To understand the modification, you must take a brief history lesson.

As a young man on his second tour of duty in the Vietnam War in 1972, Robert got a letter from his rich dad that read, “President Nixon took the dollar off the gold standard. Watch out, the world is about to change.”

He didn’t quite know what rich dad meant at the time, but he was intrigued. He read “The Wall Street Journal” to search for answers. One article that caught his attention was about gold. The price was fluctuating from $35 an ounce to $40 to $60 an ounce.

Thinking they were clever, Robert and a fellow pilot named Ted flew from their carrier across 25 miles of sea into enemy territory. They had hoped to find a gold dealer and get a good deal.

They tried to negotiate with an old woman in a small village, with an opening bid at $40 an ounce. Little did they know, spot was $55. The tiny woman they were bargaining with just smirked and at the fools in front of her; smiling, she said “Don’t you know that the spot price of gold is the same all over the world?”

Thankfully, they got out of there without any detection by the enemy, but certainly didn’t get a deal on gold. Instead, they left with a valuable lesson on real money.

In 1971 President Richard Nixon changed the rules of money. That year, the U.S. dollar ceased being money and became a currency. This was one of the most important changes in modern history, but few people understand why.

Prior to 1971, the U.S. dollar was real money linked to gold and silver, which is why the U.S. dollar was known as a silver certificate. After 1971, the U.S. dollar became a Federal Reserve Note—an IOU from the U.S. government. Instead of our dollar being an asset, it was turned into a liability. Today, the U.S. is the largest debtor nation in history due in part to this change.

Taking a brief look back at the history of modern money, it's easy to understand why the 1971 change was so important.

After World War I, Germany's monetary system collapsed. While there were many reasons for this, one was because the German government was allowed to print money at will. The flood of money that resulted caused uncontrolled inflation. There were more marks, but they bought less and less. In 1913, a pair of shoes cost 13 marks. By 1923, that same pair of shoes was 32 trillion marks!

As inflation increased, the savings of the middle class was wiped out. With their savings gone, the middle class demanded new leadership. Adolf Hitler was elected Chancellor of Germany in 1933 and, as we know, World War II and the murder of millions of Jews followed.

In the closing days of World War II, the Bretton Woods System was put in place to stabilize the world's currencies. This was a quasi-gold standard, which meant currencies were backed by gold. The system worked fine until the 1960s when the U.S. began importing Volkswagens from Germany and Toyotas from Japan. Suddenly the U.S. was importing more than it was exporting and gold was leaving our country.

In order to stop the loss of gold, President Nixon ended the Bretton Woods System in 1971 and the U.S. dollar replaced gold as the world's currency. Never in the history of the world had one nation's fiat currency been the world's money.

To better understand this, rich dad had Robert look up the following definitions in the dictionary.

"Fiat money: money (as paper money) not convertible into coin or species of equivalent value."

The words "not convertible into coin" bothered Robert. So, rich dad had him look up the word: "fiat."

"Fiat: a command or act of will that creates something without or as if without further effort."

Looking up at the rich dad, Robert asked, "Does this mean money can be created out of thin air?"

Nodding his head, rich dad said, "Germany did it and now we are doing it."

"That's why savers are losers," he added. "I fought in France during World War II. That's why I never forget that it was after the middle class lost their savings that Hitler came to power. People do irrational things when they lose their money."

Most economists would disagree with rich dad's correlation between the loss of savings and Hitler. It may not be an accurate lesson, but it's unforgettable, nonetheless.

Over the last year, we’ve experienced record inflation. As of the end of September 2022, the inflation rate was 8.2% over 12 months. In 2021, inflation was 7.0%. Inflation hasn’t been this high in over 40 years. According to CNN, June consumer prices for gasoline were up 59.9%, food was up 10.4%, and housing was up 5.6%. In short, the middle class is feeling it.

In spite of all these record increases in prices, the federal government's economists spent much of 2021 saying inflation was “transitory,” meaning it would be temporary and go away. They were very wrong, and now the Fed is raising interest rates aggressively to try and tame the inflation beast. But they are having a hard time because there is so much fake money in the economy thanks to years of low interest rates and quantitative easing.

What is fake money?

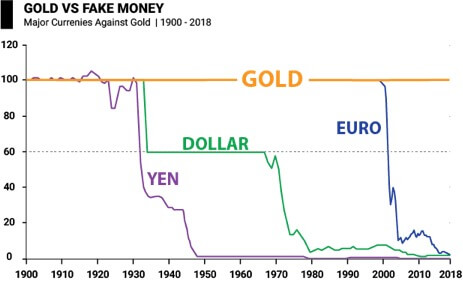

When President Nixon took the U.S. dollar off the gold standard in 1971, the U.S. dollar became fake money. To understand how taking the dollar off the gold standard turned the US dollar into fake money, you need only to look at this chart.

