Blog | Personal Finance

How to Survive the Coming Baby Boomer Retirement Crisis

Why most baby boomers are financially doomed and how you can get ahead financially to survive and thrive

October 19, 2021

For many years, I’ve written about the coming retirement crisis that the baby boomer generation would face. I didn’t do so with any type of glee, and often I hoped I would be wrong. But it sure doesn’t look like that is going to be the case.

A few years ago “The New York Times,” shared that an alarming amount of baby boomers were declaring bankruptcy. As they wrote, “The rate of people 65 and older filing for bankruptcy is three times what it was in 1991, the study found, and the same group accounts for a far greater share of all filers.”

The cause?

Driving the surge, the study suggests, is a three-decade shift of financial risk from government and employers to individuals, who are bearing an ever-greater responsibility for their own financial well being as the social safety net shrinks.

The transfer has come in the form of, among other things, longer waits for full Social Security benefits, the replacement of employer-provided pensions with 401(k) savings plans and more out-of-pocket spending on health care. Declining incomes, whether in retirement or leading up to it, compound the challenge.

The article went on to share sad stories about many people who are struggling financially in their old age, many of whom are working low-wage jobs, making less than they ever have in their life in order to supplement their meager social security checks.

Financial ignorance isn’t bliss

As the article states, a large part of the financial problems that baby boomers face today is due to the fact that they have to fend for themselves when it comes to retirement.

A while back, I wrote an article called, “Are you prepared for a lifetime of work?” In it, I shared the recent history of money and the rise of the 401(k) in the US.

All this changed when Nixon took the dollar off the gold system in 1971. This was the beginning of the end of the economic stability of the American family. Since then, we’ve had three of the worst recessions since the Great Depression, continual devaluation of the US dollar, wild swings in interest rates and unemployment rates, and the collapse of the pension system.

As a counteract to growing instability, the Revenue Act of 1978 was passed, allowing employees to save money tax deferred for retirement. Then in 1981, it became legal for paycheck deductions for 401(k) plans. By 1983, nearly half of all major corporations had switched or were considering to offer 401(k) over traditional pension systems. Today, a pension is a thing of the past.

The great tragedy of this switch is that while the rules of money were changed, education about money was not. A majority of baby boomers were raised to understand the old rules of money: go to a good school, get a good job, get a house, save money and invest in a diversified portfolio of stocks, bonds, and mutual funds.

Unfortunately, those old rules of money don’t work in the new world of money—a world where you have to know how to invest in order to succeed. And unfortunately, many baby boomers have outsourced their retirement investing to brokers who are broker than them, people who are really just sales arms for the financial industry.

Financial ignorance and the boomer retirement crisis

Over the years, as I’ve travelled and talk to thousands upon thousands of people, many of the baby boomers, and I’ve often heard people say things like:

“I’m making more money than I ever have in my life, but I just can’t seem to get ahead.”

“It seems like every time I get a little money saved up, a big expense comes up that takes it all away.”

“I can’t seem to get out of my credit card debt even though I only use them for emergencies.”

These statements and more are the symptoms of someone who suffers from lack of financial control.

Most boomers left school not even knowing how to balance a checkbook, much less how to prepare a financial statement. So it’s no wonder they struggle financially. They never learn how to control their finances.

You can tell if people are in control of themselves by looking at their financial statements. Just because people have high-paying jobs, big houses, and nice cars does not necessarily mean they are in control financially.

Most people simply increase their standard of living with each pay increase. In the process they spend their income on expenses and liabilities without ever increasing their assets. The result is a continual feeling of being financially out of control—a feeling you can’t ever get ahead.

Financial freedom comes by first understanding your financial statements

A financial statement is your report card on how you’re doing financially.

If people knew how a financial statement worked, they would be more financially literate and more in control of their money. By understanding financial statements, people can better see how their cash is flowing.

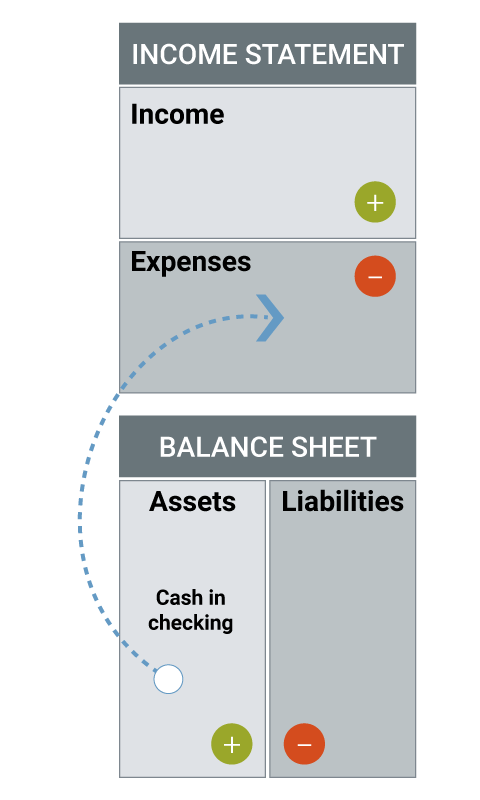

For example, this is the cash-flow pattern of writing a check. When people write checks, they are depleting an asset.

For example, this is the cash-flow pattern of writing a check. When people write checks, they are depleting an asset.

