Blog | Paper Assets

Is the 401(k) Finished?

Why financial education takes you beyond the 401k plan

Rich Dad Paper Assets Team

October 02, 2024

Summary

-

Valuable Insights: By understanding the original intentions and subsequent reassessments of the 401(k) from its early proponents, you can more effectively navigate your retirement planning with a deeper awareness of its strengths and limitations.

-

Enhanced Security: With new reforms like mandatory government-run savings plans and increased auto-enrollment rates being proposed, you stand to gain from more robust and reliable retirement savings mechanisms, providing a more secure financial future.

-

Proactive Strategies: Following advice from financial experts like John Bogle and Warren Buffett, you can adopt a more active role in managing your investments, leading to potentially higher returns and a more resilient retirement portfolio.

“We weren't social visionaries.”

That's what Herbert Whitehouse, former human resources executive at Johnson & Johnson and one of the first to implement the 401(k) plan, has come to admit about its early days.

It was oversold.

This reflection was echoed by Gerald Facciani, who played a crucial role in saving the 401(k) from legislative extinction during the Reagan administration. These sentiments and more are detailed in a pivotal "Wall Street Journal" article titled "The Champions of the 401(k) Lament the Revolution They Started."

Herbert Whitehouse, formerly a Johnson & Johnson human-resources executive, was one of the first proponents of the 401(k). He didn’t anticipate that it would largely replace traditional pensions. Photo: Eve Edelheit for The Wall Street Journal

The 401(k) plan, once hailed as a revolution in retirement planning, is now seen by many of its initial champions as a flawed cornerstone of American financial futures. It was not originally intended to be the primary tool for retirement savings, yet it was promoted with overly optimistic expectations.

Moreover, the widespread adoption of 401(k) plans has made workers vulnerable to severe stock market downturns and subjected them to high fees from financial managers, while corporations have shifted away from offering guaranteed pensions.

Financial Hindsight

As the saying goes, hindsight is 20/20.

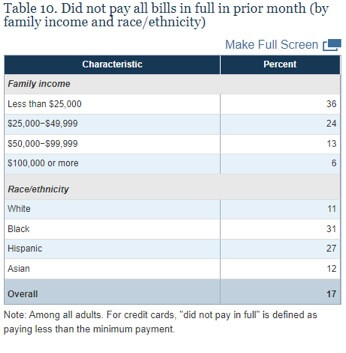

Recent data from the 2024 Federal Reserve Report on the Economic Well-Being of U.S. Households show that about three-quarters of American adults are now either doing okay or living comfortably financially.

This marks an improvement, although 60% of households feel inadequately prepared for retirement. The increasing prevalence of gig and freelance work, which often lacks access to traditional employer-sponsored retirement plans such as the 401(k), complicates this issue.

Furthermore, many households reported that they would struggle to handle unexpected expenses of $400, indicating a vulnerability that extends beyond retirement savings.

Despite these challenges, many defend the 401(k) as a viable retirement tool, arguing that substantial contributions can indeed provide a secure retirement. This perspective persists even as financial realities shift, with more workers depending on gig jobs that don't offer these plans, underscoring the need for broader solutions in retirement planning.

Amid these concerns, there is strong momentum towards overhauling retirement savings strategies. Teresa Ghilarducci and Blackstone Group President Tony James are championing a shift to a mandatory, government-run savings plan managed by the Social Security Administration to secure better retirement outcomes.

Despite its origins from Democratic thinkers, this proposal is seen as having cross-party appeal.

Calls for mandatory savings rates and policies for automatic enrollment are gaining traction too, with proposals such as Senator Marco Rubio’s suggestion to open up the federal government's Thrift Savings Plan to private-sector workers.

John Bogle, the founder of Vanguard, critiques in his book "The Battle for the Soul of Capitalism" the industry’s pivot from investment-focused to profit-driven under the dominance of large financial conglomerates. This shift has meant that investors like yourself bear all the risks and fund the entire investment, only to receive a minimal portion of the returns.

Warren Buffett has also expressed skepticism about the value that professional money managers bring to individual investors, comparing their impact unfavorably to other professionals like dentists, who provide clear benefits to their clients.

Is a Major Market Crash on the Horizon?

Echoing Robert Kiyosaki’s 2002 foresight in "Rich Dad's Prophecy," there are growing concerns that as Baby Boomers begin mandatory withdrawals from their 401(k)s in a shifting global economy, particularly with slowdowns in China, we could face a significant market downturn.

More recently, he warned of a deep collusion between the U.S. Federal Reserve and Wall Street, manipulating the economy to inflate the stock market artificially. He criticizes the practice of CEOs using "fake money" to buy back stocks, which boosts share prices without real economic growth.

Kiyosaki argues that traditional long-term investment strategies in stocks, bonds, and mutual funds are flawed and will lead to significant financial losses as the market adjusts.

What Should You Do?

Build your financial ark by diving into investments beyond the typical stocks and bonds.

Put your money into tangible assets like real estate and commodities. These investments provide steady income and are great hedges against inflation.

The story we once believed about the 401(k) has lost its luster. It’s crucial for you to keep up with these shifts to secure a reliable financial future. Otherwise, the weight of an unsecured retirement will rest entirely on your shoulders. Remember when 401(k)s seemed sensible? Back when tax rates were lower, contributing to a 401(k) felt like a smart move. People would say:

"My company matches 4% if I put in 4%—that’s a 100% return on investment right away!"

Sure, maybe you should snag that match; it’s free money. But think twice before you put in more. Because you need to hold the reins on your financial future. Do you really want to lock up extra money in a 401(k) or IRA and limit your access to it until retirement? Many will regret not having that money free to use when they really need it.

Instead, why not invest in hard assets that are inflation-proof? Or learn to play the stock market to make way more than you could with a managed 401(k).

Take control of your money; don’t let someone else dictate your financial free.

Original publish date:

August 27, 2013