Blog | Paper Assets, Real Estate

Stock Investing with Put Options for Cash Flow

An key advanced stock investing strategy you need to produce money out of thin air

Rich Dad Paper Assets Team

October 04, 2023

Summary

-

Capital gains is not the only way to make money in the stock market, you can also invest for cash flow

-

Discover how to use a gap down to actually profit

-

Options give you the right, but not the obligation, to buy or sell a stock at a predetermined price within a specified timeframe

When most people think of investing in stocks, they think of trading. Trading is betting on the price of something to go up. You hope to buy low and sell high. The type of income that this generates is called capital gains.

Unfortunately, investing for capital gains—such as stock trading—is often a glorified version of gambling—only not as much fun. Some people win, and some people lose. Instead of investing for capital gains, the wealthy learn how to invest for cash flow, even in the stock market. Any capital gains are icing on the cake, if they happen at all.

The folly of the flip

If you enjoy watching those “fix it up and flip it” TV shows, you’re probably already familiar with the concept of capital gains. Essentially, it’s the game of buying and selling for a profit.

In real estate, let’s say you buy a single-family house for $100,000. You make some repairs and improvements to the property, and you sell it for $140,000. Your profit is called “capital gains.” Any time you sell an asset or investment and make money, your profit is capital gains.

Of course, there are also capital losses (which occur when you lose money on a sale), aka the folly of the flip. Lots of house flippers are losing their shorts right now due to the Fed increasing interest rates. It takes longer to sell a house in a high interest rate market, and each month is lost profit for a flipper.

The same concept holds true outside of real estate. If you buy a share of stock for $20, and sell it once the stock price increases to $30, that’s also a capital gains profit. Of course if that stock goes to $5, that’s also capital losses. And that can happen fast and without warning.

Most investors today are chasing capital gains in the stock market through stock purchases, mutual funds, and 401(k)s. These investors are hoping and praying the money will be there when they get out. To me, that’s risky and pure folly.

As long as market prices go up, capital-gains investors win. But when the markets turn down and prices fall — something nobody can predict — capital-gains investors lose. Do you really want that gamble?

The wisdom of the wealthy: investing for cash flow

Cash flow is realized when you purchase an investment, hold on to it, and every month, quarter, or year that investment returns money to you. Cash-flow investors, unlike capital-gains investors, typically do not want to sell their investments because they want to keep collecting the regular cash flow income. That is how the truly wealthy invest, and it’s the wisest way to invest.

To cash flow in real estate, you could purchase a single-family house and, instead of fixing it up and selling it, you rent it out. Every month you collect the rent and pay the expenses, including the mortgage. If you bought it at a good price and manage the property well, you will receive a profit, aka positive cash flow.

The good news is you can do this with stocks as well! If you purchase a stock that pays a dividend, then, as long as you own that stock, it will generate money for you in the form of a dividend. That is how you cash flow through the stock market. But that’s not the end of the story. There are other more advanced ways to invest in the stock market for cash flow that we will share with you in this post.

A quick disclaimer

We’re going to share with you some real stock trading and paper asset examples given to us by our friend and super stock trader, Andy Tanner, founder of Cashflow Academy. But as we do so, it’s important to understand that we are not your stock picker. You need to be your own stock picker. We are going to simply show you how to trade with stocks, not what stocks to trade.

Why?

What would happen if we told you to go out and buy a stock for IBM and you did? You wouldn't learn anything. And if we said, “Hey, just go out and buy some gold,” and you did it. You wouldn't learn anything.

Even worse, what if we were wrong in our picks and you lost a bunch of money? Not good for you, and not good for us.

Moving beyond buy and hold in stock investing

Most people in the stock market are not investors. These people are not investors, they have no knowledge or education. They rely on strangers to invest for them. They own a 401(k). They pay their hard earned money in order to invest their money. That's how stock brokers and the big guys on Wall Street get rich. They take your money and charge you fees to do it. This is how Wall Street makes billions upon hundreds of billions of dollars off the hard working people that don't know how to invest.

But not us and, hopefully, not you. We’re going to show you how to get paid to invest. What that means is you are going to get paid to buy the asset. Confused? That’s okay. We’ll explain.

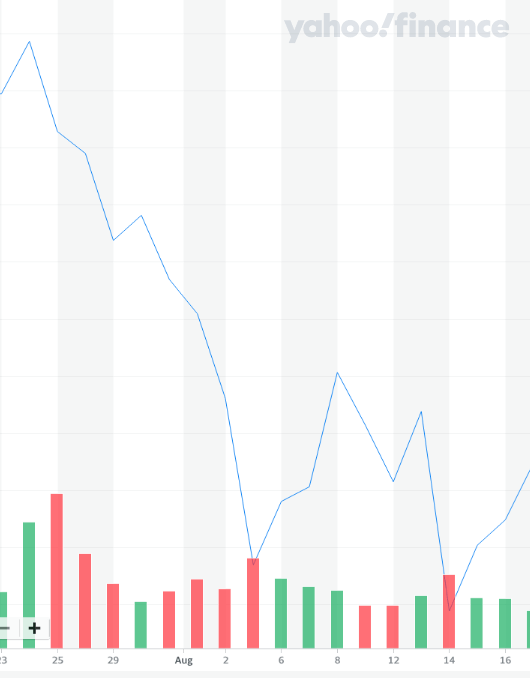

Let us explain with an example. We’ll use Facebook, whose stock ticker is FB. This is what Facebook looked like at one point in time. We’re using past data here on purpose so that you don’t try to go and just replicate this today. That would be folly. Learn the concepts here.

