Blog | Personal Finance

GDP Shock!

July 01, 2014

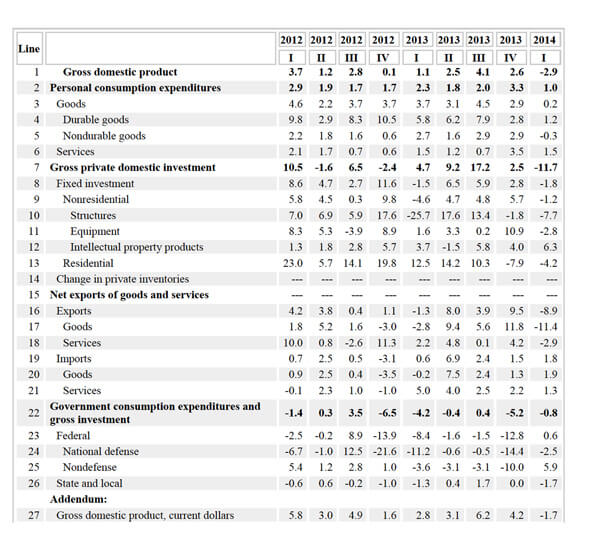

The US economy shrank by 2.9% in the first quarter. This was the biggest contraction since the first quarter of 2009 and it was far worse than anyone had anticipated. In fact, there have only been 12 worse quarters in my lifetime (b. 1960). We’ve been told that the terrible economic performance was due to the particularly harsh winter and that the economy will have a very strong, catch-up rebound in the second quarter. There is no doubt that the severe winter played a role, but that was not the entire story. Nor is it so certain that the economy is recovering very strongly this quarter. Let’s look at some of the details.

Personal consumption expenditure, which makes up 69% of US GDP, expanded by 1% in Q1. The problem was that gross private fixed investment, which makes up 16% of GDP, shrank by 11.7%, while exports, which contribute another 13% of GDP, shrank by 8.9%.

The Bureau of Economic Analysis (BEA) is the best source for the GDP data. If you would like to see the full breakdown of the Q1 growth rate of the GDP and its components, click on the following link to access the BEA’s table:

http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1#reqid=9&step=3&isuri=1&903=1

http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1#reqid=9&step=3&isuri=1&903=1

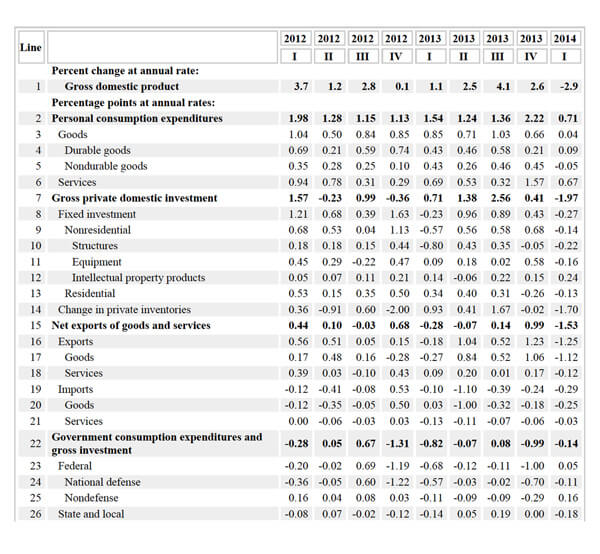

It is also useful to see how much each component contributed to (or deducted from) economic output. That is provided in a separate BEA table, which can be found here:

http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1#reqid=9&step=3&isuri=1&903=2

http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1#reqid=9&step=3&isuri=1&903=2

Notice that of the total 2.9% contraction, personal consumption added 0.71%, but gross private fixed investment deducted 1.97% and net exports deducted another 1.53%.

So, it is possible and, in fact, likely that the severe winter weather did make consumption weaker than it would have been by keeping shoppers at home. It would also have been responsible for part of the contraction in investment by preventing construction jobs from going forward. However, it is harder to blame the sharp fall in exports (-8.9%) on the weather, since imports increased, and particularly since they increased more in the first quarter (+1.8%) than they did in the preceding quarter (+1.5%). The reality is that the global economy is very weak and that global trade has practically ground to a standstill. That is the reason for the awful US export data.

I do not mean to deny that weather played a role in these terrible numbers, only to point out that other factors were also at work.

Now, let’s consider the outlook for the second quarter, which has just ended. The loud consensus from Wall Street economists is that there will be a very strong rebound in growth. After such a horrific Q1, there is bound to be a rebound in Q2. However, disappointing consumption data for April and May call into question just how strong that rebound will be.

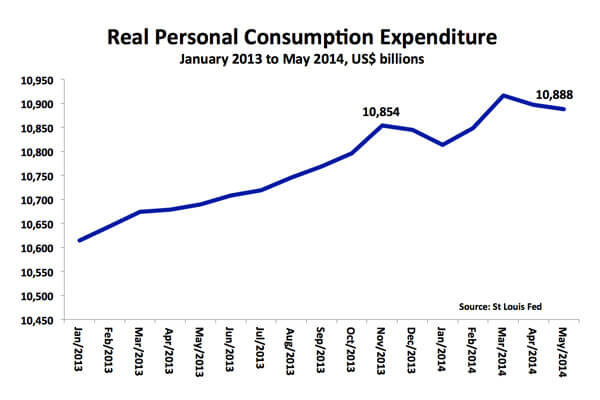

The following chart shows Real Personal Consumption Expenditure since the beginning of 2013. Keep in mind that Consumption makes up 69% of GDP.

In November, Consumption climbed to $10,854 billion. Then, as the winter set in, it contracted by 0.1% in December and by another 0.3% in January. In February it rebound by 0.3% (despite the weather) and in March, as the weather warmed up, it grew strongly by 0.6%. After that, however, Consumption began contracting again. It contracted by 0.2% in April and by 0.1% in May. That means that the change in Consumption has actually been weaker during the first two months of the second quarter than it was during the first two months of the first quarter. Moreover, during the last six months, Consumption has only increased by 0.3%, or by 0.6% on an annualized basis. That is very weak. Unless this picks up sharply (and fast!) then 2014 is going to be another year of disappointing economic growth in the United States.

As you know, I believe that the global economy became dependent on credit growth after dollars ceased to be backed by gold in 1968. Since the crisis of 2008 began, however, credit has not been expanding enough in the US to make the economy grow. Instead, the Fed has printed money and pushed up asset prices in order to drive the economy by creating a wealth effect. Even still, the economy has remained weak. Just imagine what will happen if the Fed actually ends Quantitative Easing in the fourth quarter of this year as it has indicated that it will. It won’t be pretty!

I am now working on a video analyzing how much credit growth would be required to make the economy once again grow at a solid pace. That will be the first video uploaded to Macro Watch for the third quarter. The second video will discuss “Liquidity at the Tipping Point”.

To subscribe to Macro Watch, please visit:

http://www.richardduncaneconomics.com/product/macro-watch/

And use the coupon code “richdad” for a 50% discount.

Original publish date:

July 01, 2014