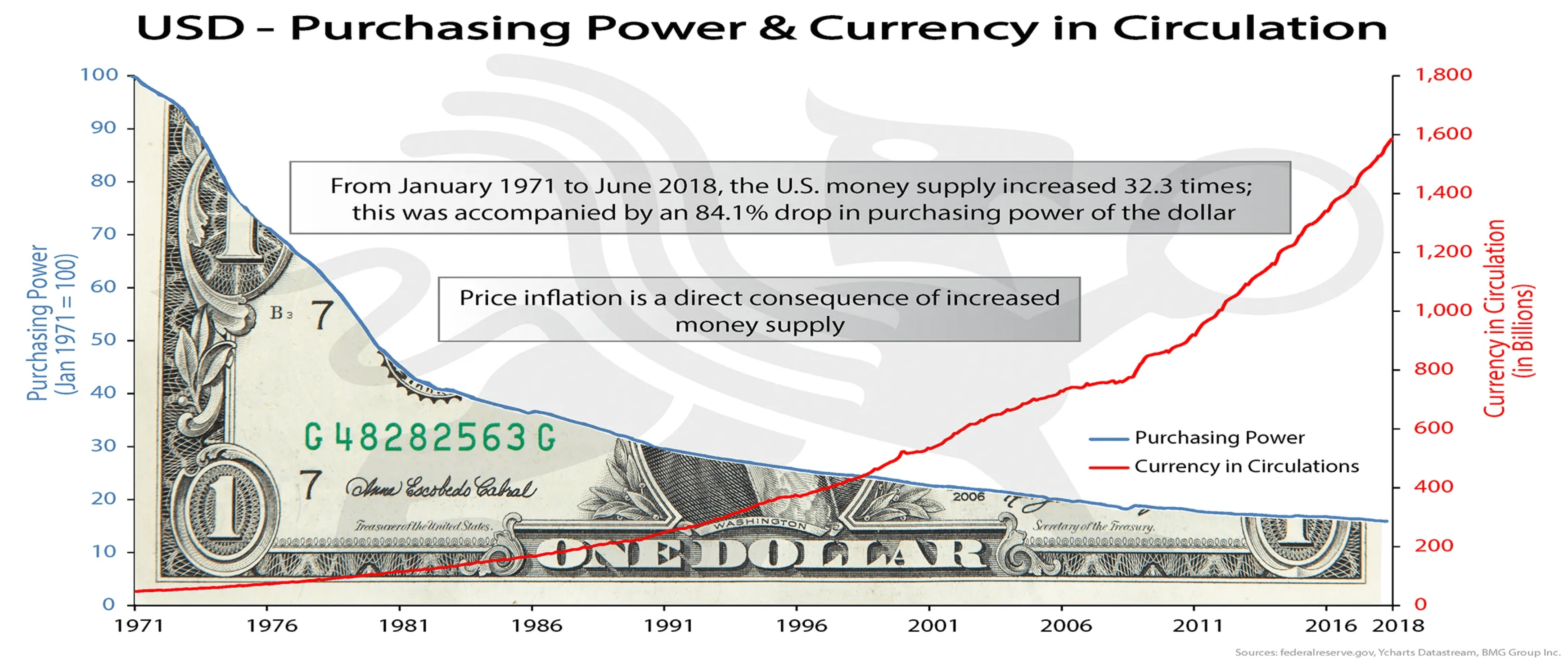

How does this happen? When a currency is not tied to real money, governments are able to print more and more money out of thin air. This leads to inflation, the devaluing of the purchase power of that currency.

Look at this chart to see how the US government printing money out of thin air has impacted the dollar's purchasing power.

This is nothing new. Countries from ancient Rome to Weimar Republic Germany to modern day Zimbabwe have printed or debased money to the point of no return. This results in hyperinflation where money literally becomes worthless and people use it to create fires rather than to buy things.

While we’re not currently experiencing hyperinflation, as mentioned earlier, the US is facing the highest inflation rates in recent history. Given the global insecurity between pandemics and war, it’s not hard to imagine a scenario where we see hyperinflation. The question is how will you prepare like the rich do?

But first, let’s dig a little deeper into why what you think is money is not really money.

Money is no longer money

Most people think of dollars as money, but the reality is that it is not. An amusing way of looking at this is to realize you can buy $10,000 in cash from The US Bureau of Engraving and Printing for only $45. The catch is that they're shredded.

More seriously, as mentioned earlier, since Nixon took the dollar off the gold standard in 1971, it is no longer money. Before 1971, there was a relationship between a dollar and how much gold was backing that dollar in the US treasury. After 1971, that dollar was not backed by anything other than the full faith and credit of the United States government.

Money vs. currency

Today, the dollar is a currency. It can go up and down in value depending on how other currencies are performing and based on many economic conditions. It is tied to nothing and can move in either direction very quickly. In 2021, the “Wall Street Journal” wrote that the dollar was “dwindling.” In 2023, “The New York Times” wrote, “A Rising Dollar Is Hurting Other Currencies.” Of course, what is really meant here is the cost of dollars vs. the value of dollars. Savers are losers in inflationary economies because their saved dollars have less purchasing power over time. But at the same time, the cost of borrowing dollars is higher in the US, so there is an influx of US dollars into the US by foreign investors, which strengthens the dollar. As “The New York Times” writes, “As a result, the currencies of other countries — which are valued in relation to each other — have weakened, upsetting markets in some of the largest economies in the world, from Japan and China to India and Britain.”

