Blog | Cryptocurrency

The Bitcoin and Ethereum Show

November 02, 2020

[October 2020 Update] Why now may be the time to seriously look into crypto

I always say knowledge is the new money. Knowledge does not go away, it stays with you and it evolves with you. No one can take it from you.

I start with that because we are seeing it right now. Your money is being taken from you. As the Federal Reserve Bank keeps printing money, money becomes devalued. Is your paycheck going up to match the disappearing value? Probably not, your money is being stolen.

Banks are not giving any real interest rates. Taxes are getting higher and will continue to do so.

Your money is vanishing… but your knowledge is not. Some of the people most respected in the finance world are finally seeing this and they are moving to cryptocurrency as one of their solutions.

Why? Because cryptocurrencies are outside of the Federal Reserve Banks control and thus safe from their games and deceptions. If you follow me on Twitter you know I recommended taking the stimulus check you receive and buy real assets like gold, silver and Bitcoin for this very reason.

What’s exciting is I’m discovering I’m not the only person who recommends you invest in Bitcoin. Paul Tudor Jones is a billionaire hedge fund manager. He’s pretty much the “top dog” in the game. He recently declared the cryptocurrency as the best hedge against inflation and compares investing in Bitcoin now to investing in early tech stocks, like Apple and Google.

To quote Paul Tudor Jones:

“I think we are in the first inning of Bitcoin and it’s got a long way to go,” he said.

So it’s not just me. Cryptocurrencies appear to have just gained incredible acceptance into our society. Paul Tutor and I both see cryptocurrencies as a hedge against the cancerous dollar.

So let’s hear what my expert Jeff Wang has to tell you:

Jeff Wang

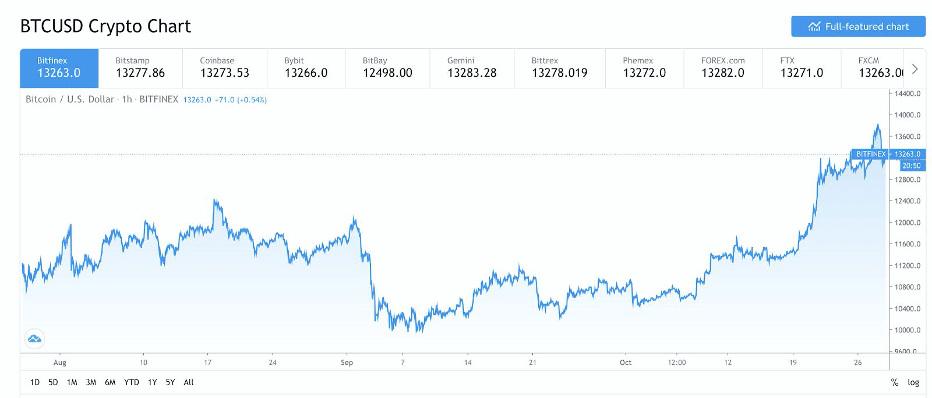

October was a huge bullish month for Bitcoin and Ethereum due to external news.

Bitcoin has diverged from markets

For the first time in a while, Bitcoin has finally decoupled from both equity markets and gold:

(Gold chart, Aug-Oct 2020)

(Gold chart, Aug-Oct 2020)

(Gold chart, Aug-Oct 2020)

(Gold chart, Aug-Oct 2020)

As you can see, for the first time in a while, Gold trended downward while Bitcoin trended upward. I think now is a good time to transition to “why?”

The Bitcoin and Ethereum Show

So with everything else stagnant (aside from market volatility), a lot of positive news came out of the crypto sector, probably more so than any other month this year. It’ll explain why there was the divergence of Bitcoin from markets, and why it’s catching up slowly to Ethereum’s stellar performance this year.

Jerome Powell comments

The US Federal Reserve Chairman gave a hint this month that a digital currency was being investigated and that they wanted to get it right before launching a central bank digital currency (CBDC) in the United States. This is showing progress that the United States government is finally trending towards the times versus regulating against it.

PayPal has entered the game

Huge news, payments giant PayPal, with 300 million users, will have cryptocurrencies as part of their core app. They join Square and Robinhood in the FinTech space to offer purchasing and trading of crypto.

This is especially big now that you consider that most phones in the United States will have access to buy and pay with crypto from their phones (though transactions between peers are still in question for regulatory issues).

Coinbase Credit Cards are here

Out of all the “killer crypto credit card” situations, Coinbase has been the first real United States launch of a major credit card that can spend crypto on your behalf.

It’ll still charge you an exchange fee, but now anyone with this card can earn 4% in crypto as well as use their crypto holdings with any vendor that accepts credit cards. Within the span of a few days both mobile and credit card gateways from crypto to cash were suddenly opened up.

JPMorgan targets JPM Coin

But that’s not all, in the financial sector, JPMorgan, the United States’ largest bank, announced they were building a blockchain group to roll out a stablecoin that could be used by its end consumers. In the past, they created Quorum to settle transactions between its partner banks. But now it’s targeting mainstream users to spend and transact JPMorgan coin with each other.

DBS Offers Cryptocurrencies

The largest bank in Singapore has also announced they will be offering cryptocurrency trading. While not as big an announcement as the above, it still follows the trend of cryptocurrencies merging into the mainstream financial sector. Now imagine if JPMorgan began offering cryptocurrencies how much more impressive cryptocurrencies status would become.

All of those stories came in the last month, the largest FinTech payments company giving access to crypto, the largest Cryptocurrency exchange in America giving credit cards for access to crypto, and the largest US Bank getting into crypto. So why is Bitcoin and Ethereum “only” up 10-20%?

A few reasons why:

-

Crypto is still a risky asset, and the equity markets are still a bit shaky on how the elections will play out.

-

We’ve all gone through one cryptocurrency bubble already, people are probably not keen on being fooled again.

-

There are a lot of crypto bag holders who are still selling their holdings back, one word of caution is that there are many huge holdings still waiting for a moment to convert back out (including the Mt. Gox recovered funds).

-

Unknown regulatory concerns since “rug pulls” (exit scams) are so common now, but expect the government to weigh in on Initial Decentralized Exchange Offerings, and fiat onramps (cash to crypto, which is now vastly easier with the above news).

Because of these headlines, Bitcoin will likely dominate headlines for the next few months because it is the most well-known cryptocurrency. And due to game theory principles, people will sell off other coins that will not have much news and try to catch the Bitcoin wave up. This is bearish for pretty much all other coins (unless there are events happening, which we’ll cover).

I know Robert does not give investment advice so let me just tell you what I’m planning to do. I will be holding Bitcoin and Ethereum. I’m expecting volatility during election week, but expect Bitcoin to hit $16k and Ethereum $500 in the next 2 months.

I’ll probably set limit buy orders as I’m expecting to buy Bitcoin at $13k a and Ethereum at $360 again, due to the wild swings.

Robert Kiyosaki

Jeff told you what he is planning to do. Please listen carefully to me now: You must take responsibility for your future and your success. Jeff does not know your risk levels, how much money you can afford to lose. Jeff is only telling you what he believes to be smart moves. But you must decide for you. There are never guarantees.

Always educate yourself before you invest. Jeff will continue to provide videos and teach those of you who’ve joined his newsletter. There will always be more opportunities.

It is not luck that lets you win. It is education that propels your win.

Original publish date:

November 02, 2020