Blog | Commodities, Paper Assets

Spiraling Into World Recession

August 01, 2015

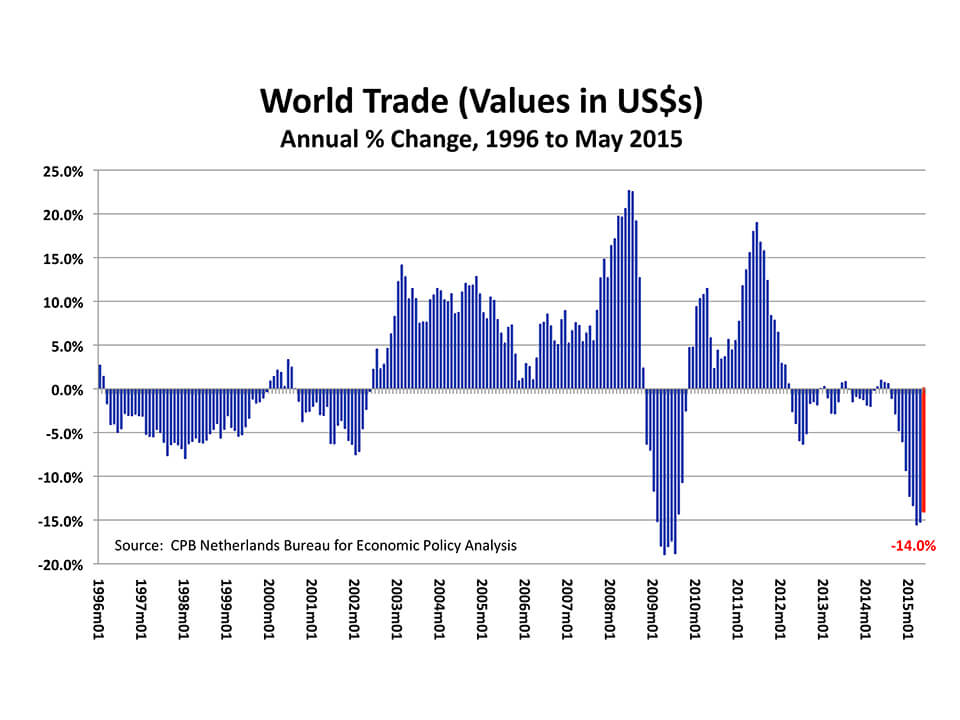

The global economy appears to be moving rapidly back into recession. Commodity prices have crashed to a 13-year low, world industrial production has begun to fall and world trade is contracting. In fact, measured in dollars terms, world trade is collapsing! All around the world, the supply of most products greatly exceeds effective demand. Consequently, prices are falling and production is being scaled back. In short, the global credit bubble is deflating.

Let’s quickly review what has brought us to this point and then consider some of the likely consequences. The world stopped backing money with gold at the end of the 1960s. Afterwards, all around the globe, credit growth ran wild for decades. In the US, for instance, total credit/debt grew fifty-fold from $1 trillion in 1964 to $50 trillion in 2007. Then, in 2008, that credit could not be repaid and the world came very close to collapsing into a new great depression.

At that stage, global policymakers launched an extraordinary and unprecedented campaign of fiscal and monetary stimulus to prevent the global credit bubble from imploding. It was successful. Trillions of dollars of budget deficits combined with trillions of dollars of new money creation not only prevented the bubble from deflating, but actually made the bubble grow considerably larger. Again, using the US as an example, US household sector net worth hit a peak of $68 trillion in 2007, then collapsed to $55 trillion in 2009, before being reflated by government intervention to $85 trillion today.

Now, however, the policy stimulus is no longer adequate to keep the air from leaking out of the global bubble. Japan is still doing its part. The Japanese government ran a budget deficit of 8% of GDP last year and the Bank of Japan is still carrying on with its extraordinarily aggressive “Qualitative and Quantitative Easing” policy by printing Yen 80 trillion a year. The European Central Bank also began doing its share when it started printing €60 billion a month last year. The problem in Europe, however, is on the fiscal side. As a percentage of GDP, budget deficits are really quite low in general, too low to provide any economic stimulus. And, astonishingly, Germany has very foolishly chosen this moment to balance its budget entirely. The United States contribution to global stimulus has ended altogether. Its budget deficit declined from 10% of GDP in 2009 to less than 3% of GDP last year, while the Fed ended its third round of Quantitative Easing in October.

Finally, there is China. After the crisis began in 2008, China made a herculean effort to keep its bubble economy inflated and, by doing so, provided a great deal of global stimulus. For instance, Chinese bank loans more than tripled between 2008 and now. That massive stimulus keep China’s economy growing at more than 7% a year, but only by investing in new plant and equipment on a ridiculous scale. During just two years (2012 and 2013), China produced more cement than the United States did during the entire 20th Century. Now China has far more production capacity across practically every industry than the entire world needs. Therefore, it is not only pointless, but also loss making for China to invest and build any more. But, nearly 50% of China’s GDP is made up of Investment. Moreover, Investment drives job creation and consumption. This explains why China is facing a real crisis. Its entire economic growth model of export-led and investment-driven growth is exhausted and incapable of generating further growth.

Suddenly, instead of contributing to global growth by buying more goods from the rest of the world every year, China has become a break on global growth because it has begun to buy less. China’s imports have contracted by more than 10% during the first half of 2015 compared with the first half of 2014. China was the main driver behind the so-called Commodities Super Cycle. Now that China has begun to buy fewer commodities, that Super Cycle has gone into reverse. As a result, commodity prices are crashing and the economies of the commodity producing countries are being slammed. Their currencies are plunging. Investment, job creation and consumption are slowing; and their government budgets are deteriorating. Soon, many of these commodity-producing nations will be unable to repay their international loans. A new “third world debt crisis” may well be just around the corner.

These global economic problems are now being compounded by the strengthening Dollar. A strong Dollar pushes down commodity prices and makes dollar-denominated debt more difficult to repay. Therefore, if the Fed now begins to increase US interest rates, these problems will not only persist, they will become considerably worse.

- The global downturn should continue to worsen.

- Commodity prices are likely to drop further.

- Commodity currencies are likely to weaken further.

- There is likely to be growing stress in Commodity producing countries: slower economic growth, growing fiscal deficits and an increasing chance of debt repayment problems.

- Corporate earnings are likely to weaken further, especially in the United States.

- And, the US economy is likely to weaken further as the Dollar strengthens more and negatively impacts industrial production and exports.

The global downturn has resumed. I expect the global economy will continue to spiral downward until the United States provides another massive dose of stimulus. A fourth round of Quantitative Easing alone would probably prove to be insufficient. A new jolt of fiscal stimulus is also likely to be required. Eventually, I expect to see the United States deliver both fiscal and monetary stimulus. Let’s just hope that that does the trick – one more time.

To learn more about the crisis in the global economy, visit my website at:

http://www.richardduncaneconomics.com

Original publish date:

August 01, 2015