Blog | Personal Finance

How to Budget Your Money Through the Holidays

The season of joy is around the corner. No need to stress, I’m here to tell you that you have a choice!

October 06, 2022

Budgeting is a hot topic—especially during the holiday season. After all, there’s a lot of shopping that goes on this time of year! Last week we discussed paying yourself first. Now, we’ll discuss how to pay yourself first while prepping for the holidays.

Holiday time - bah humbug or financial freedom?

It’s likely that in preparation of the holidays, you could be found working long hours and making personal sacrifices to afford holiday gifts.

But instead of concentrating on the negative aspects of your life, what you don’t have or all the gifts you can’t give your family, it’s time to think about what you do have.

Time to make a change

You can change your situation, even if you have nothing.

In my book, “It’s Rising Time,” I talk about what it really takes to enjoy financial freedom, and I give examples of women who started with just a few coins in their purse and became very wealthy.

Being a rich woman is just a matter of increasing your financial education – and this involves more than study and research alone. It takes gathering facts and figures, putting it into practice and actually doing it.

Below, I’ll give you some tips on how to continue saving despite the holiday season knocking on your door.

Why the conventional budgeting advice doesn’t cut it

Behind the desire to learn more about budgeting is really a desire to manage money better. The problem with most traditional budgeting advice, however, is that it focuses on scarcity rather than on abundance.

Take, for instance, the traditional advice to “live below your means.” What that really means is deny yourself the finer things in life. It is a philosophy to get ahead financially by subtracting things. That doesn’t add up.