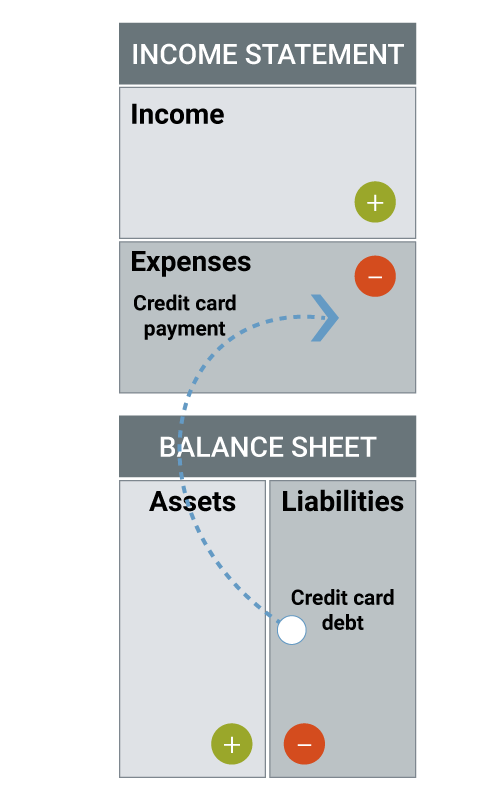

And this is the cash-flow pattern of using credit cards:

When people use their credit cards, they are increasing their liabilities. In other words, credit cards make it so much easier to get deeper and deeper into debt. Most people can’t see it happening to them simply because they have not been trained to fill out and analyze a personal financial statement.

If you want to get control of your finances, the first step is to learn how to read and analyze your financial statement.

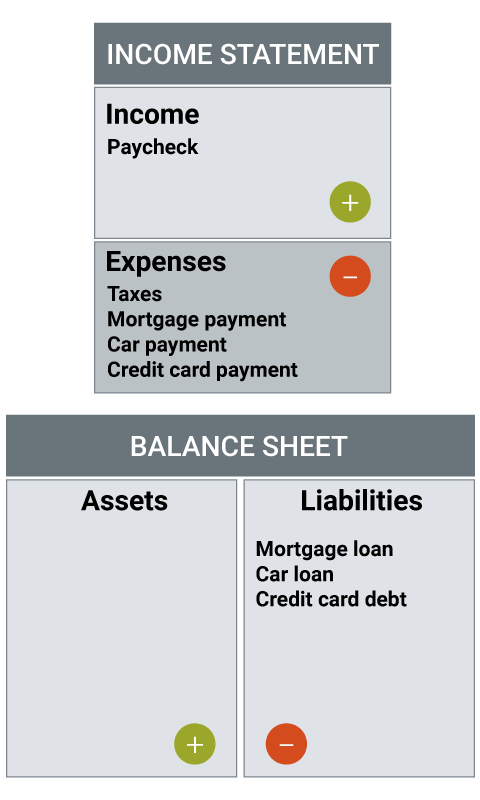

How most boomer’s financial statements look

Today, most boomer’s financial statements look like this:

Unless something changes, there’s little chance that a boomer with a financial statement like this will be able to retire. Why do I say that? Because each payment this person makes goes into the asset column of someone else to make that person richer.

When I’m asked, “What is the first step to financial freedom?” My response is, “Take control of your money and your financial statement.”

If you want to avoid the coming boomer retirement crisis, you need to learn how to make more money by taking control of your finances. Here’s how.

Assess your financial situation

If you’re a boomer, the news I shared about the coming retirement crisis should be a wake up call for you. Many of the people who ended up filing for bankruptcy in the article were surprised it had come to that. They didn’t realize how expensive retirement would be and were not ready financially. Today, they are bagging groceries to make ends meet, and that is not enough.

The good news about a wake up call is that it also presents an opportunity. Before you get too far down the path of financial ruin, take the time to honestly assess your financial position.

Line up all your expenses in the expense column

First off, list out every expense that you have. This includes things like your groceries, estimated health costs, travel and entertainment…all of it. And then assume they’ll only go up by 3 to 5% per year, especially health costs, which by some estimates are expected to be 40% higher by 2035.

Oftentimes, we’re unaware of how much we truly spend. So it’s helpful to go over your bank records for the last couple years to get a full picture of how much you truly spend and on what you spend your money.

Determine how much money you’ll need to make in passive income to retire and cover your expenses

Next, list out your income in another column. Then, take your hand and cover your in-come. What would you do if you didn’t have it and had to pay those expenses?

Frightening, isn’t it?

I like to do this exercise because it brings home the reality of how precarious our financial states can often be. The reality is that you don’t have an income when you retire to rely on, so your investments better do the trick.

Taking a look at your portfolio of investments, do you think you have enough cash flow to cover your expenses each month? If you’re like most people, the answer is no. Rather than have cash flow, most people have a strategy to pull money out of a savings account like a 401(k) each month. That is not income, it’s savings, and it will eventually run out.

So, the question you need to answer is this: how much cash flow would you need each month to retire comfortably and not worry?

Begin investing for cash flow

Once you know how much money you need in cash flow to cover your expenses, it’s time to start investing in assets that produce cash flow like real estate or business.

Want More Financial Security?

Quickly learn exactly how to think like the rich and then do what the rich do to achieve financial independence.

Choose to Be Rich—Click Here

You can start small and continue to reinvest your returns into more and more cash flowing investments. If you have a large amount of money stashed away in retirement accounts, I would explore what it would take to move some of it into these types of investments, ones that will provide true cash flow and thus true peace of mind come retirement time.

Do that, and you’ll go a long way towards escaping the fate so many other baby boomers are facing.

Original publish date:

June 10, 2014