All of this is possible because the U.S. dollar is no longer money but instead a currency.

So, what does it mean that the dollar is a currency? It’s helpful to compare it to electrical currencies. An electric currency carries electricity from one place to another. In order to survive, a currency must be moving. Once it stops, it dies.

Similarly, the dollar as a currency is simply a vehicle to move wealth from one area to another. For instance, smart investors who saw the rout in the bond market coming in 2016 most likely moved their wealth from bonds to another sector that stood to benefit from higher interest rates and a rising dollar. Today, with inflation high, smart investors are most likely moving into commodities. It’s all cyclical, but the rich know that true money is now found in assets, not in the currencies that go up and down.

The rich use fake money to get richer…and make you poorer

In another article, “Three Fake Things that Could Ruin You Financially,” you’ll learn about Robert Kiyosaki’s studies with Dr. R. Buckminster Fuller, who wrote the book “Grunch of Giants.” Grunch stands for Gross Universal Cash Heist.

That book was a revelation for Robert as a young man because he learned how those with the most power in the world manipulate money to steal from the middle and poor classes. They are the puppet masters who know how to manipulate fake money to make real money and acquire vast amounts of real assets.

The post also covers an article by Steven Brill called, “How My Generation Broke America,” in “Time” magazine (since renamed to “How Baby Boomers Broke America”.

Here’s an excerpt:

Quoting Steven Brill from the article:

As my generation of [Baby Boomer] achievers graduated from elite universities and moved into the professional world, their personal successes often had serious societal consequences.

Translation: The elites got greedy taking care of themselves, at the expense of others.

They... created an economy built on deals that moved assets around instead of building new ones.

Translation: The elites focused on making themselves rich, rather than creating new businesses, new products, more jobs, and rebuilding the U.S. economy.

They created exotic, and risky, financial instruments, including derivatives and credit default swaps, that produced sugar highs of immediate profits but separated those taking the risks from those who would bear the consequences.

Translation: The elites created fake assets that made themselves and their friends rich and ripped off everyone else. When the elites failed, they were paid bonuses. Mom, Pop, and their kids would pay for the elite’s failures via higher taxes and inflation.

Long story short, the ultra-rich and elites are able to utilize the volatile nature of the dollar to create vast amounts of wealth for themselves. Meanwhile the poor and the middle class get poorer.

The difference between the rich and poor = knowledge

The reason why fake money is so dangerous is because most people do not know that their money is fake. So, they do what they are taught. They save it. The problem is that savers become losers because money devalues over time and becomes more and more worthless.

The rich know the difference between fake and real money. That is why rich people use fake money to buy real money, i.e., gold and silver, as well as assets with real value like real estate and commodities. By doing this, they print their own fake money (cash flow) that they then use to purchase more real money and assets.

The secret to building wealth

And that is the secret the rich know about building wealth. You can never get comfortable and you can never park your wealth and forget about it. You must always be learning and always be moving your wealth to where it will grow. Once you see that area is in danger of falling, you look at the trends, determine the next area of growth in the economy, and move your money there.

An example of this is Ken McElroy and Robert Kiyosaki investing in apartment buildings during the high point of the great recession. Though it was difficult to get people to move their wealth into these investments (the fear made them want to sit on their cash), the smart people saw a ripe opportunity to pick up cash-flowing properties at rock-bottom prices. Years later, they're selling those investments at multiples of what we paid for them, and all the while they enjoyed positive cash flow from their operations.

Print fake money to buy real assets like the rich do. Here's all you need to do it... legally.

On one level, you probably already print fake money. When you save money in the bank and get interest from that bank, you’re printing money. Granted it’s very little that you’re printing, but you’re doing it.

Conversely, when you use your credit card, you’re printing money for the bank by paying them an interest rate.

In the former scenario you print money at 0.06%. In the latter one, you print money at 18%. You can see how the rich know how to use fake money to make you poorer and them richer.

The good news is you can also print fake money to buy real money and real assets like the rich do. All you need is the knowledge and to take the initiative.

For instance, in the article, “Rich Dad Fundamentals: OPM,” you learn how you can make an infinite return on your money by using other people’s money to invest.

And in his book, “Fake: How Lies Are Making the Poor and Middle Class Poorer,” Robert goes into even greater detail on how to think and act like the rich. He also shares in depth his philosophies on gold and silver, which he uses not as an investment but as a hedge, and how you can easily get started building your wealth through gold and silver.

In this article, the word “fake” is used because at Rich Dad, we’re on a mission to level the playing field between the rich and the poor, the elites and the average folks. The lessons we teach on fake money, fake teachers, and fake assets are essential to learn in order to make sure you can grow richer in a world that has and continues to change.