Blog | Commodities

Will The Price Of Gold Rise Or Fall?

January 15, 2017

That is the question I am asked more than any other. Frankly, I don't know and neither does anyone else. However, I will tell you what I believe it depends on: the inflation rate and how the Fed responds to the inflation rate.

Under normal circumstances, the price of gold rises when people expect higher inflation. In times of inflation, people buy gold because gold tends to maintain its purchasing power better than dollars (or other currencies). When the inflation rate is high, it takes more dollars to buy the same amount of goods one year later; whereas, with gold, it is possible to buy the same amount of goods with the same amount of gold. I believe everyone reading this understands this point.

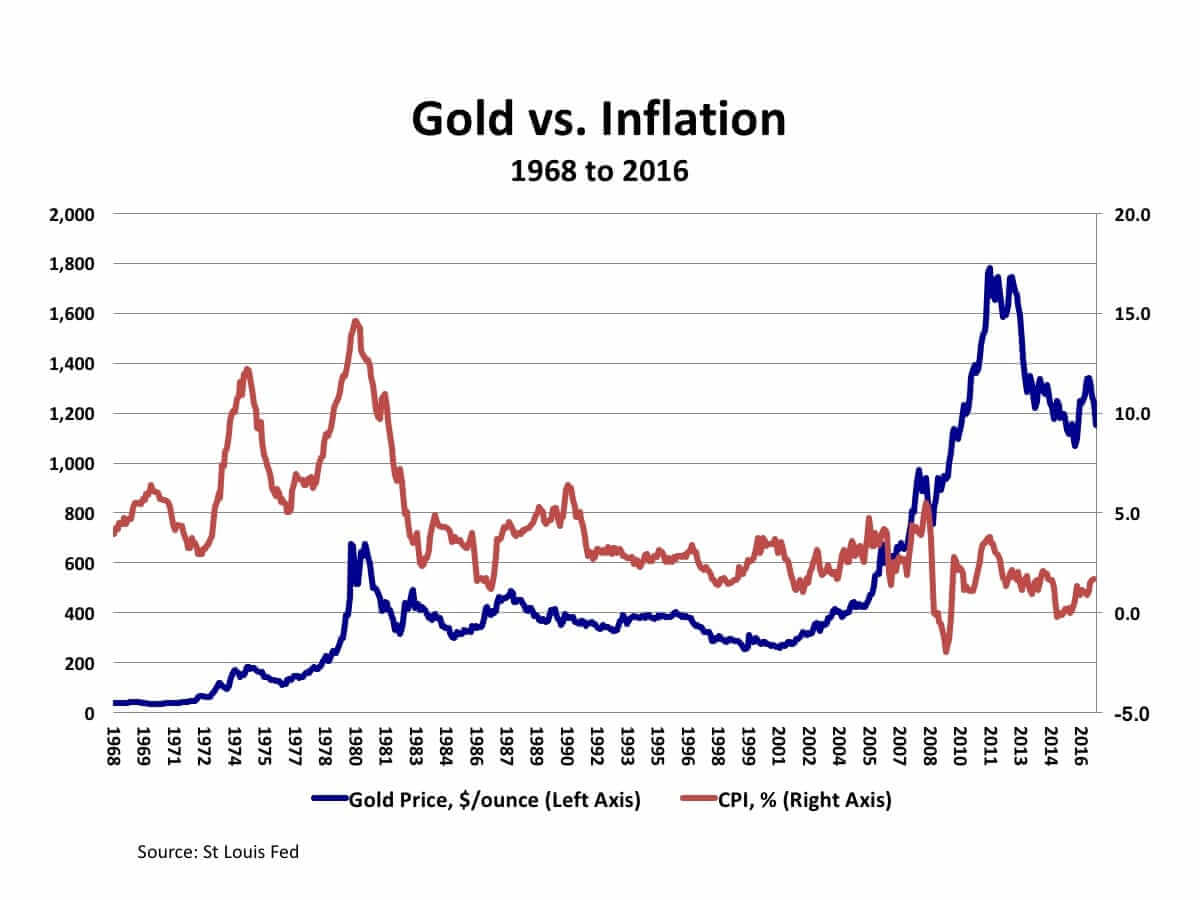

Take a look at the first chart. The US Consumer Price Inflation (CPI) rate (the red line, measured on the right axis) started climbing in the 1970s. It peaked at 14.6% in 1980. As inflation picked up, people bought gold (the blue line, measured on the left axis). This chart shows gold peaked at $670 per ounce in 1980, but this chart only shows the price at the end of the month. The mid-month peak was well above $800. That's how it normally works: if inflation goes up, the price of gold goes up.

Gold vs. Inflation

Gold vs. Inflation

What we have seen since 2008 has not been normal. The price of gold spiked to nearly $1,900 per ounce in 2011 even though the inflation rate fell. Gold rose because the Fed was printing trillion of dollars and that caused people to believe there would be inflation. So far, however, the inflation rate has remained very low - at least at the Consumer Price level.

So what will happen next? If President-elect Trump carries out his campaign promises of: 1) increasing government spending on infrastructure and the military; and, 2) imposing trade tariffs and bringing factory jobs back to America, it is very likely that the inflation rate will pick up very significantly. As it does, the price of gold should move up.

