It’s easy to call yourself an investor. People across the world have claimed that they invest and are investors, but that doesn’t actually mean much. Typically, they’d have to go through a series of inquiries to really understand the type of investor they are.

Three types of investors

This is because there are investors, and then there are people who dabble in investing. Have you ever wondered why some investors make more money with a lot less risk than others?

It’s because those people are a different kind of investor who bring a different type of mindset to the table.

At Rich Dad, the types of investors have been narrowed down to three.

Type-C Investor

Type-C investors are financially uneducated and look for people to tell them what to invest in. They have little interest in investing in their education so they can become better investors. They know little-to-nothing when it comes to finances, which means they have to rely on the advice of other so-called experts.

What are the chances of a Type-C investor becoming financially free? About as much as winning the lottery.

Type-B investor

Type-B investors seek answers. They often ask questions like:

- What do you recommend I invest in?

- Do you think I should buy real estate?

- What stocks are good for me?

- I talked to my broker, and he recommended I diversify. What do you think?

- My parents gave me a few shares of stock. Should I sell them?

Type-B investors should interview several tax advisors, attorneys, stockbrokers, and real estate agents. They should find advisors who practice what they preach and run fast from anyone who is selling investment advice and getting rich on commissions and fees alone. Type-B investors should look for investment advisors who make money investing in the same investments they are selling.

You may find that many high-income employees and self-employed folks fall into the Type-B investor category because they are busy and have little time to look for investment opportunities.

Type-A investors

Type-A investors look for problems. In particular, they look for problems caused by those who get into financial trouble. Investors who are good at solving problems expect to make 25 percent to infinite returns on their money. They have a strong financial foundation and possess the skills necessary to succeed as business owners and investors. They use those skills to solve problems caused by people who lack such skills.

For example, when Robert Kiyosaki first started investing with only $18,000, he focused on small condominiums and houses that were in foreclosure because of problems created by investors who did not manage their cash flow well and ran out of money.

After a few years, Robert was still looking for problems, but this time, the numbers were bigger. Several years ago, he was working on acquiring a $30 million mining company in Peru. While the problem and numbers were bigger, the process was the same.

The average investor

“I bought my house for $500,000 and today it’s worth $750,000. My house is my biggest investment.”

“My retirement account is worth $1 million today. It will be worth $3 million when I retire.”

“The stock market on average has been going up 8 percent every year since 1974, and real estate over time has averaged over 4 percent per year for the last 20 years.”

Have you heard people say things like this before? These statements are evidence of investors who count their chickens before they’re hatched.

Each statement above relies on the word of others and the future unfolding as we hope it will be rather than on facts.

And that is why Robert’s rich dad said the average investor does not make much money in the market. “The average investor has a count-your-chickens-before-they-hatch mentality. They buy items that cost them money each month, yet call them assets based upon opinions. They count on their house and stock portfolio going up in value in the future. Because of this, they lose control over their personal finances. To me that is risky.

Work less, make more

Then, there are others who “work” to make their money. Here’s an insight from rich dad: the paradox of hard work.

Rich dad told Robert, “Your dad believes in hard work as the means of making money. Once you master the art of building B-I Triangles, you will find that the less you work, the more money you will make and the more valuable what you are building becomes.”

At first, Robert didn’t understand what rich dad meant, but after a number of years of practice, it made complete sense.