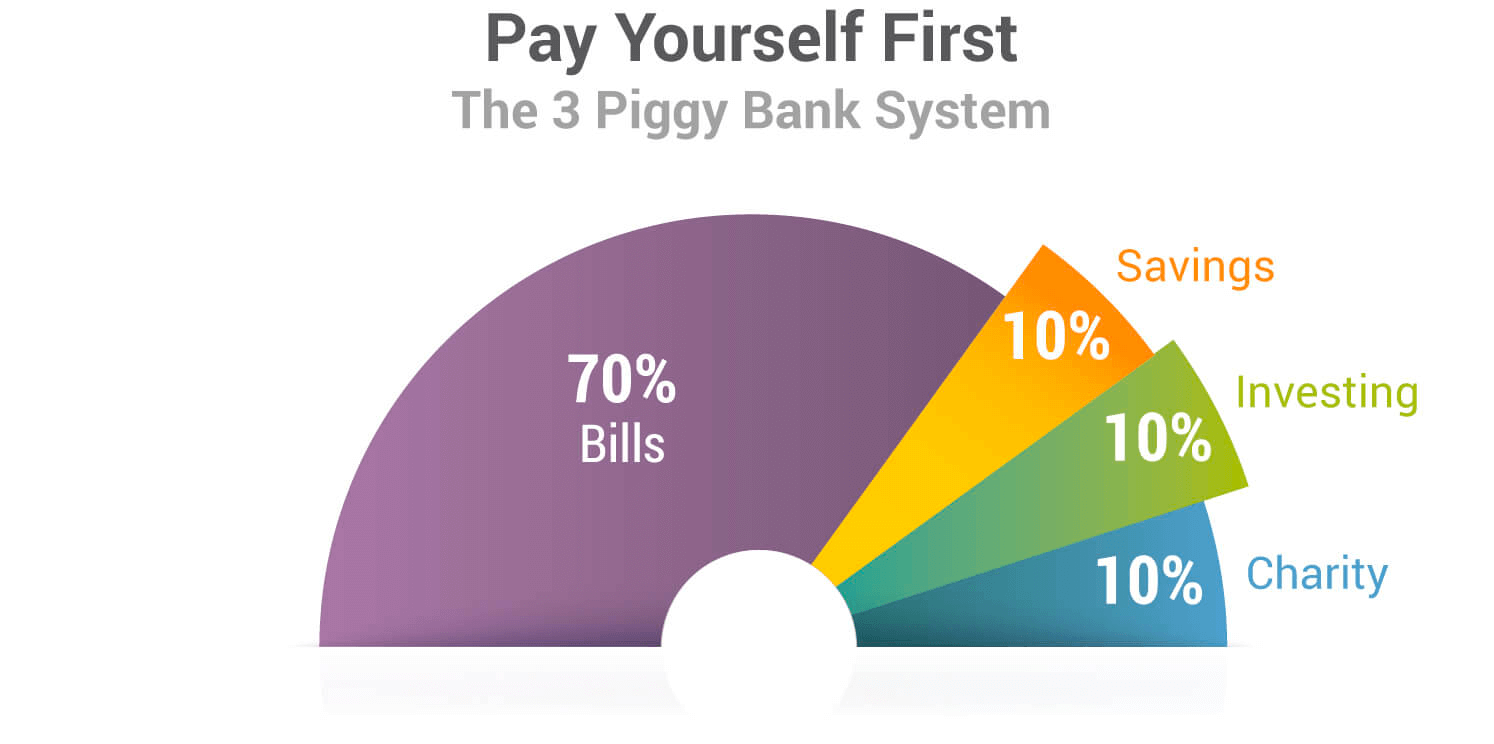

Another common piece of advice is to pay all your bills and then save the rest of your money. In translation that means, pay others first and then keep what you can. The problem is there’s rarely anything left to keep!

Early in our relationship, Robert and I came up with a different way to budget our money—a way that seems counterintuitive at first, but that has served us well over many decades.

Paying yourself first

When we had little-to-no-money, we still hired a bookkeeper to help us manage our expenses. Each month, our bookkeeper would come to us with our expenses and give us her advice on how to divvy up what little money we had. While we understood where she was coming from, we did not follow her advice.

Instead, we put money aside for ourselves first and then paid what expenses we could, deferring other payments for as long as possible. Ultimately, we embraced the philosophy of every business owner, including those trying to get money from us. It was our money, and we’d pay it when we wanted to.

Even with the money that goes out the window with gift-giving, paying yourself first MUST remain a top priority. Becoming rich means making - and sticking to - habits that encourage your mission; even if that means staying humble during the holidays.

Make investing an expense

With the extra money we kept aside each month, we created a portion of our budget that was for investing. We included that investing fund in our expense column. Like any other creditor, we had obligations to that investing expense column, and we chose to make a payment every month. That decision gave us the capital we needed to make some of our very first investments.

Instead of saying to ourselves “we can’t afford that;” we started asking ourselves “how can we afford that?”

This simple change in language allowed us to expand our thinking when it came to our budget. Rather than just rely on our incoming and existing income streams, we forced ourselves to set income goals and to meet them by thinking creatively about how we could generate more revenue, typically via new investments. The result was new product and service offerings we hadn’t previously explored in our business. We were growing both ourselves and our business.

Perhaps if there’s something you’d like to gift someone that’s just not within reach this year, you can ruminate on what investments would make said gift available in the future.

Give back

Finally, it was important for us to always give back. After all, isn’t that what the holiday season is all about?

Do you want a better life for you and your family?

Stop struggling. Take our short quiz and discover how to create a life of freedom.

Take The Quiz Now

Take The Quiz Now

Our budgeting wasn’t just about us and our gain. It was also about giving back. We understood that when much is entrusted to you, much is also required of you. So, we always made it a priority to give a certain percentage of our income away to causes we cared about—even when it hurt to do so. Much had been invested in us, so we knew we needed to invest much in others as well. This was a non-negotiable, and it’s done wonders to help us grow financially, and as individuals.

As you get ready for the holidays ahead, take some time to evaluate how you budget your money. Do you do so as a poor woman or a rich woman? How can you make adjustments this year to change the way you approach money and investing? Putting these simple principles into action will make for a dramatically different holiday season—one focused on financial freedom. And that’s something worthy of good cheer.

Original publish date:

December 03, 2015