Blog | Cryptocurrency

Inflation Is Robbing You: How Bitcoin Helps You Fight Back

Why a Balanced Approach with Bitcoin & Gold is the Smartest Inflation Hedge

Rich Dad Cryptocurrency Team

March 05, 2025

Summary

-

Inflation is reducing the value of cash, making it important to invest in assets that preserve wealth

-

Gold remains a stable store of value, but Bitcoin offers higher growth potential

-

Institutional adoption of Bitcoin is increasing, making it a modern alternative to gold

-

A diversified strategy with both Bitcoin and gold provides a strong hedge against inflation while balancing risk and reward

Why Inflation Is Destroying Your Wealth

Inflation is all about the decreasing value of your money.

-

A $100 bill today buys you far less than it did five years ago.

-

Wages rarely keep up with inflation. This means that you are slowly getting poorer.

-

Traditional savings accounts don’t grow fast enough to offset inflation. This makes them a bad long-term storage method for wealth.

So, what's the solution? Investing. But to combat high inflation, they need to be assets with a finite supply and intrinsic value.

Bitcoin & Gold: The Fight for Financial Security

The pressure of inflation is hitting hard. The Consumer Price Index (CPI)rose 0.5% in January 2025. This was after a 0.4% increase in December.

If we look back over the last 12 months, inflation climbed 3.0%. Shelter costs accounted for nearly 30% of the increase and gasoline prices jumped 1.8% while food costs rose 0.4%.

Even excluding things like food and energy, prices for needed essentials like auto insurance, medical care, and travel continued to rise.

Like a storm rolling in from the horizon, inflation is steadily eroding our fiat currencies and our purchasing power. Finding a reliable store of value as a hedge against inflation is more important than ever.

When you think about the words "inflation hedge", usually the first thing to come to mind is gold.

Gold has been a timeless and trusted store of value for thousands of years.

It's a hard, tangible asset that both governments and investors turn to in times of economic uncertainty. Gold has stood the test of time and proven itself again and again. And while gold continues to prove itself as a stable store of value, there are some challenges that investors face with gold.

Let's explore some of these challenges:

-

Physical gold also requires investing in secure storage. This might be at home or in a vault.

-

Holding large amounts of gold can increase your risk of theft.

-

Having safe deposit boxes or private vault storage adds extra costs.

-

Moving precious metals such as gold from one vault to another can have pricey associated costs.

-

Traveling with your gold, depending on how much you own, might prove to be difficult.

-

In an emergency it might be challenging to gain quick access to your gold if it's kept in a vault.

-

Purchasing gold often comes with dealer markups that increase the total cost.

-

When you want to sell your gold, dealers may offer you prices below market value, reducing your profitability.

-

Premiums on coins and small bars are much higher than larger bars. This means that small investments can be less efficient.

And that isn't even all of the challenges. Now, to make things clear, gold still is an amazing investment, despite these challenges. But over the last decade, Bitcoin (digital gold) has emerged as a modern alternative. It offers scarcity with its fixed supply, it has decentralization, and it has gone through explosive growth.

Both Bitcoin and gold appreciate over time, but their market behavior is wildly different.

-

Gold is stable and slow-moving.

-

Bitcoin is volatile and fast-growing.

That volatility, which might be scary to some, is where Bitcoin’s biggest opportunity lies.

What does that mean? Well, instead of choosing one over the other, holding both Bitcoin and gold creates a strong hedge against inflation while balancing risk and reward.

Let's get deeper into adding BTC into a portfolio and how it complements precious metals.