This chart was pulled just after Facebook gave an earnings announcement. A couple of things happened on this earnings announcement. Facebook thought they were going to make $1.84 per share, but they only made $1.75. They also announced that they were having some problems with subscriber volume.

These two negative announcements created something called a gap down.

What is a gap down?

A gap down is when a stock or another trading instrument opens at a price that is significantly lower than its closing price from the previous trading session, with no trading occurring between these two prices. This results in a visible "gap" on a price chart between the previous session's closing price and the current session's opening price.

Gaps can occur for a variety of reasons, including:

- Earnings Reports: If a company releases a disappointing earnings report after the market closes, its stock may gap down the next trading day in response to the news.

- Economic Data: Macro events, like unexpected changes in interest rates or unfavorable economic indicators, can influence the broader market to gap up or down.

- News and Events: Any significant news related to a company (like a lawsuit, regulatory hurdles, or a failed product launch) can result in a gap. Similarly, geopolitical events, natural disasters, or major policy announcements can affect entire sectors or indices.

- Low Liquidity: In stocks or instruments with low trading volume, prices can be more volatile and may experience more frequent gaps simply due to a lack of buyers or sellers at certain price points.

Facebook: The biggest gap down in history

At the time right before the announcement, Facebook was at a high of $220 a share. After the announcement, the stock gapped down to $117. It was in the news, and at the time, this was the largest market cap loss in history—roughly hundreds of billions of dollars.

A lot of people saw this and saw an opportunity. Andy Tanner was one of them.

We’re going to walk through Andy’s Facebook trade front and back.

First, why did the Facebook stock value stop dropping at $171? Why didn’t it plummet further? The answer is simple. $171 is the price where people started buying Facebook again. In other words, they decided now was a good time to get into the action.

Essentially, traders were asking themselves, “When's the next time we're going to be able to pick up Facebook this cheap?”

We don’t recommend trying to predict whether a stock will go up or down. That is gambling. Instead we try to position ourselves to make money on a stock no matter what direction it goes up, down, and even sideways. So while we can't tell you and won't tell you whether it's going to go up or down, we can say that we do not believe that Facebook will be going out of business in the next month.

So an average investor would invest for capital gains and buy Facebook while its price is low with the hope of selling later when the price is higher. That is what an average, amateur investor might do. But Andy is not an amateur investor. He’s a pro.

Andy wanted to buy 100 shares of stock in Facebook at $171, a total investment of $17,100. Andy knew that if Facebook went bankrupt that he’d lose his $17,100. But he was willing to take that risk. Why? He was educated enough to know the risk of Facebook collapsing completely was very low.

But Andy had a problem. He didn’t want to spend $17,100 of his own money. Instead, he wanted to have someone pay him to buy this asset.

Getting Paid to Buy an Asset

Andy decided to use options trading to get his stake in Facebook.

Options give you the right, but not the obligation, to buy or sell a stock at a predetermined price within a specified timeframe. The specific type of option Andy used is called a put option. With a put option, you can sell a stock at a predetermined price, regardless of the market price.

In this case, Andy sells a put option for Facebook at $165 (this is termed the strike price), essentially promising someone that he’ll buy Facebook from them at $165 per share, even if the stock drops to $150 or lower.

Why would he make such a promise? Because he gets paid a premium upfront for selling this put option. In this case, $5 per share. At 100 shares, that's $500 in Andy’s pocket instantly. He’s getting paid to buy an asset he wanted anyway!

Now, two scenarios can happen:

- Facebook stays above $165: If, by the expiration of the option, Facebook’s stock price is above $165, then the person who bought Andy’s put option won't exercise it. Why would they sell Andy the stock at $165 if they could get a higher price in the open market? This means Andy keeps the $500 premium and his obligation goes away. Win-win for him.

- Facebook drops below $165: If Facebook's stock price falls below $165, the buyer of Andy’s put option can force him to buy the stock at $165. This is still a win for him, because he wanted to buy Facebook anyway, and $165 is even cheaper than his original $171 target. Plus, remember the $5 premium he got for selling the option? That effectively reduces our buying price to $160 per share.

In the end, Andy got paid to own a stock he wanted to buy anyway, and at a cheaper price. Now he’s free to exercise even more advanced stock strategies with his asset. But we won’t get into those today.

A Strategy for the educated investor

This approach requires knowledge and a bit of courage, but it can be a very powerful strategy. You’re essentially getting paid to agree to buy a stock you wanted to buy anyway, and at a cheaper price than you initially considered.

It’s important to remember, though, that options trading carries its own set of risks, and it’s not suitable for everyone. Just as with any other investment strategy, you need to do your homework, understand the risks involved, and be prepared for all potential outcomes.

But for us, this is just one of the ways we apply our financial education to real-world investing. By understanding and using strategies like these, we don’t just passively invest—we actively create opportunities to grow our wealth.

Original publish date:

April 08, 2014