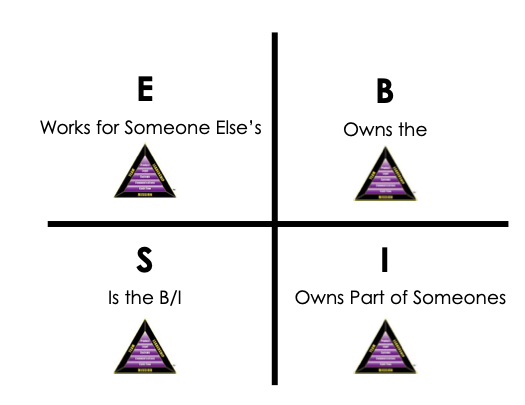

Another great tool of Robert’s we references is the B/I Triangle, shown here.

The B/I Triangle is a great way to analyze any business/investment when planning the move from the left side of the CASHFLOW® Quadrant to the right.

The B/I Triangle has eight integrities. It’s important to assess each one. If the integrity is weak or not functioning properly the entire business is at risk.

“E” Employee-- works for someone else’s business. No control, no asset and exchanging time and labor to improve someone else’s B/I.

“S” Self-employed-- is the business. Or in other words, they are the asset. If an “S” stops working, often so does the income. Usually the only person working on improving the B/I is the same person working in the B/I.

“B” Big Business owner-- owns the B/I. Other people are working on improving their asset, the B/I.

“I” Investor—invests in and owns part of a B/I. The “I” is responsible to keep an eye on their investments but they are not working in the B/I. Other people’s time, systems and management are key to the “I”.

Looking at the Cashflow Quadrant and B/I Triangle together in this light, there is one more principle that gets to be added to the equation.

Another Piece of the Puzzle

The number one lesson in Rich Dad Poor Dad is the rich don’t work for money.

You can see that by looking at the CASHFLOW® Quadrant, when you are on the right side of the quadrant, you own a part of a business. You have some ownership of the assets the business creates. You do not work for the business.

You may recall rich dad’s definition of an asset: An asset puts money in your pocket whether you work or not.

If you think of that statement in the context of a business, it really explains the difference between an S business and a B business.

If you think you are a B business owner, take a six month vacation. No emails, no phone calls… nothing. If you return and find your business is still operating, there’s a good chance you have a B business.

Understanding this difference was eye opening for Lisa and I. At the time, we redesigned our last business as a B business without realizing it.

The goal should always be optimization. Set up your systems, reporting mechanisms, team and internal leadership to operate with — or without you — there.

Test it by stepping out for a day, a week, a month, or longer to test its strength. Very few businesses will allow you to do so.

If you have one, there’s a good chance you’re not even in the B quadrant but have successfully made it to the I quadrant.

Intrigued to learn more about how Lisa and I made it from the left side of the quadrant to the right? In doing so, we not only built successful businesses but also help our community at large through social entrepreneurship? Grab a copy of our book, The Social Capitalist.

Original publish date:

December 03, 2018