Blog | Personal Finance

From Despair To Euphoria (and Back?)

November 01, 2014

When I wrote my last blog, “Very Scary”, on October 14th, the stock market was very shaky. Bloomberg reported that $744 billion had been wiped off equity values just since October 8th. Things became very much scarier the next day. When the markets opened on October 15th, panic set in. The Dow fell as much as 470 points, and bond yields collapsed. The yield on the 10-year US government bond fell from above 2.2% to 1.86% nearly as soon as the market opened. CNBC’s savvy bond market watcher, Rick Santelli, said he had never seen anything like it. The Fed had long signaled that it would end the third round of Quantitative Easing in October and the markets were terrified by the thought of what would happen to stocks when the Fed stopped pumping money into the financial markets.

The following morning (October 16th) stocks were moving down sharply again. The NASDAQ was down more than 10% from its September high, while the S&P was off 9.8% from its peak. Then, in the blink of an eye, everything changed. In a live TV interview, St Louis Fed President James Bullard recommended extending QE. The Dow jumped 120 points so quickly that it looked like a computer error must have occurred. The following day, the chief economist of the Bank of England revealed that the first interest rate hike in the UK was likely to be delayed relative to earlier expectations. On October 20th, the European Central Bank announced it had begun buying covered bonds to boost the Eurozone’s economy. And on October 28th, Sweden’s central bank cut its policy interest rate to zero percent for the first time in history.

By this point, stocks had recovered most of their losses from earlier in the month. On October 29th, the Fed put on a brave face and announced that it had decided to end QE 3, as scheduled. But, then, two days later, the Bank of Japan stunned the financial world by announcing that it would increase its Quantitative Easing program from Yen 60 - 70 trillion a year to Yen 80 trillion a year, an amount equivalent to US$727 billion.

Within the space of two weeks, market sentiment flipped from despair to euphoria. By the end of trading on October 31st, both the Dow and the S&P had hit new record highs. The Yen fell to its lowest level against the dollar in nearly seven years, while the Nikkei index jumped to its highest level since November 2007. The strong dollar pushed oil down 9% during October and gold fell to its lowest level since 2010. What a couple of weeks!

So, what next? As you know, I believe central banks (primarily the Fed) have been driving economic growth by printing money and pushing up asset prices, thereby creating a wealth effect. Stocks came very close to crashing mid-month on the thought that QE was about to end. But, James Bullard restored calm by strongly implying that the Fed was prepared to step back in with more QE if necessary. Then all the other central banks chipped in, one way or the other (the BOJ most dramatically), to send a strong signal that they would not allow the global bubble to deflate.

But, here’s the thing. Without more – in fact, without much more – fiat money creation by the Fed (a.k.a. QE 4), the global bubble is going to deflate, or, at least, that’s how it looks to me.

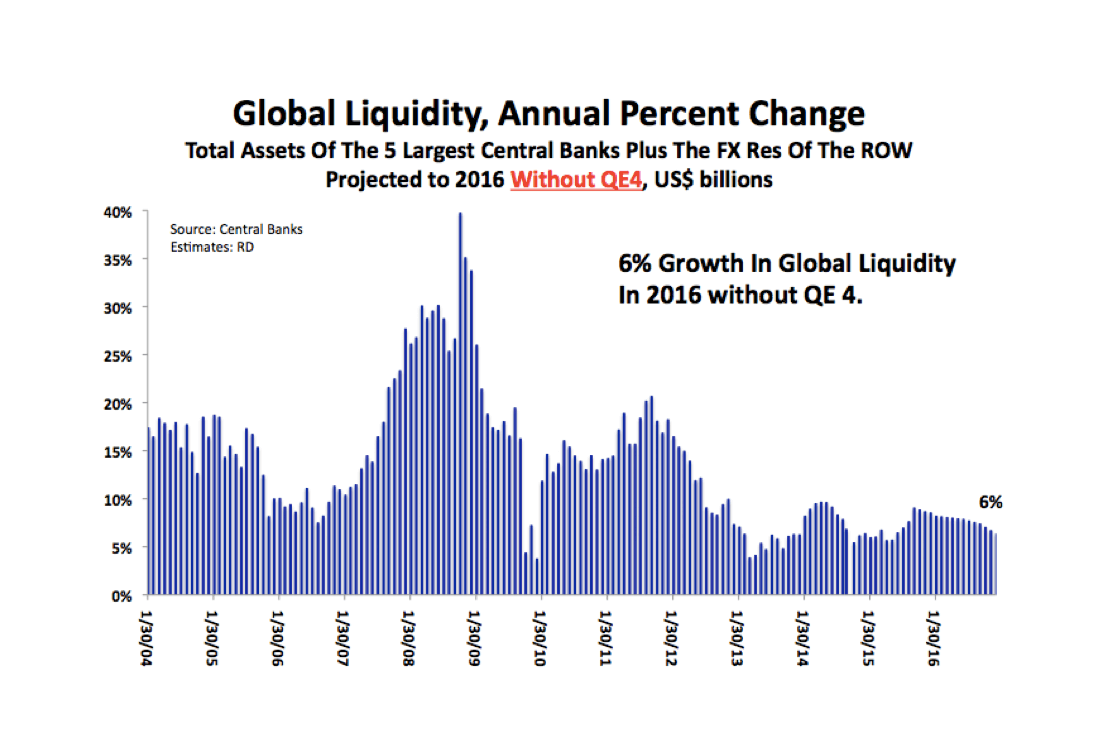

The following chart was taken from my latest Macro Watch video, which was called “Analyzing The Five Largest Central Banks”. It shows the annual percent increase in Global Liquidity projected out to the end of 2016.

It shows that, without more Quantitative Easing from the Fed, global liquidity will expand by only 6% during 2016, compared with 20% in 2012, 30% in 2009 (at the peak of the policy response to the crisis), and 15% in 2004 and 2005 (the years leading up to the crisis). This chart was made before the BOJ announced the expansion of its QE program, but even incorporating that, the growth in global liquidity will still be less than 7% in 2016. That will not be enough to keep the global economic bubble inflated. Only another very large round of Quantitative Easing by the Fed will achieve that. It will be fascinating to watch how much longer stock prices will continue to levitate without additional policy intervention to keep them afloat. Not for long is my guess.

To learn more about how the global economic crisis is likely to play out and how it will affect you, subscribe to my video-newsletter, Macro Watch:

http://www.richardduncaneconomics.com/product/macro-watch/

Click on the “Sign Up Now” tab, and then, for a 50% discount, use the coupon code:

richdad

Original publish date:

November 01, 2014