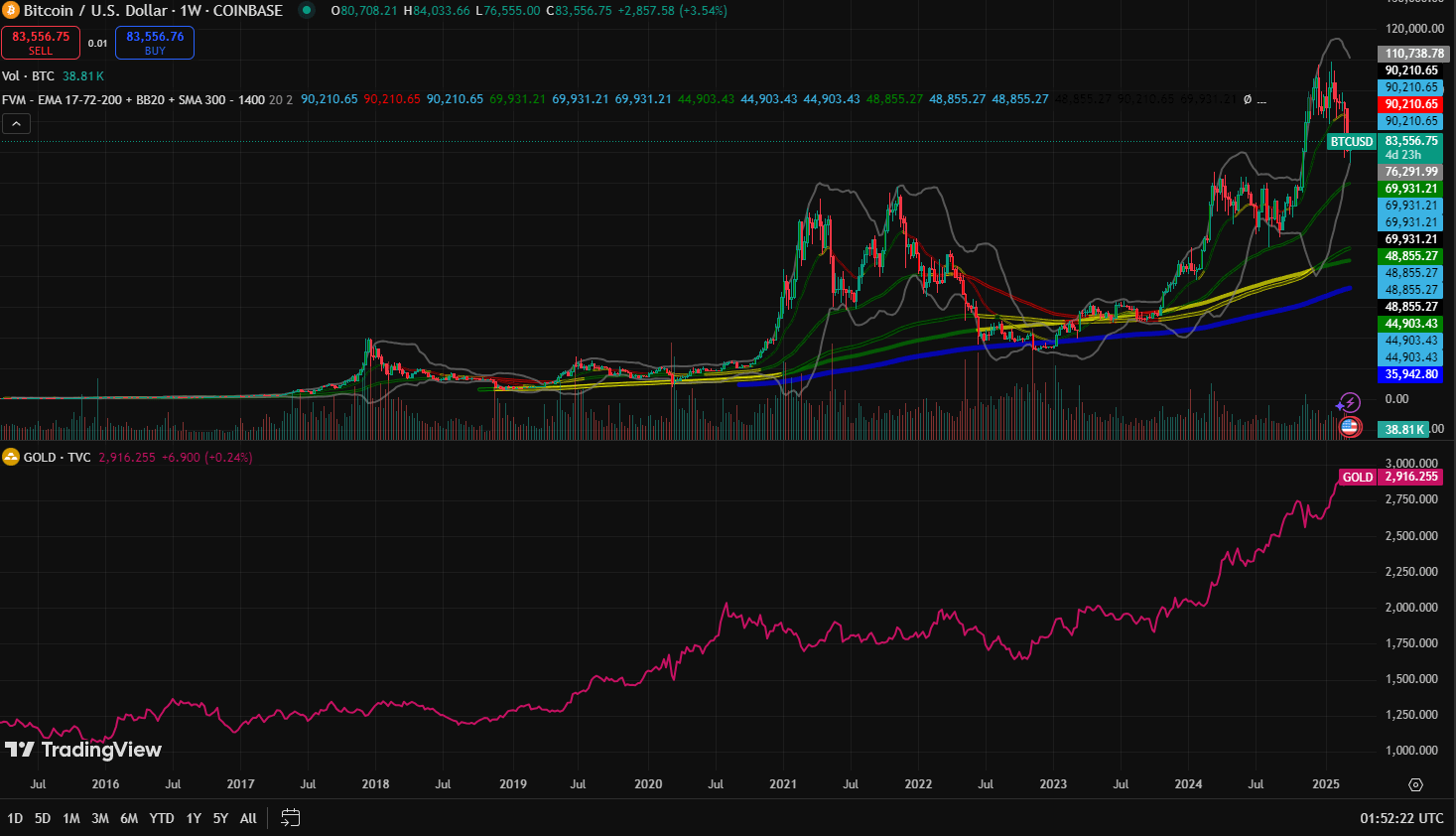

(Image Source: Trading View)

-

Upward Price Trends Over Time

So, why should someone add a bitcoin inflation hedge to their investment planning strategy? Both Bitcoin and gold have seen consistent long-term appreciation. This is especially apparent when you compare the price charts of the two over the past ten years.

-

Gold has had steady and gradual growth that reflects inflation and the central banks' demand for it.

-

Bitcoin moves in boom-and-bust cycles. It usually has these massive price spikes followed by corrections.

Looking at the chart, despite Bitcoin’s volatility, it has outperformed gold over the last decade.

If you had invested $1,000 in gold five years ago, it would be worth around $1,500 today. That same investment in Bitcoin? Likely $10,000 or more.

If you're seeking long-term wealth preservation, gold is reliable and it's something a lot of investors understand and are familiar with. But Bitcoin has a much higher growth potential and that's a reason why it can potentially add to a well-rounded portfolio.

-

Market Cycles and Corrections

An important thing to understand about Bitcoin is that both BTC and gold experience market cycles, or periods of rapid growth followed by corrections.

