Blog | Personal Finance

The Fed’s New Magic Trick

July 15, 2014

In this age of fiat money, Liquidity determines whether asset prices move up or down. The Fed understands this. That’s why it has been printing money and injecting that Liquidity into the financial markets. It’s goal has been to push up asset prices in order to drive the economy by creating a wealth effect that allows Americans to keep spending more even though median income continues to drop. The Fed has recently employed a new tool to allow it to better manage the level of Liquidity in the financial markets: Reverse Repos. Today, I will explain how the Fed’s use of Reverse Repos has impacted the stock market during the second quarter and how it is likely to impact it during the rest of this year.

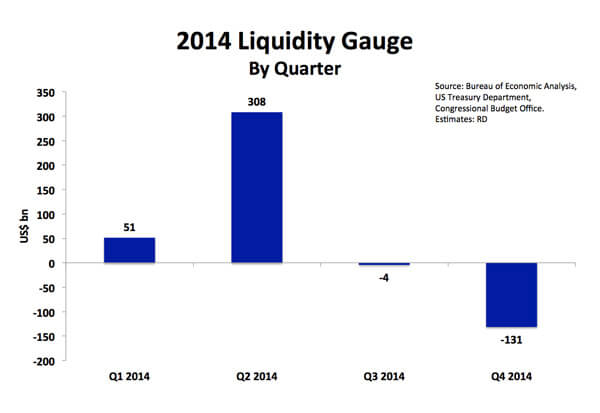

I have developed a Liquidity Gauge to measure whether Liquidity is excessive or inadequate. It compares the amount of fiat money the Fed and other central banks are pumping into the markets with the amount of money the government is removing by borrowing to fund its budget deficit. When Liquidity is excessive, asset prices tend to rise; and when it is inadequate, asset prices tend to fall. Here is the Liquidity Gauge for 2014 based on quarterly estimates.

Notice that during the second quarter, there was a great deal of excess Liquidity ($308 billion). However, Liquidity is set to turn negative in the third quarter and then there will be a very significant Liquidity Drain in the fourth quarter (-$131 billion). As I explained in my March 1st blog, Treacherous Markets Ahead, the very high levels of Liquidity in the second quarter posed the risk of creating a stock market bubble by mid-year; while the subsequent drain of Liquidity threatened to cause a stock market crash and a recession during the second half of the year.

I can now see the Fed has used Reverse Repos to smooth out the level of Liquidity between the second quarter and the second half. In this way, they contained the stock market boom during the second quarter (although the S & P 500 Index still went up nearly 5% during those three months). And, they may also succeed in pushing back the Liquidity Drain closer to the end of the year or even to early next year.

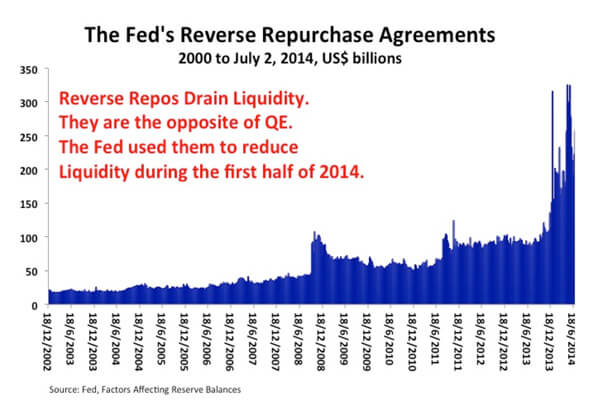

Here’s how the process works. In a Reverse Repurchase Agreement, the Fed sells Treasury bonds that it owns (with an agreement to buy them back later). It receives cash in exchange for the Treasury bonds it sells. In that way, it drains Liquidity from the financial markets. In other words, this transaction has the opposite effect of Quantitative Easing (which injects cash into the financial markets). Later, when the Fed buys back its Treasuries, it will pay cash, thereby injecting the Liquidity back into the financial markets. The effect then will be similar to the effect produced by QE.

The following chart makes clear what the Fed has been up to.

The level of Reverse Repos on the Fed’s books increased from less that $100 billion throughout 2013 to an average of $200 billion in the first quarter of 2014 and to an average of roughly $250 billion during the second quarter. By increasing its Reverse Repo agreements by $150 billion, the Fed was able to remove some of the excess Liquidity during the first part of the year. And now, if the Fed runs these Reverse Repos back down to the 2013 level by buying back its Treasuries, it will be able to inject $150 billion (or more) of additional Liquidity into the financial markets during the second half of the year, thereby potentially offsetting the Liquidity Drain that would have otherwise occurred.

You’ve got to give these people credit. It looks as though they found the right tool to manage their most immediate challenge, that is, preventing a second quarter boom followed by a second half bust. That said, Reverse Repos will only take them so far. With Quantitative Easing scheduled to end in October, the Liquidity Drain will still strike sometime near year end. When it does, without some new liquidity-injecting trick by the Fed, interest rates are likely to begin to rise, the property market and the stock market are likely to begin to fall and the US economy is likely to begin to move back into recession.

So watch this space. In early 2015, the Fed may resort to another round of Quantitative Easing, QE 4, or they may pull a new rabbit out of their hat. One way or the other, these magicians of money are determined to keep the global economic bubble inflated. So far, they’ve put on a very impressive performance.

A note to readers: If you would like to watch a video that explains how Reverese Repos are impacting the financial markets, click on the link below to subscribe to my video-newsletter, Macro Watch. For a 50% discount, use the coupon code: richdad

http://www.richardduncaneconomics.com/product/macro-watch/

Original publish date:

July 15, 2014