Blog |

test

January 07, 2022

When it comes to financial freedom, saving is a losing strategy. It’s important to remember that cash is just simply a currency; in order for it to bring value, it must move into something. If it stops moving, it dies. Just like an electrical current.

Many people think that putting money in a savings account that accrues interest is a form of investing. Unfortunately, the interest received can be offset or even eradicated by inflation. For that reason, saving money means you’re not growing your money at all. In fact, there's a strong chance your money will lose value as inflation outpaces your gains.

That’s why in order to be rich, you have to budget like the rich.

In this post, we’ll dive into what that looks like - all consolidated into 4 critical rich dad poor dad tips.

Table of Contents

Cash is a sum zero game

There is no shortage of stories about currencies crashing to nothing. But the truth is, you don’t have to go that far back in history to find examples of when saving cash was a losing strategy.

For example, in 1983, the Zimbabwean dollar could be exchanged 1 to 1 with the US dollar. By 2008, it took 669 billion Zimbabwean dollars to exchange for that same US dollar. Because it was decimated by hyperinflation in the early 2000s, people who saved Zimbabwean dollars lost - big time.

How rich people budget

So if saving is losing, how does one win? Start by looking at how you budget.

My poor dad said, “Live below your means.”

My rich dad said, “Expand your means.”

My poor dad’s budget focused on cutting expenses to meet his income. It was his priority to pay everyone else first, and then enjoy what was left - if any.

My rich dad’s budget focused on increasing income. It was important that he paid himself first, and then took care of expenses. “Most people use their budget as a plan to become poor or middle class rather than become rich;” he said, “My budget is a plan to become rich.”

So without further delay, let’s explore the four budgeting tips my rich dad taught me.

Tip #1: A budget surplus is an expense

One of rich dad's most important lessons was, "You have to make a surplus an expense."

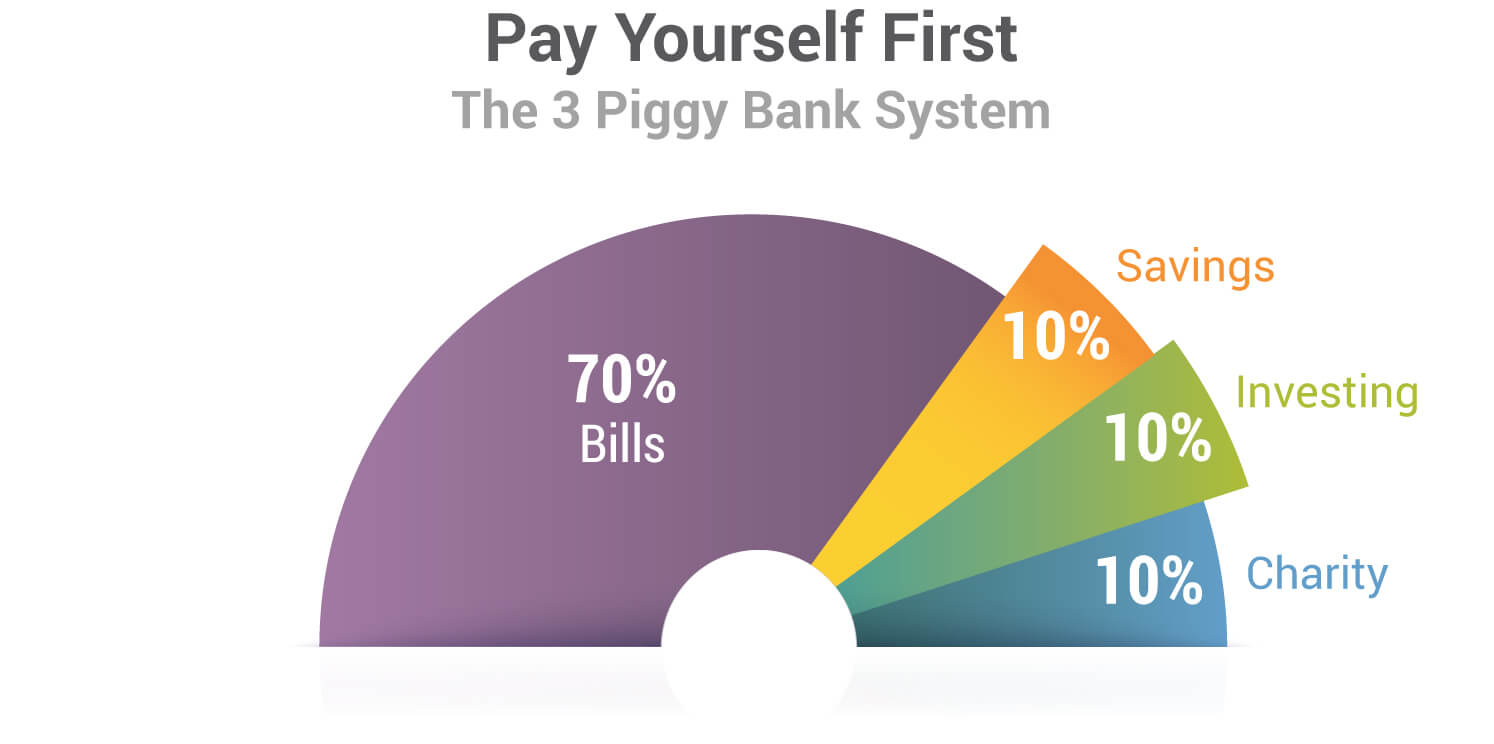

He was referring to the idea that most people view a surplus as an asset; and perpetuate that concept by placing their extra cash in the bank or spending it on liabilities. Instead of viewing extra money as an asset, rich dad viewed it as an expense in the form of charity, investing, and saving.

