Blog | Personal Finance

The Best Teacher In the World

Discover why the rich consider failure to be the best teacher

April 23, 2019

One of the biggest reasons so many people struggle financially today is because they were exposed to fake teachers who were taught to believe they were the best teacher.

I discovered this at a young age when I moved to the rich side of Hilo, Hawaii.

The first thing I noticed about my new classmates was that they were rich. While they were friendly and welcoming, I knew they were richer than me because most had new bicycles, they lived in big homes on a private island, their parents belonged to the yacht club and the country club, and they had vacation homes either at the beach or on their ranches in the mountains.

I had a used bicycle that my dad bought for $5. I did not know what a yacht club or country club was. Our family lived in an older house that we rented, two blocks from my new school, next to the Hilo Library. The land our home was built on is a parking lot today.

I had never felt poor, until I went to a school with rich kids.

That is why, when I was nine years old, I raised my hand and asked my teacher, “When will we learn about money?”

She just looked at me, stammered, and said, “We don’t teach money in school.”

Later, when I talked to my dad, who was the head of the Hawaii school system, he said, “Son, never ask a teacher a question he or she cannot answer. Teachers must know all the answers. They are not trained to say, ‘I don’t know.’ You embarrassed her.” He also said,

“The main reason money is not taught in school is because teachers can only teach what the government allows us to teach.” His advice to me was that if I wanted to learn about money, I should ask my friend Mike’s dad. He was an entrepreneur. Mike’s dad became my rich dad. It was the best advice my poor dad ever gave me.

The difference between fake and real teachers

In my latest book, “Fake: Fake Money, Fake Teachers, Fake Assets: How Lies Are Making the Poor and Middle Class Poorer,” I go into great detail about fake teachers: who they are, how they lead you astray, and how to spot them. I also go into what makes for a real teacher. A couple stories here can help illustrate what I talk about more in the book.

After I was done with my tours of duty in Vietnam, my poor dad encouraged me to get my masters and my PhD. So, I enrolled in an executive MBA class. One of my classes was accounting.

In the classroom, I was not enjoying the MBA program. I felt like I was back in high school. One night, my frustration hit a boiling point.

“Have you ever been a real accountant?” I asked the accounting teacher.

“Yes,” he replied. “I have a degree in accounting.”

“That is not what I am asking you,” I said tersely. “I know you have a degree in accounting, but have you ever been a real accountant... in the real world?”

After an extended pause, the teacher admitted, “No, I haven’t. I am a graduate assistant. I have a bachelor’s degree in accounting. I am going for my master’s.”

“I can tell you don’t know what you’re talking about. You’re teaching from a textbook, not real life.” I had been working with my rich dad as an apprentice and I could see the difference between a fake teacher and a practitioner.

In stark contrast, around the same time I attended a seminar on real estate investing that was three-days and cost $385. I could tell the person teaching the seminar was the real deal. He was not trying to sell us anything. He was simply running us through his many deals, what he’d learned, and how we could apply those lessons to our own real estate investing.

At the end of the three days he said, “Ok, now the class is just beginning.” Confused we asked how the end could be the beginning. He said, “Because putting this knowledge into practice in real life is where you will really learn. I want you to evaluate 100 properties in 90 days. Write a one-page analysis on each, and by the end you will know which is the one you should go after.”

I did this, found a property I could buy with no money down, and made $25 a month in cash flow. I cancelled my MBA classes and never looked back.

The world’s best teachers is...

While my first foray into real estate investing was a success, I wish I could say that everything I did in business and investing was. Instead, I made a lot of mistakes, including leveraging my father’s home for $100,000 that I immediately lost to a crook.

It was through these failures and mistakes, however, that I learned the most and grew the most. In fact, failure was my greatest teacher, and it will be yours as well. This is why one of my favorite murals ever is this one at the famous advertising firm, Wieden + Kennedy, which reads, “Fail Harder.”