However, how high it moves up and how long it remains high will depend on how the Fed responds to the pick up in prices. The Fed has a "dual mandate". They must try to achieve both maximum employment and price stability. Therefore, if inflation begins to rise, the Fed, in theory, at least, should increase interest rates (the Federal Funds rate) high enough to crush the inflation.

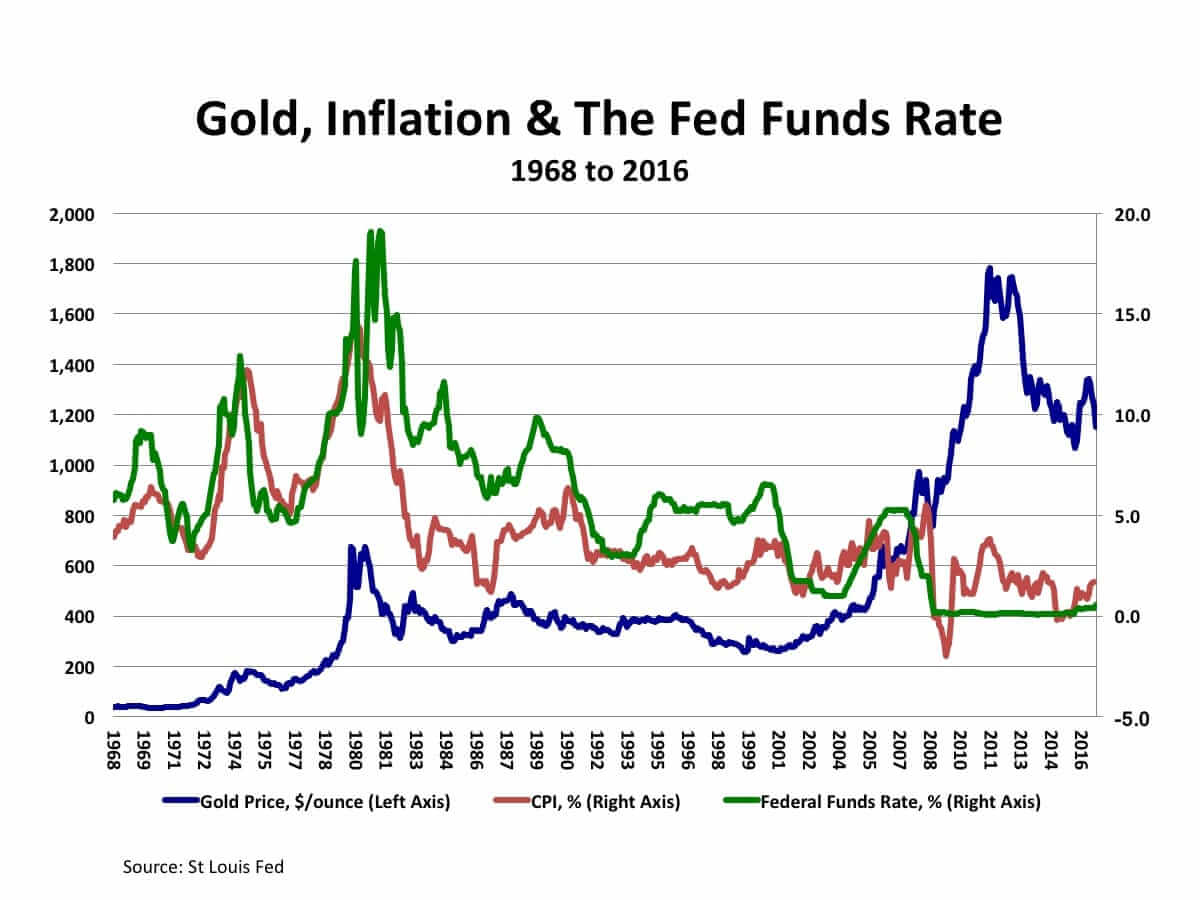

That's what Fed Chairman Paul Volcker did in 1980. See Chart 2. Chart 2 is the same as Chart 1, but with a third line added, representing the Federal Funds rate (in green, measured on the right axis). With US inflation running out of control, Volcker increased the Federal Funds rate to 19.1% in 1981. Those high interest rates crushed inflation, crushed the price of gold and crushed the economy. The unemployment rate rose to 10%.

Gold, Inflation and The Fed Funds Rate

Gold, Inflation and The Fed Funds Rate

That was then. This is now. What would the Fed do next year if the US inflation rate rises to 5% and looks set to keep rising? Unfortunately, at the beginning of 2017, we just don't know. Janet Yellen's term as Fed Chair ends in January 2018. President Trump will then appoint a new Fed Chair. It is possible that President Trump will appoint someone willing to completely ignore inflation and keep interest rates low. In that case, the price of gold is likely to go significantly higher. Presidents have bullied Fed Chairmen in the past in order to keep interest rates low.

On the other hand, the new Fed Chair may prove to be an inflation killer like Paul Volcker. In that case, the Fed could hike interest rates once again to whatever level is necessary to crush the hypothetical pick up in inflation. In that scenario, the price of gold would very likely tumble sharply from here.

So, those are the things we must watch: inflation and the Fed's response to it. I'll be watching closely.

If you would like to follow this issue in much more detail, subscribe to my video-newsletter, Macro Watch:

http://www.richardduncaneconomics.com/product/macro-watch/

For a 50% subscription discount hit the "Sign Up Now" tab and, when prompted, use the coupon code: richdad

You will find more than 31 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Original publish date:

January 15, 2017