Because BTC's price fluctuations are so large, this is an aspect most people forget. They give into fear and doubt when BTC's price dips, not realizing that historically Bitcoin always has a pullback. It's never consistently a vertical line up in profit.

-

Bitcoin follows a predictable cycle. It is driven by its halving events (which happen every four years). These halvings reduce the number of new BTC entering circulation, typically driving price increases. This has historically happened every time.

-

Gold reacts to macroeconomic events, such as inflation, interest rate changes, and financial crises.

Just following data provides a clear, distinct roadmap that can help investors time their purchases wisely. If you know both these assets will go up in value over time, because the dollar loses its power over time, then pullbacks cause less fear and doubt.

-

Increasing Correlation Since 2020

Ever since the COVID-19 pandemic, Bitcoin and gold have shown a higher correlation than ever before.

Bitcoin was once seen as a completely separate asset class, but now major institutional investors are treating it similarly to gold. Look to examples such as:

-

Deutsche Boerse's Clearstream: Starting next month, Clearstream will offer cryptocurrency custody and settlement services or institutional clients, focusing on Bitcoin and Ether.

-

U.S. Government's Strategic Crypto Reserve: In March 2025, President Donald Trump announced the creation of astrategic cryptocurrency reserve, including Bitcoin, Ethereum, XRP, Solana, and Cardano.

-

Hedge Funds and Bitcoin ETFs: Following the approval of spot Bitcoin ETFs in the U.S.,hedge funds have become leading holders. They view these investments as strategic assets. Look at Millennium Management who holds $2.5 billion, and Brevan Howard, who holds $1.4 billion in Bitcoin ETFs.

-

Activist Investors Advocating for Bitcoin: Activist investors are encouraging struggling companies to hold Bitcoin on their balance sheets to boost revenue and secure their financial future. Take a look at Strive Asset Management's CEO, Matt Cole, heurged GameStop to invest in Bitcoin.

-

Institutional Adoption & Trading Patterns

Another move in favor of BTC is that institutions are adding both Bitcoin and gold to their portfolios. They aren't picking one or the other, they are growing their holdings in both of these scarce assets.

Think about the fact that if every millionaire in the world wanted 1 Bitcoin there'd not be enough Bitcoins for them.

Keep in mind that:

-

Volatility Differences

Now, if we compare gold to BTC, Bitcoin’s biggest advantage—and disadvantage—is its volatility.

Bitcoin is known for rapid price swings. it can sometimes gain or lose 20%+ in a single day. And yes, that should be taken into consideration prior to investing. Especially if a person intends to purchase BTC during its all-time highs, they can expect 40%-80% losses in the short term.

Bitcoin’s volatility can be intimidating, but it’s also the reason for its high returns. On the other hand, gold provides a comfortable and reliable stability along with wealth preservation.

By holding both, investors gain exposure to Bitcoin’s upside and then can use gold’s safety net to balance the risk.

-

Moving Averages & Support Levels

Another thing these two assets both have in common is that bitcoin and gold follow technical trends, like moving averages (MA) and support/resistance levels.

-

Bitcoin moves faster, it can break resistance levels aggressively and have deeper corrections.

-

Gold follows a predictable price range, so it's much easier to hold long-term without major price shocks.

Final Thoughts

Many investors over the years have asked "is bitcoin an inflation hedge?" The answer so far seems to be "yes". Bitcoin's ability to rebound after corrections and its growing acceptance over the time frame of the past decade is proving its value.

Look at it this way: those who invested ten years ago are in profit, and those who invested five years ago are also in profit, which proves the demand in Bitcoin is still strong.

Ultimately, the best inflation hedge involves making an investment plan. Consult with a financial advisor, self-educate, and determine if adding exposure to BTC is a good option for you. As inflation rises, having financial assets with intrinsic value matters.

Keep in mind, bitcoin is not a safe haven, but it is a high-growth asset with strong long-term potential to help offset currency devaluation.

Adding BTC in with a plan that involves knowing how to invest in the stock market and precious metals makes sure all your bases are covered and you can weather difficult financial times with more potential upside awaiting you in the future.

(Disclaimer: This article is not financial advice and is intended for educational purposes only. It is important to conduct thorough research and only invest an amount that you are comfortable potentially losing. For personalized financial advice, consult a professional.)

Original publish date:

March 05, 2025