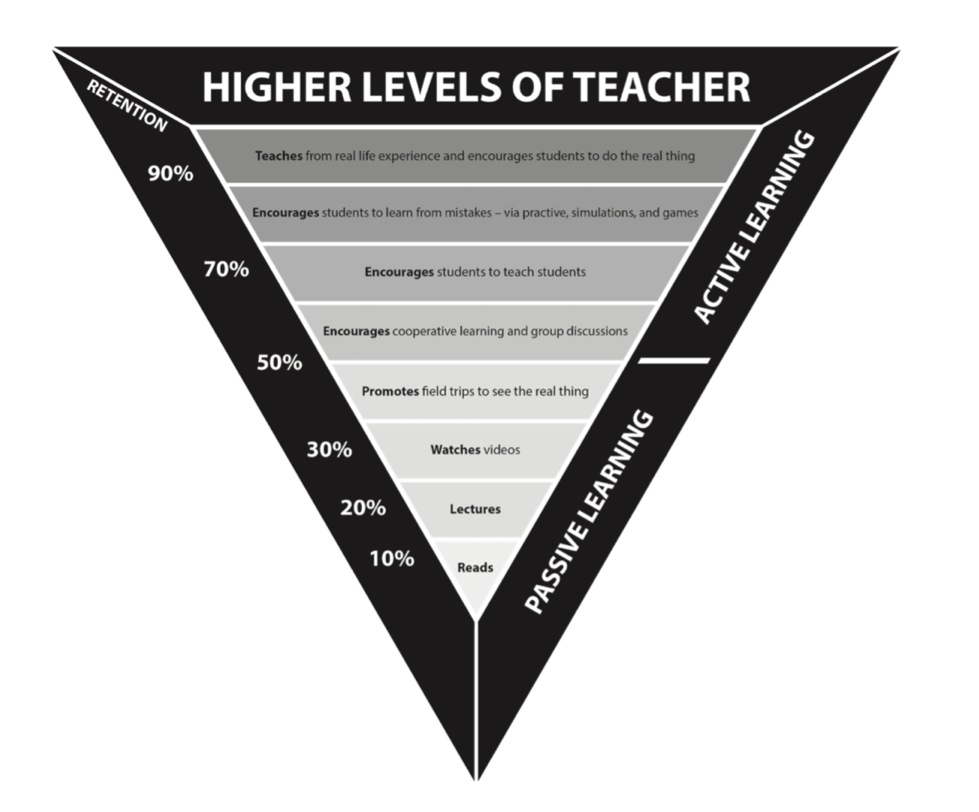

Through my failures, I finally understood what the real teacher at my real estate seminar was saying about the classroom being just the beginning. He was right, you learn most from experience and doing, especially your failures, than from reading, watching, and listening.

Fake teachers teach via lecture and books. Real life is a classroom.

Real teachers teach from real-life experience, from their mistakes, and encourage you to do the same.

Mistakes are the key to success

Thomas Edison changed the world by making mistakes. He reported failing 3,000 times before inventing the electric lightbulb.

Henry Ford went bankrupt before Ford Motor Company became a success.

And Jeff Bezos’ Amazon-offshoot zShops failed.

Larry Ellison struggled for years and was on the verge of bankruptcy and mortgaging everything before Oracle took off.

Fred Smith received a failing grade in business school for his business plan which today is FedEx.

Colonel Sanders had to reinvent himself many times and found himself broke at age 65 before KFC succeeded.

Two sides of the coin

Of course, most people in the world do not believe this. There are always two sides of the coin, and they are on the other side.

In today’s dysfunctional society, the temptation is to:

-

Pretend to never make mistakes

People like to pretend they are perfect. These people treat mistakes like cats covering up their mess in kitty litter, pretending the kitty litter is clean.

-

Lie

I remember President Bill Clinton saying, “I did not have sexual relations with that woman.” Having sex is not a crime. On December 19, 1998, he was impeached for lying under oath.

-

Make excuses

Excuses are like air fresheners: although the bathroom may smell good, you can still smell the lie.

-

Blame

Blame is really two words: “be” and “lame.” Someone who blames is a wimp not willing to take responsibility and learn.

-

Go to court

Sue the person who caught you in the lie. Keep the lie going for years. This has happened to me twice. I was sued after discovering people I trusted were cheating, lying, and stealing.

-

Go big or go home

Rather than cut their losses, people will double down or “bet the ranch,” hoping to win back all their losses. They go big and most go home broke.

The rich do not do this, and those who study the best teachers in the world—failure and mistakes—grow to embrace the antidote to each of these, mainly, humility and the desire to always be learning.

As one of the greatest teachers I ever sat under, R. Buckminster Fuller, said, “Mistakes are great—the more I make the smarter I get.”

The most important thing I can do is encourage you to make your own mistakes and learn from them.

Original publish date:

April 23, 2019