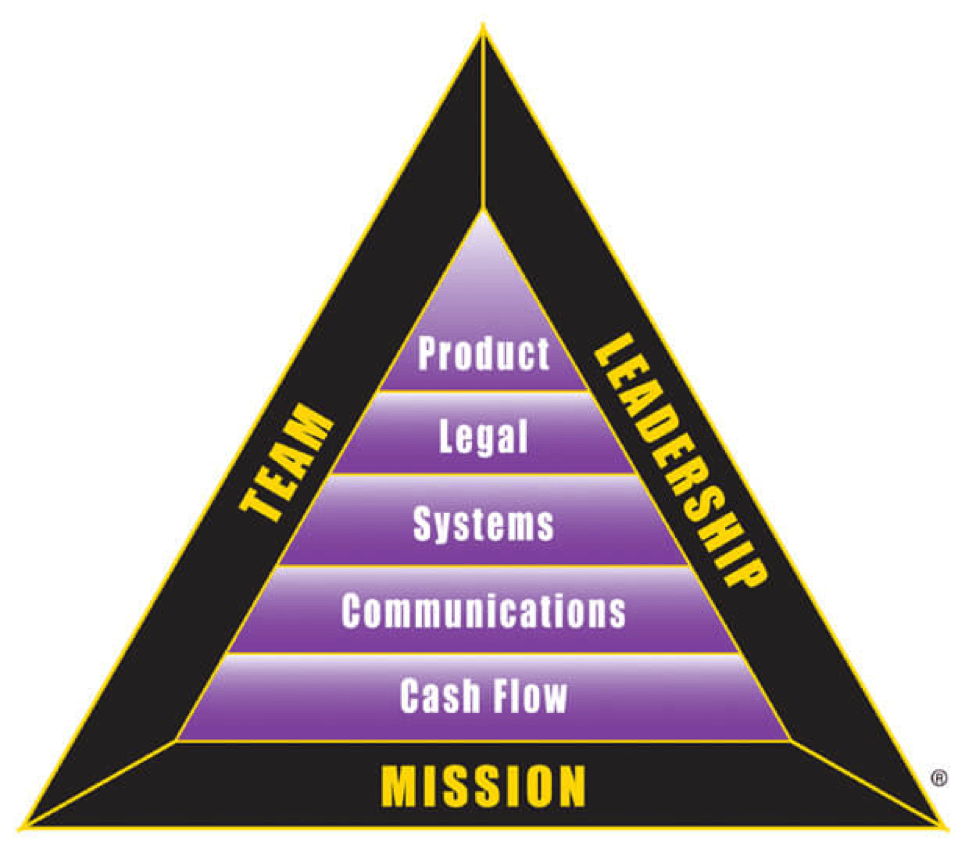

In order for him to become rich, Robert needed to learn to build and put together systems that could work without him. After he built his first B-I Triangle and sold it, he realized what rich dad meant by “the less you work, the more money you will make.” He called that thinking, “Solving the B-I Triangle riddle.”

Then, he began referencing the CASHFLOW quadrant.

The CASHFLOW Quadrant is divided into four types of people, each representing the four different ways to make money.

- Employee

- Small business/self-employment

- Big business

- Investing

The difference between those in the E and S quadrants and those in the B and I quadrants is that the E and S people are often too hands-on, and fall into the classic error that it’s more important to work in your business than on your business.

Rich dad used to say, “The key to success is laziness. The more hands-on you are, the less money you can make.” Rather than being hands-on and working hard, successful people find innovative ways to do more with less—and they empower their teams to be successful for them.

Don’t be an average investor

In order to be successful, it’s important to understand how you make money, and whether or not it’s actually making you rich.

For example, when it comes to mutual funds, Robert is a Type-C investor.

As a Type-B investor, he seeks professional answers to his financial problems; his advisors include tax and wealth strategists, stockbrokers, bankers, and real estate brokers. When you find good ones, these professionals provide a wealth of information many people do not personally have the time to acquire.

And as a Type-A investor, Robert solves problems that others cannot or do not want to solve, and he makes a lot of money in return. He may also give his money to other trusted Type-A investors in areas where he’s not an expert.

Averages are for the average

This is why you need not be average.

There are many “investors” who have been investing for less than 20 years. Most have never been through a market crash or owned real estate worth much less than they paid for it. These new investors come up to me and spout off industry averages.

As rich dad said, “Averages are for average investors. A professional investor wants control. And that control begins with yourself, your financial education, your sources of information, and your own cash flow.”

That is why rich dad’s advice to average investors was, “Don’t be average.” To him, being an average investor was being a risky investor.

Additionally, if you’re going to be the kind of person who creates assets that buy other assets, you need to find ways of doing less so that you can make more and build more.

Take control

If you want to be rich, you must take control over your financial education as well as your personal cash flow. There is nothing wrong with hoping the price of something goes up in the future, as long as you don’t lose control of your finances today.

The sophisticated investor knows that being financially educated gives you more control today and, if you keep studying, greater financial control tomorrow.

Don’t be an average investor any longer. Invest in your financial education today and start building a tomorrow where you have control over your investments and your cash flow.