Most people want to give to charity, invest in assets, and save money, but the problem is that they view it as something to do after they've paid their expenses. By making these things expenses in his budget, my rich dad ensured that he would make them a priority. He called it paying himself first.

portion of his money aside for savings in case he needed liquidity in an emergency.

This is key to understanding how to save money and get rich. Rich people budget savings not as an investment or means to get rich, but as a hedge to protect them should the need arise and they can’t liquidate their assets quick enough. Kim and I save about six months of living expenses at any given time.

Each month, before he paid any other expense, he took care of his most important expenses: giving to charity, investing in assets, and putting a

Tip #2: Your expense column determines your financial future

Once you enter the real world, you soon discover that bankers don’t care about your grades. Rather, they are only interested in your financial report card.

What is a financial report card? The answer can be found with your personal financial statement.

Not sure what your financial report card looks like? Find out here.

The income section of an income statement is where you place every source of income you make: earned (paychecks, tips, wages), portfolio (dividends from stocks), and passive (cash flow from real estate). Your expense column, however, is where you list everything you pay for each month like your mortgage, car, and insurance payments.

My rich dad taught me that if you want to predict a person's financial future, look no further than their expense column.

Here’s an example of two different expense columns:

| Person A: |

Person B: |

| Donation to charity |

Six-pack of beer |

| Savings |

New shoes |

| Books on investing |

New TV |

| Seminar on real estate |

Football tickets |

| Gym dues |

(Another) six-pack of beer |

| Personal coach |

Bag of potato chips |

While that’s a humorous example, it’s not far from the truth. When you look at most people’s expense columns, they’re littered with payments to other people and for liabilities. In each case, expenses don’t go towards anything that will make money and only things that permanently take money out of your pocket.

As you evaluate your budget for this year, take a look at your expense column. What does it say about you? If it looks more like the right column than the left column above, then you’ll find it difficult to get rich.

Tip #3: Use assets to pay for liabilities

As we discussed above, most budgeting tools help you gain a better understanding of your finances by instructing you to list your monthly income and expenses using a budgeting template or spreadsheet. While this is a great start, my rich dad taught me that the income statement only shows you half of your financial picture. To understand your entire financial picture, you need to also understand your assets compared to your liabilities.

What’s an asset vs a liability?

Simply put, an asset is anything that puts money in your pocket, regardless of whether you work for it or not. Dividends from a stock, rental income from a real estate investment, or residuals earned from book sales are all different forms of assets.

A liability, on the other hand, is anything that takes money out of your pocket. While many people consider their home to be an asset, it’s a liability. Not only do you have the mortgage to eventually pay off, but the property taxes, utilities, and maintenance will always take money out of your pocket.

The key is to acquire assets that pay for your liabilities.

My poor dad was frugal and thought that was a virtue. If he wanted a luxury item, he'd simply deny himself that item. He'd say, "we can't afford it."

My rich dad, however, loved luxury and if he wanted a nice toy, he'd find a way to buy it. He wasn't reckless with his money, but instead asked himself “how can we afford it?”

By increasing his assets, which increased his monthly cash flow, my rich dad used this money to purchase his luxury items and liabilities. If he wanted a nice car, he’d invest money until the asset produced the cash flow required to purchase that car. Then he had a nice car and a great asset. This is why paying himself first in his budget was the most important thing he could do to get rich. It ensured he’d have the money each month set aside to grow his assets.

Kim and I have used this philosophy over and over in our life to buy things we enjoy and build our wealth in the process.

Tip #4: Don’t save; spend to get rich.

Being able to execute on the first three tips on budgeting means building a mindset that says when the going gets tough, the tough get going. Most people stop spending on charity, investing, and saving when times get tough. That is not how rich people budget. The rich figure out ways to make more money by spending more money on assets, even when times are tough.

By pushing through those hard times, you develop a mentality that will enable you to make more money no matter what the circumstances. That will make you richer than you ever imagined.

When Kim and I began our businesses over three decades ago, we had our eyes set on one thing: financial freedom. It took less than a decade for us to accomplish our goal. Once we had passive income flowing into our pockets each month that covered our expenses, we knew we were free.

It wasn’t easy, however. When we started out, Kim and I were over $1 million in debt, we could have easily thrown in the towel, gotten jobs, and settled into a middle-class life. But we knew that the only way to achieve financial freedom was through acquiring assets. That required us to pay ourselves first with our three-piggy bank system mentioned below. To help us stay accountable, we hired our bookkeeper, Betty.

Although Betty didn’t agree with our plan, she followed our plan and was vital to us staying on track. What we asked her to do was place money in three separate accounts: emergency savings, investing, and charity. Our creditors, and there were many, were to be paid with what remained. There were many months when Betty informed us that we weren’t going to have enough money to fund our three piggy banks and the creditors. We used that as motivation to find extra money.

The temporary pain we felt was necessary for us to increase our financial education, spend money on acquiring assets, and achieve our goal of financial freedom. By pushing through those hard times, we developed a mentality that enabled us to make more money, no matter what the circumstances-and you can do the same.

And that will make you richer than you ever imagined.

Original publish date:

January 07, 2022